Justin Sullivan/Getty Images News

Price Action Thesis

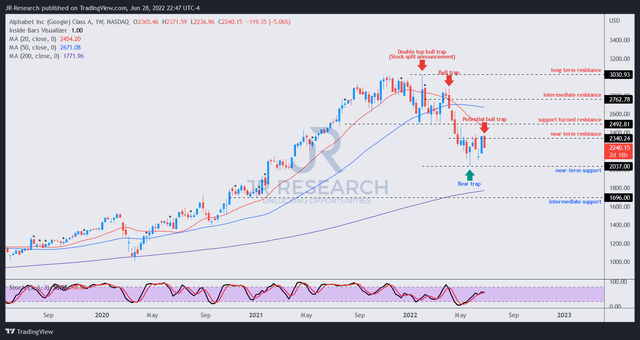

We present our detailed price action analysis as a follow-up to our previous update on Google (NASDAQ:GOOGL) (NASDAQ:GOOG). We noted several noteworthy developments in its price structure that investors should monitor.

We argued that GOOGL was not undervalued in our previous article (Buy rating). With markedly slower revenue growth estimates, GOOGL will likely underperform its historical average, and possibly the market moving forward. Therefore, the market is justified in asking for higher free cash flow (FCF) yields to compensate for slowing growth.

Our price action analysis also indicates a double top bull trap (which we missed earlier in the year) that drew in buyers astutely into its stock-split announcement post-FQ4 earnings. It led to a significant rejection of further buying momentum and also decisively reversed its bullish bias. So, the market has set up the move to digest GOOGL’s massive gains since late January/early February. As a result, we urge investors to continue paying close attention to GOOGL’s price structures to discern essential clues into the market’s forward intentions.

We reiterate our Buy rating on GOOGL stock as it has held its May bottom firmly. But, we maintain that GOOGL is not undervalued, and investors should be prepared for a further fall if the market decides to price in additional headwinds relating to a worsening recessionary scenario. That could lead to even better buy points (possibly undervalued), helping GOOGL stock outperform the market moving forward.

Double Top Drew In The Stock Split Buyers

GOOGL price chart (TradingView)

Google announced a 20-for-1 stock split after its FQ4’21 earnings call (in early February), which will see its stock trade on a split-adjusted basis on July 15.

Unfortunately, we ignored its price structure back then and missed the potent double top. Double tops are early warning signals highlighting the market’s intentions to reverse GOOGL’s bullish bias. Therefore, we paid the price for several poorly-timed executions on GOOGL.

The stock then formed a subsequent lower-high bull trap in March, adding further caution, given its preceding double top. March’s bull trap was significant. It indicated that the market has likely completed its distribution phase (given its lower highs). The ensuing steep sell-off forcing a rapid liquidation confirmed that GOOGL’s momentum reversed to a bearish bias decisively.

However, a validated bear trap formed in early May helped stanch its decline. Notwithstanding, GOOGL has met stiff selling pressure (although no bull trap) at its near-term resistance ($2,340). Therefore, we believe investors should avoid adding near that level, given GOOGL’s bearish bias.

Why GOOGL Is Not Undervalued

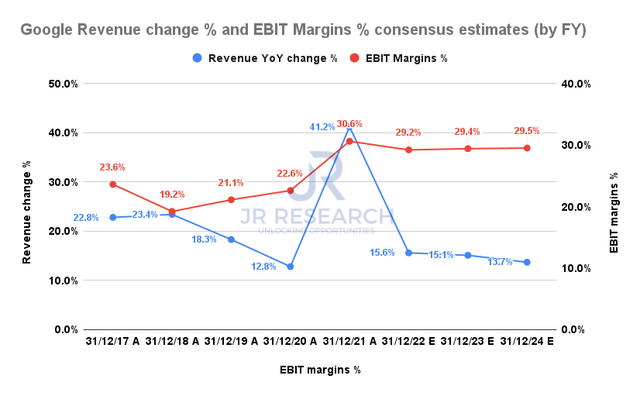

Google revenue change % and EBIT margins % consensus estimates (S&P Cap IQ)

GOOGL has helped its investors outperform the market over the past five years. It posted a 5Y total return CAGR of 19.56%, compared to the Invesco QQQ ETF’s (QQQ) 17.04%. However, investors must be wary in expecting such outperformance moving forward.

