Leon Neal

Grindr Inc. (NYSE:GRND), the largest online dating and social networking application for the LGBTQ community, is an attractive long-term play now that its stock price is well below its online dating peers that have recently been updated to Buy status due to growth in online dating demand. There is a lot of upside opportunity due to its above-average revenue growth, generous profit margins, asset-light and scalable business model, increase in paid users, high engagement level and future monetisation opportunities through a web application and premium add-ons in a TAM of $4 billion with further growth expected. While its SPAC merger into the public space may have left a bad taste, investors should be cautious that GRND remains a young company with a short performance history in a new and reasonably unpredictable industry. Investors may want to hold onto what appears to be more than just a hookup app.

Company overview

GRND was founded in 2009 as an LGBTQ+ dating and networking app designed to find profiles based on GPS location. It is available in 21 languages in over 190 countries. 11 million daily users spend an average of 61 minutes per day on the app, and the high-tech, scalable solution processes over 12 billion messages daily. Since 2021 paid users, have increased by 41.76% to reach 818,000 users, 7.4% penetration of total users. GRND makes money through in-app ads and tiered subscription services ranging from $19.99 to $39.99 per month, although 80% of its revenue is from paid subscriptions. It has also invested in additional content streams, such as the miniseries ‘Bridesman’ on YouTube earlier this year. The company is yet to be profitable, although its users and revenue are growing.

In a short time, the company has been through several ownership changes, coloured with international ownership structures that upset US regulators. In 2016 60% was sold to a Chinese firm, Kunlun Tech Co Ltd., which made a total purchase of GRND in 2018 with a plan to IPO. After pushback from US regulators, 98.59% of the company was sold at $608.5 million to San Vicente Acquisition LLC in 2020. Fast forward to today, GRND went public through a disaster of a SPAC with Tiga Acquisition Corp.

SPAC merger and going public

GRND wanted to go public to establish itself as a respectable organisation and increase its ability to raise capital. It chose to do this via the faster but riskier SPAC merger route rather than a traditional IPO offering which could take up to 18 months. In May 2022, GRND was valued at $2.1 billion, including debt. Only two years prior, the company was bought for $608.5 million, and while it grew over those two years, the consensus was that this was highly overvalued. Over the next six months, 98.2% of SPAC investors redeemed their shares. This left GRND with a free float of only 500,000 shares and substantially less potential to raise capital.

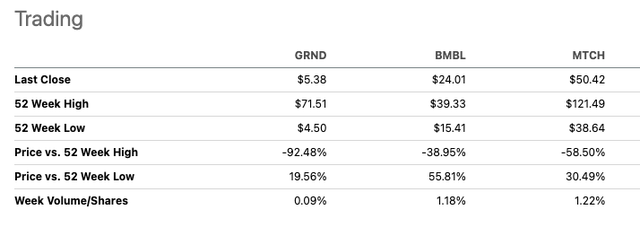

Due to the high valuation and the low number of shares on opening day, the stock went through a rollercoaster ride as there was a frantic attempt by investors to get their hands on the few stocks available, with the price shot from $16.90 to around $70 and then came tumbling back down again. Not the most incredible start to a public career, and some burnt investors. Over the last two months, the stock price has remained around its single-digit value, which is much cheaper than its direct competitors, the giant that is Match Group (MTCH) and the newcomer Bumble (BMBL).

Online dating industry and growth potential

While online dating stocks have not traded well, all three of these companies have been growing, and GRND is at almost double the growth rate of its peers.

Online dating stock comparison (SeekingAlpha.com)

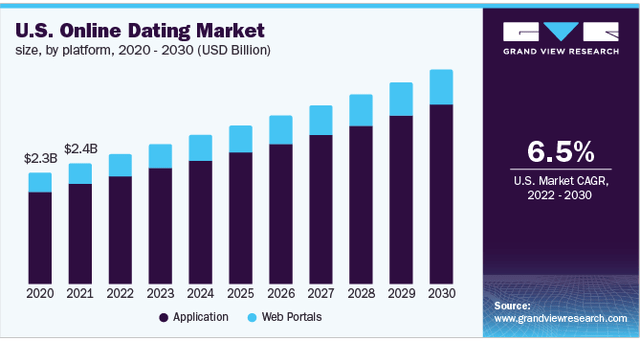

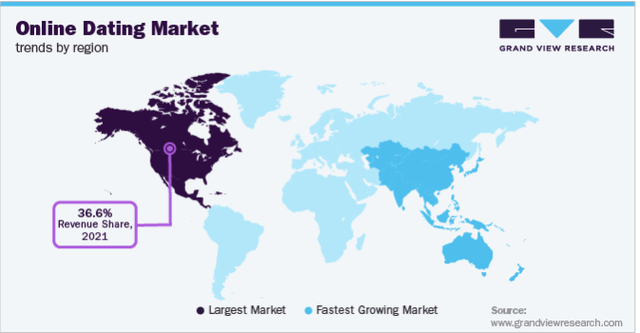

GRND revenue grew by 34% YoY. In the same period, MATCH grew 12% and Bumble 18%. GRND is also more of a social network platform than its competitors, with its 11 million active users spending 61 minutes on average on the site and processing over 12 billion messages daily. The US is the biggest online dating market taking on 36.6% of the estimated $8.9 billion total market, and is estimated to grow at 6.5% by 2030. APAC will be crucial to growth.

