DKosig

Dear Fellow Investors,

The Fund[1] is enduring its worst drawdown since inception. We were down again in the third quarter, bringing year-to-date returns to approximately -59%. Returns vary by entity and class so please check your individual statement for actual returns. As somebody with the vast majority of my net worth invested in our funds, I feel every percentage point, as do my parents, children, and other family members invested alongside us.

In spite of this very large drawdown, we are still compounding at over 960 bps per year since the January 2011 inception of the Fund, outperforming the Russell 2000 annually by approximately 160 basis points. $100,000 invested in the Fund on Day One would be worth nearly $300,000 at quarter-end[2].

While we have given back a large portion of the sizable gains that we had accumulated in recent years, we have made money over many years in many different ways. Historically, we have drawn down in line with or more than the market during market drawdowns and earned outsized returns when it recovers. There is no guarantee that will happen again, and I acknowledge that there is a long road to recovery from here, but I do not believe that our capital is impaired permanently.

In fact, as I will hammer home in various ways throughout the letter, I believe we own durable companies with low churn, secular tailwinds, strong balance sheets, and operating leverage and that there is a large disconnect between the prospects of these companies and their share prices. The latter have been decimated, but the businesses have not, and I believe that, even in the face of economic headwinds, they are well-positioned to remain fundamentally sound.

If I could re-do 2022, I would make at least two changes. At the end of last year and the beginning of this year, I sold two of our highest multiple holdings and invested in Teladoc Health (TDOC), believing that swapping out of the highest multiple holdings into a lower multiple holding would provide protection in the event of multiple compression. However, the reality is that the multiple compression on currently loss-making (unprofitable) companies has been severe regardless of starting multiple, and TDOC’s lower relative starting point afforded us far less protection than I expected.

We are no longer shareholders today but continue to follow the business and may return someday given its market size, product portfolio, and valuation. Secondly, with the benefit of hindsight, Digital Turbine (APPS) should have been sized smaller. The combination of the cyclical nature of the advertising business, the execution risk in combining companies, and the fact that too large a portion of 2022 growth was to come from two customers (AT&T and Verizon) created many potential air pockets that have had a negative impact.

Fed actions are raising the cost of capital and actively pushing the economy towards recession. These dynamics pose potential threats to growth companies, particularly those that are not profitable today. I believe that our companies are well-suited to navigate an environment of rising rates and a recession, but that has not insulated their shares from the weight of macro sentiment. Unrelenting multiple compression has been the most frustrating part of 2022 for me.

Except for Digital Turbine, our holdings’ price declines have been driven by a decline in the multiple investors are willing to pay for shares, not a rapid deterioration of the underlying businesses or their future prospects. In fact, I believe the businesses themselves remain quite healthy, executing on their business models with the management teams that initially formed our investment theses. If the stock market were closed or not subject to daily pricing, I believe the mood would be positive as these companies are fundamentally strengthening. Progress is being made on sales, products, and margins/profitability.

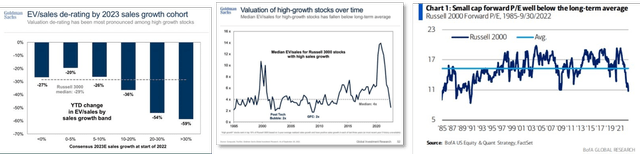

As the charts below show (in order from left to right), multiple compression has been the most severe for stocks with the highest growth expectations. Growth stock multiples are approaching the financial crisis lows, and small cap P/E multiples are approaching 30-year lows. These dynamics have placed our portfolio in the bullseye of multiple layers of multiple compression, outpacing the overall market. Small, growthy, and misunderstood has been a very difficult neighborhood to live in during 2022.

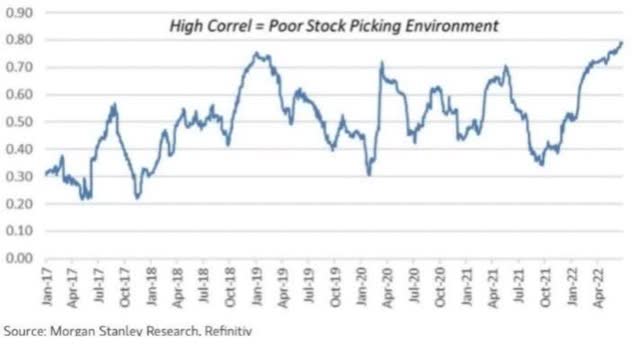

Another challenge of 2022 is that correlations have increased, particularly among software companies, which have been rising and falling as a group. This is not a good environment for “stock picking” as both good and bad companies are declining together. Below is a chart showing the daily correlations of software stocks rising to historical highs.

