JHVEPhoto

Introduction

My thesis is that Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is well positioned to continue reaping benefits from AI.

The ways in which Google Search benefits from AI are obvious and I’ve written about them many times. In the 3Q22 call, CEO Sundar Pichai said we’re still in the early innings with AI and he cited BERT [Bidirectional Encoder Representations] which recognizes that small search words like “to” and “for” can be very important. Less appreciated are the ways in which Google’s other businesses like YouTube and Google Cloud benefit from AI. CEO Pichai talked about these considerations in the 3Q22 call:

It makes YouTube better ads, better – and through Cloud, we are bringing it to other companies as well.

AI Makes YouTube Better

Google is uniquely advantaged in that they take the benefits of AI investments from the search business and then apply the learnings to the YouTube ad business which has an enormous audience. Nielsen reports that YouTube had 7.6% of overall US TV time in August and nearly 22% of streaming time.

In the 3Q22 call, COO Philipp Schindler talked about the opportunities at YouTube saying global viewers are watching more than 700 million hours of YouTube daily. He revealed that Nielsen says YouTube reached more viewers during primetime on CTV than any linear TV network during the 2021 to 2022 U.S. broadcast seasons:

On the brand side, as I said earlier, eyeballs are moving away from linear TV, and we’re helping brands move beyond tradition to efficiently really achieve their reach and awareness goals. And obviously, you mentioned that as well – Connected TV is an important part of this strategy. When you think about it, YouTube is really the best place for advertisers to reach new consumers across multiple formats and screens from shorts to long-form, podcast, music all the way to CTV.

A May 2022 blog post from YouTube Director of Global Advertiser Marketing Cenk Bulbul explains that YouTube uses machine learning to optimize how many times a viewer sees an ad from a given company. This improves the advertising experience for both viewers and advertisers.

YouTube Product Management Director Nicky Rettke explains in a September 2022 blog post that machine learning helps YouTube advertisers convert landscape video ads into square or vertical formats:

We’re experimenting with a new machine learning technology that reformats landscape video ads into square or vertical formats based on how someone is watching YouTube. The machine learning model detects important elements in the landscape ad – such as faces, key objects, logos, text and motion – and breaks the video into distinct “scenes.” This ensures that important elements show up properly – centered, for example – in the reformatted video. Businesses who may not have dedicated resources to create multiple assets can easily benefit from this technology, which automatically adapts their existing assets for several different formats.

Google Cloud Makes AI Available To Customers

At Next ‘22, we learned about the ways Google makes their AI research, AI models and ML tool kits available to cloud customers as enterprise-grade products and solutions; Vertex AI is an example of this. Vodafone Analytics Product Lead Ashish Vijayvargia talks about the platform they’ve built with Vertex AI:

As a technology platform, we’re incredibly proud of building a cutting-edge MLOps platform based on best-in-class Google Cloud architecture with in-built automation, scalability and security. The result is we’re delivering more value from data science, while embedding reliability engineering principles throughout.

Google CEO Pichai talked about the way ML is a key part of their translation efforts at Next ‘22, saying they are now up to 135 languages. CEO Pichai used Munich Re as an example of a company using Google’s ML to extract insights and predictions from data:

One of the most powerful AI applications for organizations is the ability to extract insights and predictions from their data specific to their business needs. For example, Munich Re, one of the leading reinsurance companies in the world is collaborating with Google Cloud to use AI to respond to natural disasters quickly and thoroughly. Our tools help them to build better damage reduction models faster and more cost efficiently. This speeds up response time, helping get people and resources where they are needed most.

Google Cloud Senior Director of Engineering Kamelia Aryafar @KAryafar reported at Next ‘22 that data scientists can build and train ML models 5 times faster with Vertex AI. Google Cloud Analytics Product Leader Irina Farooq gave us more insight on the success Vodafone is having with Google’s ML at Next ‘22. Product Leader Irina Farooq reminded us that data is in Google’s DNA and that the same data infrastructure that allowed them to innovate is available to Google Cloud customers. Product Leader Farooq said Vodafone now runs AI development 80% faster with the help of Google.

