Дмитрий Ларичев/iStock via Getty Images

Welcome to the November edition of the graphite miners news.

November saw not a lot of specific graphite market news and good progress from the graphite juniors.

Graphite price news

During the past 30 days the China graphite flake-194 EXW spot price was up 0.22%. The China graphite flake-199 EXW spot price was up by 0.16%. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was up 0.28% the past 30 days.

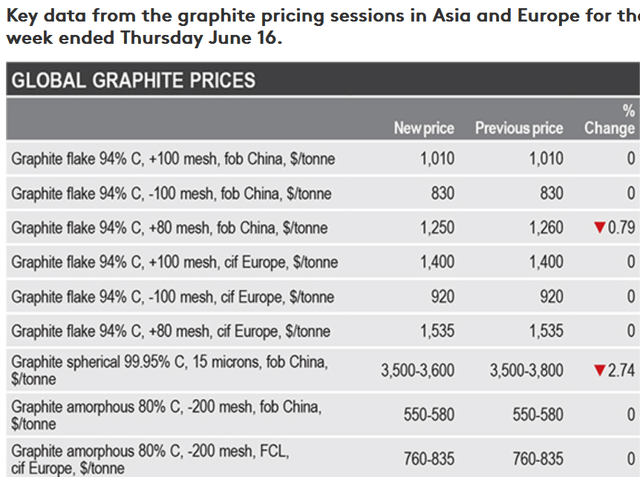

Fastmarkets (see below, not updated) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t. Note: Fastmarkets stated recently: “The most recent price assessments for graphite flake, 94% C, -100 mesh, cif Europe, and graphite flake, 94% C, -100 mesh, fob China, were $800 and $810 per tonne respectively on September 22.”

Fastmarkets graphite prices the week ending June 16, 2022 (not updated)

Note: You can read about the different types of graphite and their uses here.

Graphite demand and supply forecast charts

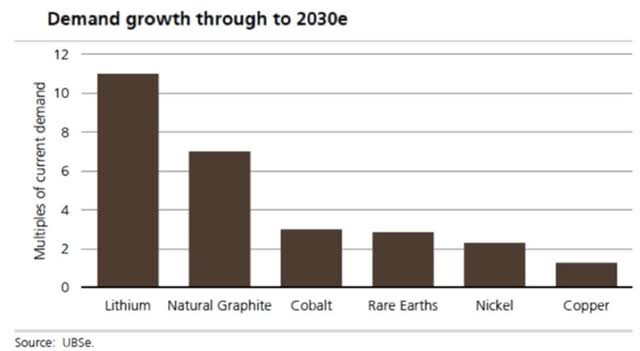

UBS’s EV metals demand forecast (from Nov. 2020)

