Wirestock/iStock via Getty Images

Halliburton’s (NYSE:HAL) stock has been buoyed in recent months by a resilient global economy and the potential for China’s reopening to drive oil prices higher. 2023 should be a strong year for Halliburton, but it could also be about as good as it gets. Growth in demand for oil and gas is likely to be weak going forward, and the purported underinvestment in exploration and production is not as clear as many believe. With treasury yields over 4% and Halliburton trading on a forward PE multiple of approximately 12, the stock does not look particularly cheap.

Energy

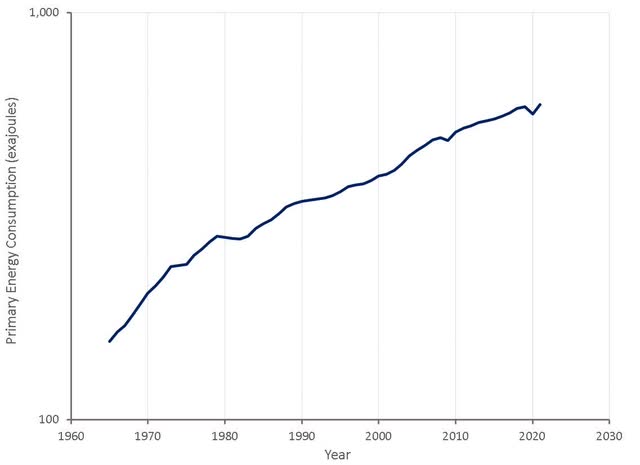

Energy consumption has a long history of reasonably steady growth, driven by a rapidly growing global population and increasing economic activity. These tailwinds are starting to come to an end though, population growth is declining, economic activity is shifting towards services and energy efficiency is increasing. Energy consumption will continue to increase, but with the Chinese economy maturing, it won’t be at the same pace as the last 20 years. In addition, oil and gas are likely to lose share due to climate change and geopolitical concerns. A basic breakdown of this argument is presented here.

Figure 1: Global Primary Energy Consumption (source: Created by author using data from BP) Table 1: Energy Consumption Growth 2011-2021 (source: Created by author using data from BP)

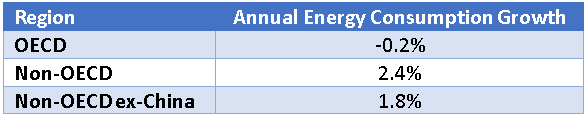

With demand growth for oil and gas set to soften going forward, the question should be raised as to what level of investment is required to support reserves and production. Rather than attempting to grow reserves through exploration, producers will increasingly need to consider what level of reserves are appropriate, and when reserves should be allowed to fall.

Figure 2: Global Oil Reserves and Production (source: Created by author using data from BP)

Oilfield Services

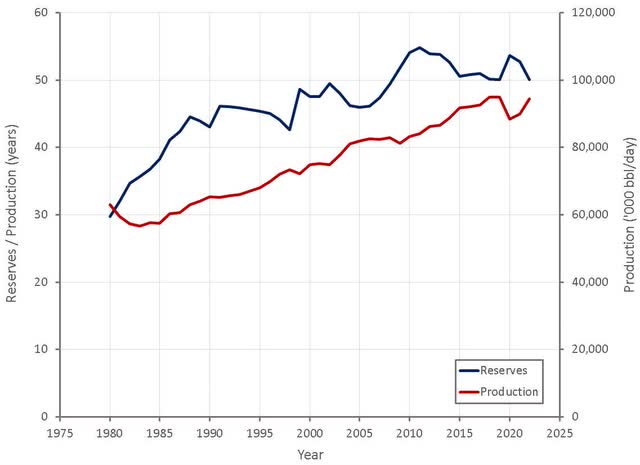

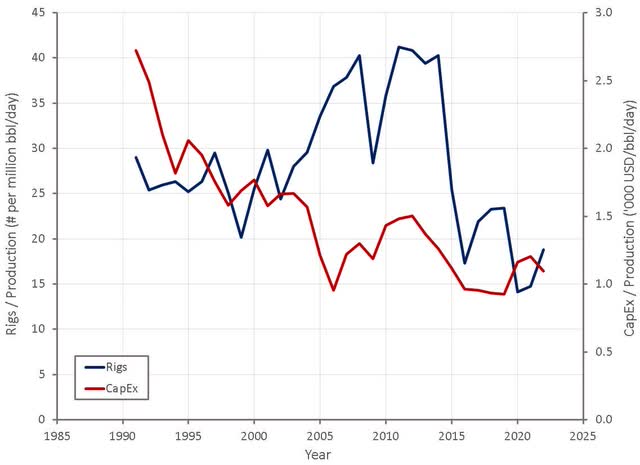

Jeff Miller continues to point to an 8-year period of underinvestment in E&P as a reason why Halliburton will continue to grow going forward. The last 8 years has seen far less CapEx than 2007-2015, but this was a period of massive overinvestment with hugely inflated service pricing that cannot be used as a benchmark.

Comparing CapEx to production levels, both in nominal terms and deflated by oilfield service price inflation in the US, indicates that spending levels are already returning to healthy levels. This is obviously a flawed method, but it clearly shows that much of the increase in spending during the 2010s boom was directed towards higher prices rather than a genuine increase in activity. If operators truly remain disciplined during the current cycle, a similar level of price inflation is unlikely to occur.

Figure 3: E&P CapEx (source: Created by author using data from EIA, McKinsey, BP and The Federal Reserve)

This can also be seen from the number of rigs operating globally. Service activity may continue to increase, but a return to 2005-2015 levels is unlikely.

Figure 4: Global Rig Count and E&P CapEx (source: Created by author using data from BP, The Federal Reserve and Baker Hughes)

Based on an Evercore survey, global E&P spending is expected to increase by 14% relative to 2022, down from the previous year’s 20% growth rate. North American CapEx is expected to increase by 18% in 2023, down from 2022’s 44% growth rate. Average oil and gas prices of 125 USD for WTI oil and 7.70 USD for HH gas were cited for budgets to revise higher, while 62 USD WTI oil and 3.25 HH gas were cited for budgets to revise lower. Based on current market prices, this would suggest far greater risk of a decline in anticipated service activity than an increase.

These figures are broadly in line with Halliburton’s expectations of international growth in the mid-teens, driven by the Middle East and Latin America, and North America growth of at least 15%. The expectation is also that spend will be directed towards development activity rather than exploration.

Investor-driven return discipline by both operators and service companies is expected by Halliburton’s management to create a prolonged market upturn. This is not an unreasonable expectation, but it may involve CapEx and pricing that remain near 2023 levels, rather than a period of strong growth, particularly if operating companies remain disciplined. In any event, this will be highly dependent on global economic growth, which could face significant headwinds towards the end of the year.

Halliburton

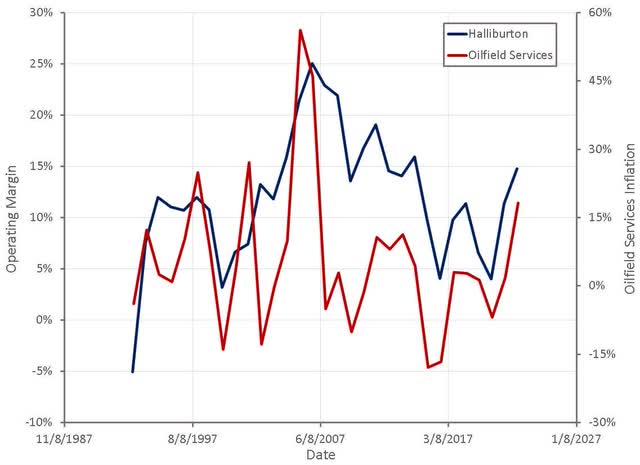

Halliburton’s tender pipeline and backlog suggest an increase in activity in 2023 and the market for frac equipment remains extremely tight. This is unsurprising, but the more important consideration is how long this situation will last. Jeff Miller remains extremely optimistic about Halliburton’s prospects, but it seems like this view is shaped by his time in the industry. Miller joined Halliburton in 1997, and much of the period since then was a boom for service companies, and in particular, Halliburton. Oilfield service price inflation in the US averaged 8.2% annually between 1996 and 2013 and Halliburton’s revenue grew 9.3% annually over the same period. The commodity boom caused by China and the rise of shale production in North America made this period highly unusual, and expectations of a return to this type of market strength are unlikely to be fulfilled.

Halliburton’s margins continue to improve across both their D&E and C&P businesses as a result of increased activity and higher prices. Halliburton’s stock price returns going forward will be heavily dependent on how tight service markets remain and to what extent higher prices can be pushed onto customers. A rapid increase in demand in 2022 returned Halliburton’s margins to what I would consider average / above-average levels. This is difficult to assess though as Halliburton’s product portfolio has evolved over time, like increased exposure to chemicals and artificial lift. With robust growth set to continue in 2023, margins could continue to increase, but this is unlikely to be sustainable. Whether through a market downturn, or increased competition, operating margins in the 10-15% range seem more reasonable.

Figure 5: Halliburton Operating Profit Margins (source: Created by author using data from Halliburton and The Federal Reserve)

Valuation

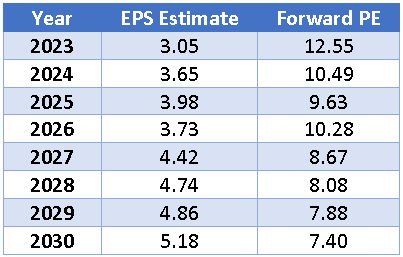

Halliburton’s profits are expected to increase significantly in 2023, which seems reasonable given ongoing revenue growth and margin expansion. Beyond 2023, the economic outlook becomes cloudy though, and oilfield service activity and margins are likely to stabilize. Even if Halliburton does meet these fairly high expectations, the stock is not particularly cheap. Halliburton is in a low-growth, cyclical industry with high CapEx requirements, which doesn’t make a forward PE ratio of 12.5 looks particularly appealing next to treasury yields of over 4.5%.

Table 2: Halliburton Earnings Estimates (source: Created by author using data from Seeking Alpha)

This situation does not appear to bother Halliburton though, with the company continuing to engage in buybacks. Halliburton has Board authorization for approximately 5 billion USD worth of repurchases and in the fourth quarter of 2022, bought back shares totaling 250 million USD. Going forward, Halliburton expects to return at least 50% of their annual free cash flow to shareholders through dividends and buybacks. These buybacks are expected to be evenly loaded through 2023, with management stating that it is just a way to return cash to shareholders, rather than an attempt to trade the stock.

Buybacks often seem to be viewed as an unequivocal good, but this type of viewpoint from management should concern shareholders. It is highly likely that Halliburton’s stock will be far lower than it is today at some point in the next 5 years. Repurchasing shares at the market top rather than increasing dividends or strengthening the balance sheet to weather a downturn is likely to be viewed poorly in hindsight.

Halliburton’s current valuation is high by historical standards, which is typical of a boom period, but this will inevitably be followed by a bust. There could still be 20-30% upside from current levels, but investors should also be prepared to face a 40-60% drawdown when a recession or market oversupply hits.

Be the first to comment