So, we have a very negative environment with rising rates, compressing multiples, and correlations approaching one. European banks such as Credit Suisse and UBS are rumored to be on the brink of failure, Russia continues to wage war and is highlighting their possession of tactical nuclear bombs, oil is expensive, and inflation is elevated around the world. Why remain invested in this cesspool of despair? Should we just cut our losses and go to cash?

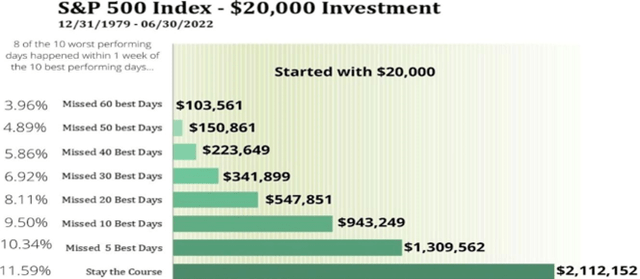

One reason to remain invested is that timing the market is very difficult and can lead to missing some of its best days. In fact, in the period from 12/31/1979 to 6/30/2022, eight of the ten BEST days of market performance happened within a week of the ten WORST days. Sometimes they occurred before and sometimes after, but missing the best days has a large impact on returns. Over the 42-year period above, if you took a starting investment of $20,000 and stayed invested the whole time – experiencing the worst days, but also capturing the best days – your ending balance would be approximately $2.1M.

If by attempting to time the market / cut your losses you happened to miss the five best days, your ending balance would be 38% lower at $1.3M. If you missed all ten best days, it would be less than half.

If we are going to remain invested and the environment is challenging, there had better be a logic to what we are holding. The stock market is forward-looking, so while fundamental results have not been impacted to date, perhaps we are on the precipice. Owning a not-yet-profitable company certainly calls for a cautious approach ahead of and during a potential recession.

Can our companies survive a recession? Is there a payoff if multiples stop compressing? Will we be rewarded when correlations come down and investors are looking for the babies that were thrown out with the bathwater? Of our largest holdings, six share a set of common characteristics that I believe set them up for operational and financial success, even in a very challenging environment. I will layout these qualities and then how they are manifested in our individual holdings:

Low Churn – Predictable / stable demand makes it easier to manage a company through a downturn as it significantly reduces the likelihood of revenue falling off a cliff.

Secular Tailwinds – Even in a recessionary environment, secular tailwinds can provide company-specific growth despite a shrinking GDP.

Positive Product Lifecycle Dynamics – A combination of new products or products that are early in their adoption curve can provide growth, even in a weak economy.

Operating Leverage – When combined with revenue growth, operating leverage should lead to accelerated profitability. We don’t own companies with broken unit economics that are growing for growth’s sake. Instead, we own companies with strong unit economics that are scaling and, over time (as they hold down general and administrative, development, and marketing expenses), the companies’ profitability growth should exceed their overall growth rate.

Strong Balance Sheets – None of these companies are reliant on the markets to fund their operations. They have years of cash to operate and are either profitable or quickly approaching profitability.

For all the companies that we own, even the ones with all the attributes listed above, a recession would be unequivocally negative… but a weakening economy and a weakening job market should not grind them to a halt. I consider them wellsuited to navigate such an environment and likely to continue to grow revenues and improve margins even amid the headwinds.

Let’s look at the companies individually. Accepting that there likely will be a recession, I still believe it makes sense to remain invested.

PAR Technology (PAR)

PAR provides technology to quick serve restaurants (QSRs) such as Dairy Queen. Unlike the “mom and pop” restaurant on the corner, QSR customer volumes are very stable, and this type of restaurant generally benefits as consumers “trade down” in a recession. PAR’s core point of sale system (Brink) has a 4% churn rate, meaning that 96% of customers renew every year. It also has a backlog of contracted revenue equal to more than 15% of current recurring revenue, which provides an additional cushion to an already very stable revenue base.

On the product front, PAR is introducing a payments product that has an 80% attach rate amongst new customers. The plan is to roll this out to a significant portion of their base as customers’ contracts with existing payment processing providers roll off. PAR has also indicated that they will be rolling out multiple new products next year and recently acquired an online ordering company, MENUU (sic), which is also rolling out to a pipeline of enterprise customers in 2023.

PAR’s product development strategy is to make each of their modules even more valuable when used in conjunction with other PAR products in order to facilitate cross-selling and take advantage of the large customer base. The net effect is that the product line-up is getting better and better and the base to cross-sell into is getting larger and larger. This product cycle provides significant opportunities, which are layered on top of PAR’s stable customer base and a contracted backlog.

In any economic scenario where restaurants remain open, I believe it is highly likely that revenues grow in 2023. Might the growth rate be lower than the 30%+ the company is projecting currently? Yes, but there is a lot of momentum and opportunity, and, in my mind, it is a question of not if there is growth, but how much. They should exit a recession stronger; the question is, how much stronger?

PAR benefits from secular tailwinds more modestly than some of our other holdings do, but their end customers (QSRs) are eager to find ways to reduce labor costs and consolidate technology vendors, simplifying their overall operations and getting a clearer and more accurate picture of their business. Using PAR’s products – and especially using them in combination – can provide a clear path to improving and simplifying operations, therefore yielding a very high ROI for restaurant chains that choose to adopt them.

PAR is projected to reach profitability by the end of next year. Under existing management, they have grown software revenue more than 8X (acquisitions included) while growing employees 2X.

I believe the company should be able to grow revenue far faster than overhead and new product development, leading to profitability, and can likely end 2023 as a Rule of 40 company, which typically would be afforded a higher multiple. (In such a company, growth rate + profit margin > 40%.) PAR has also dramatically improved gross margins on their software products as they have invested in their legacy products, adding 3,000 basis points of gross margin over the last four years.

The runway is long, the customer base is sticky, and the trajectory to profitability is clear. If the growth is as durable as I believe it to be, the recent multiple compression will matter less and less over time as the power of compounding works.

Elastic Software (ESTC)

Elastic has not disclosed churn, but at their recent investor day, they disclosed that the software (which powers search for a wide range of customers, including UBER, and also provides observability and security solutions) has been downloaded over 3 billion times.

While we cannot extrapolate cleanly to the number of active users because one user can do multiple downloads as versions are updated, the active users should dwarf the company’s 19,000 paying customers. One thing is clear – once a customer is “landed,” they tend to spend more in the subsequent years. Elastic’s net revenue retention has hovered around 130% for several years.

Elastic benefits from the secular tailwinds of ever-growing amounts of unstructured data and employs a usage-based pricing model: the more data used, the more they can charge. The fastest growing portion of their business is related to security products, and there does not appear to be a slowdown in cyber threats coming any time soon.

There are also two tailwinds on the product front. The first is that they have succeeded in stopping AWS (Amazon Web Services) from selling a confusingly named competitive product (Elasticsearch). Secondly, the gap between the quality of their free offerings and paid offerings has only widened, nudging users towards paid.

The company has added 2,000 basis points of operating profits in the last four years and has indicated that this progression should continue. They are currently break-even and cash flow positive with a rock-solid balance sheet. ESTC shares are trading at less than 5X 2023 revenue with a long runway for 30% growth and ever-improving margins and profitability.

A recession will not be good for Elastic, but their products are mission critical and the company will benefit from both secular and product tailwinds.

Private equity firm KKR is designed to weather an economic downturn. One-third of capital is permanent and cannot be redeemed. Over eighty percent of AUM has 8+ year lock-ups at inception, and the firm is currently sitting on over $100B in “dry powder” which means it is committed and will be called when KKR is ready to invest it (which is not up to LPs’ discretion). This capital will start paying management fees upon investment. We can argue about the likelihood and timing of KKR realizing incentive fees, but management fees are almost certainly going up as capital is called.

KKR benefits from the secular tailwinds of the continued migration to private equity. Typically, funds get successively larger and with scale comes increased profitability. The industry has grown in the teens, and KKR has grown management fees at an average of 27% per year for the past decade. On the product front, they have 30+ funds (more than 20 of which are less than 10 years old) across geographies and asset classes (private equity, credit, growth, real estate, infrastructure) and are increasingly selling to new types of clients, including insurance companies and high net worth individuals.

So, in summary, they have new funds and new geographies and are selling into new channels, all built on a base of very attractive historical returns and an excellent brand. This is a dynamic business with an enormous amount of opportunity in front of them, even if GDP shrinks by 3%. Management fees will go up as contractually committed “dry powder” capital is called, even if the ten-year bond yield rises further and parts of our economy decelerate.

You don’t get fired for selecting KKR. Fundraising may slow down, but extrapolating from 2008 when KKR had far fewer products, far fewer limited partners, and far fewer channels to sell into, the market is likely not giving KKR enough credit for the progress that has been made.

