Tutye/iStock via Getty Images

Here at the Lab, when we initiated to cover Grifols S.A. (NASDAQ:NASDAQ:GRFS), we could never have imagined the Russian/Ukraine war and its effect on the interest rate development. At that time, Grifols already concluded the Biotest acquisition for a total consideration of €1.6 billion, and exponentially increased its high leverage which was already pretty high (6.2x at that time). On the core business, our contrarian idea was based on: 1) a higher plasma collection capacity compared to Wall Street numbers and 2) better guidance on top-line sales 3) and combining points 1) and 2), better profitability estimates with a run-rate saving cost following the acquisition estimated in €50 million per year until 2026. Given the rising rates, the company was impacted by Wall Street’s negative sentiment; however, Grifols has:

- lower exposure to interest rate increases given the fact that 65% of its total debt is fixed;

- 35% is then linked to a floating interest rate (and 22% is referred to US rates);

- no significant debt maturities before 2025;

- €500 million in cash and cash equivalents in Q3;

- no maintenance of financial covenants.

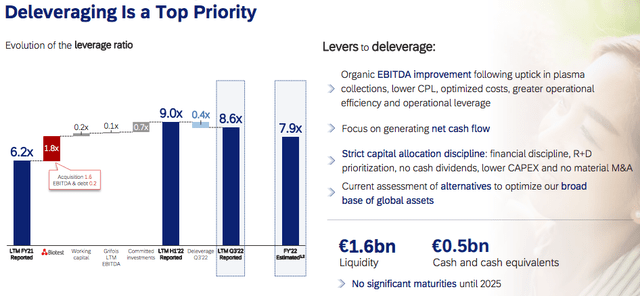

Of course, an 8.6x net debt/EBITDA ratio is a scary ratio; however, Grifols’ top priority is to deleverage, and coupled with low CAPEX requirements and a strong cost discipline, we are not surprised to see the company’s forecast number presented below. In detail, excluding IFRS 16 impact, the net debt/EBITDA ratio decreased to 8.6x from 9.0x in Q3 and is expected to further reduce to 7.9x at the 2022 end.

Grifols net debt/EBITDA development

Source: Grifols Q3 results presentation

Q3 results

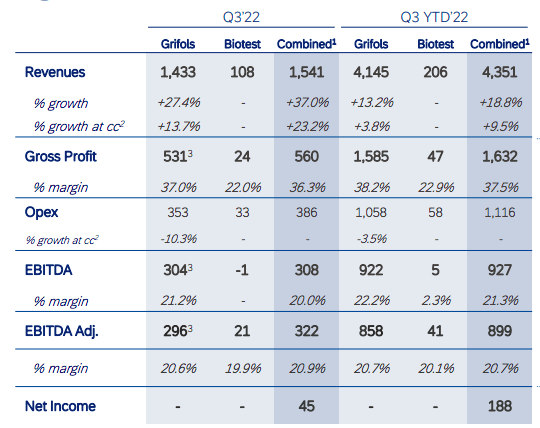

Grifols reported a good third-quarter performance, very much in line with our thesis. Q3 top-line sales grew by 23% and 37% in constant currency effect and on a reported basis respectively. Turnover reached €1.5 billion and was supported by Biopharma (this was already emphasized following Grifols’ half-year numbers). Cross-checking analyst estimates, Wall Street was expecting a high single-digit growth, but the company not only beat estimates, but it also accelerated its sales trajectory in Q3. The other compelling case was referred to plasma collection volumes, which grew by 25% on a year-to-date basis, lowering Grifols’ cost per liter. This was also supported by the US collection. Looking at the company press release, it is important to report that “the robust growth in plasma collections is expected to continue in the fourth quarter of 2022 and onwards, supported by current momentum“. Going down to the bottom line, the company’s gross margin slightly decrease from 38.9% to 38.2%, this was mainly due to higher donor compensation and personal costs. No disclosure of numbers, but the company released its net income development which reached $45 million in Q3 and €188 million in the combined nine months. This lower result was impacted by higher financial expenses.

Grifols financials in a snap

Source: Grifols Q3 results presentation

Conclusion and Valuation

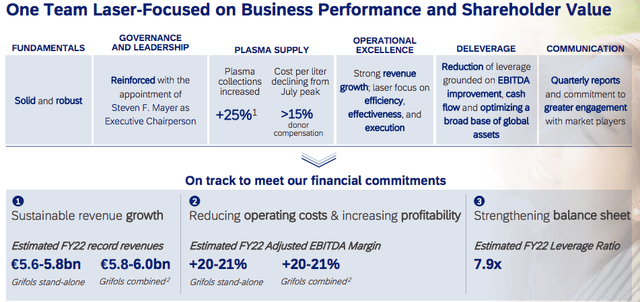

Grifols confirmed its revenue guidance estimated at €5.8/6 billion and its adj. EBITDA in the 20/21% range. With the latest management indication, we are still ahead of Wall Street estimates in the revenue line and on the gross margin improvement. Plasma collection and higher sales were pretty much in line with our thesis. Concerning the valuation, after minus 40% since our coverage, the company is trading at an extremely low P/E ratio compared to its historical average (8x versus 18.08x). CSL Limited which is Grifols’ closest competitor is trading at a Price Earning ratio higher than 40x and looking at the EU specialty pharma, we see another -40% discount. As already mentioned, deleveraging is a priority, and it will be critical to see Grifols’ promises of its debt evolution at the closing of 2022 numbers. If we are applying the company’s historical EV/EBITDA (17.5x), and taking into consideration its Q3 debt, we should reach a valuation of at least €18 per share. Our buy rating is confirmed and Mare risks paragraphs are included in the following two articles:

- Grifols: Every Cloud Has A Silver Lining

- Grifols: Short-Term Turbulence But Long-Term Upside

Source: Grifols Q3 results presentation

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment