Semih Akgul/iStock via Getty Images

Slowdowns in economic activity and carnage in advertising spending seem to go hand in hand when a recession is imminent – or so it seems. In mega-cap land, efficient market theorists are often correct with regard to efficiency in pricing. These (mainly academic) theorists, preach that it is impossible to find mispricing – and so it may seem in mega-cap land – but even in the most ‘efficient’ market, it does occur, albeit in one of two environments: extreme fear/greed or when a misguided narrative takes shape.

We look to explore the latter today.

(We’re retaining a ‘Buy’ on Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) – with a ‘watch’ status)

YouTube

The American Association of Advertising Agencies (‘AAAA’) conducted a study that demonstrates that advertising during recessions (“difficult times”) has empirically resulted in much greater growth of market share than in times of “economic prosperity”. This has historically proven to be effective when companies conducted this advertising tactic. Notable examples below:

- When McDonald’s decided to pull advertising during a recession in the 1990s, Taco Bell and Pizza Hut rushed into the void, growing sales by 40% and 61% respectively, while McDonald’s sales dropped nearly 30%.

- In the same recession, peanut butter brand Jif grew sales by 57% and Kraft Salad Dressing grew sales by 70%. How did both brands do it? By increasing advertising.

- In 2009, Amazon sales shot up 28% despite the downturn, largely through the launch and promotion of the Kindle. The product offered a terrific value proposition– a low cost new way to read. Even though the recession was in high gear, it was a massive marketing success.

There are numerous drawbacks of aggregating industry dynamics into simple statements (such as: “advertising is the first to go in recessions”) to emphasize how elastic industry profitability is during shifts within the economic cycles, it should be noted that there is always a caveat. Companies will cut advertising spending, that is an empirical fact, but companies will not cut spending on high ROI advertising.

I spoke about this in my last note on Google and the 2008 recession – exert below:

2. Now, The Bigger Picture – Recession? Who Cares

The clear and concise bear case surrounding Google is the nature of its business – advertising and the economic backdrop. Advertising has imperially proven to be where companies cut costs in times of crisis. Is that always the case?

Information presented below indicates that during the Great Financial Crisis, Google’s Ad business was still generating growth in revenues, albeit at a more modest pace. This currently juxtaposes the much too pessimistic nature that surrounds its prospects in the event of a recession. While this economic slowdown is starkly different to the GFC, the conclusion is the same. Companies cut costs in waste; they will continue to pay for what allows them to generate revenue in a crisis. Given the leaps and bounds that Google has taken with regards to the value their Ad business generates for businesses, it is likely that spending on advertising as a sector to slow down but remain marginally stronger at Google.

Google Total Ad Revenues ($ in Billions)

2008

2009

2010

Worldwide

7

9.1

11.2

Change (%)

30.00%

23.08%

Google Display Ad Revenues ($ in Billions)

2008

2009

2010

Worldwide

0.4

0.7

1.6

Change (%)

75.00%

128.57%

Google Search Ad Revenues ($ in Billions)

2008

2009

2010

Worldwide

6.6

8.4

9.6

Change (%)

