bjdlzx/E+ via Getty Images

Ranger Oil (ROCC) looks capable of generating a bit over $300 million in positive cash flow in 2022 at current strip prices, which would allow it to do some share repurchases as well as pay off its credit facility debt during 2022.

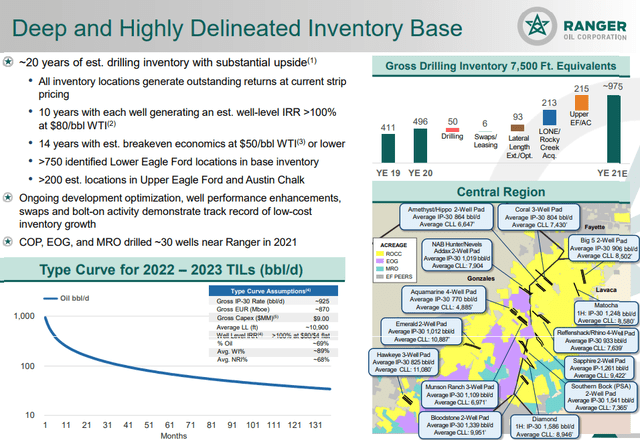

Ranger appears roughly fairly valued at the moment based on my expectations for longer-term oil prices. Ranger may be able to increase its value through efficient development of its drilling inventory, of which it claims to have around 20 years worth (including 14 years of inventory with a breakeven point of $50 WTI or lower).

Potential 2022 Outlook

Ranger is currently expecting approximately 39,750 BOEPD in average production in 2022, including 28,500 barrels per day in oil production. This is a slight decrease in total production from Q4 2021 levels, but a 4% increase in average oil production compared to Q4 2021.

At current strip of approximately $100 WTI oil and $4.85 NYMEX gas, Ranger is projected to generate $1.156 billion in oil and gas revenues before hedges. Ranger’s 2022 hedges have negative $184 million in value at those prices.

Ranger has approximately 62% of its 2022 oil production hedged with collars or swaps. It also has purchased puts giving it some downside protection with Q1 2021 oil prices, while not restricting its upside there.

| Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million | |

| Oil | 10,402,500 | $99.00 | $1,030 |

| NGLs | 2,135,250 | $33.00 | $70 |

| Natural Gas | 11,826,000 | $4.70 | $56 |

| Hedge Value | -$184 | ||

| Total Revenue | $972 |

Ranger intends to spend around $400 million on D&C capex ($408 million in total capex) in 2022, which will fund two continuous drilling rigs as well as an occasional spot rig. Ranger’s 2022 capex budget is higher than I previously expected due to cost inflation plus plans for that spot rig.

| $ Million | |

| Lease Operating Expense | $75 |

| Gathering, Processing and Transportation | $35 |

| Production and Ad Valorem Taxes | $72 |

| Cash G&A | $33 |

| Cash Interest | $44 |

| Capital Expenditures |

$408 |

| Total Expenses |

$667 |

This would result in an estimate of $305 million in positive cash flow for Ranger Oil in 2022 at $100 WTI oil.

Debt Situation

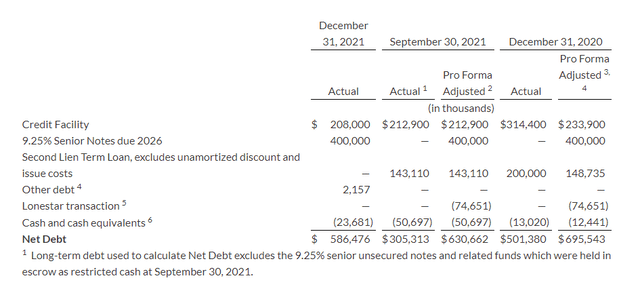

Ranger’s net debt at the end of 2021 was $586 million. Ranger is also planning initiating a modest $0.25 per share annualized dividend ($11 million per year) starting in Q3 2022.

The positive cash flow in 2022 (less dividends) would reduce its net debt to $287 million by the end of 2022 (or a relatively low 0.4x EBITDAX). This doesn’t include the effect of any potential share repurchases, as Ranger is planning on authorizing a $100 million share repurchase program.

Ranger’s Net Debt (rangeroil.com)

There does seem to be room for Ranger to increase its dividend in the future, although it may want to redeem some of its high-interest 9.25% notes due 2026 first. These notes are redeemable starting in August 2023 at 106.938% of par.

Valuation

I’ve now updated Ranger’s estimated value (for early 2023) to $35 per share at long-term (after 2022) $70 WTI oil and $3.50 NYMEX gas.

At long-term $75 WTI oil and $3.75 NYMEX gas, Ranger’s estimated value (also for early 2023) increases to around $38.50 per share.

Thus I’d consider Ranger to be roughly fairly valued at the moment. WTI futures currently drop below $75 during 2024. Ranger could increase its value through effective development of its inventory. It claims to have around 14 years of inventory with breakeven economics of $50 WTI or lower, and around 20 years of total drilling inventory.

Ranger’s Inventory (rangeroil.com)

I also consider Ranger’s 9.25% notes due 2026 to have a relatively good risk/reward ratio as it should be able to eliminate its credit facility debt during 2022.

Conclusion

Ranger (at $37.56 per share) appears roughly fairly valued for a longer-term low-$70s WTI oil environment. As I tend to lean more to the conservative side around longer-term oil prices, I am thus neutral on Ranger at its current price.

Ranger’s balance sheet should be in pretty good shape with its ability to generate over $300 million in positive cash flow in 2022. This would potentially allow it to reduce its leverage to 0.4x by the end of the year (without share repurchases). If it does conduct share repurchases, it should still be able to eliminate its credit facility debt during 2022.

Be the first to comment