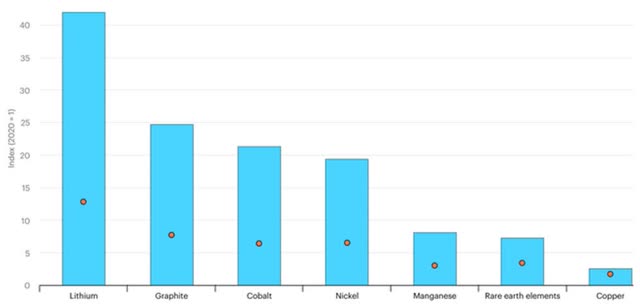

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

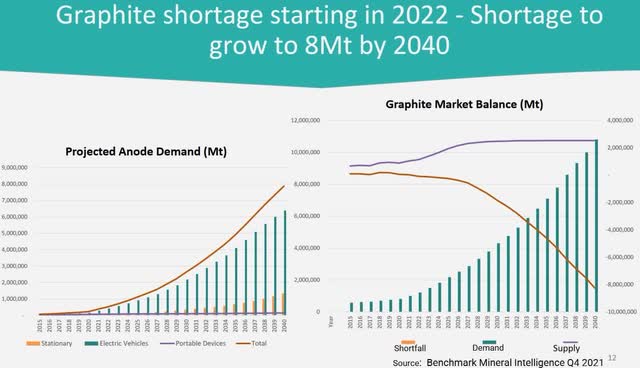

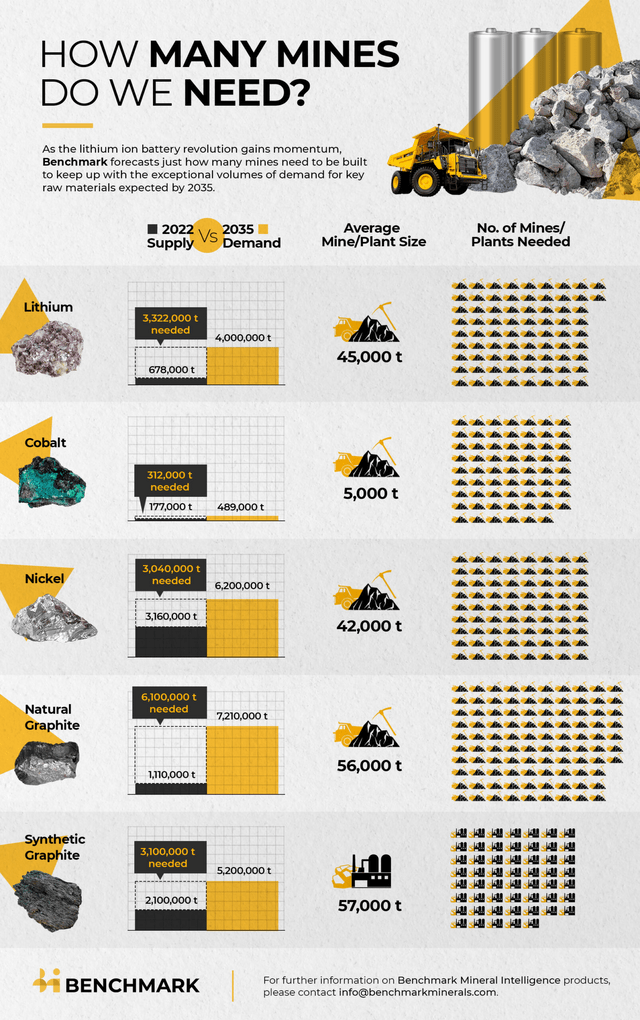

2022 – BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

2022 – BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 97 new 56,000tpa natural flake graphite mines

Graphite market news

On November 1 The Business Times reported:

South Korea launches government-backed battery alliance to source key metals…… The country, home to major battery makers LG Energy Solution, Samsung SDI, and SK Innovation’s SK On, is seeking to bolster supply chain stability and metals to become a major player in the field, which is dominated by China…….

On November 8 Bloomberg reported:

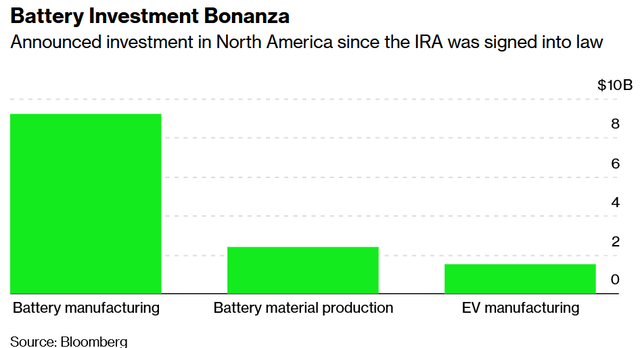

Democrats supercharged EV investment while they had the chance…… More than $13 billion of investment in battery raw material production and battery and EV manufacturing has been announced in the less than three months since Biden signed the IRA into law on Aug. 16. Volkswagen and Mercedes-Benz almost immediately sealed agreements to secure mining and refining resources from America’s neighbor to the north. Honda and Toyota earmarked almost $7 billion worth of EV battery plant investments within two days of one another. An Australian development company started up the first US cobalt mine in three decades. BMW said it would spend $1.7 billion expanding its South Carolina SUV factory, and that its battery supplier would build a new plant nearby.

Democrats supercharged EV investment. Battery manufacturing being the main winner so far (Source: Bloomberg)

On November 11 BloombergBNN reported:

Ford, GM in talks with Posco on investing in battery metal hubs. Ford Motor Co., General Motors Co., and Stellantis NV are in talks with South Korea’s Posco Chemical Co. about potentially investing in plants producing electric-vehicle battery materials in North America, according to people familiar with the matter. The factories would make cathode-active or anode materials……

On November 13 CBS News reported:

U.S. military weighs funding mining projects in Canada amid rivalry with China. Canadian companies told they qualify under Defense Production Act…… The United States military has been quietly soliciting applications for Canadian mining projects that want American public funding through a major national security initiative.

