Scott Olson/Getty Images News

We’ve all heard the common adage that “everybody loves an underdog.” Well, this isn’t true in today’s market. With volatility returning in a big way as investors assess the impacts of potential rate hikes on growth stocks, today’s market is all about high quality. The safest, strongest stocks are holding onto their value, while more speculative and smaller growth stocks are rapidly losing the majority of their remaining value.

No one has the patience for a turnaround story these days either, and unfortunately that is what Groupon (NASDAQ:GRPN) is. The once-popular local deals site has seen a huge diminishing interest for its website, and it’s struggling to maintain relevance in a post-COVID world.

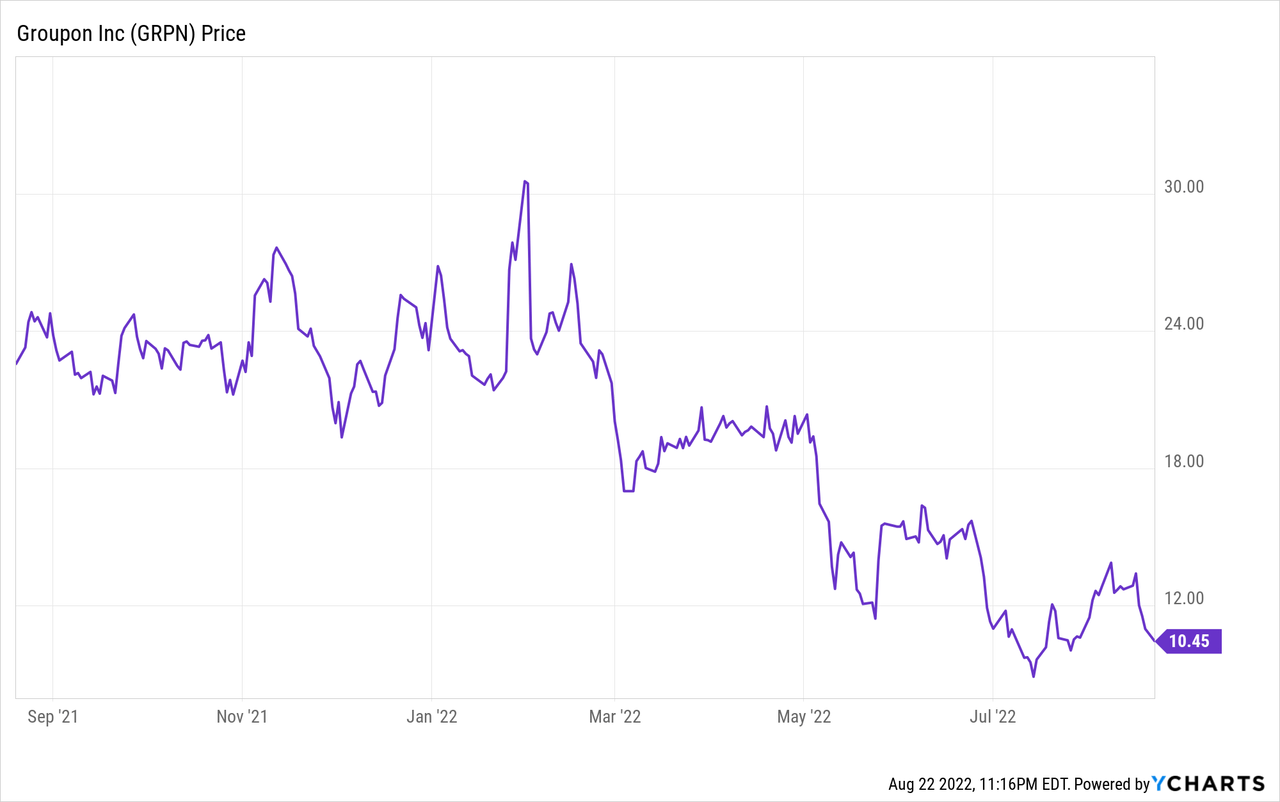

Year to date, Groupon has lost more than 60% of its value. And since reporting Q2 earnings in early August, the stock has cut ~25% alone. The pain, unfortunately, doesn’t seem to have a light at the end of the tunnel.