Valuation

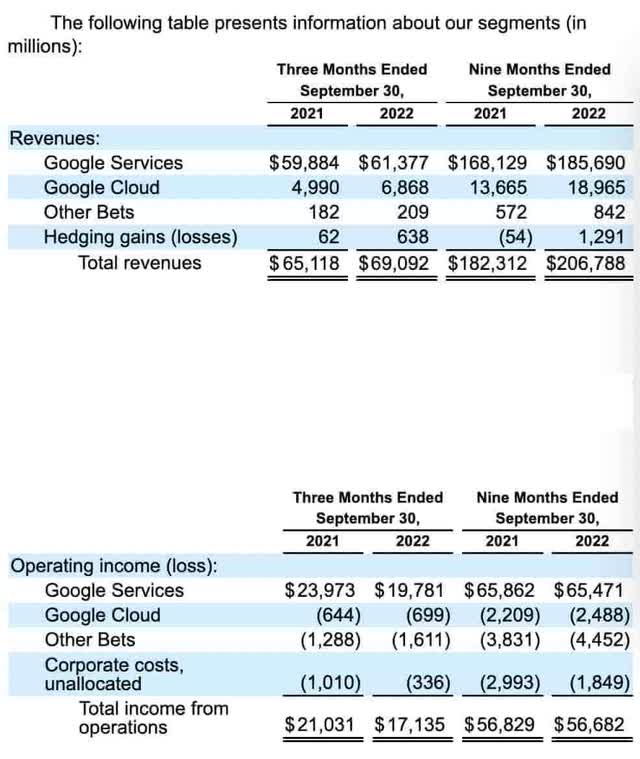

In the 3Q22 call, CEO Pichai said there has been fundamental growth in Search along with momentum in Cloud. Challenges have come in the form of foreign exchange, the macro climate and the lapping of an elevated period. CFO Ruth Porat said in the 3Q22 call that the quarterly revenue of $69.1 billion was up 6% versus a year ago or 11% in constant currency. She mentioned that an even bigger foreign exchange headwind is expected in the fourth quarter and that this is harder on revenue than expenses seeing as much of the R&D expenses are in the U.S. CFO Porat mentioned that 12,765 people were added in 3Q22 and that 2,600 folks came from the Mandiant acquisition. During the 3Q22 call, Morgan Stanley’s Brian Nowak pointed out that 51,000 new people have been added to Google during 2022 and investors are concerned that this headcount growth is dramatically outpacing revenue growth.

Google COO Schindler explained some of the challenges with revenue in the 3Q22 call:

And from my side, Eric, in the third quarter, as I mentioned, there was a further pullback in spend by some advertisers across both brand and direct response. But overall, I feel YouTube remains in a really good position to continue to benefit from the streaming boom. In direct response, we think there’s a lot of room to run to make really due more shoppable, more actionable from video action campaigns to product feeds, app campaigns, live commerce features.

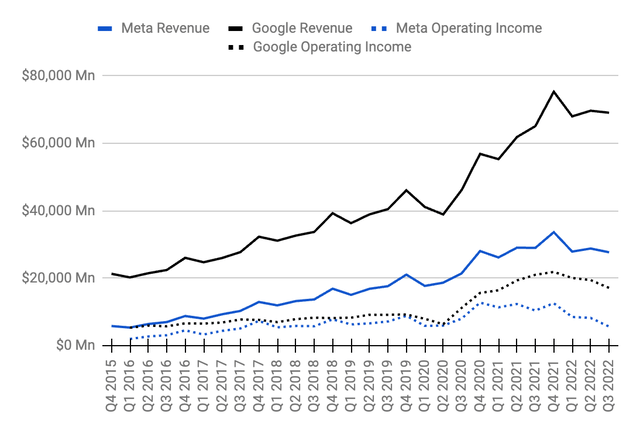

Like Meta (META), much of Google’s operating income and revenue comes from digital advertising. Things have slowed down recently, but this is still an area with the potential for tremendous growth over long periods of time:

Google Operating Income (Author’s spreadsheet)

Looking at 3Q22 relative to 3Q21, revenue is up but operating income is down per the 3Q22 release:

The cloud, bets and service segments are disparate businesses, so I like to do a sum of the parts valuation. Google has shown some resilience but interest rates are going up which means P/E ratios go down. I think the operating income multiples of 18 to 20x from my June article are still somewhat reasonable but we need to keep an eye on interest rates; lower multiples will be needed in the future if rate hikes don’t show signs of stopping.

One of the things I like to do with Google Cloud is compare their numbers to the numbers we saw from Amazon (AMZN) AWS 4 years earlier. In some ways it’s not fair because AWS got out there first, ahead of the competition, such that they didn’t have the same types of challenges faced by latecomers like Google Cloud. Still, the numbers are telling! AWS never struggled with operating income at similar levels of revenue. I’m sure Google Cloud’s operating income will turn positive eventually but it’s been a long wait. AWS went from operating income of $580 million on revenue of $2,405 million in 4Q15 to operating income of $2,077 million on revenue of $6,679 million in 3Q18. Google Cloud went from operating income of $(1,194) million on revenue of $2,614 million in 4Q19 to operating income of $(699) million on revenue of $6,868 million in 3Q22.

Here are the numbers in millions:

|

Google Cloud Qtr End |

Google Cloud Op. Inc. |

Google Cloud Rev. |

AWS Qtr End |

AWS Op. Inc. |

AWS Rev. |

|

|

Dec 2019 |

-$1,194 |

$2,614 |

Dec 2015 |

$580 |

$2,405 |

|

|

Mar 2020 |

-$1,730 |

$2,777 |

Mar 2016 |

$604 |

$2,566 |

|

|

Jun 2020 |

-$1,426 |

$3,007 |

Jun 2016 |

$718 |

$2,886 |

|

|

Sep 2020 |

-$1,208 |

$3,444 |

Sep 2016 |

$861 |

$3,231 |

|

|

Dec 2020 |

-$1,243 |

$3,831 |

Dec 2016 |

$926 |

$3,536 |

|

|

Mar 2021 |

-$974 |

$4,047 |

Mar 2017 |

$890 |

$3,661 |

|

|

Jun 2021 |

-$591 |

$4,628 |

Jun 2017 |

$916 |

$4,100 |

|

|

Sep 2021 |

-$644 |

$4,990 |

Sep 2017 |

$1,171 |

$4,584 |

|

|

Dec 2021 |

-$890 |

$5,541 |

Dec 2017 |

$1,354 |

$5,113 |

|

|

Mar 2022 |

-$931 |

$5,821 |

Mar 2018 |

$1,400 |

$5,442 |

|

|

Jun 2022 |

-$858 |

$6,276 |

Jun 2018 |

$1,642 |

$6,105 |

|

|

Sep 2022 |

-$699 |

$6,868 |

Sep 2018 |

$2,077 |

$6,679 |

The cumulative numbers above are staggering. Summing up 12 quarters, Google Cloud had operating losses of over $12 billion. At similar revenue levels, AWS went the other direction, with operating income of $13 billion spread out over 12 quarters.

In some ways the operating income losses for Google Cloud are good for the hyperscale cloud companies. This is because few companies in the world can get past this barrier to entry; I don’t think AWS, Azure and Google Cloud will have new hyperscale competitors in the near future.

Google Cloud CEO Thomas Kurian talked about analyzing data from other clouds at Next ‘22:

Did you know that over 90% of Google Data Cloud customers also access and analyze data from other clouds using Google’s Data Cloud? BigQuery Omni allows you to analyze data stored in AWS, Azure and others without needing to actually move the data, saving egress fees. From BigQuery then, customers can use [CICO] queries, programs written in Spark and built-in machine learning capabilities to analyze the data.

It’s hard to put a valuation on the Google Cloud segment because their operating income is still negative. One optimistic method is to conjecture that they’ll eventually reach an operating margin similar to what we’ve seen for the last few years at AWS. Per the Amazon 2021 10-K, the AWS operating margin was 29.82% or $13,531 million/$45,370 million and 29.97% or $18,532 million/$62,202 million for 2020 and 2021, respectively. Perhaps AWS will almost always be the largest of the hyperscale companies with the best margins. Having said that, I’m optimistic that Google Cloud can get to a point where their operating margin is about 15% to 20% or half to 2/3rds of what we see at AWS. If Google Cloud had a 15% to 20% operating margin today then annualized operating income would be about $4,120 million to $5,494 million based on annualized revenue of $27,472 from the $6,868 million figure in the 3Q22 quarter. If we use a multiple of 18 to 20x on these figures and round to the nearest $5 billion then the Google Cloud business could be worth $75 to $110 billion.

The details of the “Other Bets” segment are obfuscated and it has TTM operating losses of $5,902 million or 9M22 + FY22 – 9M21 or $(4,452) million + $(5,281) million – $(3,831) million. Given these heavy operating losses, I think this segment could be worth $0 in this environment of rising interest rates.

The services segment has TTM operating income of $91,464 million or $65,471 million + $91,855 million – $65,862 million. I think this segment is worth 18 to 20x this amount or $1,650 to $1,830 billion when rounded to the nearest $10 billion.

Here is my sum of the parts valuation summary:

$1,650 to $1,830 billion Google Services

$75 to $110 billion Google Cloud

$0 Other Bets

——————————-

$1,725 to $1,940 billion Total

On October 28th, GOOGL closed at $96.29 while GOOG closed at $96.58. We multiply these by the A/B and C share counts which were 6,857 million and 6,086 million, respectively, as of October 18th per the 3Q22 10-Q. This gives us a market cap of $1,248 billion or $660.3 billion + $587.8 billion. The enterprise value is well below market cap due to the fact that there is $22 billion in cash plus $94.3 billion in marketable securities, which are only partially offset by debt and lease obligations.

The market cap and enterprise value are substantially lower than my valuation range so I think the stock is a buy for long-term investors willing to hold it for at least a few years.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment