halbergman

A cyclical small-cap with exposure to Russia. Does that sound like a buy? Readers understandably might scoff at the notion, but one small-cap Materials dividend payer sports impressive relative strength this year and while earnings might dip in the coming 12 months, the stock is attractively priced.

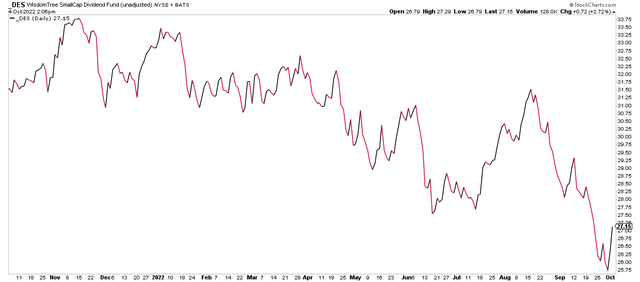

DES Small-Cap Dividend ETF: Down Sharply YoY

According to Bank of America Global Research, Greif Inc (NYSE:GEF) is the leading manufacturer of industrial packaging products globally with $5.6 billion of revenue in F2021. Products include steel containers, fiber and plastic drums, rigid and flexible intermediate bulk containers (IBCs), water cooler bottles, closure systems, and containerboard and corrugated products. Greif also provides services such as container lifecycle management. GEF reports on an Oct. 31 fiscal year-end.

The Ohio-based $2.9 billion market cap Containers & Packaging company trades at a low 9.8 trailing 12-month GAAP price-to-earnings ratio and pays a robust 3.2% dividend yield, according to The Wall Street Journal.

Greif has significant exposure to shifts in the global growth outlook. Making matters more worrisome is operational risks associated with Russia. Despite a souring cyclical situation around the world and no material improvement in what’s happening with Russia, GEF is not far from its decade-plus share price high.

Strong free cash flow and earnings as reported in recent quarters suggest there’s solid fundamental momentum, and the company could benefit from its customers re-ordering along with lagging price benefits. Risks to the bullish thesis, in addition to the ones mentioned earlier, include volatility in raw materials prices, its class B ownership voting rights, litigation concerns, and unfavorable regulatory changes.

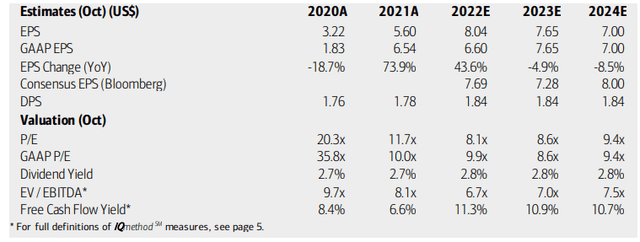

On valuation, BofA analysts see earnings having grown sharply in the firm’s fiscal year 2022 which is just now wrapping up. The coming four quarters, however, are expected to see a slight decrease in per-share profits. While the Bloomberg consensus forecast calls for an earnings rebound in 2024, BofA is not so sanguine with its $7 EPS figure. Still, its dividend looks to remain decent while Greif’s EV/EBITDA valuation is attractively low. Finally, the company generates significant free cash flow, so it’s possible there could be improved shareholder accretive activities.

Greif Bros: Earnings, Valuation, Dividend Forecasts

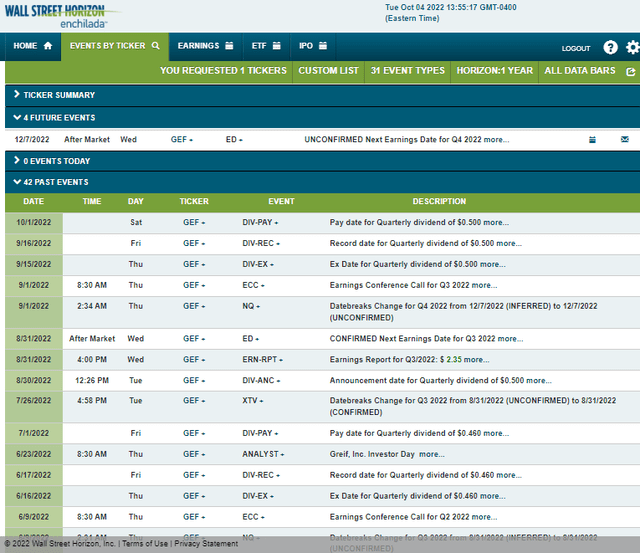

Looking ahead, Greif has an unconfirmed Q4 2022 earnings date on Wednesday, December 7, according to corporate event data provided by Wall Street Horizon.

Corporate Event Calendar

The Technical Take

Despite major macro risks and growing pessimism regarding the global growth outlook, GEF has been extraordinarily resilient over the last year. The stock, while significantly off its 52-week high, is simply rangebound in a market of so many downtrends. That relative strength is certainly something technicians like to see.

In terms of price levels to watch, I see immediate support in the $57 to $58 range while major support is further down in the $52 to $54 area. The stock is currently bouncing off the former level. On the upside, there’s apparent resistance between $72 and $73. There was even a minor false breakout in August at that level; shares then swiftly fell to support.

I’d like to see the stock make new highs on a weekly basis – that would be a very bullish move. But being long this relative winner now, with a stop under $52 is a good play.

GEF: A Relative Strength Stock Holding Support

The Bottom Line

While cyclically-exposed, Greif Bros sports a good valuation and strong free cash flow. Holders also get a solid dividend along the way. Meanwhile, the chart looks strong compared to so many other areas of the market. Both long-term investors and swing traders can be long here.

Be the first to comment