I turned bearish on Groupon following its Q1 earnings release, and unfortunately it seems the deterioration in Groupon’s fundamentals continue to only get worse with each passing quarter. This is a company whose entire turnaround plan rests on cost-cuts – which exposes it to two major risks:

- Cost cuts don’t end up generating as much in run-rate savings as the company originally intended, with offsetting inflationary/wage pressures weighing against the expense reductions created by layoffs

- The business continues to decline, and gross profit dollars shrink faster than opex savings

We’ll discuss Groupon’s Q2 earnings in the next section, but the bottom line here: I don’t see any near-term or longer-term catalysts that can restore this business to anywhere near its former heights. It’s time to discard this stock and move on.

Q2 shows an ugly picture that is only getting uglier

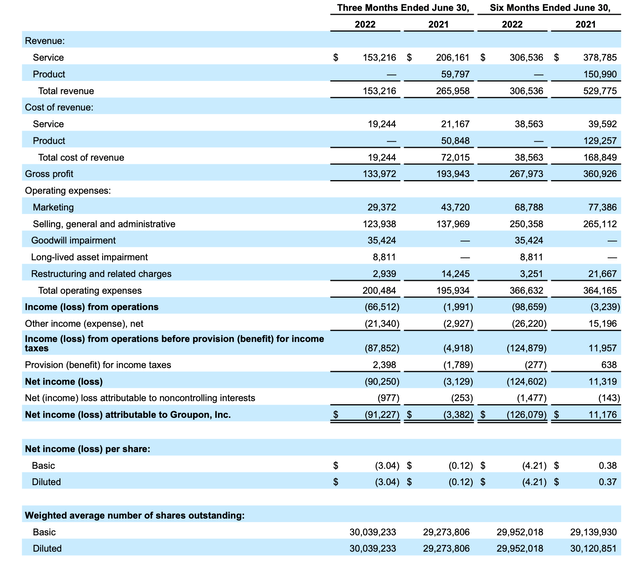

Let’s start with the elephant in the room: Groupon isn’t getting any more popular with the general population, and its results show it plainly. Take a look at the Q2 earnings summary below:

Groupon Q2 results (Groupon Q2 earnings deck)

Revenue declined -42% y/y to $153.2 million, missing Wall Street’s expectations of $156.8 million (-41% y/y). For investors who are newer to Groupon, recall that the company discontinued its first-party Marketplace business, which resulted in the complete loss of last year’s $59.8 million in product revenue.

Still, however, the revenue line we are paying more attention to – services revenue – still also declined -26% y/y to $153.2 million. This is a steeper decline than Q1’s -11% y/y decay.

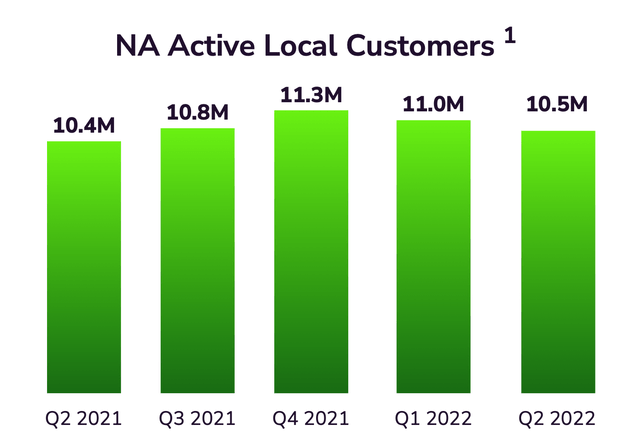

Further illustrating the deterioration in this business: in Q2, Groupon lost another 500k North American local customers, ending at 10.5 million. Again, this is a greater sequential loss in customers than in Q1.

Groupon customer base (Groupon Q2 earnings deck)

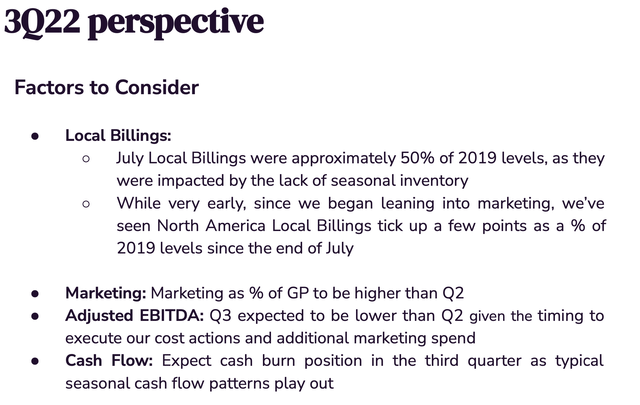

We note as well that Groupon’s anecdotal commentary on Q3 suggested weakness in July billings, hurt by lower levels of inventory on Groupon’s platform.

Groupon Q3 commentary (Groupon Q2 earnings deck)

Here’s some commentary from CEO Kedar Deshpande’s prepared remarks on the Q2 earnings call, detailing the challenges the company is seeing in the market:

While we have stabilized the business, we are still not stimulating the customer engagement we need to grow the business. And as a result, our customer retention and purchase frequency metrics are not where we want them to be. Bottom line, our overall performance is not at the levels we anticipated, and we know we must do better.

On the merchant side of our marketplace, macro headwinds have persisted. Labor availability is still constrained and many merchants with limited capacity have been able to raise prices. This means that these merchants have not needed discounts to bring customers through their doors, so many merchants are not leveraging the Groupon marketplace to sell discounted inventory as they have in the past.

On the other side of our marketplace, we haven’t yet seen consumers widely trading down to discount channels, and with our purposeful pullback in marketing spend, both traffic and customer counts have been impacted. While these factors are a headwind to our performance today, we believe that Groupon should benefit if the economy continues to decelerate and merchants and customers need to lean into discount channels.”

The alarming situation is that Groupon is feeling chills on both the supply and demand side of its marketplace – an almost certain death knell for this kind of business.

The turnaround plan relies entirely on cost cuts

Now that we’ve established that Groupon’s top line and customer base are at risk, we’ll address the meat of the company’s plan to turn itself around: which relies entirely on cost cuts.

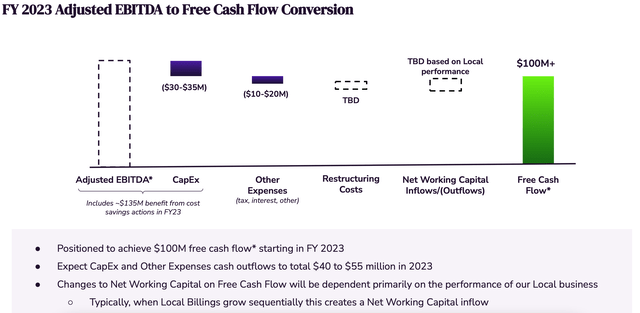

Groupon profitability bridge plan (Groupon Q2 earnings deck)

Ultimately, Groupon aspires to hit $100 million in free cash flow by FY23. Note that this is substantially higher than the $19.2 million in FCF that the company generated in FY21, and $68.9 million in FY20.

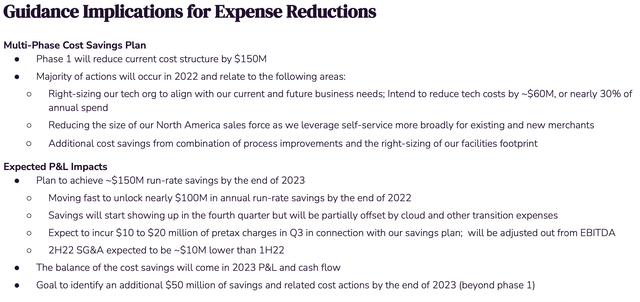

Groupon cost cut plan (Groupon Q2 earnings deck)

As noted in the slide above, Groupon’s cost reductions are intended to generate $150 million in annual run-rate savings. The company is downsizing its tech organization, laying off a chunk of its sales force and switching to more of a self-service marketing model, and shrinking corporate real estate.

Again as we mentioned at the outset, cost-cutting plans can frequently fail to achieve the targeted level of savings – especially in the current environment, where Groupon is likely having to boost wages for the staff it retains. Secondly, Groupon’s FCF ambitions also rest on stable top-line revenue, when the reality is that services revenue is still declining double-digits year over year. Cost cuts aren’t the be-all, end-all antidote if Groupon can’t retain its relevance with consumers.

Key takeaways

All signs point to continued decay for Groupon. The company’s planned cost-cuts are a good signal of a management team that is under no illusion about the difficulties that lie ahead for Groupon, but with continued customer erosion and service revenue decay, it’s difficult to justify a reason to invest in this company. Steer clear here.

Be the first to comment