Cellebrite (CLBT)

I wrote about Cellebrite extensively in the last letter. Their software is used by law enforcement to manage digital investigations with products that enable law enforcement to access data on cell phones without knowing the passcode. 90% of their revenue is from government sources and 10% from large companies – they have zero exposure to the individual consumer and have reported customer churn of 2%. Governments need their products.

Cellebrite benefits from several trends. As the company disclosed in their initial investor presentation, data stored on devices has grown between 2,000X – 8,000X in last 17 years. Annual cell phone sales have gone from 300M in 2010 to 1.6B last year. Apps and encryption are increasing, as is complexity, and the use of crypto currencies further complicates the financial tracking of crimes. This combination of trends heightens investigators’ need to have powerful tools to gather, organize, and analyze data in digital investigations.

Beyond their initial suite of useful offerings, Cellebrite is expanding their product lines to meet these diversifying needs. Our digital lives increasingly reflect our real lives, and it is implausible that texts, geo locations, emails, photographs, and other digital communications will play less of a role in criminal investigations, even in a recession.

The company is profitable, has 80%+ gross margins, and self-funded for more than a last decade. They are currently investing heavily in product and sales, which has led to depressed earnings in the short term, dragging EBITDA margins to between 7-9% this year (guidance).

However, EBITDA margins were as high as 21% just two years ago and the company has guided to 25-35% long-term, so I consider it highly likely that profitability will revert to higher margin levels as these investments are harvested. Cellebrite shares ended the quarter trading at approximately 2.5X recurring revenue, which is growing 30%+. At EBITDA margins of just two years ago, shares would be trading at approximately 10X EBITDA.

Boutique brokerage firm Cowen has a $10 price target on Cellebrite, more than 150% higher than its latest quarter-end price. Embedded in this target is a 5X multiple on 2023 revenues with revenue growth at 20%. Given the company’s current investment in sales and product, historical growth rates, and focus on government agencies as their end customers, neither the sales growth nor the multiple strike me as particularly aggressive.

The combination of a very strong and stable customer base, an expanding product portfolio, and large investments in new products and sales set Cellebrite up well to navigate the headwinds of a slower economy and higher interest rates. If public market investors do not recognize this, private equity firms have a long history of buying software businesses like Cellebrite at far higher multiples.

APi Group (APG)

The majority of APi’s business relates to fire safety, specifically the inspection, maintenance, and repair of fire safety systems. Such systems are a non-discretionary purchase, tying into the “forced buyers” theme of our last letter. If you are a landlord and want to have people in your building, having a functioning fire suppression system is a requirement.

Since APi Group’s focus is on the inspection and repair of existing fire suppression systems, not new installation, they are not beholden to new commercial construction. The company has a history of 7% organic growth in the fire suppression business and also has a specialty contracting business serving telecom and utility companies building large products for natural gas distribution, potable water distribution, and 5G rollout.

Currently, the overall company has a record-high $3.2B project backlog. While some of this would likely be burned off in a weaker economy, it is highly unlikely that revenue is falling off a cliff given the statutory nature of the majority of their revenue, history of organic growth, and this backlog.

On the margin front, APi Group made a substantial acquisition of Chubb’s (CB) fire and safety business from Carrier Group.

Chubb has a large European footprint, and APi management believes there is an opportunity to bring Chubb margins up to APi margins. This progression can be seen in the financials and the guidance given to date. The overall fire safety business should see margins and earnings rise as one-time issues related to supply chain roll off and new pricing absorbs the inflation on materials costs.

I believe that normalized EBITDA for the business is approaching $1B as supply chain issues roll off, inflation is passed through to end customers, and the Chubb acquisition is optimized. This figure is significant relative to their quarter-ending $3.1B market capitalization, $6.4B enterprise value, and minimal capital requirements. Similar private market companies have traded hands at 3X the multiples of APi Group.

While APG may never trade at 18X-20X EV/EBITDA of private market transactions, there is support for multiple expansion as the market recognizes the transition to a more asset light, lower capital intensity, and more stable inspection and repair business.

Hagerty, Inc. (HGTY)

Specialty insurance company Hagerty is a new investment for the Fund and therefore has a longer write-up as an appendix to this letter. Their insurance product, which primarily focuses on classic and collector cars, has low churn and, of course, auto insurance is legally mandated if you want your car on the road. Hagerty has better unit economics than other auto insurers, with significantly lower customer acquisition costs and lower loss ratios. The company’s large, contracted partnership with State Farm should grow their policies by 30% next year.

