andresr/E+ via Getty Images

The Global X MSCI Colombia ETF (NYSEARCA:GXG) is a ~$39bn valued ETF which tracks 26 stocks based in Colombia.

The preferred option for access to Colombian equities

Investors who are on the lookout for ETFs with focused access to Colombian equities have a couple of options to choose from; besides GXG, you also have the iShares MSCI Colombia ETF (NYSEARCA:ICOL). Whilst both ETFs are similarly sized at roughly $39bn AUM each and have identical expense ratios of 0.61%, I believe GXG has an edge in other areas.

Typically, some of these less-covered emerging market (EM) products tend to face liquidity issues, thus it is preferable to go with the ETF that has a better volume profile; according to Seeking Alpha’s screens, GXG’s average daily dollar volume works out to over $600k, more than 3x the level of ICOL. GXG also appears to be the more stable fund of the two and does not resort to ample churn; the annual turnover ratio is only 16%, more than 3x lower than ICOL’s corresponding figure of 52%. Currently, the yield differential too is in favor of GXG at ~2%, over 100 bps higher than the ICOL’s corresponding figure.

The Colombian picture

GXG has enjoyed a nice steady year in 2022, delivering returns of around 15% and I believe much of this is on account of what’s happening with oil prices as the commodity accounts for close to 60% of total exports. This will likely do a world of good for the country’s balance of payments position, which is also reflected in the strength of the Colombian Peso (COP) this year. At one stage, the Peso was up by 8.5% vs the USD, although it has given up some of its gains (even as oil prices have receded) and is currently up by ~6% on a YTD basis.

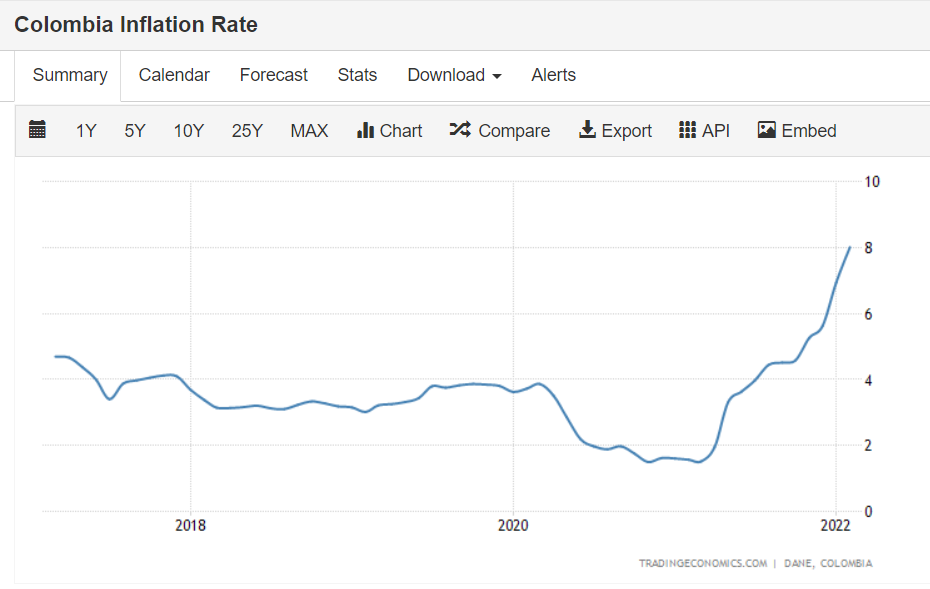

What has also made the COP quite relevant this year, is the central bank’s hawkish positioning with rates (the bank has raised rates on five successive occasions with the most recent 100 bps hike coming in ahead of the 75bps expectation from the markets). This is of course a function of a rather elevated inflation level which is at its highest point in six years. A year ago in March, the annual inflation rate was only 1.5% but since then, it has increased every month and is currently over 8%!

Trading Economics

One of the main drivers of this phenomenon is the steep high food inflation which alongside non-alcoholic beverages was up a whopping 23% in February! Going forward you would imagine that things would subside from these 8% levels, particularly as the country also recently cut import tariffs on around 200 items (most of which are the agricultural-based product), but do consider that inflation expectations still point to levels well above the central bank’s target rate. Consumer price inflation by the end of this year is expected to come in at 5.4%, falling to 3.7% the following year, both of which will be above the central bank’s long-term target of 3%. This means, one can continue to expect further rate hikes in the months ahead; the expectation is for anything between 100-150bps in the March meeting followed by another 100bps in April and another 50bps in June. This should take the benchmark rate to anything between 6.5%-7% by the end of H1. The country’s FX reserves could also receive some support from a pickup in the tourism sector which is still convalescing from the pandemic; in December-2021, tourist arrivals stood at over 420k, a 43% sequential increase but still a long way from peak levels of 1.4m in December 2018. Broadly there are some fairly encouraging tailwinds for the COP.

What could potentially put a spanner in the works, and also cause a lot of volatility in GXG in the short term, is developments regarding the Presidential elections which are due to be wrapped up by May/June this year. Recent polls suggest that Colombia could well gravitate to a leftist regime as a leftist candidate- Gustavo Petro won handsomely in the presidential primaries. Some of Petro’s proposals should have investors worried as he wants to transition the economy away from oil and coal and redistribute land and wealth whilst raising taxes on the rich. He has also suggested that he would look to implement import tariffs to boost the prospects of local businesses.

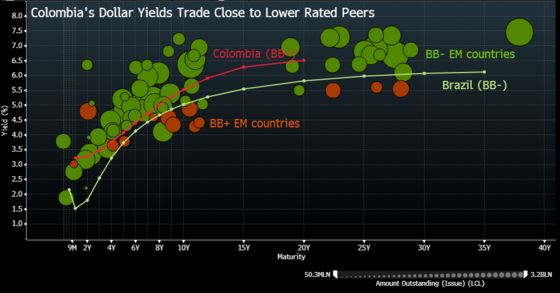

Bloomberg

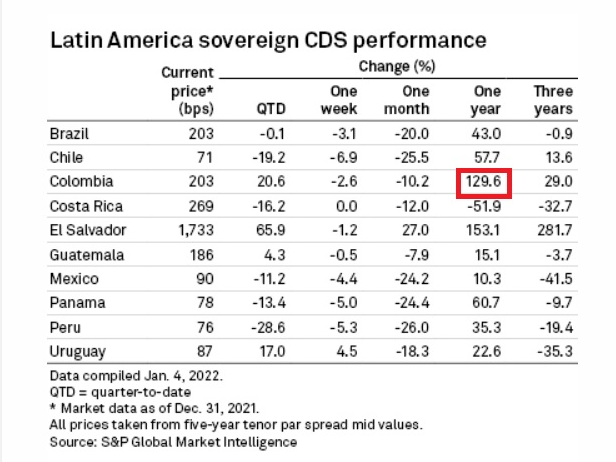

It’s fair to say that the smart investors are currently on tenterhooks on account of this and this is reflected in the yield developments and the movement of credit default swaps (CDS). Consider something like Brazil where central government debt to GDP is around the 80% levels, more than Colombia’s corresponding levels of around 65%; yet still, Colombia’s 2031 dated BB+ rated bonds trade at a 30bps premium over similar-dated BB- rated Brazilian bonds (six months ago, you were looking at a discount of 50bps). CDS spreads too are on par with Brazil. Also consider that last year, with the exception of El Salvador, no other country in the Latam Region witnessed such a pronounced expansion in its CDS spreads, a gauge of investment risk and sovereign credit perception.

S&P Global

Closing thoughts- Is The Global X MSCI Colombia ETF a BUY, a SELL or a Hold?

I’m not necessarily sure GXG would appeal to prospective investors who are looking for bargain opportunities in Latin America. According to YCharts, on a forward P/E basis, GXG currently trades at 10% premium to the corresponding forward P/E multiple of the iShares Latin America 40 ETF (NYSEARCA:ILF). Just for some additional perspective, do note that Colombian equities account for less than 3% of ILF’s total portfolio which is heavily oriented towards Brazil and Mexico.

If one were to look at the relative strength ratio of these two ETFs as well, I wouldn’t say the risk-reward is in favor of GXG, with the ratio now close to the upper boundary of the long-term descending channel.

Stockcharts

Investing

Finally, some considerations with GXG’s standalone technical chart; the ETF has delivered close to 14% returns over the last three months and is now close to making up for all the pandemic-era losses. Having said that, even though we are only halfway through March, the shooting star candle for this month suggests that some investors are cashing in on their positions at around last year’s peak levels of around $33. Even if we were to witness a resumption of some strength in what’s left of March, do consider that the ETF will be running into a price zone that served as a congestion area for much of 2019 (GXG moved sideways between $34-$40 for much of 2019). That certainly isn’t ideal. Ongoing uncertainties around the Presidential elections until May/June could keep the ETF’s movements in check for the short term; I would imagine one is in for a choppy or range-bound picture over the next few months. Hold.

Be the first to comment