Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 19.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of November.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

The BDC sector was roughly flat this week though the range between the top (OCSL) and bottom (CSWC) performers was nearly 14%. CSWC underperformed due to the secondary offering. As we discussed in a separate weekly, secondary offerings are typically positive for investors and are not something to be feared, despite the bad optics of the price drop. OCSL outperformed on the back of good Q3 results – a typical dynamic we described in last week’s write-up. The sector is up around 5% so far in November.

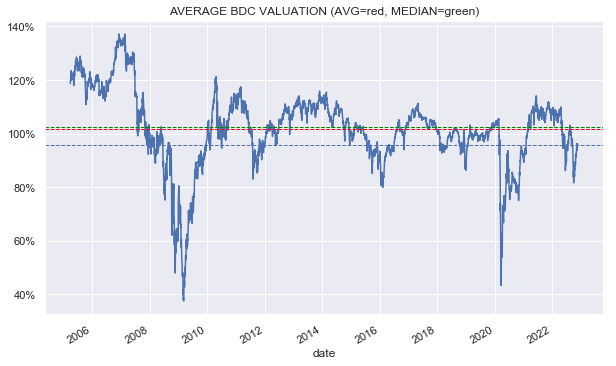

BDC valuations continue to recover towards 100%. At the current level, valuations are fair-to-expensive in our view, particularly given the likely eventual recession next year.

Systematic Income

Market Themes

With nearly all of the BDC sector having reported so far, it’s much easier to highlight those BDCs that haven’t raised their dividends than it is to highlight those that have.

Within our coverage universe (of 25 names that have reported) it appears like there are only two: GSBD and WHF that haven’t hiked dividends. However, even with those two, both GAAP and core net income was above the declared dividend and also above the previous quarter’s levels. It’s not clear why they chose not to hike – BDCs pursue different dividend strategies. One direct outcome of retaining earnings is that it raises the amount of spillover.

Many BDCs are happy carrying large amounts of spillover like ARCC or MAIN. However, this requires BDCs to pay additional tax. There are two levels of taxation to worry about – first is the normal federal income which BDCs can avoid by distributing 90% of earnings each year. The other one is the 4% excise tax which can only be avoided by paying out 98.2% of ordinary income and a similar amount of capital gains. 4% is not a massive number so BDCs are normally happy to retain some amount of spillover to cushion lean earnings periods.

BDCs also adopt different strategies with respect to their dividends. This includes distributing special dividends, supplemental dividends, making frequent updates to base dividends, declaring deemed dividends and carrying large amounts of spillover in order to smooth out their dividend profiles. It’s fairly likely that GSBD and/or WHF will pay out additional dividends this year so investors holding these securities shouldn’t necessarily lose heart.

Market Commentary

Sector news continues to be dominated by earnings.

OCSL adjusted net income rose 6% while the NAV fell 1.5% (vs. a 1.3% median drop so far). Q3 total NAV return was a decent +1%. The dividend was hiked once again to $0.18 – double the previous rate of increase and a $0.14 special was declared as well. There was the usual reaction of the stock rising 5% that we have seen across other BDCs although it’s not clear why the market remains surprised – another dividend hike was very likely and was discussed in our Q2 update.

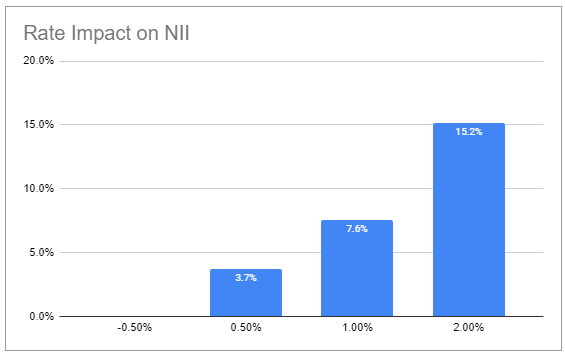

There is still room for further hikes. OCSL does have a lower net income beta to short-term rates than the broader sector (+7.6% vs. +11%) due to its high level of floating-rate debt and modest leverage so we shouldn’t expect as large dividend hikes as the rest of the sector in the coming quarters.

Systematic Income BDC Tool

OCSL has also tended to be fairly conservative with NAV marks – we saw the same dynamic during the COVID crash. This is likely why its NAV has underperformed so far this year – with a fall of 7.5% vs. a 2.5% median drop. Non-accruals remained at zero and 2022 has delivered net realized gains so there aren’t obvious portfolio issues. We should see the NAV outperform during the inevitable recovery. OCSL remains in the Core and High Income Portfolios. It is trading at a 10.1% yield and a 105% valuation.

PennantPark Investment Corp (PNNT) dividend was hiked by 10%. The NAV fell around 7% which was primarily due the RAM Energy position being marked down by a third. This was after a large mark-up in Q2. The markdown seems to be due to lower energy prices. Management said on the call that the company is performing well and there are no operational issues. It is also exploring strategic options and it would be good to see it leave the portfolio given its large portion of the NAV. There was a one-off credit facility amendment fee of $5.1m without which GAAP income would have come in 30% over Q2 level. There was one company on non-accrual (unchanged over Q3) for a 1% of total cost and zero on fair-value basis i.e. fully written down. PNNT remains in the High Income Portfolio. It trades at a 10.7% yield and a 69% valuation.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Be the first to comment