On the product front, they are in the early innings of rolling out online and offline marketplaces for collector cars and they also have an upcoming positive contractual change in the revenue share agreement with Markel (MKL) for their reinsurance business. The net effect of these contractual events and new products should position Hagerty very well for 2023 despite economic volatility.

Degree of Difficulty

In my career, I have been in a senior role at two operating companies. The first was a manufacturing business selling to small retailers. Predicting revenue was difficult because the business was cyclical. If we got GDP growth right AND we had no inventory issues AND there were no outlier marketing campaign results, we could get close. Managing expenses when you don’t know demand is hard; if your input costs fluctuate widely, it is even harder. In the other business, 95% of the revenue was tied to government contracts, so an elementary schooler could project it accurately.

Predictable and stable revenue is an advantage, as management is left to manage expenses and capital allocation. With low churn, the businesses we own in Greenhaven’s portfolio are far closer to the stable revenue side of the spectrum. For example, given their history of >100% revenue retention, Elastic’s business will grow even if they don’t add customers – they are managing expenses and investments in future product. These planes are landable even with inflation, rising rates, recessions, and wars.

What Happens when The Multiple Compression Stops?

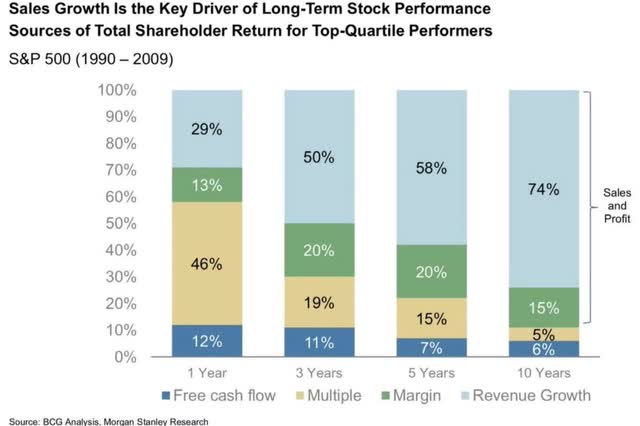

We are in the painful position of owning a number of companies that have endured rapid multiple compression this year. It is worth noting that, over time, multiple expansion or contraction contributes less to returns than revenue growth or margin improvement – both of which I believe are drivers in our portfolio companies. On the following page is an analysis of those stocks in the S&P500 in the top quartile of returns for a 19-year period.

I acknowledge that multiples can certainly go lower as rates rise and/or panic further infuses throughout the market psyche. Year to date, we have experienced the rapid multiple compression but have not had the benefit of time to realize the positive benefits of growth and operating leverage.

Shorts

During the quarter, the Fund remained short some major indices. We also shorted a flying taxi company (not a joke), an EV charging company, and a computer hardware company.

Outlook

The wall of worry is quite high. In fact, it is hard to find anything to be positive about other than how extremely bearish everybody is. At the macro level, IF there is a silver lining, it’s that the markets usually bottom before the economy does and many of the types of companies we own peaked earlier and have fallen harder than the overall market, which may set them up for bottoming earlier. At the company level, when I return to the fundamentals – the low level of churn, secular tailwinds, product life cycles, unit economics, balance sheets, and operating leverage – I am far more sanguine.

Multiples may continue to compress and GDP may shrink, but we continue to fight this battle with companies that I believe are well financed, have durable growth, and can prosper. This chapter is not fun, which is an understatement especially for our LPs who joined us in the past 12 months. The gap between my perception of long-term value and what Mr. Market is willing to pay us right now is extremely wide. We have taken more than our share of “medicine” … but the final chapter has not been written.

Sincerely,

Scott Miller

New Investment – Hagerty (HGTY)

A SPAC trading at over 200X forward earnings run by a man who almost became a priest should be either the set-up to a bad joke or a pitch for a short investment. However, out of the rubble of SPAC-ageddon emerges a very interesting company: Hagerty, Inc. (HGTY).

Earlier this month, we held an Annual Meeting for LPs that included a “Fireside Chat” with Hagerty’s CEO. The interview is worth watching as it covers much of the ground of this write-up and provides additional details.

Hagerty stood out to us when they disclosed their historical and prospective investors during their “de-SPAC” process. State Farm, the largest auto insurance company in the U.S., invested $500M in the SPAC deal at $10 per share, and specialty insurance company Markel not only owned 25% of Hagerty prior to the de-SPAC, but also invested an additional $30M in the deal at $10 per share. Two sophisticated insurance companies investing in another insurance company… It was unlikely the trailing P/E ratio that convinced State Farm to part with half a billion dollars and have their CEO join Hagerty’s Board, so we decided to do some digging.