27.27%

14.29%

Source: Company filings and Author’s work

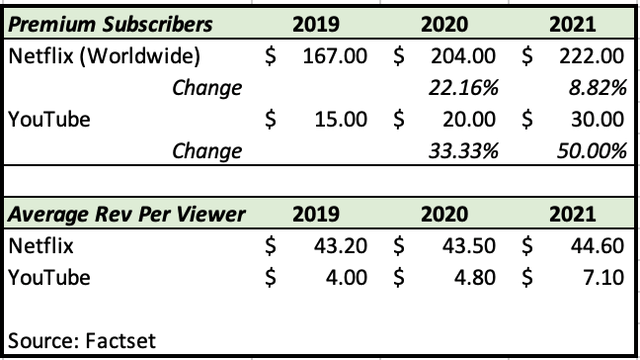

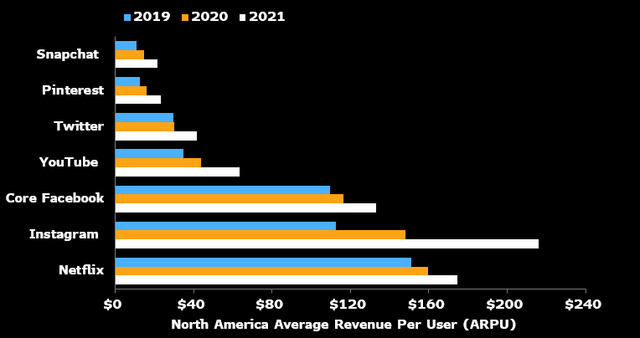

Advertising to targeted audiences continues to equate to the highest ROI, while video as a medium has continued to be the most engaging method of delivery. YouTube is in a unique position to do both, and effectively, due to the data that it collects on consumer behavior (if you’ve ever fallen down the rabbit hole of watching recommended videos for hours on end – that is the power and reach of their data). Companies such as Netflix (NFLX), within the connected-TV industry, are experiencing headwinds with churn and increased subscription pricing, but YouTube’s unique dynamics place the underlying factors that control profitability within their control. YouTube identifies its premium (subscription) services as a ‘bonus’ to its ad business and thus earns more the longer a consumer spends on the app. This contrasted with the subscription-only model of Netflix and Disney (DIS) effectively caps the average revenue per subscriber (see table below) that they can earn.

Streaming services are looking to advertising dollars as a means of growth which may see viewership move back into streaming (I don’t believe there will be). This has been cited by analysts as a headwind for YouTube, as this directly affects ‘watch time’ for their ad-supported viewers who might reallocate screen time back to streaming services. I contrast this with the content on both platforms. YouTube is dominated by user-based content in which initial acquisition cost is immaterial to YouTube, while Netflix (and other streaming services) do not have the same saleability due to their extreme content acquisition costs (Case and point: Netflix Reveals $17 Billion in Content Spending in Fiscal 2021).

YouTube also employs an extra strength, video length. The average video length for YouTube is 11.7 minutes, greatly increasing the number of videos watched per day (average time spent on the app is 44 mins which equates to roughly 4 videos) therefore YouTube is collecting more data on the consumer. This also allows for more advertisements to be played (at the start and at the end – multiple at each interval). Netflix’s average movie is 90 mins and show length is 55mins, drastically reducing the number of data points collected and therefore the ability to play more ads.

Cloud

Unfortunately, cloud has provided a drag on margins in a time in which the company’s main business is also putting a drag on margins, but there are highlights to implement.

- It appears that the new CEO, Thomas Kurian has continued to build Google cloud since his appointment to CEO in 2019. This is most evident in the $5.5 billion acquisition of cloud security firm “Mandiant” at 11.5x sales. This continued inorganic growth strategy may prove to be beneficial in the long run but causes significant drag on operating performance in the short them.

- This revenue could become ~9% of Google’s revenue in 2022, providing a robust hedge against a decline in advertising spend.

- Retail companies may look to push industry leader AWS away due to its competitive nature and therefore Google cloud may push for growth within this industry.

Advertising

Google is set to remove cookies from Chrome (now postponed to 2024) through an initiative known as Privacy Sandbox. This coupled with Apple’s move to restrict access to user data through IOS 14 could continue to provide data moats for the tech giants as they continue to retain customer data while disallowing third-party vendors to be privy to such data. This could continue to see ad dollars shifted from social media to Google but could therefore introduce further regulatory scrutiny.

Bear cases:

The Bear cases for Google are summarized well in other articles, very much so within this article Could Google Trade Lower? Exploring The Bear Case Arguments

The additional risks I would add are as follows:

- Google cloud revenue continually putting a drag on margins.

- The removal of cookies can further intensify the structural position that Google has within the advertising space and therefore one could further stipulate that this may cause an increase in what is already a considerable amount of regulatory risk.

- Microsoft (MSFT) has continued to successfully take market share from Google with respect to the G-suits with their new update for Office 365. This trend may continue to show out in the ‘race for second place’ within cloud.

- For Gen-Z, Google’s untouchable search engine is under fire from a surprising source – TikTok.

“In our studies, something like almost 40 percent of young people, when they’re looking for a place for lunch, they don’t go to Google Maps or Search. They go to TikTok or Instagram,” Prabhakar Raghavan, a Google senior vice president, said at a technology conference in July.

Final Thoughts

I believe that the short-term future for Google will be one of robust growth, and much like all other times within its history, it is facing fierce competition. Whether Alphabet – as a holding company – will survive the next decade is unknowable and un-modelable as it depends solely on management and the decisions they make. Much of it also rests with the consumer and their behavior – all very strong unknowns.

Be the first to comment