Sean Gallup/Getty Images News

Introduction

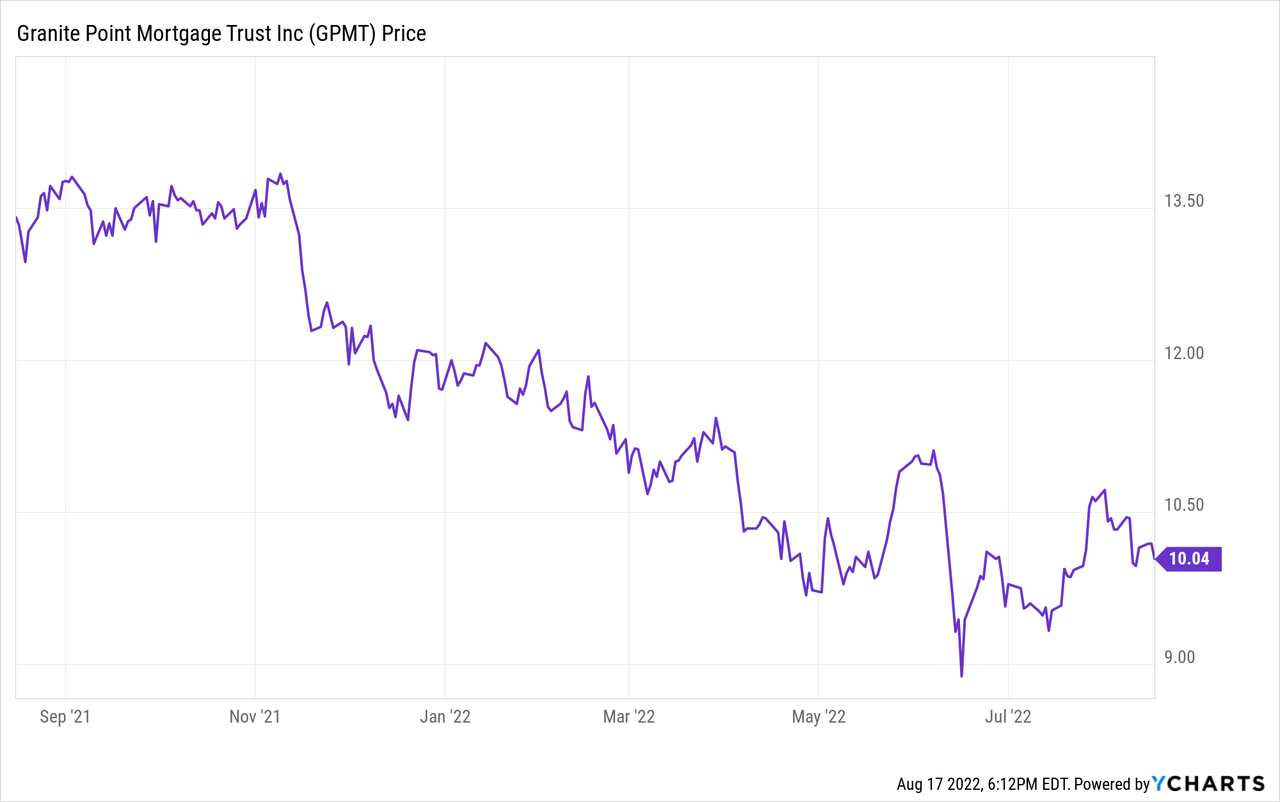

I have been following Granite Point Mortgage (NYSE:GPMT) for a while now. I’m not too interested in the common shares but the preferred shares have dropped to a level that I think is now very appealing. An additional interesting feature of the preferred issue, which is trading with (NYSE:GPMT.PA) as ticker symbol is the fix-to-float: in a few years the preferred dividend will be reset to the 3 month SOFR plus a mark-up. And as interest rates have been increasing, the reset could be more advantageous than I originally had thought.