Today, 92% of Hagerty’s revenues are insurance-related. I will describe the other pieces of the business shortly, but the economic engine that powers the company is automobile insurance. More specifically, the company specializes in a particularly niche insurance category: classic and collectible cars. Hagerty insures everything from 100-year-old cars requiring a crank to start to Mazda Miatas from the 1980s and modern “Super Cars” (McLarens, Bugattis, Lamborghinis, etc.) that are currently in production.

What differentiates a Hagerty policy from the traditional policy you have on your Ford / Toyota / etc.? Hagerty policies aren’t for “daily drivers.” Instead, they are insuring people’s prized possessions like the old convertible that the owner only drives on sunny Sundays to a farmers’ market. People treat their “toys” well, and this shows up in Hagerty’s numbers with their loss ratio (amount paid out for claims) coming in around 41% vs. 70%+ for a typical auto insurer.

In capitalism, profit pools typically get competed away, but Hagerty has not seen this happen to date despite being in existence since the mid-80s. The low loss ratio is not a new phenomenon – it has consistently been nearly half the industry average. Can that persist going forward?

Pricing and servicing a policy for a collector car has its pitfalls. To cite one of the company’s simple examples, take the Chevrolet Camaro from 1969, considered the finest year for classic Camaros. Over 240k Camaros were produced in 1969; however, they were made in 147 different variants. The least valuable version is worth approximately $11,000 while the most valuable version is worth over $1M. An insurance underwriter better understand which version they are insuring.

In addition, unlike most automobiles, the value of classic/collector cars tends to appreciate each year. Both the insurance company and the customer need to understand the rate of appreciation for the model in order to avoid a situation where the insurance proceeds are insufficient to replace a beloved car. Classic cars also face service challenges. If one needs to replace the windshield on a 1915 Model T Ford, trying to file (let alone complete) a claim with the 800-number of a mega insurer will likely be a frustrating experience.

Hagerty has a whole team dedicated to helping its members source specialty parts, a service of extremely high value to customers. Large insurers are not equipped to service this niche market well – they have neither the data nor the operational support for this niche product that ultimately equates to a small percentage of their overall insurance book.

The typical owner of classic/collector cars loves their cars but also has many other items needing insurance (homes, boats, daily drivers, etc.). Consequently, nine of the top ten insurers (not Geico) partner with Hagerty to price and service insurance to their policyholders with classic and collectible cars. Why would they partner with a company some would see as a competitor?

Hagerty provides more accurate pricing and better service and reduces the likelihood of losing excellent customers by mishandling a classic/collector car policy that is only a small, but emotionally charged portion of the overall relationship. By not offering homeowners, umbrella, and other insurance products, Hagerty avoids channel conflict, meaning that those that would otherwise be Hagerty’s competitors are instead their partners, creating a favorable competitive dynamic within the industry that provides at least a partial explanation for the persistence of the company’s low loss ratio.

For more than a decade, Hagerty has grown at three times the rate of the overall auto insurance industry, fueled by high retention rates (90%+), effective marketing (more on that later), and the partnerships described above. What is not obvious when first studying the company is that existing partnerships tend to be a source of ongoing growth. Many auto insurance agents are independent, meaning, for example, that they may represent Allstate (ALL) as well as other companies.

Hagerty has a partnership with Allstate, but agents do not have to use Hagerty or switch their customers off an inferior Allstate classic car policy on to an Allstate/Hagerty policy. That means that the book of business on classic cars not with Hagerty has continued to grow at the same time as the mutual policies have. This semi-captive audience is a source of value because Hagerty has a “hunting license” within that population and slowly converts over agents and policies. The fact that nine of the top ten insurance companies are partners does not mean that future growth is stunted – Hagerty is still early in the penetration of those customer bases.

The market size for classic and collectible cars is larger than I would have thought. Hagerty estimates that there are over 43M registered classic and collectible cars. That number grows each year as new collector cars (McClaren, Ferrari, etc.) are produced and other cars “age into” the category (25 years old or more). Hagerty currently has ~2M cars insured, so there is a long runway for growth.

In addition to acquiring customers through the partnership model, Hagerty also acquires customers directly. Unlike many large insurers that blanket the NFL television broadcasts with commercials every fifteen minutes, Hagerty focuses on content and events that tap into classic car lovers’ passion for cars. They now own several of the largest classic car shows in the United States in addition to the second-largest (by circulation) automobile magazine, a YouTube channel focused on classic cars with over 2M subscribers, and an automobile valuation tool that is widely used.

