FG Trade

Editor’s note: Seeking Alpha is proud to welcome Long-Term Winners as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

After a blockbuster debut on the Nasdaq following a SPAC merger in December last year, Grab’s (NASDAQ:GRAB) share price has fallen about 80%. As a popular app in Southeast Asia, it’s a company worth considering investing in. However, even after this drop, I rate Grab’s shares as a hold because valuation remains high, profitability is a concern, and threats exist to its long-term growth prospects.

Overview of Grab

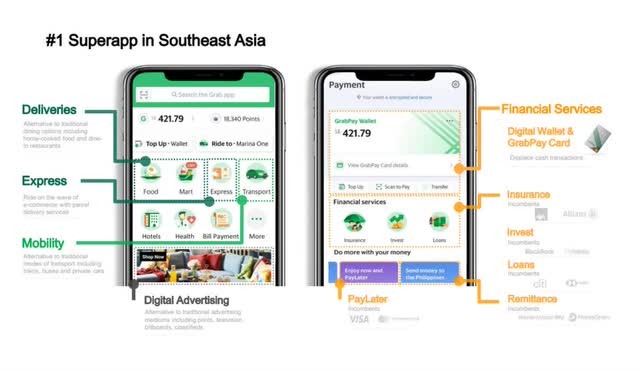

GRAB Investor Day Presentation

Grab prides itself on being Southeast Asia’s leading super-app. It provides everyday services like food and grocery deliveries, mobility, financial services, and more. In a short 10 years, the company has grown its footprint from one city to across most of Southeast Asia, covering eight countries and more than 480 cities and counting. Despite having roots in Kuala Lumpur in Malaysia, Singapore has today become the largest revenue contributor to Grab.

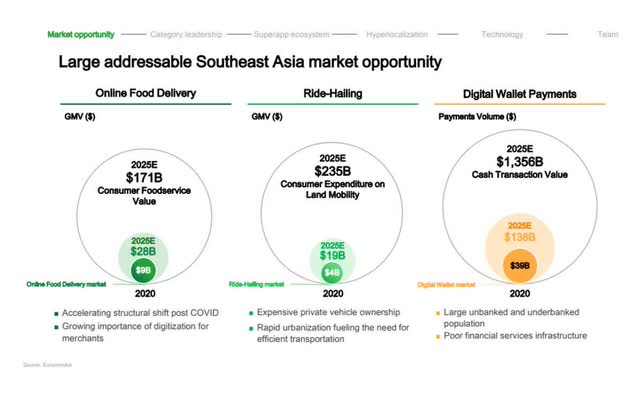

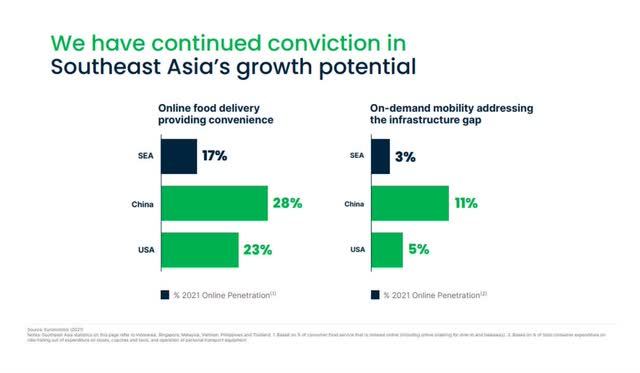

GRAB Investor Day Presentation GRAB Investor Day Presentation

Even after this tremendous growth over the past 10 years, Grab is still in the early stages. Primary markets where Grab competes in continue to have tremendous development potential. Furthermore, Southeast Asia has a long way to go before it catches up to its more advanced peers in terms of online penetration.

When hunting for long-term winners, I look for businesses that still have a long growth runway. This increases the likelihood of higher returns.

Business Model

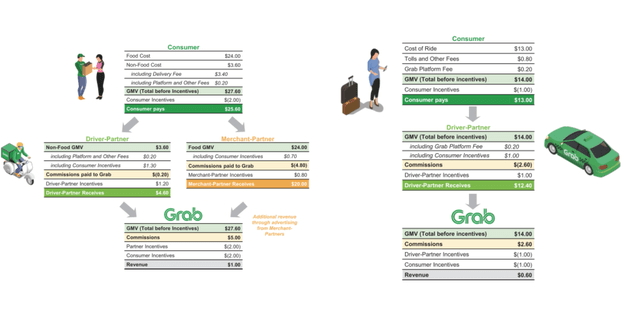

Grab is primarily functioning as a middleman. It connects passengers and drivers for its mobility segment and consumers and merchants for its delivery segment, earning a commission in the process. It is a two-sided marketplace that requires a large volume of users to be effective. Both demand and supply should be present, and you can’t have one without the other.

Grab used aggressive marketing, promotions, and incentives to attract users to this platform. This came in the form of discounts to consumers, and bonuses to merchants and drivers for fulfilling demand.

Grab has done very well with its customer acquisition and market penetration. This is evident in how it has increased its mindshare with consumers, with the word “Grab” becoming part of users’ vocabulary. For example, “Hey, let’s order Grab!” means to order food, and “No car, just Grab!” means to call for transportation.

Financial Performance

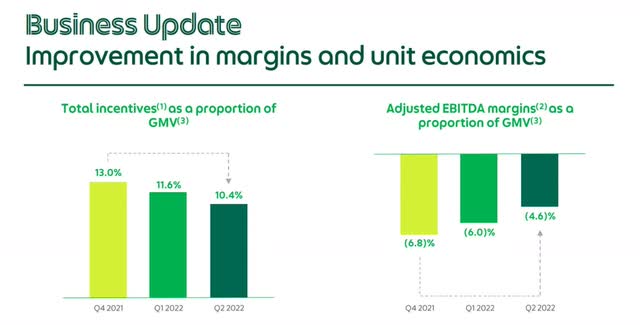

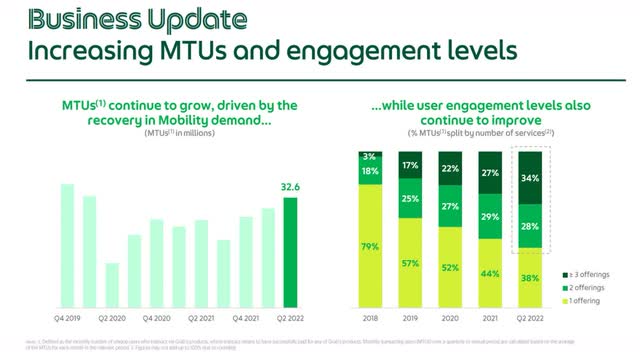

GRAB 2022 Q2 Results Presentation

In August 2022, Grab reported its latest second-quarter performance report. Top line figures show revenue soaring by 79% YoY, GMV by 30% YoY, and GMV/Transacting users increasing by 16% YoY. Incentives as a percentage of GMV have also dropped, as adjusted EBITDA margin as a proportion of GMV improves.

GRAB 2022 Q2 Results Presentation GRAB 2022 Q2 Results Presentation

One of Grab’s key business metrics, monthly transacting users (MTUs), also shows strong recovery following the COVID-19 pandemic where Grab’s services took a hit due to the various city lockdowns across Grab’s operational territories throughout most of 2020 and 2021. Yet Grab’s stock continues to trade downward.

While it can be expected that a high-growth company like Grab is operating at a net income loss as it invests heavily in increasing its market share, it’s surprising to know that even at the gross profit level, Grab is loss-making. This is beyond the generous incentives it offers, as revenues are reported net of incentives. A case in point happened in 2019 when Grab announced its first publicly reported financial statements in 2019 – revenue was negative $845 million.

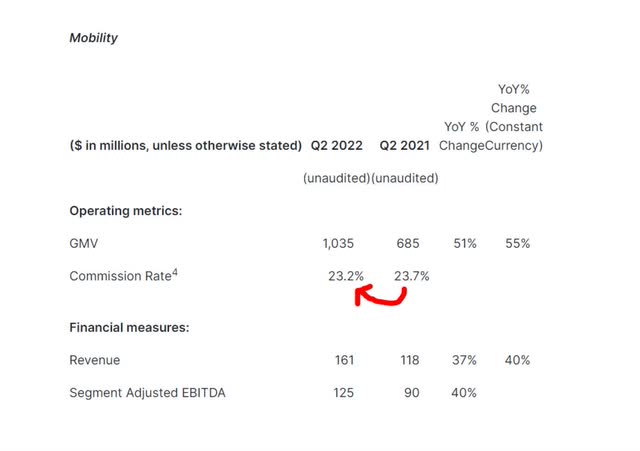

Moreover, even as recently as the fourth quarter of 2021, the delivery segment – Grab’s largest by GMV – saw a 98% YoY decline in revenue, primarily as a result of incentives. This presents unpredictability that long-term investors might shy away from. At the same time, looking at the Mobility segment, what stood out was the commission rate, which has dropped by 50 basis points to 23.2% this quarter from 23.7% in the same quarter last year.

As a marketplace business with revenues primarily generated from commissions following the successful completion of mobility and delivery jobs, incentives fueled growth and reduction of take rates reflect a weak economic moat. This can be attributed to the intense competition Grab faces in their operating segments, especially with the emergence of recently listed Gojek (GoTo), which competes strongly in the mobility segment within Indonesia, the largest economy in Southeast Asia, and also within Singapore.

Similarly, it is also uncertain how the deliveries segment will perform in future endemic times as it only began contributing meaningful revenue when the demand for food delivery grew during pandemic lockdowns. European brands Foodpanda and Deliveroo (OTCPK:DROOF) have also diluted some of Grab’s market share.

Risks

Grab has been a game changer and will continue to make inroads into a rapidly digitalizing SEA. Nevertheless, its segments are highly competitive, and consumers are price sensitive. Grab mobility fares for consumers can soar high, especially with surge pricing during rainy days or peak hours. Commuters have encountered frustration over these “crazy” fare hikes, as a Singapore news outlet reports.

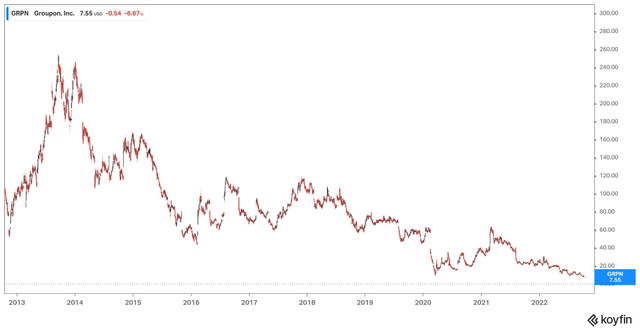

The performance of Grab thus far has some parallels to U.S. company Groupon (GRPN), which in 2011 was the largest IPO by a web company since Google (GOOG) (GOOGL). Groupon was a game changer then in introducing group coupon deals to consumers. However, consumers had little loyalty or reason to stick with the brand and were also free to use any of the other hundreds of coupon sites in existence at that time. Groupon failed to establish its competitive moat and its stock never recovered.

For Grab, consumers across Southeast Asia also have a variety of choices when it comes to fulfilling their delivery and mobility needs. It will require strategic innovations for it to ensure continuous market growth, keeping in mind the technology disruptions looming with autonomous driving and drone deliveries possibly becoming a reality in the not-too-distant future. This can potentially have a serious impact on Grab’s business as a going concern.

In addition, the Grab app adoption rate grew massively because of the introduction of Grab Pay, Grab Wallet, and Grab Rewards, where users could use the app to make a variety of payments for both Grab services and to other merchants, accruing Grab Rewards in the process. For some time, users could double dip on these rewards, earning credit card bonuses when they top up and earning Grab Rewards when they pay using Grab. Unfortunately, Grab has been progressively adjusting these rewards, in the process reducing its appeal. Unlike Tencent Holdings’ (OTCPK:TCEHY) WeChat, the Grab app lacks the social aspect that keeps users glued to it.

Valuation

Grab, being a company in a growth phase, is best valued using the P/S ratio. Using a comparables approach, I have selected the following companies:

- Uber Technologies, Inc. (UBER): a U.S.-based company operating in similar segments as Grab. It was previously even operating in Southeast Asia before being bought out by Grab.

- DoorDash, Inc. (DASH): a U.S.-based company focused primarily on the deliveries segment for restaurants, groceries, and convenience stores.

- Sea Limited (SE): another giant from Southeast Asia operating within the gaming, e-commerce and fintech segments.

- Tencent Holdings: a Chinese company known for gaming and its all-in-one app WeChat.

As shown, Grab is valued around 4-5 times higher than these other companies who are similarly in their growth stages (with the exception of Tencent, which is a large-cap firm). A reason for this premium comes down to its integration of multiple functions into a super-app as well as its current dominant position in Southeast Asia.

With the Southeast Asian market being less economically mature than other global regions like the U.S. or North Asia, Grab’s valuation has priced in consistent strong growth in revenues. Should Grab instead face unforeseen revenue slowdowns or disruptions to its business, its stock price would definitely crash further.

Conclusion

Grab is undoubtedly one of the most prominent companies in Southeast Asia and is a good play on the region’s growth. However, the opportunity requires further assessment and is one that I prefer to sit out on, as looming risks deter the general market and there are better companies at a cheaper valuation. I rate the stock a hold and will wait to see how Grab’s plans to turn profitable come along, as well as if its financial services segment can gain some traction.

Be the first to comment