Granite Point’s Q2 results were improving

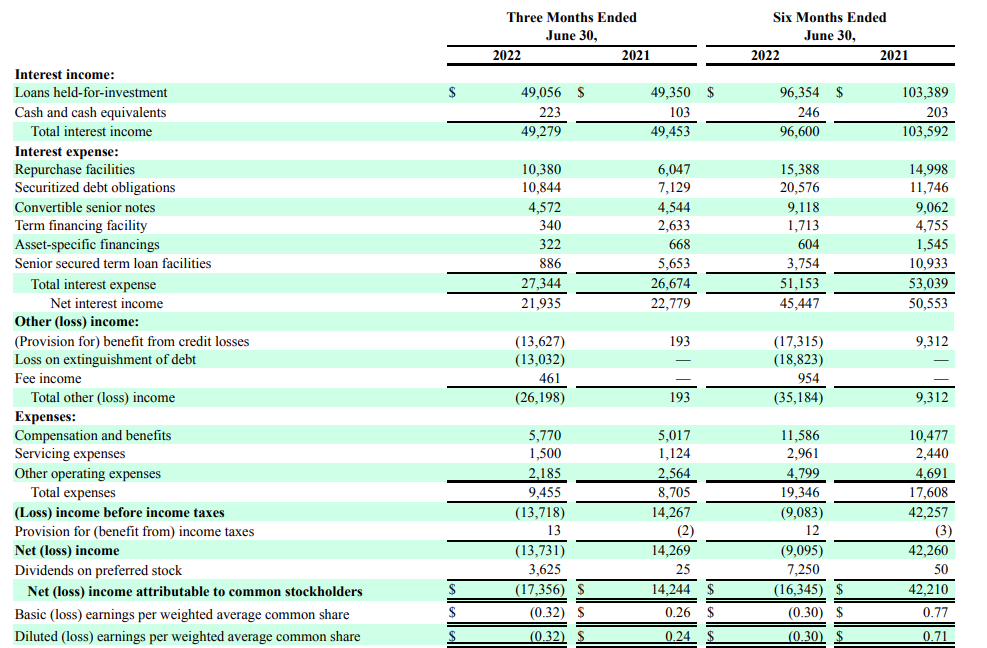

While the headline result in the second quarter was very uninspiring (a net loss of 32 cents per share), the income statement of Granite Point shows the net loss was caused by a loan loss provision in combination with the loss on extinguishment of debt.

GPMT Investor Relations

As you can see in the image above, the net interest income was just under $22M and after deducting the $9.5M in other net operating expenses, the normalized net income would have been approximately $13.5M compared to the loss of $13.7M. And even after making the payments on the preferred shares (costing about $3.6M per quarter), Granite Point would still have posted a net income of approximately $10M or approximately 19 cents per share attributable to its shareholders. And if we would look at GPMT from a distributable earnings perspective (which also adds back the non-cash equity compensation to the equation), these earnings would have come in at $11.7M for a result of $0.22/share.

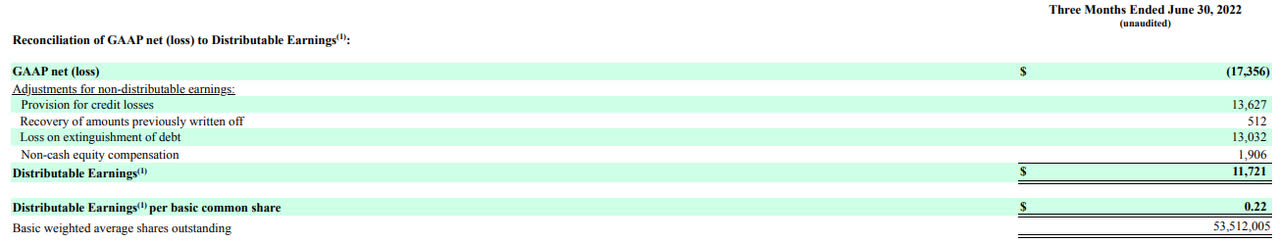

GPMT Investor Relations

This means it is important to understand why exactly GPMT posted a net loss in the second quarter. The loss on the extinguishment of debt is easy to explain. The company repaid the $100M owed under the senior secured term loan and the total payment included a prepayment penalty as well as a charge-off related to the unamortized discount used for this loan. This term loan had a total cost of around 8%, which means that going forward, Granite Point will save millions of dollars in interest expenses.

The increased amount set aside to cover loan losses also makes sense. As of the end of June, the company had almost $3.9B in loans yet its total allowance for loan losses was just over $34M. As some more loans became riskier, Granite Point added an additional $13M to the provisions to make sure it was taking the appropriate measures to deal with some of the more questionable loans.