Hagerty also operates a “Drivers Club,” which provides roadside assistance and weekly emails to over 2M members. This diverse set of assets is intended to fuel peoples’ passion for cars – insurance is rarely, if ever mentioned directly. However, these offerings serve as very effective customer acquisition tools. By our math, Hagerty’s customer acquisition costs are less than half the industry average.

To further monetize their core insurance business more effectively, Hagerty entered the reinsurance business in 2017-18 with the creation of HagertyRe. Since its acquisition of Essentia in 2013, Markel was Hagerty’s captive reinsurance partner whose primary function was to provide their balance sheet and credit rating to support the underlying growth of Hagerty’s insurance book. The reinsurance business is very attractive for both Hagerty and Markel due to the low loss ratios experienced in the underlying book of business.

To illustrate this point, let’s see how $100 of premium flows through the reinsurance business. First, Hagerty gets to keep ~$42 as a commission for servicing the policy. $32 of that is a base commission and $10 is a contingent commission that is earned if loss ratios stay within a pre-determined range. The next ~$41 will be paid out to policyholders because of accidents incurred. (We are now up to ~$83 out of the $100 premium.)

Next, ~$6 will used on operating expenses and reinsurance costs. The net result is that, for every $100 in premium received, HagertyRe earns ~$11 in operating profit. That sounds great by itself, but there is more: for every dollar retained in HagertyRe’s business, it can write $3-4 in premiums. In other words, the return on every incremental dollar retained in the reinsurance business is 30-40%.

For the past two decades, Hagerty has been led by CEO McKeel Hagerty. His parents started the company in their Michigan home in the 1980s, initially focusing on insuring wooden boats on the Great Lakes. Recognizing that people love their toys and, if done properly, insuring the toys was a good business, they added collector cars and began to expand beyond Michigan.

On paper, their son is not a person you would select for the job. On paper, he is a tenth-round draft choice. He was an English and Philosophy major in college and then then decided to enter seminary, studying to be a Russian Orthodox priest and pursuing higher education. However, since it came under the leadership of McKeel and his sister Kim (who held various roles before retiring in 2014), Hagerty has grown the company from 30 employees to over 1,700 today while launching the partnership model, entering the media business, beginning the Driver’s Club, creating their specialty valuation tool, and buying up classic car shows.

McKeel has a very folksy demeanor, but this is no simple small-town boy. In 2016, he was elected to serve as the global chairman for YPO (Young Presidents Organization, the world’s largest CEO organization) and has traveled the world interacting with business leaders. The company has a strong culture and has been voted among Fortune’s Best Places to Work for the past four years. If one peels back the layers, this business has been assembled methodically and is about to enter its next phase of growth.

Insuring cars with low loss ratios, low customer acquisition costs, and low churn is an excellent business. Creating and supporting a marketplace for classic and collectible cars might be an even better business. For a marketplace business, there are three important components – the supply side (goods), the demand side (customers), and a trusted intermediary. Hagerty has these pieces. They can feed the demand side through their media properties and leverage email relationships with over 2M Hagerty Drivers Club members.

They also have a top-of-funnel position controlling the valuation tool that is used across the industry. On the supply side, Hagerty owns the software used by over 200 leading classic car dealers to manage their inventory and also owns several car shows that have traditionally hosted in-person auctions as part of their programming. Through their recent acquisition of Broad Arrow Group, Hagerty also acquired the management team that led the automobile auction and financing business at Sotheby’s. As an insurance company and the name behind the valuation tool most widely used in the classic car space, Hagerty is starting from a position of trust.

While Hagerty has been laying the groundwork to enter the auction business for several years, they only completed their acquisition of Broad Arrow Group last quarter and have since held two auctions selling a total of $70M+ of classic cars. They also began to offer classified ads, but the real volume will come over time, as an alternative to Bring-A-Trailer (a popular auction platform for classic and enthusiast vehicles) was recently announced and will debut next month.

The company’s data suggests that, of the cars that Hagerty insures, $12B in market value traded hands in a combination of auctions and private transactions over the last 12 months. In addition to monetizing a passionate car-loving community that Hagerty has assembled, the marketplace provides an opportunity to both improve retention and acquire new customers since the moment of purchase is an ideal time to attach a new insurance policy. Given that a Hagerty member selling their single classic/collector vehicle is the largest cause of churn, Hagerty is simply better positioned to monetize and execute such transactions than traditional auction houses or marketplaces.