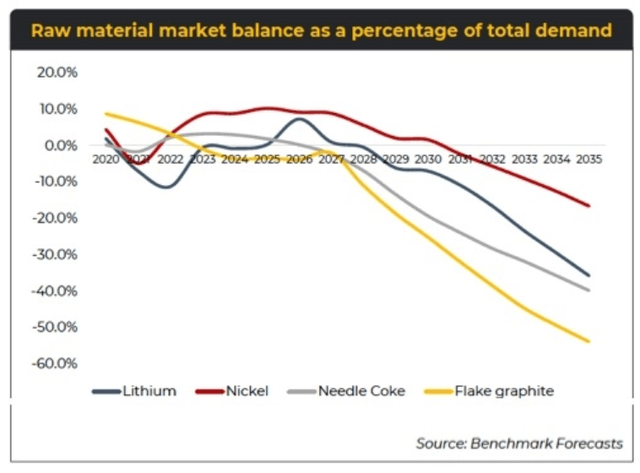

On November 23 Mining.com posted the chart below. It shows the Benchmark Mineral Intelligence (“BMI”) flake graphite balance of demand v supply forecast. For graphite BMI is forecasting the flake graphite market to be balanced 2023 to 2027, then moving into a growing deficit from 2027 to 2035.

graphite-market-balance benchmarkweek-2022 (source)

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [AMS:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite, vanadium, and lithium. SGL Carbon (ETR:SGL) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On October 27, Syrah Resources Limited announced:

Balama update…..Mining and processing operations, and unrestricted logistics movements have resumed at Balama with the full complement of the Company’s employees and contractors onsite…..

On November 14 Syrah Resources announced:

Balama update……security concerns in Namuno district around 50 kms from the Balama Graphite Operation…..Syrah has assessed that the safe return of the workforce to site and resumption of operations at Balama will be undertaken from today.

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – First Stage 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

No news for the month.

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On October 31, Mineral Commodities Ltd. announced: “Quarterly activities report-September 2022.” Highlights include:

During the quarter:

- “MRC secures finished product garnet offtake and Mineral Separation Plant funding term sheet with GMA.

- MRC granted De Punt prospecting right at South Tormin,2 with subsequent exploration work identifying the high prospectivity of De Punt, which appears to extend the Tormin Western and Eastern Strandline deposits to the south.

- Government confirms Critical Minerals Grant funding for MRC to build pilot scale battery anode plant in Australia.

- MRC and Green Graphite Technologies sign an Equity/Licence Agreement5 to build alternate process pilot scale battery anode plant in Canada.

- Tormin mining and processing throughput remains above budget expectations.

- Fourth consecutive quarter of stabilised operating performance at Skaland.”

After quarter end.

- “MRC Secured Funding Support for its Strategic Plan Growth Strategy.”

Corporate and Cash

- “Cash: US$1.9 million as at 30 September 2022, with an A$15.7 million Placement and Rights Issue announced for the December 2022 quarter.

- Debt: US$9.3 million as at 30 September 2022.

- Securities: 558.8 million shares and 27.7 million performance rights as at the date of this report.”

Tirupati Graphite [LSE:TGR]

No news for the month.

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern Graphite purchased from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On November 9, Northern Graphite announced:

Northern Graphite third quarter operational and development project update. The LDI operation continued to perform well in the third quarter with 53,263 tonnes of ore milled at an average feed grade of 6.4% graphite……..

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Graphite developers

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in December, 2022.

No news for the month.

Investors can view the latest company presentation here or the latest Trend Investing article here.

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On October 31, Talga Group announced: “Quarterly activities review for period ending 30 September 2022.” Highlights include:

Commercial and project development

- “Automotive Cells Company (“ACC”) signs non-binding offtake for 60,000 tonne anode supply…..”

Product and technology development

- “Talga receives funding to further Talnode®-Si commercialisation…..”

Corporate and finance

- “Oversubscribed A$22 million institutional placement completed subsequent to quarter.

- Oversubscribed A$10 million Share Purchase Plan completed subsequent to quarter.

- Talga and Mitsui extend Vittangi Anode Project MoU……”

On November 3, Talga Group announced:

Vittangi environmental permit hearing date. The hearing is scheduled to take place in Luleå, commencing the week of 30 January2023 and expected to conclude the week of 20 February 2023…..