Notably, the consensus estimates suggest that Google’s revenue growth could slow markedly. As seen above, the market is justified to have set up the bull trap to digest those massive gains from 2020-21, as Google is projected to post revenue growth of 15.6% in FY22 (Vs. FY21’s 41.2%). Notably, it’s also expected to slow to 13.7% by FY24 (Vs. 5Y revenue CAGR of 23.3%).

As a result, with slower growth, it only makes sense that the market is asking for higher FCF yields to hold GOOGL stock.

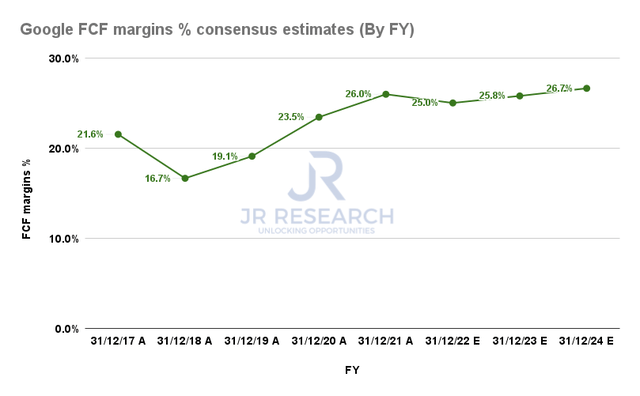

Google FCF margins % consensus estimates (S&P Cap IQ)

| Stock | GOOGL |

| Current market cap | $1.48T |

| Hurdle rate (CAGR) | 12.5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 5% |

| Assumed TTM FCF margin in CQ4’26 | 25.4% |

| Implied TTM revenue growth by CQ4’26 | $494.47B |

GOOGL reverse cash flow valuation model. Data source: S&P Cap IQ, author

Notwithstanding, Google’s inherent operating leverage could help sustain its robust FCF margins, which undergirds its valuation. Despite the significant moderation in revenue growth, the consensus estimates indicate an FCF margin of 25% in FY22, just slightly below FY21’s 26%.

However, we believe that GOOGL could underperform with markedly slowing topline growth, despite its operating leverage. Even though Google Cloud remains a key growth driver, its search advertising business is unlikely to grow as fast. Even YouTube’s organic growth has been slowing down, and its efforts to ramp and monetize Shorts will be near-term headwinds.

We apply a hurdle rate of 12.5% in our reverse cash flow valuation model, below the QQQ’s 17.04% 5Y CAGR. In addition, we observed that the market formed its bear trap at around the 5.6% mark in May. Therefore, we infer that the current dynamics suggest that the market considered that level too high.

Accordingly, we used a FCF yield of 5%. We think it’s an appropriate trade-off against its 5Y mean of 3.94%. With a lower hurdle rate, the market is justified in asking for higher yields. Consequently, we derived a TTM revenue of $494.47B by Q4’26, which we think is achievable.

However, given a much lower implied hurdle rate at its current valuation, GOOGL could underperform its historical averages and the market over the next four years.

Therefore, investors should be prepared to layer in at lower levels to improve their chances of market outperformance. Consequently, we believe a level closer to $2,000 is appropriate. Moreover, a level closer to $1,700 (GOOGL’s intermediate support) is considered highly attractive.

So, investors are encouraged to adjust their valuation parameters accordingly.

Is GOOGL A Buy, Sell, Or Hold?

We reiterate our Buy rating on GOOGL stock.

Notwithstanding, our valuation model indicates that GOOGL could underperform the market over the next four years. As a result, investors should be prepared to layer in at lower levels ($1,700 to $2,000) to improve their chances of outperformance.

Our price action analysis suggests its May bear trap has held firmly. However, the selling pressure at its near-term resistance has consistently hindered its upward momentum. Hence, investors are encouraged to avoid adding near that level.

Also, GOOGL remains entrenched in a bearish flow; therefore, we believe a steeper sell-off to break its May lows, before forming a double bottom bear trap cannot be ruled out.

Be the first to comment