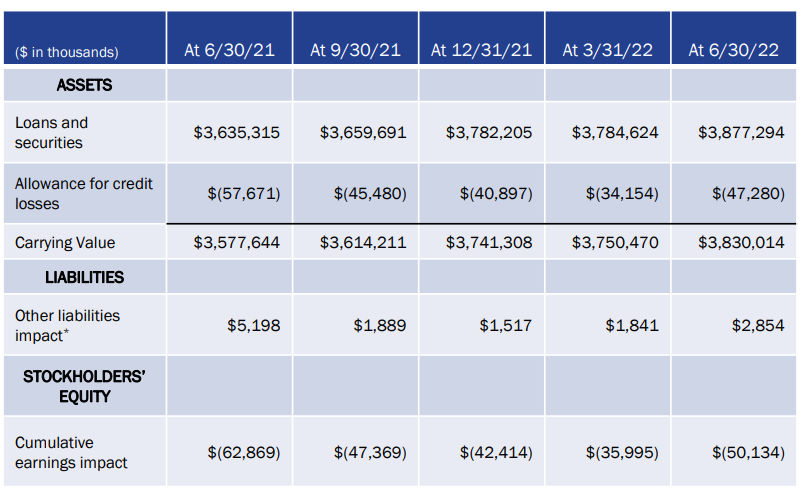

GPMT Investor Relations

This does not mean Granite Point is suddenly facing massive portfolio losses. Keep in mind the average LTV ratio is in the mid-60s range while GPMT usually also is the most senior creditor of a borrower entering the default stage. One of the assets where an additional provision was recorded is an office building in the San Diego market. And on the Q2 conference call, Granite Point’s management did a good job in explaining the situation. The soft leasing market in San Diego resulted in an impairment charge but GPMT also emphasized the sponsor has sunk a lot of equity in the project and is thus very incentivized to make it work rather than handing the keys to Granite Point.

So as I mentioned in the prepared remarks, we placed the loan on non-accrual status took the asset-specific reserve that we mentioned of $4.5 million.

We’ve been in ongoing call it constructive conversations with the sponsor. They have a significant amount of equity in the property. The CapEx portion of the business plan is complete, but leasing has been for the reasons that I mentioned. I also mentioned that the borrower is currently in the process of marketing the property […].

While it’s too bad seeing Granite Point moving some of the loans into a higher risk category, let’s not forget the total amount of loans with a risk rating of 4 and 5 have actually decreased compared to the end of last year.

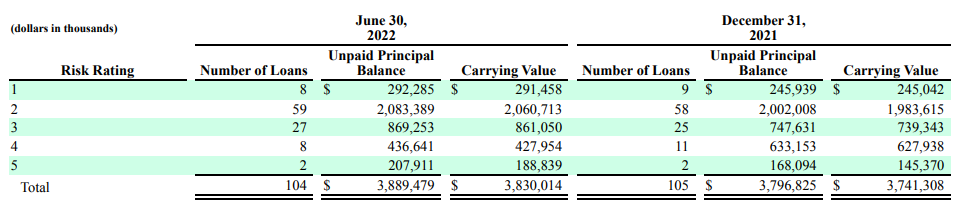

GPMT Investor Relations

This also means the third quarter should be much better and the reported earnings should be getting closer to the distributable earnings as I expect to see a lower loan loss provision while there should be no additional losses on the early extinguishment of debt.

Why does this matter for the preferred shareholders?

As a reminder, the preferred shares were issued in November last year and the underwriters confirmed the issue price would be $25 and the preferred dividend would be $1.75 per year for a preferred dividend yield of 7%. As mentioned in the introduction, the preferred dividend will be reset in 2027 (if Granite Point doesn’t call the preferred securities). The call date is November 30th 2026, and from the next preferred dividend payment on, in 2027, the preferred dividend gets updated to the 3 month SOFR rate plus a mark-up of 583 base points. A second interesting feature is that there is a floor: the minimum preferred dividend will be 7%, even if the 3 month SOFR would be zero.

With the 3 month SOFR currently at approximately 2.77%, this means that if the interest rate remains at the current level, the preferred dividend will reset to 8.6%. That’s 8.6% on the principal amount of $25 indicating an annual preferred dividend of $2.15 will be payable.

We already know the distributable earnings were $11.3M during the quarter and this already includes the $3.6M in preferred dividend payments. This means the normalized distributable earnings before taking the preferred dividends into consideration was already $15M, resulting in a preferred dividend coverage ratio of in excess of 400%.

We also know the balance sheet contains about $1.04B in equity, of which roughly $206M consisted of preferred equity. This means in excess of $800M in equity ranks junior to the preferred shares and that junior equity will absorb the first potential losses.

Investment thesis

I’m not buying the common shares. Despite paying a generous distribution of $0.25 per quarter, Granite Point hasn’t covered this distribution rate since the third quarter of last year. And on a LTM basis, the total amount of distributable earnings came in at $0.97 per share while GPMT paid out $1 in dividends.

While the floating interest rate portfolio should be positively impacted by higher interest rates, I think the preferred shares are a much safer option here. Trading at just $22.19 (Wednesday’s closing price), the current yield is approximately 7.9%. The yield to call is roughly 10.3% and if the securities don’t get called, there’s an excellent possibility the preferred dividend will be reset at a higher rate from 2027 on.

I have a small long position in the preferred shares, and will likely continue to add to this position in the next few weeks and months.

Be the first to comment