On November 23, Talga Group announced:

Advanced progress with European Investment Bank for Vittangi Anode Project funding….. The Project will use 100% renewable electricity to extract graphite, an EU defined critical material, and refine it into coated anode for Li-ion batteries. The first stage of the Project will produce 19,500tpa of anode for 24 years from the integrated mine-to-anode operation (ASX:TLG 1 July 2021). EIB’s potential financing commitment of up to EUR300m, pending final due diligence, credit approvals and agreements, is foreseen to cornerstone and complement debt funding discussions underway with a consortium of leading export credit agencies and international banks.

You can view the latest investor presentation here.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

On November 10, Westwater Resources Inc. announced: “Westwater Resources, Inc. announces results for third quarter ended September 30, 2022.” Highlights include:

- “…..Net cash used in investing activities of $32.0 million for the nine months ended September 30, 2022, relates to construction spend for Phase I of the Kellyton graphite plant……

- Consolidated net loss for the third quarter of 2022 was $3.5 million, or $0.07 per share….

- Cash and working capital as of September 30, 2022, were $100.3 million and $80.1 million….”

You can view the latest investor presentation here.

Magnis Energy Technologies Ltd [ASX:MNS] (OTCQX:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On October 31, Magnis Energy Technologies Ltd. announced: “Quarterly report for quarter ending September 2022.” Highlights include:

- “Magnis’ Lithium-ion battery manufacturing facility operated by Imperium3 New York Inc (“iM3NY”) commences commercial production and begins scale up phase towards Gigawatt scale. At capacity, iM3NY expects to produce ~15,000 cells per day.

- Bankable Feasibility Study Update confirms strong financial and technical viability for the Nachu Graphite Project.

- Positive results continue in C4V’s Extra Fast Charging battery program using 7Ah (Amp hour) commercial graded cells with 20 minute-charge and 20-minute discharge. Results show only 3% loss of the initial cell capacity after approximately 2600 cycles.

- Magnis’ US traded OTC shares (OTC: MNSEF) has been approved by the US’ Depository Trust Company for real-time electronic trading and settlement in USD making it easier and cheaper for US investors.”

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On November 15, Gratomic Inc. announced: “Gratomic announces completion of NI43-101 Technical Report for 100% owned Capim Grosso Project…..in Brazil “

On November 17, Gratomic Inc. announced: “Gratomic announces assay results on Aukam Diamond Drilling Program.” See the news release for details. Drill lengths were very short.

Black Rock Mining [ASX:BKT]

On October 28, Black Rock Mining announced: “Quarterly activities/appendix 5B cash flow report.” Highlights include:

- “Front End Engineering Design process completed, reconfirming Mahenge as a significant Tier 1 scale project with attractive forecast returns.

- Conditional Framework Agreement signed with US cleantech graphite processing company, Urbix, Inc.

- Special Mining Licence awarded for Mahenge.

- Resettlement activities commenced covering areas for planned Modules 1 and 2.

- Initial Tanzanian leadership appointments made with first Board constituted under joint-venture Company, Faru Graphite Corporation.

- Debt financing process advanced.

- Project development and execution activities ongoing.

- Graphite market outlook continues to show positive signals with substantial supply deficits predicted in the near-term.

- A$20.5M cash at bank as at 30 September 2022.”

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

On October 25, Nouveau Monde Graphite announced: “Investor Briefing: Offtake and strategic partnership with Panasonic Energy and Mitsui.”

On November 8, Nouveau Monde Graphite announced:

NMG announces the closing of US$50 million Private Placement by Mitsui, Pallinghurst and Investissement Québec….. Through the Private Placement, Mitsui subscribed for US$25 million in Convertible Note, while Pallinghurst and IQ each subscribed for US$12.5 million. The Company intends to use the proceeds of the Private Placement to work in the upcoming months on optimizing the feasibility study dated July 6, 2022, on NMG’s Phase-2 Commercial integrated operations, which was filed on SEDAR and EDGAR on August 10, 2022.

On November 11, Nouveau Monde Graphite announced:

NMG reports on quarter progress on the heels of commercial partnership with Panasonic Energy and commencement of expansion planning, and appoints Stephanie Anderson to its Board of Directors…….Period-end cash position of CA $14M and CA $81.5 million on a pro-forma basis.

You can view the latest investor presentation here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM])

On October 31, Greenwing Resources Limited announced: “Quarterly activities report – September 2022 quarter 31 October 2022.” Highlights include:

Corporate

- “A$12m strategic funding transaction with NIO Inc. announced on 26 September 2022.”

Graphmada Graphite Mining Complex, Madagascar

- “Updated Graphmada Mineral Resource announced, with 61.9 million tonnes (Mt) at 4.5% Fixed Carbon (FC), nearly tripling the total contained graphite to 2.7 Mt.”

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On October 31, Triton Minerals announced: “Quarterly activities report for period ending 30 September 2022.” Highlights include:

- “$8.5M Two Tranche Capital Raising – to accelerate development of Ancuabe, including Cornerstone investment of A$5M by major Chinese listed commodities trading and resources company, Shandong Yulong Gold (subject to Shareholder approval and Australian and Chinese regulatory approvals).

- A$3.5M Tranche 1 – with institutional and sophisticated investors settled during the quarter.

- Cash on hand – as at 30 September 2022 – A$4.8M, with commitments for a further A$5M from Tranche Two of Capital Raising.”

You can view the latest investor presentation here and the latest article on Trend Investing here.

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

No significant news for the month.

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU](OTC:RSNUF)

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On October 31, Renascor Resources announced:

Quarterly activities report for the period ended 30 September 2022…. Renascor secured a site for its proposed state-of-the-art Battery Anode Material (BAM) Manufacturing Facility from South Australian Government-owned utility SA Water…..Siviour is currently the second largest reported Proven Graphite Reserve in the world and the largest Graphite Reserve outside Africa2, supporting a 40-year mine life with production of Graphite Concentrates up to 150,000 tonne per annum3……Renascor is progressing work on an updated, optimised BAM study (BAM Study) that is assessing an increase in Stage 1 PSG production capacity, as well as additional staged expansions of PSG operations in order to meet projected demand. Studies to date have considered an initial Stage 1 production capacity of 28,000tpa PSG4. Renascor’s cash position as of 30 September 2022 was approximately $71 million.

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On October 31, EcoGraf Limited announced:

Quarterly activities report. Clean energy initiatives drive strong North American and European Battery Minerals demand…..ISO compliant Life Cycle Assessment demonstrates potential for EcoGraf HFree™ anode material to reduce CO2emissions by over 92% compared to synthetic graphite…..Cash and deposits at end of quarter of $43.4m.

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

No news for the month.

Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF)

No news for the month.

Metals Australia [ASX:MLS]

On October 31, Metals Australia announced: “Quarterly activities report for the quarter ended 30 September 2022.” Highlights include:

Lac Rainy Graphite Project, Quebec, Canada:

- “Final stage of Phase 2 metallurgical testwork at Lac Rainy Graphite Project produced6.5kg high-grade bulk-concentrate (actual LOI grade 95% graphitic carbon, Cg)which was despatched to Germany for spherical graphite and battery testwork.

- Initial results of high-purity spherical graphite testwork are expected shortly. The next stage of electrochemical (battery) testwork will follow and this work will determine lithium-ion battery anode charging qualities and durability.

- Following the battery testwork the Company plans to testtargets for high-grade graphite resource growth and generate further graphite concentrate for downstream testwork with potential offtakers.”

You can view an August 2022 Metals Australia update video here.

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML]

On October 26, Sovereign Metals announced:

Further aircore drilling confirms significant pit expansion potential at depth. This newly defined high-grade rutile and graphite mineralisation at depths >15m is consistent and occurs in coherent blocks…..

On October 31, Sovereign Metals announced: “September 2022 quarterly report.”

You can view the latest investor presentation here.

Sarytogan Graphite [ASX:SGA]

Sarytogan Graphite has a 209mt @ 28.5% TGC Inferred Resource (60mt contained graphite) in Central Kazakhstan.

On October 31, Sarytogan Graphite announced: “Quarterly activities report quarter ending 30 September 2022.” Highlights include:

- “29 diamond drill holes for 2,222m completed to end September at the Sarytogan Graphite Project since April.

- Thick high-grade graphite mineralisation reported, including in areas outside of the existing 209Mt @ 28.5% TGC Inferred Mineral Resource…

- Drilling is on track to be completed by November 2022 to enable an updated Mineral Resource Estimate in Q1 2023.

- Interim step of 92.1% purity graphite concentrate produced by our Australian lab partners using flotation, low-temperature caustic roasting, leaching with a weak sulphuric acid and a final calcine step (Refer ASX Announcement 12/10/22).

- Preferred product strategy identified as battery anode material at an optimal micro-crystalline sizing which attracts a premium product price.

- Optimisation and purification test work continuing in Germany and Australia.”

On November 8, Sarytogan Graphite announced: “High-grade drill results from the central graphite zone.” Highlights include:

- “Thick high-grade graphite intercepts returned in fourteen diamond drill holes from the Central Graphite Zone (CGZ)……Significant intercepts above 30% TGC or thicker than 60m include: 22.9m @ 30.1% TGC from 16.2m……”

BlackEarth Minerals [ASX:BEM]

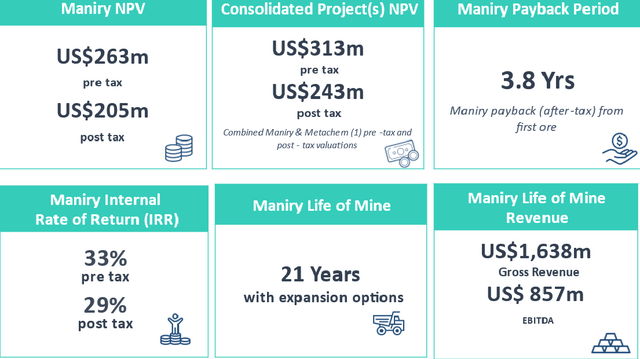

On November 3, BlackEarth Minerals announced: “DFS forecasts strong returns for Maniry Project. Study finds Maniry will be financially robust, producing graphite which meets the criteria needed for processing into lithium battery component.” Highlights include:

- “Maniry Definitive Feasibility Study [DFS]) confirms the Project will generate compelling financial returns and be technically robust. The findings are based on a flowsheet designed by Independent Technical Experts.

- The DFS confirms Madagascar is an optimal location for graphite processing and has potential to be the largest producer of graphite outside China.

- Tests confirm Maniry graphite will meet the requirements for many value-added products, including lithium batteries and other decarbonisation-related products.

- Detailed Environmental & Social Impact Study (ESIA) program is ongoing with the aim of further enhancing Maniry’s viability.”

DFS highlights for the Maniry Project

Zentek Ltd. [TSXV:ZEN] (ZTEK)(formerly ZEN Graphene Solutions Ltd.)

On October 28, Zentek Ltd. announced:

Zentek provides update on Battery Technology Development. “The Canadian government and the auto industry have committed to invest over $10 billion in battery manufacturing in 2022 alone. With the significant push toward electrification in North America, we are excited to be working with the team from U of T, who have worked with a number of international battery manufacturing companies,” said Greg Fenton, CEO of Zentek. “This is an important research project to seek to develop next generation graphene-based battery materials to potentially enhance energy density, increase charging rates and improve battery safety.”

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTC:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], South Star Battery Metals [TSXV:STS] (OTCQB:STSBF), Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon (ETR:SGL)

- Novonix Ltd [ASX:NVX](OTCQX:NVNXF)

Graphene companies

- Archer Materials [ASX:AXE]

- Black Swan Graphene Inc. [TSXV:SWAN]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN] (ZTEK)

Conclusion

November saw only slightly higher flake and spherical graphite prices.

Highlights for the month were:

- Democrats supercharged USA EV investment with US$13b of investments announced so far, led by battery manufacturing.

- Ford, GM in talks with Posco on investing in battery metal hubs….including anode materials.

- U.S. military weighs funding mining projects in Canada amid rivalry with China.

- BMI flake graphite forecast is for a balanced market from 2023-2027, then growing deficits from 2027-2035.

- Syrah Resources – Balama operations resume.

- Mineral Commodities – Government confirms Critical Minerals Grant funding for MRC to build pilot scale battery anode plant in Australia.

- Talga Group – Automotive Cells Company signs non-binding offtake for 60,000 tonne anode supply. Advanced progress with European Investment Bank for Vittangi Anode Project funding.

- Nouveau Monde Graphite signs MoU with Panasonic Energy to confirm intentions for a multi-year offtake agreement for a significant portion of NMG’s active anode material. US$50 million Private Placement by Mitsui, Pallinghurst and Investissement Québec.

- Greenwing Resources A$12m strategic funding transaction with NIO Inc.

- Metals Australia Final stage of Phase 2 metallurgical testwork at Lac Rainy Graphite Project produced6.5kg high-grade bulk-concentrate.

- Sovereign Metals further aircore drilling confirms significant pit expansion potential at depth.

- BlackEarth Minerals Maniry DFS confirms the Project will generate compelling financial returns and be technically robust.

As usual all comments are welcome.

Be the first to comment