Justin Sullivan

As discussed in previous analysis of Altimeter Capital’s Brad Gerstner cost cuts at Meta Platforms (META), a company like Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) only needs targeted cost cuts for substantial financial improvements. Investors should be skeptical of activists looking for short-term boosts to profits that hurt the long-term financial picture. My investment thesis is Bullish on the stock with expectations that activists will help push Alphabet into controlling costs without drastic cuts impacting the business.

TCI Fund Management Plan

TCI Managing Director Christopher Hohn sent a letter to Alphabet CEO Sundar Pichai addressing the cost structure at the tech giant. The activist owning $6 billion worth of shares wants Alphabet to cut employees costs with the company having far too many employees and costs per employee too high.

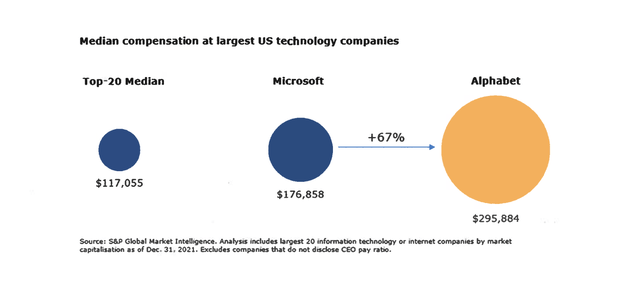

The CEO has already discussed plans to make employees 20% more efficient. TCI wants the company to quit spending far higher on employee compensation in comparison to other tech companies such as Microsoft (MSFT). According to the data from S&P Global used by TCI, Alphabet is spending $119K more per employee with a total compensation cost per employee reaching an absurd $295K.

As discussed in previous research, Alphabet has seen operating expenses soar from $5 billion per quarter to over $20 billion now. With revenues stalling this year, the tech giant clearly has a spending problem previously hidden by strong growth.

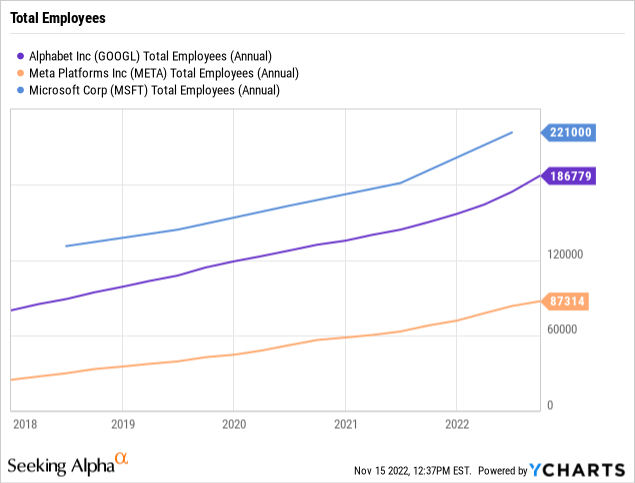

In addition to just the total costs, Alphabet has grown the employee base to nearly catch up to Microsoft. Though, Alphabet is on pace to generate more revenues now.

The issue isn’t necessarily the amount of employees, as much as the compensation for the employees. Alphabet will need to figure out a plan to either cut employees or eliminate some of the perks given to employees which are out of touch with the rest of Silicon Valley.

Cutting Waymo Goes Too Far

Google has long been considered one of the leaders in self-driving technology. TCI wants the tech giant to cut spending by 50% in Other Best which mostly amounts to slashing the spending on Waymo.

The Other Bets quarterly losses are as follows:

- Q3’22 – $1.61 billion.

- Q2’22 – $1.69 billion

- Q1’22 – $1.16 billion

- Q4’21 – $1.45 billion

- Q3’21 – $1.29 billion

- Q2’21 – $1.40 billion

- Q1’21 – $1.15 billion

Alphabet has already lost $4.5 billion this year and should easily top $6.0 billion in losses in the Other Bets category. The loss doesn’t match the Metaverse spending at Meta, but Alphabet is losing about 50% of the amount of the Reality Labs division with actual revenues from selling Oculus devices. In Q3’22, Alphabet only produced $209 million worth of revenues in Other Bets.

While the hedge fund points to the Argo AI startup funded by Ford (F) and Volkswagen (OTCPK:VWAGY) shutting down as a reason for Alphabet to shift away from funding Waymo, the auto giants aren’t moving away from self-driving technology. The whole sector is moving forward with spending aggressively on automotive technology.

Argo made the following statement to employees:

In coordination with our shareholders, the decision has been made that Argo AI will not continue on its mission as a company. Many of the employees will receive an opportunity to continue work on automated driving technology with either Ford or Volkswagen, while employment for others will unfortunately come to an end.

Ford is shifting to more driver assistance systems and moving away from autonomous vehicle tech for robotaxis. Most importantly, the giant auto OEM sees the ability to purchase more advanced technology in the future without the need to develop internally.

The decision to shut down Argo AI appears all related to Ford no longer wanting to invest in the technology while most other companies are full speed ahead. Clearly, Waymo shouldn’t shutdown like Argo AI, but Alphabet needs to better justify the spending and become more efficient with matching the current spending with actual revenue opportunities.

$10 EPS Ahead

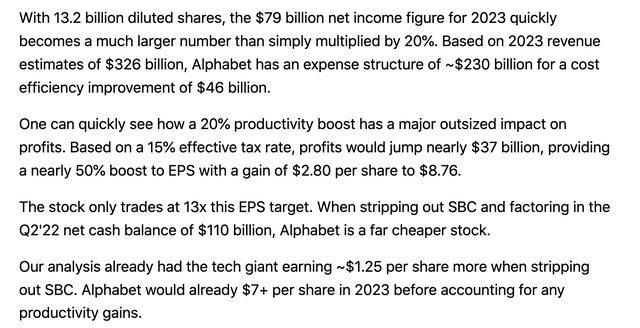

As mentioned in previous research back in September, once the company implements 20% efficiency improvement to the cost structure, Alphabet could be looking at a $10 EPS as follows.

Analysts have Alphabet now earning $5.43 per share in 2023 based on GAAP. Once adding nearly $3 from efficiency boosts and another ~$1.25 for SBC charges, the company would be on path for a nearly $10 EPS.

With Meta and Amazon planning large workforce reductions, Alphabet definitely has the clearance for making similar cuts without disrupting the remaining employee base. The real key to efficiency gains isn’t via mass layoffs that have rolling impacts on the business, but for the company to continue growing revenues without adding new employees.

Takeaway

The key investor takeaway is that Alphabet is cheap based on current non-GAAP EPS targets of nearly $7 for a stock trading below $100. A 20% more efficient Alphabet would generate a $10 EPS placing the stock trading at 10x EPS targets.

The big question is whether Alphabet can actually generate the 20% efficiency targets announced by the CEO, though the announcement appears somewhat an unofficial target. Either way, the tech giant has massive EPS growth by controlling costs over the next few years. What investors shouldn’t want is for activists to force employee reductions that cut too far into the future like Waymo.

Be the first to comment