US market growth (grandviewresearch.com/) Global market (grandviewresearch.com)

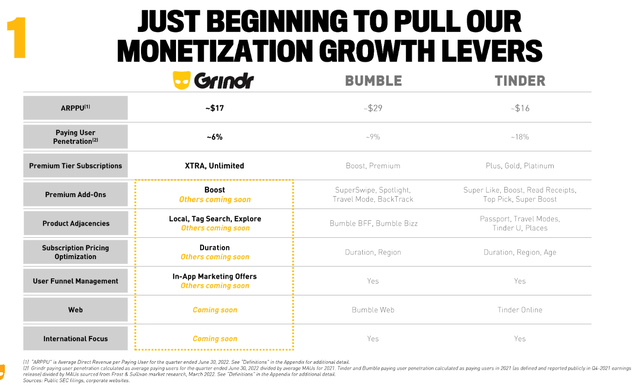

TAM, according to GRND, is currently a $4 billion dating app for the LGBTQ community, with future opportunities expected to be as high as $14 trillion. GRND has significantly grown the number of users, revenue per user, and market share over the last few years. It has genuine monetisation opportunities if we consider the soon to come web app or premium add-ons.

Growth Levers (Investor Presentation 2022)

Financials and valuation

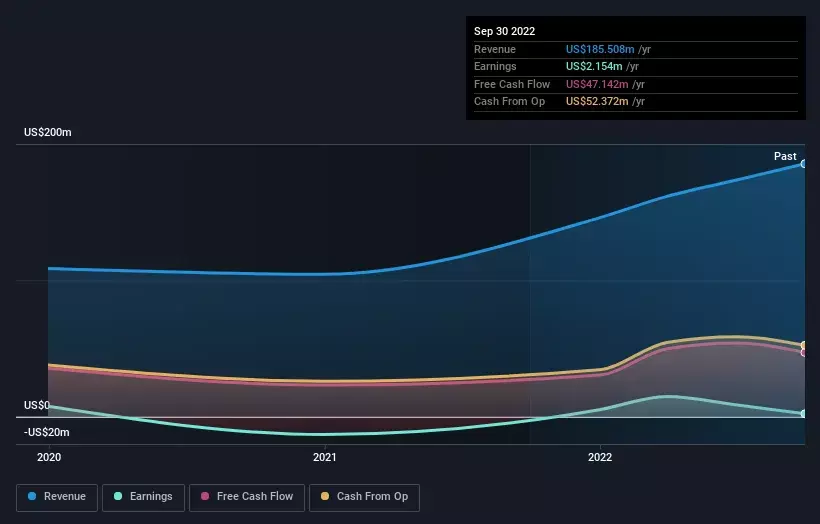

GRND has a short-term operating history, and its financials could not validate the high valuation. We can see that it has grown organically and continuously increased its revenues through little marketing efforts. The earnings and free cash flow dip can be related to merger expenses. Over the last nine months, it had $140.5 million in revenue, a net loss of $4.3 million, and adjusted EBITDA of $65.8 million at a margin of 47%, which shrunk from 53% in Q3 21. Paid user average has increased to $17.12 per user, and as of Q3 22, the company has 768,000 paid users. This is one of the more significant highlights at a growth rate of 33%. Most of its 11 million users are non-paying, and roughly 20% of its revenue is generated through advertising.

Company fundamentals (simplywall.st)

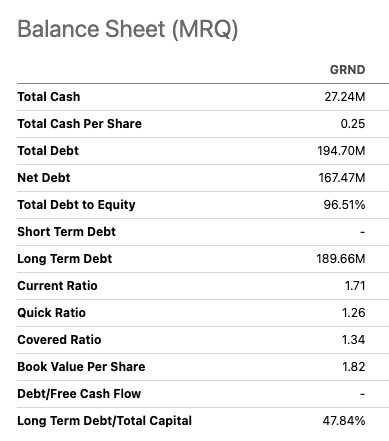

If we look at the balance sheet, the company has a relatively high debt of $194.7 million compared to its total cash of only $27.24 million. However, we can see that it is sufficiently liquid at a current ratio of 1.71 and a quick ratio of 1.26.

Balance Sheet (SeekingAlpha)

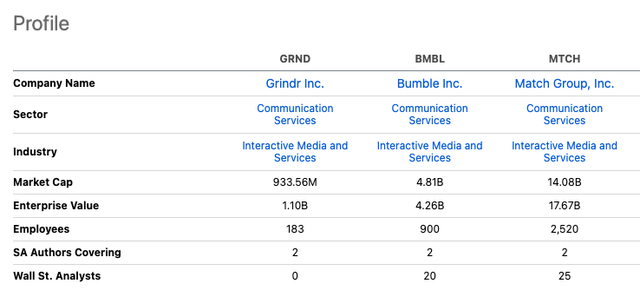

I decided to compare its performance to fellow online dating peers. GRND is much smaller than its peers in terms of enterprise value, market cap and employees.

Peer comparison (SeekingAlpha.com)

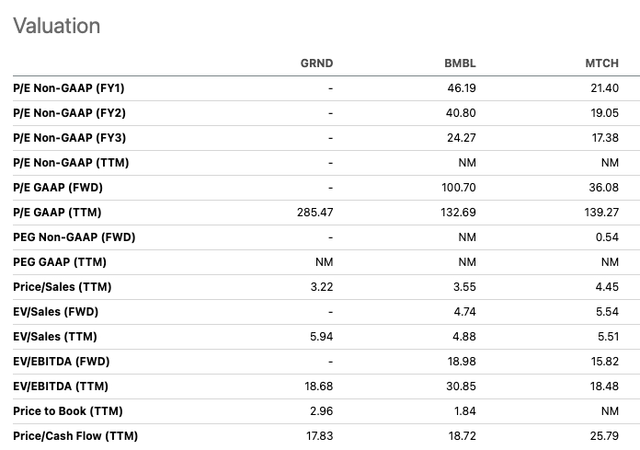

While GRND is barely profitable at a TTM net income of $2.15 million and has an incredibly unattractive TTM price-to-earnings ratio of 285.47, with BMBL at 132.69 and MTCH at 139.27, we should account for the fact that these companies are all in a fast-growing industry which has gone from barely existing to more people using dating apps to meet than any other alternative.

Relative peer valuation (SeekingAlpha.com)

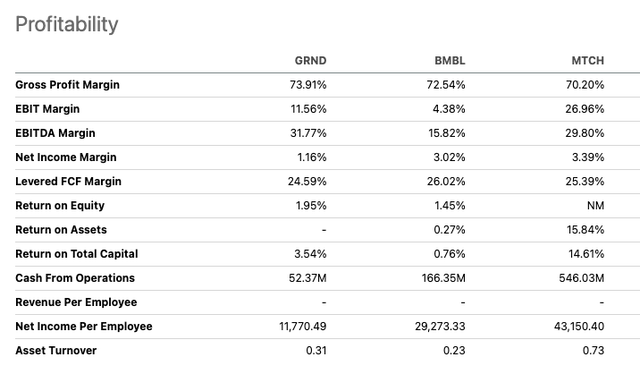

GRND has the highest gross profit margin at 73.91% and the highest EBITDA margin at 31.77% compared to its peers.

Peer comparison (SeekingAlpha.com)

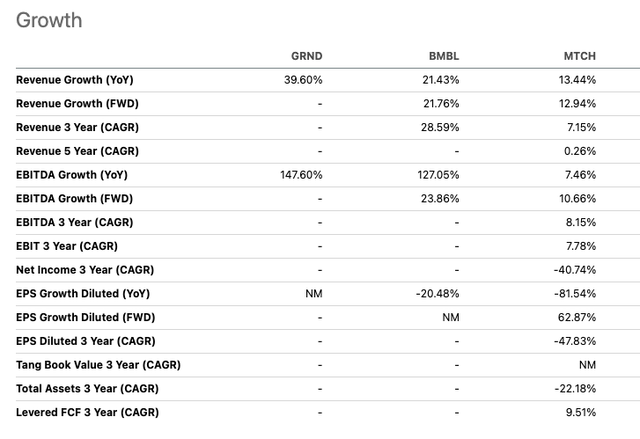

The most compelling is GRND growth rate, which is almost double that of its competitors. There are several additional monetary offerings, such as a website and premium add-ons, to continue this rate.

Peer Comparison (SeekingAlpha.com)

Risks

GRND is a young company with a short operating performance history, which makes it a riskier company to invest in. We need to see how the company has performed in various economic environments or follow long-term trends to drive future performance predictions. Furthermore, the online dating industry is competitive with new technologies and offerings capable of disrupting the space. Gen Z often has different customer expectations from their fellow millennial and boomers, which an offering may become obsolete if they do not manage to attract this market group’s attention. In its short history, the company has made headlines due to data misuse for advertising, including a $7 million fine. The business carries highly personal data from its consumers. Data breaches could have enormous implications for the company’s future performance if there were to be data breaches.

Final thoughts

GRND was deeply overvalued at $2.1 billion, and the SPAC deal to go public with a float of only 500,000 shares has put serious doubt into the business as we watched the stock implode. However, I think it is essential to look at the business fundamentals which have been growing, the increase in paid users, and the vast opportunity the company has in the online dating space if we look at how the site is not only used as a hookup place but a social network in which the technology is processing over 12 billion messages per day. Therefore, investors should take a hold status on this stock.

Be the first to comment