Kevin Frayer/Getty Images News

At the beginning of this week, Alibaba’s (NYSE:BABA) stock experienced one of the greatest declines in its history, as the reelection of Xi Jinping for the third term as the general secretary of CCP along with the election of loyalists into the Politburo Standing Committee disappointed investors. Last week I’ve already highlighted what the company’s investors should expect in the foreseeable future, as Beijing begins to double down on policies that include new lockdowns and a redistribution of wealth, which would more than likely negatively affect China’s private sector.

Just a couple of days ago, China has already implemented new travel restrictions in some of its big cities to prevent the spread of Covid-19 there, while at the same time Beijing has continued to actively expand its reach in the digital payments industry to strengthen its grip over the Chinese society. This has direct negative consequences for Alibaba, as its commerce business has already shown to be vulnerable to lockdowns earlier this year, while the rise of the digital yuan along with Beijing’s geopolitical ambitions threatens to undermine the company’s dominant position in the digital payments and cloud computing businesses.

Therefore, as bullish investors continue to believe that Alibaba is a bargain, especially at the current price, this article aims at presenting additional arguments that undermine the bullish thesis and give more reasons to believe why Xi Jinping’s China has become uninvestable for international investors.

Prepare For More Disruptions

When I was writing my previous article on Alibaba, the 20th National Congress of the CCP was still ongoing and at that time it was still unknown who will become a part of the party’s main governing body, which is called the Politburo Standing Committee that includes 7 people along with the general secretary. After that article was submitted, news broke out that the pro-market reformists were sacked from the newly formed Standing Committee and the people who would replace those reformists are considered to be Xi Jinping’s loyalists.

It was reported that the role of the Premier, which is the most important person in the CCP after general secretary Xi Jinping himself, will go to Li Qiang, who is the chief of the Communist party in Shanghai. Li Qiang got his position at the Standing Committee unexpectedly fast by breaking the party’s tradition by not serving as a Vice Premier before getting a higher role, and he’s also the person who was blamed for the bad handling of Covid-19 lockdowns in Shanghai earlier this year. Nevertheless, the international press and countless experts on China were saying that Li Qiang would become the party’s Premier mostly due to his loyalty to Xi Jinping, as he’s more than likely to help the general secretary to implement the policy of common prosperity on the mainland.

To understand why is this a pretty significant development to the markets and to Alibaba in particular we should look at Li Qiang’s predecessor, a man named Li Keqiang, who served as the party’s Premier for the previous two terms. Back in March, Li Keqiang was the one to reassure the tech sector of its importance to China. Then in May, he has been saying to the tech companies that the government supports them, the platform economy, and also supports their desire to raise capital not only at home but also abroad. At the same time, the Wall Street Journal, by citing its own sources in Beijing, also reported that Li Keqiang was Xi Jinping’s main economic fixer and a person who advocated for the easing of the crackdown against China’s tech sector.

As Li Keqiang along with the outgoing members of the Standing Committee are about to be replaced by Xi Jinping’s loyalists, it’s more than likely that we would see additional interferences from the state into China’s private sector, which is more than likely going to negatively affect Alibaba and its peers. In my previous article on the company, I’ve already mentioned how Alibaba is about to spend ~22% of its liquidity to help Xi Jinping implement his common prosperity vision, and as the general secretary continues to call for the redistribution of wealth, it’s hard to imagine how Alibaba would be able to thrive in this new reality.

Alibaba’s Digital Payments Business Is Already Under A Threat From Beijing

We shouldn’t forget that the crackdown against Alibaba started back in late 2020 when the Chinese regulators stopped the IPO of Ant Group, in which Alibaba has a 33% stake, while the rest at that time was owned by Alibaba’s founder Jack Ma and a number of his close associates. Back then, the Wall Street Journal reported that Xi Jinping himself got personally involved in the process, which in the end resulted in more government interference in the company’s affairs, a record fine, and billions in shareholder value destruction.

One of the biggest advantages of Ant Group is the fact that its major product Alipay is one of the most popular digital payment systems in China along with Tencent’s (OTCPK:TCEHY) WeChat Pay. Alipay is used not only within Alibaba’s ecosystem of products and services but also among a wide range of online and retail places. However, there’s an indication that this Ant Group-Tencent duopoly is about to end.

The Rise of The Digital Yuan

In 2020, the People’s Bank of China started trialing China’s central bank digital currency called the digital yuan. In a way, the digital yuan is a paperless version of the fiat currency issued by the People’s Bank of China that could be considered a universal digital legal tender. At the same time, the People’s Bank of China has also released a digital yuan app similar to the Alipay app in order to give Chinese citizens the ability to collect and transfer digital yuans themselves, which makes both of the apps direct competitors in the digital payments business.

The problem for Ant Group, and subsequently for Alibaba, is the fact that Alipay’s business model is fee-based, under which it charges fees on each transaction in order to make a profit. Considering that the People’s Bank of China doesn’t have any merchant fees or service charges within the digital yuan app, it makes its own offering more attractive for merchants and consumers without directly forcing them to adopt the new payment method in the first place.

Thanks to this, Beijing is able to take away the power from the private sector and its ability to harness customer data, while at the same time it gives the state the ability to fully control the flow of money transfers. The latest data shows that the transaction volume of the digital yuan has suppressed $14 billion in the last couple of years since the trial started, as over 6 million merchants already began using it.

The trial itself is expected to last for the next couple of years before the full adoption and the People’s Bank of China also plans to use digital yuan for cross-border payments, which is also more than likely to undermine Alipay’s expansion strategy in Southeast Asia.

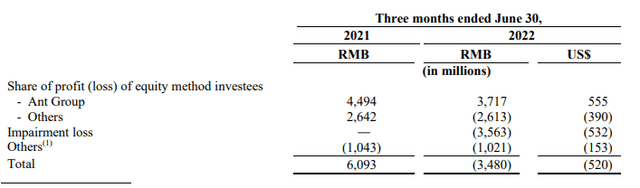

Considering this, it’s safe to say that digital yuan represents an existential threat to Ant Group and it’s more than likely to also decrease Alibaba’s ability to improve its own financials in the long run. After all, if we look at Alibaba’s latest earnings report for Q1, we would see that Ant Group is the only major equity investment that continues to generate profits for the company in the current environment, but the Y/Y growth in profits is already negative and it could become even worse going forward.

Performance of Alibaba’s Equity Investments in Q1 (Alibaba’s Q1 Earnings Report)

Geopolitical Pressure Is Not Going Away As Well

Even though Beijing allowed the U.S. inspectors to audit the books of the Chinese-based firms, Alibaba continues to face far greater geopolitical challenges, which it’s unlikely to overcome due to them being outside of its control. In my latest article on the company, I focused mostly on highlighting the domestic challenges that Alibaba would face with the reelection of Xi Jinping and ignored the geopolitical aspect of the 20th National Congress. Now is the time to address it as well.

Considering Xi Jinping’s aggressive and confrontational rhetoric during the National Congress, there’s every reason to believe that the general secretary is preparing China for a potential conflict with the United States. By not ruling out the use of force in order to take Taiwan and making it clear that Sino-American relations won’t improve anytime soon, it’s safe to assume that Alibaba has all the chances to become one of the biggest casualties of the potential confrontation, as some of the geopolitical risks already started to materialize.

One of the downsides of Alibaba is that its AI projects rely on chips designed by Nvidia (NVDA) and Intel (INTC). Considering the latest White House chip restrictions implemented earlier this month, there are questions about whether Alibaba would be able to realize its latest AI projects and enhance its cloud computing capabilities, as China is not known for designing and producing high-end chips. At the same time, a week ago it was reported that the Biden administration already explores additional export controls that could hamper Alibaba’s ambitions in the AI field even more. In addition, there’s always a possibility that with the worsening of relations, the U.S. Department of Defense could follow on its warning and add Alibaba and its peers to the list of Communist Chinese Military Companies, which is something that it backed off from doing back in 2021.

With that in mind, it’s safe to assume that Alibaba’s AI and cloud computing initiatives could be in danger. What’s worse for the company is that the cloud business was one of the few biggest positives from the latest Q1 report, as it generated $2.6 billion in revenues, up 10% Y/Y, while the core commerce business didn’t show any growth during the period. As a result, with additional geopolitical headwinds, there’s a risk that it won’t be able to perform as well in the future due to its reliance on Western components, which are going to be harder to obtain due to the worsening of Sino-American relations in the foreseeable future.

The Bottom Line

After the recent depreciation, Alibaba’s stock hasn’t become a bargain in my opinion even if the fundamentals suggest that it did. We shouldn’t forget that after Beijing began its crackdown against the company, its stock price entered a distressed territory, which prompted Alibaba’s bulls to say that the business is now undervalued. However, it didn’t help the stock to rebound, as the shares continue to depreciate to this day and currently trade below the 2014 IPO levels.

Considering this, it’s safe to assume that such a rebound is unlikely to happen today, as Beijing has given a clear indication to the world and the markets that it plans to strengthen its grip over China’s private sector. This would undoubtedly have greater negative consequences for Alibaba in the foreseeable future since it’s unlikely that the business would be able to outperform the state in industries in which Beijing has already become the company’s direct competitor. Therefore, I stick with my opinion that Xi Jinping’s China has become uninvestable and it’s hard to justify a long position in Alibaba even at the current levels given the latest developments.

Be the first to comment