Warchi/iStock via Getty Images

Introduction

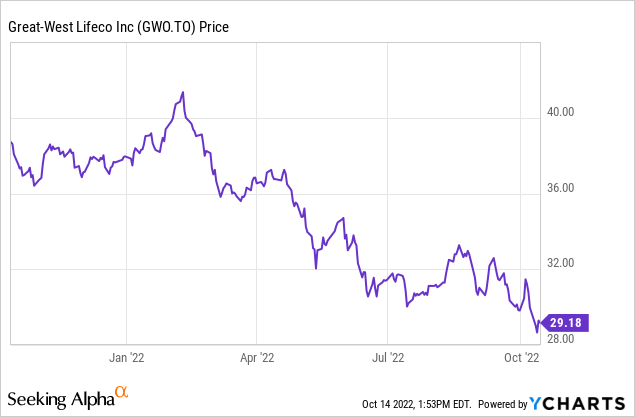

It has been over a year since I last looked at Great-West Lifeco (OTCPK:GWLIF) (TSX:GWO:CA). As the Canadian life insurance company has closed the sizable acquisition of Prudential’s (PRU) US-based retirement business for in excess of US$3.5B, I’m obviously curious to see how Great-West is performing these days. The recent acquisition added in excess of $300B in assets under administration (based on the value when the deal was announced) and I hoped the company was well underway to realize the promised US$180M in annual expense synergies.

Great-West’s primary listing is on the Toronto Stock Exchange, where the company is listed with GWO as its ticker symbol. The average daily volume in Canada is roughly 2.2 million shares for a monetary value of in excess of C$60M per day. This means investors should consider the TSX listing as it clearly is the most liquid listing to trade in the company’s shares.

A decent earnings profile, but the Prudential acquisition may not be as good as I had hoped

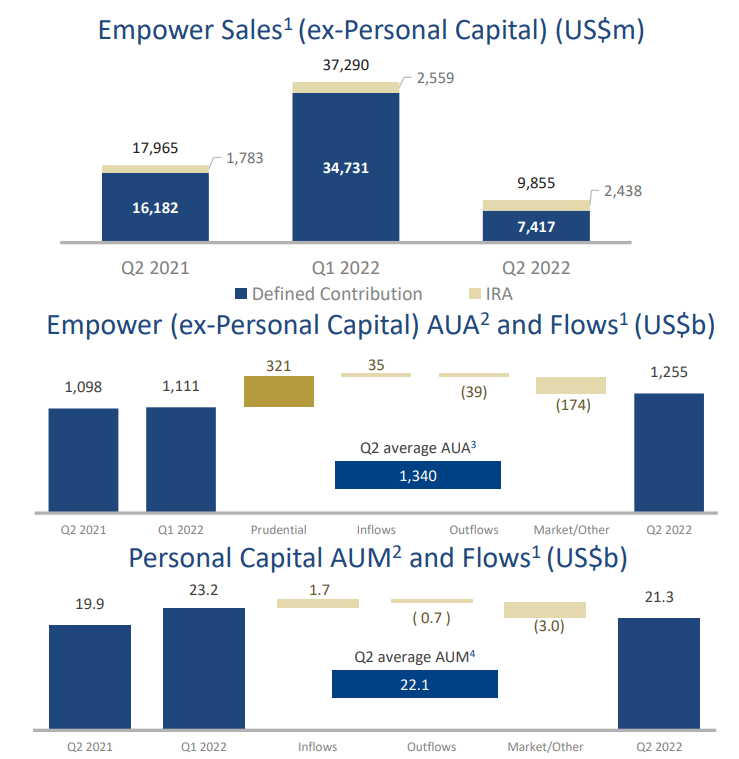

Although the acquisition of Prudential’s US retirement business was announced in July of last year, the transaction only closed on April 1 of this year. This means the company has just started to incorporate the new division in the existing network, and the contribution so far has been minimal. That should accelerate in the second half of the year as a bunch of the one-time expenses will already have been incurred while the operations reach the cruising speed. One caveat though: Although the Prudential retirement business had $314B in assets under administration when the transaction was announced, the tough markets already had reduced this to $250B as of the end of June. The total amount of assets under administration increased to $2.3T and Empower, the US subsidiary accounted for just over US$1.25T (C$1.7T) of that total amount.

Great-West Lifeco Investor Relations

At this point, Great-West is a synergy machine. Not only did it acquire Prudential’s retirement business, just before announcing that acquisition, it closed the acquisition of MassMutual’s retirement services business. That was another US$3.35B acquisition, so needless to say, Great-West was really building out its presence in the US. Its Empower Retirement subsidiary has now solidified its position as the number two in the US.

As the MassMutual acquisition closed about one year before the Prudential acquisition, it acts as some sort of litmus test to see how fast the synergy benefits can actually be realized. Upon announcing the acquisition, Great-West anticipated US$160M in annual synergy benefits by the end of this year, and in its H1 update, GWO confirmed it remains on target as it already reached $88M in pre-tax synergy benefits as of the end of Q2.

That’s great, and Great-West has confirmed it’s using the MassMutual playbook to try to achieve the same result with the Prudential portfolio. And although the acquisition was completed just one quarter before the end of Q2, Great-West was able to unlock US$25M in annual synergy benefits. A good start to reach the US$180M in synergy benefits it plans to achieve within 24 months (so by the end of Q1 2024).

While the focus has been on building out the asset management base, let’s not forget Great-West is more than that.

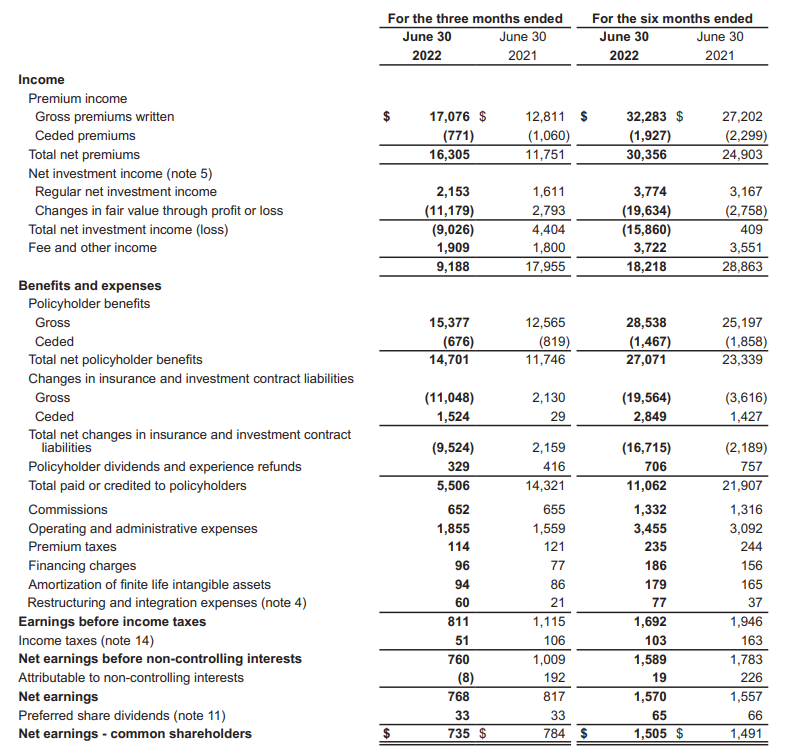

In the second quarter of the year, the company collected about C$16.3B in net premium income while it had to pay out C$14.7B in policyholder benefits. And although the income statement shows an C$11.2B loss based on the fair value of its investment portfolio, its policyholders took the brunt of the hardship. As you can see below, the net reported income (we can’t really call it a revenue if it already includes the fluctuation in the asset portfolio) was C$9.2B, and after paying out C$5.5B to the policyholders, the gross margin was approximately C$3.7B.

Great-West Lifeco Investor Relations

From this amount, GWO still has to cover its own overhead expenses as well as the commissions paid to third-party agents. The bottom line shows a pre-tax profit of C$811M, resulting in a C$768M net income attributable to GWO and C$735M after taking the preferred dividend payments into account.

The EPS came in at just under C$0.79 which means the current quarterly dividend of C$0.49/share is well-covered as it allows Great-West to retain in excess of C$1/year in profits which will help to further increase the book value per share. Based on the current share price of C$29.20, the current dividend yield is approximately 6.7% and that is making Great-West increasingly attractive.

Let’s also not forget, GWO expects to generate additional synergy benefits from the MassMutual and the Prudential acquisitions. It will generate an additional US$72M in pre-tax synergies on the MassMutual acquisition before the end of this year while it also anticipates US$155M in additional synergies from the Prudential acquisition by the end of Q1 2024.

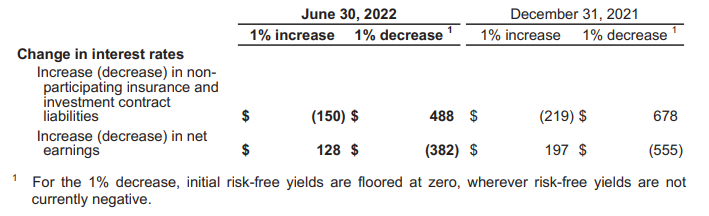

These two combined will add C$300M to the pre-tax earnings profile of Great-West and will likely compensate for potential lower fee income and higher operating expenses. Let’s also not forget that based on the sensitivity analysis provided by Great-West, every 100 bp increase in interest rates will boost the net profit by C$128M as well.

Great-West Lifeco Investor Relations

Investment thesis

Last year, I didn’t really want to pay a premium of about 60% on the tangible book value of the company, and in hindsight, that was a good call. Although the share price went up to in excess of C$40/share in Q1, it has lost about 30% since and is currently trading below C$30/share.

Based on the book value of C$25/share (and tangible book value of around C$12 after deducting the goodwill and intangible assets from the equity portion on the balance sheet) as of the end of Q2, that premium has now been reduced to just around 15%. GWO did warn the book value will decrease when it transitions to the IFRS 17 accounting rules for insurance companies as it will have to incorporate a contractual service margin in its assets and liabilities base. That being said, the transition to IFRS 17 should boost the LICAT ratio (the Canadian capital adequacy of an insurance company, comparable to Solvency II for European insurance companies).

I currently have no position in Great-West as I’m still mulling over initiating a long position in the common shares or the preferred shares. Both are valid ideas but as the common shares now have the same yield as most of the preferred shares and considering Great-West is still unlocking synergy benefits which should boost the EPS I have a slight preference for the common shares at this point, but I haven’t made up my mind yet.

Be the first to comment