photovs

The utility sector has long been a favorite holding of conservative investors that are looking for income, such as retirees. This is because most of the sector boasts sustainable and consistent cash flows through any economic environment, coupled with remarkably high dividend yields. This is something that will likely prove more and more important over the coming months, as it appears essentially certain that economic conditions will continue to worsen in the United States.

Unfortunately, many utilities do not have high enough yields to provide for the needs of many of those that need income most. There are solutions to this problem, though, such as investing in a closed-end fund (“CEF”) that specializes in the utility sector. These funds are able to benefit from professional management and can, in most cases, provide a higher yield than any individual utility company offers.

In this article, we will discuss the Gabelli Utility Trust (NYSE:GUT), which is one of the most popular CEFs in this sector. I have discussed this fund before, but a year has passed since then, and obviously, a great deal has changed. This article will, therefore, specifically focus on these changes and attempt to determine if this 8.84%-yielding fund could be right for your portfolio.

About The Fund

According to the fund’s webpage, the Gabelli Utility Trust has the stated objective of providing its investors with long-term growth of capital and income. This is hardly surprising for a utility fund. The sector is quite well known for boasting companies that have a long history of delivering slow and steady earnings per share and dividend growth over time. I have mentioned this in many of my past articles about the companies in the sector.

The fund states that it achieves its objectives by investing in companies involved in providing products, services, and equipment for electric, water, gas, or telecommunications utilities. This is a very broad definition that could even include a company like Cisco Systems, Inc. (CSCO), as that firm provides networking equipment used by many telecommunications firms. However, in practice, the fund invests in companies that most people would actually consider to be utilities.

With that said, many of us here in the United States do not consider telecommunications companies to be utilities, but they do have many of the same characteristics, such as stable cash flows and generally high yields. Interestingly, the fund does not state whether or not it invests solely in common equities or if preferred shares might also be included. Preferred stocks issued by utility companies generally have higher yields than the common equity but lack both the dividend growth potential and the capital appreciation. Thus, including a mix of these two equity types might have the effect of increasing the fund’s income but at the expense of capital appreciation.

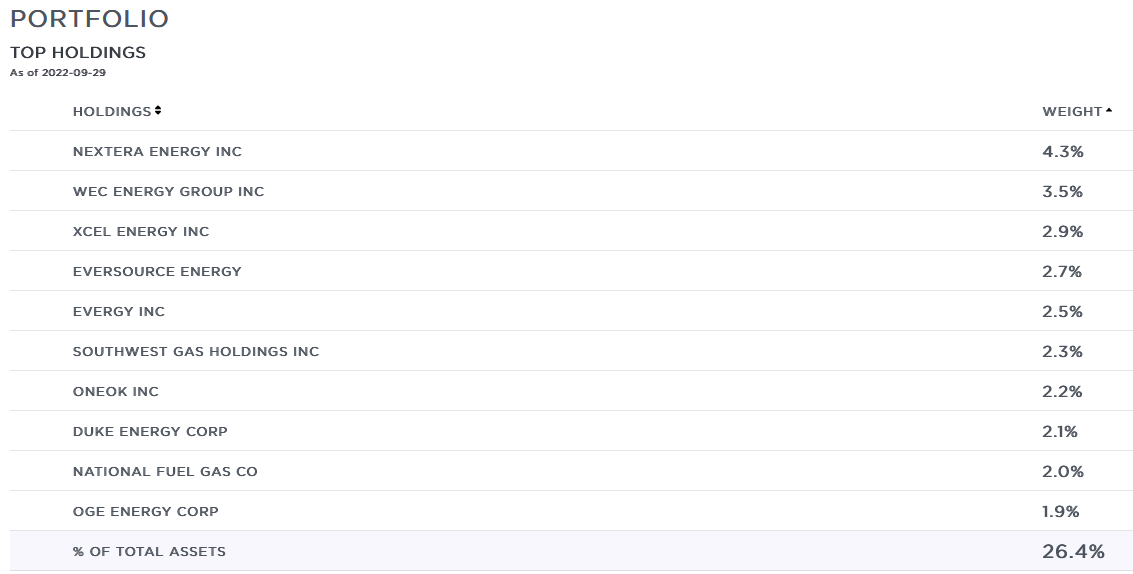

Over the past few years, I have devoted a great deal of time and energy to discussing various utility companies on this site. As such, many of the fund’s largest holdings may be very familiar to most regular readers. Here they are:

Gabelli Funds

I have discussed only a very few of these companies, however. These include NextEra Energy (NEE), Eversource Energy (ES), Evergy (EVRG), ONEOK (OKE), and OGE Energy Corp. (OGE). The remainder are either diversified utility companies serving a certain geographic region of the United States or pipeline operators. The inclusion of pipeline companies like ONEOK might seem unusual since these are usually considered to be energy firms and not utilities. However, midstream firms like ONEOK do share many of the same characteristics as utilities, such as stable cash flows and high yields. They tend to trade much like oil and gas companies, so they are typically much more volatile than electric or gas utilities. This may add a certain amount of volatility to the fund’s holdings, but only 7.37% of the fund’s assets are pipeline operators so it should not be too big of a deal. Overall, the fund’s portfolio should prove to be relatively stable, which is indeed what we see over the long term:

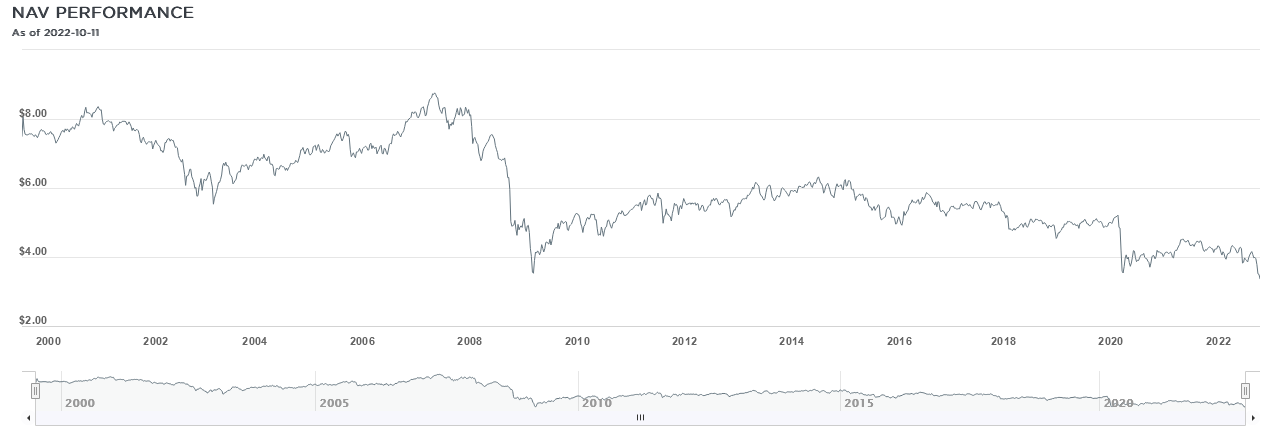

Gabelli Funds

We do, of course, see two significant drops in the fund’s portfolio value. The first of these was back in the 2008 to 2009 period and the second was in 2020. This may appear to destroy the argument about relative stability, but when we consider the events that occurred during both of those periods, it is quite understandable. The first significant decline that we see here directly corresponds to the stock market crash that accompanied the most recent financial crisis and the Great Recession. The second of these declines was in 2020 accompanying the stock market crash at the start of the COVID-19 pandemic. The declines are therefore understandable but it is quite disappointing that the fund never managed to retain its former portfolio values despite the incredibly strong market surges that followed the crashes. This may be a sign that the fund should have cut its distributions at those times to preserve its assets. The fact that it did not may be appealing to those that are holding the fund for income but it is not particularly good for the preservation of capital.

One thing that we notice by looking at the fund’s largest positions is that they changed only slightly over the past year. The only changes were the replacement of The AES Corporation (AES) and PNM Resources (PNM) with National Fuel Gas Company (NFG) and OGE Energy. In fact, even the weightings of the positions did not change very much over a year.

This may lead one to believe that the fund only does minimal trading and has a low turnover. This is indeed the case, as the fund’s 10.00% turnover is one of the lowest figures that I have ever seen among any sort of closed-end fund, let alone an equity fund. As a general rule, we like to see low turnover rates, because trading stocks or other assets is expensive and therefore represents a drag on the fund’s returns. This is one of the reasons why index funds have become so popular over the year as their minimal trading and low expenses tend to result in higher performance than most actively managed funds. This does not necessarily mean that a fund that does a lot of trading cannot outperform but it does mean that management has a much larger hurdle to jump over. As we can see though, we do not need to really worry about this here as the Gabelli Utility Trust does not do very much trading.

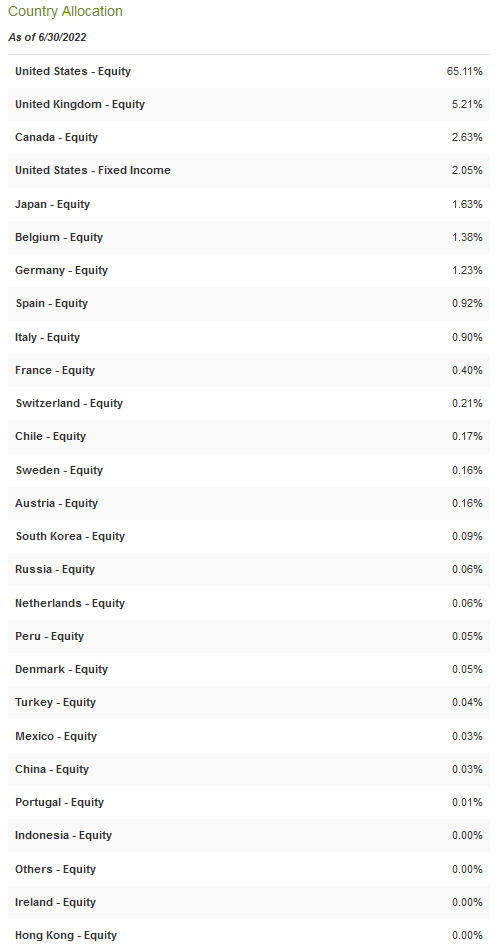

Unlike its counterpart, the Gabelli Global Utility & Income Trust (GLU), the Gabelli Utility Trust does not specifically advertise itself as a global fund. Nonetheless, the fund’s description of itself found on its webpage does state that the fund invests in both domestic and foreign companies. A look at the full portfolio likewise reveals that this is the case:

CEF Connect

We do, however, see that the fund’s allocation to the United States has decreased from the 67.50% weighting (domestic equity plus fixed income) that it had the last time that we looked at the fund. This is not unusual among global funds as they typically do have a domestic 60% to 70% weighting. That is substantially more than the nation’s actual representation in the global economy, however. The United States, in aggregate, represents just under 25% of the global gross domestic product.

With that said, though, this fund does not specifically advertise itself as being a global fund, so many of those people buying it are likely expecting it to be mostly American anyway. It is still somewhat nice to see the global exposure, however, as it provides us with some protection against regime risk. Regime risk is the risk that some government or other authority will take some action that has an adverse impact on a company that we are invested in. We saw a great example of this back in 2021, when the incoming Biden Administration unilaterally canceled the permits for the KeystoneXL pipeline and caused TC Energy (TRP) to essentially lose all of the money that was invested in it.

The only way to protect ourselves against this risk is to ensure that only a relatively small percentage of our portfolios is exposed to the whims of any given government. While the Gabelli Utility Trust is admittedly not doing that perfectly, it is still making an effort, which is nice to see.

Distribution Analysis

One of the primary reasons why investors purchase utilities is because they tend to pay out a reasonably high dividend yield. Indeed, as of the time of writing, the iShares U.S. Utilities ETF (IDU) yields 2.53%, which is significantly above the 1.73% yield of the S&P 500 index (SPY). In addition, the Gabelli Utility Trust specifically states that one of its objectives is to provide its investors with long-term growth of income.

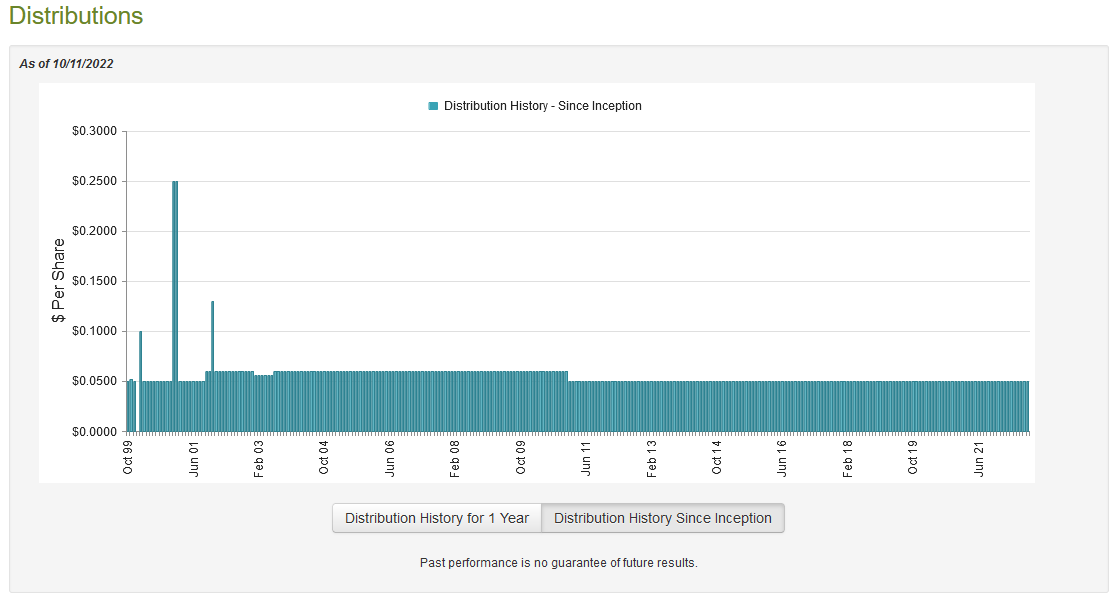

We might, therefore, assume that the fund pays out a respectably high yield itself. This indeed is the case, as the fund pays out a monthly distribution of $0.05 per share ($0.60 per share annually), giving it an 8.84% yield at the current price. The fund has been remarkably consistent about this over time, as it has maintained the same distribution since January 2011:

CEF Connect

This will undoubtedly appeal to many investors that are seeking a steady and secure source of income to use to pay their bills. Unfortunately, it has failed to provide the long-term growth of capital and income that it states as its objective, although anyone that reinvests their distributions has certainly seen this. The fact that the fund did not cut even during the market crash in 2020 is likely to be attractive to some, although it is a big reason why the fund’s asset base never completely recovered from that event. The fund has proven to have a relatively stable asset base since that time, however. The most important thing for new money is how well the fund can continue to maintain its distribution at the current level.

Fortunately, we have a very recent report that we can consult for this task. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. This is a much more recent report than we had available the last time that we looked at the fund and it should give us a good idea of how well the fund has been performing in the somewhat choppy markets that have been dominating the economy this year. During that six-month period, the Gabelli Utility Trust received $4,690,464 in dividends and $113,533 in interest off the assets in its portfolio. It used this money to pay its expenses, leaving it with $2,695,556 available for investors. This, however, was nowhere close to enough to cover the $20,106,217 that the fund actually paid out in distributions.

A fund like this does have other methods that it can use to obtain the money that it needs to pay its distributions, though. The most common of these is capital gains. As most people reading this are no doubt aware, these have been somewhat hard to come by so far in 2022. It has proven to be so for the fund as well. It did realize $820,088 in capital gains but this was more than offset by $21,836,964 in unrealized capital losses. Overall, the fund was not able to cover its distributions, which is very concerning.

The Gabelli Utility Trust did see its assets under management increase during the six-month period in spite of this, though. This is because it sold a total of $50,234,410 to new investors as well as another $3,260,012 in new shares to those investors that are opting to reinvest their distributions. Once we net out the expenses involved in doing this, the fund brought in $53,130,279 through the sale of new shares. This allowed it to increase its assets by $12,990,205 during the six-month period even after covering the distributions. The big question is how long it can ultimately maintain this but the answer is that it probably is reasonably sustainable since investors are likely to continue to contribute money to a fund like this in exchange for the yield that it provides them with.

Thus, even though there may be some dilution in weak markets, it does seem likely that the fund can probably continue to maintain its distribution (especially if we assume that it can also repurchase shares when the market performs well).

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Gabelli Utility Trust, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is, therefore, the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain them for a price that is less than the net asset value. This is because such a situation implies that we are acquiring the fund’s assets for less than they are actually worth. That is, unfortunately, not true in the case of the Gabelli Utility Trust. As of October 10, 2022 (the most recent date for which data is currently available), the fund had a net asset value of $3.37 per share but actually trades for $6.81 per share. This gives it an enormous 102.08% premium to the net asset value. This is a very high price to pay for any fund, even though it is in line with the 102% premium that the fund has had on average over the past month. Thus, this high price may prevent the fund from being worth buying, even though there is otherwise a great deal to like about the fund.

Conclusion

In conclusion, there appears to be quite a bit to like about the Gabelli Utility Trust. The fund boasts a relatively stable portfolio of high-quality utility companies that provide it with a relatively steady source of income through any economic environment. Unfortunately, the fund appears to be paying out too much money when the market is weak and thus damaging its net asset value. In addition, the fund trades at a tremendously high valuation that largely destroys any interest that I have in purchasing or recommending it. It could be a decent buy if one can get it at a more appropriate price, though.

Be the first to comment