flyzone/iStock via Getty Images

Authors Note: All funds listed in Canadian currency unless otherwise noted.

Investment Thesis

Hamilton Enhanced Canadian Bank ETF (TSX:HCAL:CA) (“HCAL”) combines a formula of leverage and mean reversion that adds torque to the Canadian bank stocks. Over the long term, the mean reversion strategy has outperformed holding an equal weight index or individual banks.

Regular readers will know that I am overweight the Canadian banks. These are high conviction holdings for me due to the favourable regulatory framework in Canada. This regulatory regime protects the existing banks from foreign competition and offers implicit subsidies through federal deposit insurance. This backdrop of advantages has helped the bank stocks thrive and suggests a propensity for continued outperformance. Adding HCAL’s special sauce of mean reversion and leverage to these already great assets, is just gravy on top.

Fund Overview

The Hamilton Enhanced Canadian Bank ETF utilizes leverage and a mean reversion strategy to maximize yield and long-term performance by holding an intentionally weighted combination of the large Canadian bank stocks. HCAL overweights the three weakest performing Canadian banks and underweights the highest performing banks. The fund is rebalanced quarterly based on the performance of the individual underlying holdings. In addition to employing a mean reversion strategy, HCAL adds 25% cash leverage to seek a higher monthly distribution and the potential for a higher total return.

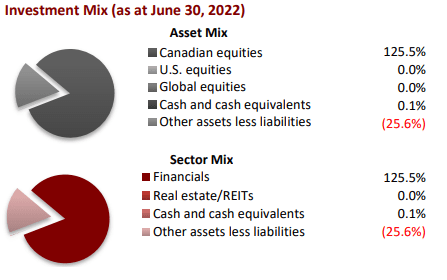

Asset Mix (Hamilton ETFs)

In 2021, with the Canadian banks rebounding from the pandemic, HCAL’s combination of leverage and systematic rebalancing returned an impressive 51%. HCAL trades on the Toronto Stock Exchange with average daily volume of approximately 152,000 units. The fund has net assets of $360M and a management fee of 0.65%.

Holdings

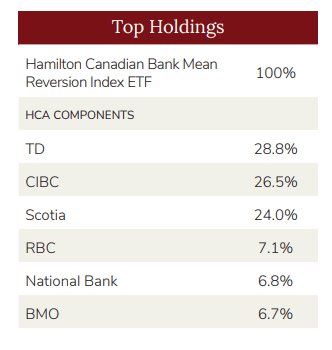

HCAL holds the Hamilton Canadian Bank Mean Reversion Index ETF (HCA:CA) as its sole holding. The difference between the HCAL and HCA is the 1.25X leverage employed by HCAL. HCAL’s holdings are comprised of the six Domestic Systemically Important Banks: The Bank of Montreal, Royal Bank of Canada (RY), Toronto-Dominion Bank (TD), Canadian Imperial Bank of Commerce (CM),The Bank of Nova Scotia (BNS), and National Bank of Canada (OTCPK:NTIOF). Based on recent performance, TD, CIBC and Scotia are overweight in the portfolio, and RBC, National and BMO are underweighted.

Holdings (Hamilton ETFs)

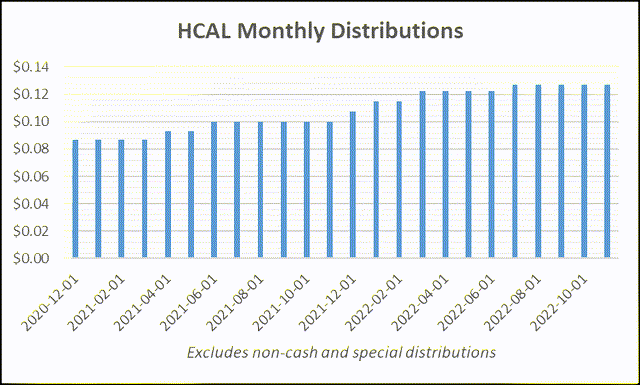

Distribution Yield

HCAL pays a steady monthly distribution of $0.1270 for a projected annualized distribution of $1.524. This equates to a forward yield of just over 7%. The fund has increased the distribution as the underlying banks have increased their dividends. With boosts in February and June 2022, HCAL now pays out 10.4% more than in January 2022. It is worth noting that the distribution amount could fluctuate should the fund be underweight on all the highest yielding banks at the same time (i.e. BNS and CIBC, tend to have higher yields than RY and TD).

Mean Reversion Strategy

HCAL employs a mean reversion strategy that seeks to take advantage of the variability of price movements among the Canadian banks. HCAL invests 80% of the portfolio in the three banks which have recently underperformed, and the remaining 20% in the three banks which have outperformed. The fund rebalances these positions quarterly based on performance. Mean reversion is effective, as the Canadian banks tend to move in unison.

This correlation is expected since the banks operate in the same market, have the same regulator and have similar capital structures and dividend policies. Canada’s large systemically important banks have used their profits from the high-margin domestic Canadian personal and commercial banking sector to invest in capital markets, wealth management and international markets. Each of the large banks has pursued a variation of this strategy with different geographic and business mix focuses. While each of these individual companies will have variability based on their execution of growth strategies, the core of their business remains very similar across the group.

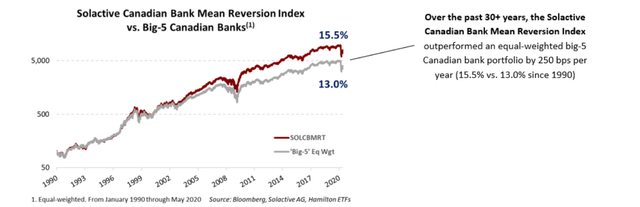

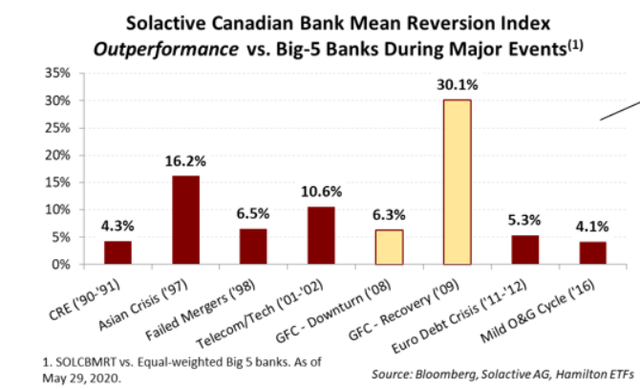

Mean Reversion Outperformance (Hamilton ETFs)

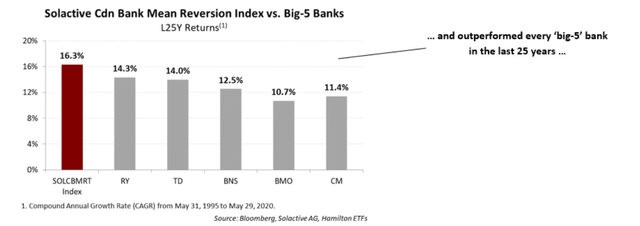

The Solactive Canadian Bank Mean Reversion Index has outperformed a similar portfolio of equal weighted large Canadian banks over 5, 10, 15, 20 and 25-year time horizons. With the underlying holdings being identical, the outperformance can only be attributed to shifting the weighting of the individual securities to capitalize on the laggards catching up to their industry peers. Over the past 25 years, the mean reversion strategy has also outperformed any individual bank.

Mean Reversion Outperformance (Hamilton ETFs)

Interestingly, the mean reversion strategy employed through the Solactive Canadian Bank Mean Reversion Index has done even better during periods of market turbulence. The impact of the mean reversion approach is most significant during periods when the banking index’s constituent parts experienced higher than average volatility. As market forces come to bear on individual bank stocks, the magnitude of price movements will differ leading to short term performance divergence among individual banks.

Volatility and Performance (Hamilton ETFs)

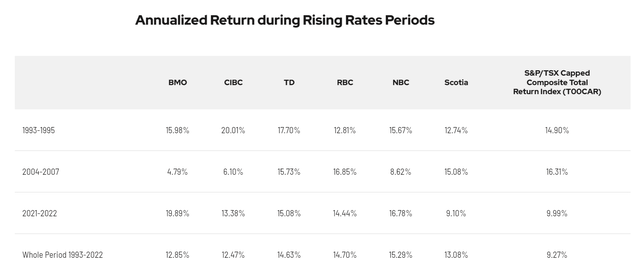

Interest Rate Tailwinds

The Canadian banks are excellent holdings for investors with long time horizons. These are solid and resilient businesses in all economic conditions. However, rising interest rates will be a good catalyst for improving net interest margins. Historically, the Canadian banks have outperformed in periods of rising interest rates.

Interest Rate and Bank Performance (Horizon ETFs)

Risk Analysis

Longer time horizons are a prerequisite for this strategy. It is possible that over shorter trading time horizons, the mean reversion among underlying holdings could fail to materialize. There can be a wide difference in annualized performance between the big banks. Investors with shorter time horizons could consider an equal weight strategy. Hamilton ETFs suggests that investors use limit orders instead of market orders and avoid trading at the beginning or end of trading hours when the prices of the underlying assets are most volatile.

HCAL employs a strategy of 1.25X leverage to enhance dividends and returns. This is achieved through borrowing cash from a financial institution. While there is still meat on the bone here, rising interest rates could make this leverage strategy less attractive. While cash leverage comes with the risk of interest rate exposure, it does not limit capital gains upside. In this regard, it is preferable strategy to using covered calls while seeking to boost yield.

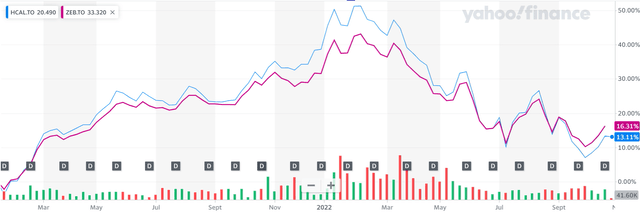

The key thing to note with and kind of leverage is that it cuts both ways. The offsetting rush of magnifying yield and capital gains is the potential for the use of leverage to magnify losses in a down cycle. This is evidenced by the differences between 2021 performance and 2022 YTD performance. Compared to the BMO Equal Weight Canadian Bank ETF (ZEB:CA), HCAL rose higher in the last up cycle and has come down further over the past 10 months. Any use of leverage may also increase volatility and affect liquidity. While the leverage is modest at 1.25X, it is still a risk to be fully understood before adding HCAL to your portfolio.

Equal Weight to Mean Reversion Performance (Yahoo Finance)

Lastly, there are risks associated with the underlying holdings of this fund. The Canadian banks are all well regulated and well run; however, they could see increased volatility in the event of a housing market correction or recession.

Investor Takeaways

Over the long term, the mean reversion strategy has outperformed the equal weight bank index or holding individual bank stocks. In addition to HCAL’s winning mean reversion strategy, the fund can help investors earn a steady and growing stream of income through the ETF’s 7% yield. This is a great option for investors who have the time horizon to take on some additional risk.

Be the first to comment