Short-term financing is yet another ancillary business that will emerge from the marketplace business. Hagerty, which has the industry leading valuation tool, insurance relationships with millions of owners, and a strong balance sheet, is in prime position to provide short-term loans to facilitate transactions (typically at 50% loan to value). Frequently, these loans are essentially bridge financing until a collector can sell another car, a transaction which Hagerty again is well-positioned to capture vs. competitors. The flywheel at Hagerty is spinning – what would once have been a simple car insurance policy can now turn into a buyer’s commission, a seller’s commission, listing fees, and financing fees.

While the marketplace business has the potential to be quite large, it is in its infancy and will likely not be a source of large profits in 2023 or 2024 as Hagerty invests in growing the business. Fortunately, Hagerty has two contractual events that will occur in 2023. The first is that State Farm will onboard 470,000+ policies to Hagerty. This is part of their 10-year contractual relationship and $500M PIPE investment.

The State Farm opportunity has not contributed any revenue for the past two years, instead actually only contributing costs as massive systems integrations and upgrades have been undertaken. Those costs are now dropping off as the partnership becomes revenue-generating next year. The second contractual event will be the change in reinsurance revenue share between Markel and Hagerty, increasing Hagerty’s share of revenue from 70% up to 80%.

One would think that the upcoming contractual events and burgeoning marketplace opportunity would be well understood and reflected in the HGTY share price, but to us that seems to not be the case. One more casual indication of investor apathy is that, on the website Seeking Alpha, fewer than 500 people “follow” Hagerty vs. more than 42 million for Apple (AAPL) and hundreds of thousands for many companies you know.

It was a SPAC, screens expensive (in part because State Farm has been all expense no revenue) and has a small free float (less than $3M trades daily). Until last week, Hagerty had only one sell side analyst who, in their initiation report, did not even give financial projections beyond 2022 for 2023. Last week, a new analyst initiated coverage and did include 2023 projections, but these somehow appear to ignore the State Farm policies and the marketplace revenue, which are both 2023 events.

Hagerty has grown at 3X the overall insurance industry and, with increased penetration of their partnerships, the realization of contractual events, and launching of the marketplace, I believe the topline growth rate will inflect to over 30% per year for the next few years.

Loss ratios should hold steady at ~40% lower than the industry average, and customer acquisition costs will likely decline further to less than half that of the industry average. Because of the statutory nature of the product (you need insurance if you want to drive your car), the contractual events in 2023 (State Farm and Markel/reinsurance), and a growing marketplace, Hagerty is well-positioned to withstand a recession should one occur in 2023.

Hagerty will continue to screen expensive on an earnings basis for the next few years as they invest in their marketplace and international insurance businesses. However, at the core of Hagerty is a very profitable car insurance business with excellent unit economics and a very long runway for growth as they continue developing the ecosystem to support, sustain, and monetize peoples’ passion for cars.

|

Disclaimer: This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private placement memorandum (“PPM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, MVM Funds LLC (“MVM”), Greenhaven Road Capital Partners Fund GP LLC (“Partners GP”), and Greenhaven Road Special Opportunities GP LLC (“Opportunities GP”) (each a “relevant GP” and together, the “GPs”) make no express warranty as to the completeness or accuracy, nor can it accept responsibility for errors, appearing in the document. An investment in the Fund/Partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The portfolio is under the sole investment authority of the general partner/investment manager. A portion of the underlying trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. An investor should not make an investment unless they are prepared to lose all or a substantial portion of their investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the Fund/Partnership. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of the relevant GP. The information in this material is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of the GPs, which are subject to change and which the GPs do not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the Fund/Partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. The Fund/Partnership are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(S) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. |

Footnotes[1] Greenhaven Road Capital Fund 1, LP, Greenhaven Road Capital Fund 1 Offshore, Ltd., and Greenhaven Road Capital Fund 2, LP are referred to herein as the “Fund” or the “Partnership” [2] Net Performance from 2011 to present (i) is representative of a “Day 1“ investor in the domestic limited partnership “Greenhaven Road Capital Fund 1, LP”, (II) assumes a 0.75% annual management fee, and (III) assumes a 25% incentive allocation subject to a loss carry forward, high water mark, and 6% annual (non-compounding) hurdle. Fund returns are audited annually, though information contained herein has been internally prepared in order to represent a fee class currently being offered to investors. Performance for an individual investor may vary from the performance stated herein as a result of, among other factors, the timing of their investment and the timing of any additional contributions or withdrawals. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment