Ronald Martinez/Getty Images News

After 7 years of oversupply, the market for oilfield services finally appears to be tightening. This should lead to greatly improved margins for service companies, particularly Halliburton (NYSE:HAL), given their large exposure to unconventional basins in the US. Continued productivity gains by E&P companies make a return to the boom years of the early 2010s unlikely though. Despite the claims of management teams, the structure of oil and oilfield services markets remain unchanged, meaning that it is a matter of time before the promise of high returns leads to investment and an inevitable compression of margins. The pace at which E&P companies try to expand production and the extent to which service companies fight for market share will determine how this plays out. Given these prospects, Halliburton appears fully valued, although there may be further upside if large price increases can be pushed onto customers. There is also significant downside risk if the war in Ukraine is resolved sooner than expected, or the global economy enters a recession.

The Cyclical Boom

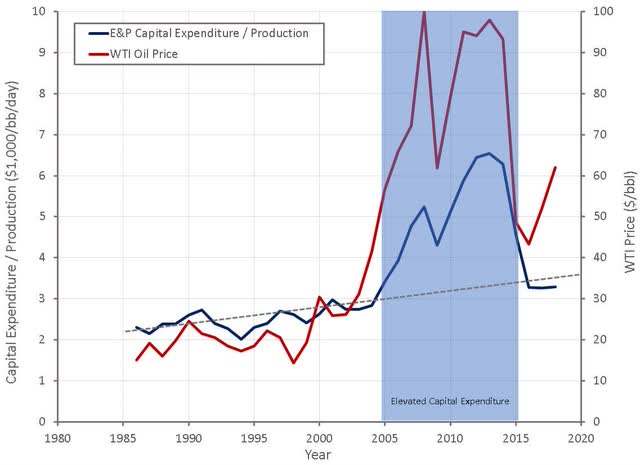

Investors and oil companies are quick to point out that there has been seven years of underinvestment in the oil and gas industry globally, which has created tightness in markets independent of geopolitical tensions. Jeff Miller specifically mentioned that spending has been about half of what it was, and while this is true it is also misrepresentative. The period between 2005 and 2015 was characterized by extreme overinvestment that flooded the market and has taken many years to be digested. Much of this spending was also directed towards exploration in risky projects, often with long timelines. Due to ESG concerns and a lack of investor appetite, CapEx in the current cycle is likely to be directed towards increasing current production, which should lead to more production per dollar of CapEx.

Figure 1: Global Exploration and Production Capital Expenditure to Oil Production Ratio (source: Created by author using data from BP, EIA and McKinsey)

Growth in demand for oil and gas is also likely to be weak going forward as developed economies try to reduce their carbon footprint and China’s growth rate declines. China’s rapid economic growth during the early 2000s was responsible for much of the growth in oil consumption. Over the past 20 years China’s oil consumption increased by 9 million bpd, but is only projected to increase by 3-4 million bpd over the next 20 years.

CapEx on exploration and production is likely to increase going forward but it is unlikely to return to anywhere near the previous cycle highs. Halliburton is likely to benefit from its high exposure to the North American onshore market, but increased productivity there will also limit the increase in service activity.

Operator Discipline

Producers are likely to support oil prices through this upcycle due to investor return requirements, public ESG commitments and regulatory pressure. This is also likely to drive investment towards short-cycle barrels. This should mean the prioritization of development over exploration, tiebacks over new infrastructure and shale over deepwater. Halliburton should benefit from this as more CapEx will be directed towards wellbore services rather than infrastructure, and completions and production rather than drilling and evaluation.

Whether large publicly listed producers remain disciplined or not may not end up mattering though. If high double-digit returns are available and payback periods are measured in months rather than years, there will not be a shortage of operating companies willing to spend. Smaller, privately held firms are likely to take the opportunity to expand production in the current high price environment. For example, Tall City Exploration is aiming to increase production from 6,400 boepd to 20,000 boepd this year. Over 60% of US land rigs are being utilized by private companies, and demand from them is growing. There are approximately 9,000 independent oil and natural gas producers in the US and they are responsible for 91% of wells, 83% of oil production and 90% of natural gas production.

Regardless of where CapEx comes from, activity is likely to increase in coming years which will lead to improved margins and revenue growth for service companies.

Halliburton

Halliburton’s Completion and Production division and North America are currently driving growth, which is not a surprise as an investment in Halliburton is to a large extent an investment in the US frac market. Jeff Miller recently pointed towards an expectation of a 35% increase in spending in North America and a mid-teen increase in spend internationally. This is more of a normalization of business after the pandemic than an expansion driven by high oil prices though.

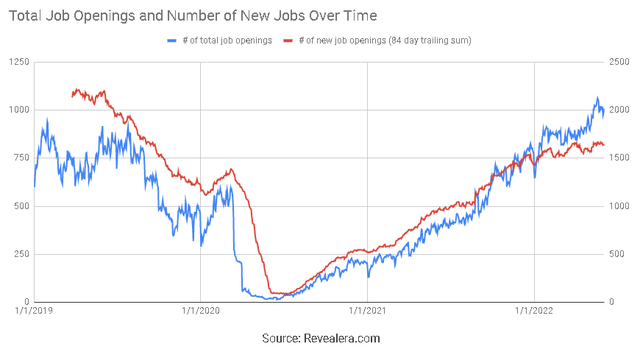

Hiring has only recently recovered to pre-pandemic levels and revenue isn’t expected to exceed pre-pandemic levels until 2023-2024. Halliburton has stated that this is a margin cycle rather than a build cycle though, so changes in margins are likely to be more important than revenue growth, CapEx or hiring in the short-term.

Figure 2: Halliburton Hiring Trends (source: Revealera.com)

While margins are likely to improve as the services market continues to tighten, Halliburton will also face its own inflationary pressures. Halliburton have seen input cost increases ranging from 20% to 100% and labor supply may also be a bottleneck.

The Frac Market

There are now close to 300 frac spreads operating in the US, which is approaching pre-pandemic levels. Halliburton’s fleet is currently sold out and the rest of the market is in a similar situation. In addition to improving activity levels, Halliburton believes that the structure of the frac market has changed in recent years due to:

- The largest four pressure pumping companies accounting for approximately two-thirds of the market

- Poor service industry returns in recent years limiting access to outside capital

- Greater differentiation in hydraulic fracturing equipment

Some of this is likely to be wishful thinking though. If prices increase sufficiently, service companies will be able to fund growth from cash flow and outside capital will be attracted by the promise of high returns. Halliburton believes equipment differentiation is based on operational and environmental performance with electric fleets at the top; dual fuel and Tier 4 diesel in the middle; and finally, Tier 2 diesel equipment at the bottom. How much this matters in a tight market remains to be seen though.

Diamondback’s (FANG) most recent earnings call is illustrative of the attitude of some customers.

We recognize they need to make margin. But if there is another provider that can provide the same service for less cost, we’ll go that route. And we’ve done that a few times this year – Diamondback CFO

Diamondback also stated that they saw little point increasing activity while the service market was tight as it would reduce their capital efficiency.

International

In international markets Halliburton believes they are well positioned due to a relatively greater presence of national oil companies and independents compared to previous cycles. These customers in general require more collaborative service providers, which Halliburton believes fits their broad technology portfolio, local expertise and ability to execute reliably.

Halliburton points towards their increased competitiveness in drilling and evaluation leading to a doubling of their contract win rate in global exploration work over the past 2 years. This could be due to improved services or may just be the result of undercutting competitors on pricing. Drilling and evaluation has historically been Schlumberger’s (SLB) strength, meaning Halliburton’s gain here could be Schlumberger’s loss. Halliburton has also invested in specialty chemicals and artificial lift, which they believe creates growth opportunities in international markets. These were previously areas of relative weakness for Halliburton.

Schlumberger and Baker Hughes (BKR) have also tried to develop more integrated services in recent years and expand into higher value add services. Whether Halliburton is truly differentiated in this area remains to be seen, but investors should be skeptical that financial performance will be significantly improved over past cycles.

Valuation

Halliburton is trading above historical averages across a broad range of multiples, which means that going forward Haliburton’s stock price is likely to be driven by the balance of improving fundamentals and multiple compression.

There are a number of factors which could limit Halliburton’s upside potential:

- Customers are focused on returning capital to shareholders

- Customers are focused on production from highest quality resources

- Drilling and completion techniques continue to improve, reducing CapEx per BOE

- Some customers are forward integrating to reduce cost or improve productivity (e.g. EOG’s (EOG) downhole tools)

- In the US there is limited ability to increase production without oversupplying the market

Conclusion

This time is not different, despite the claims of most management teams in the oil and gas industry. At current prices, operating company margins are extremely high which will lead to an increase in activity. Increased activity will lead to improved pricing for service companies, which will in turn result in increased supply from service companies. How long this boom and bust cycle takes to play out will depend on geopolitics, the macro environment and the discipline of companies in the oil and gas industry. Halliburton’s stock likely has further room to run as fundamentals improve, but deterioration of economic conditions or an end to sanctions on Russia represents large downside risks.

Be the first to comment