Alena Kravchenko

What Matters

One of the biggest problems with investors is an instant and bright focus on some particular piece of news, as if that specific piece of information is worth billions. For example, ChatGPT is the current flavor. While this is eye opening, it’s not about to suddenly transform Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) future.

Here are two quick facts that matter to me. ChatGPT is not a cure all. It doesn’t do everything. It requires a “dance” between humans and machines. While you can get results fast, it’s not likely to replace keyword searches with any real speed. So the first point is that GOOGL is transactional whereas ChatGPT is more conversational. The second point is more nuanced and far more important. GOOGL has DeepMind. Research includes:

- Deep learning

- Theory and foundations

- Control and robotics

- Unsupervised learning and generative models

- Reinforcement learning

- Neuroscience

- Sciences

The approach is more focused on the big picture versus practical applications. But, make no mistake, DeepMind is integrating with the rest of GOOGL. The key here is that GOOGL is intimately familiar with artificial intelligence. Perhaps far more than most investors realize.

See, when investors see something like ChatGPT, there’s an assumption that no one has anything remotely close. It seems like a radical leap forward, and it is, from the point of view of most folks. But, appearances deceive because most of those same people lack knowledge about GOOGL’s incredible firepower in the same space. They just aren’t as flashy about it. And, they are using it in different ways.

Adding all of this up, I’m investing in GOOGL based on fundamentals, not because of ChatGPT or DeepMind. I’ll spend the rest of this article looking at some charts that capture what’s going on with GOOGL right now and why I rate it as a Buy.

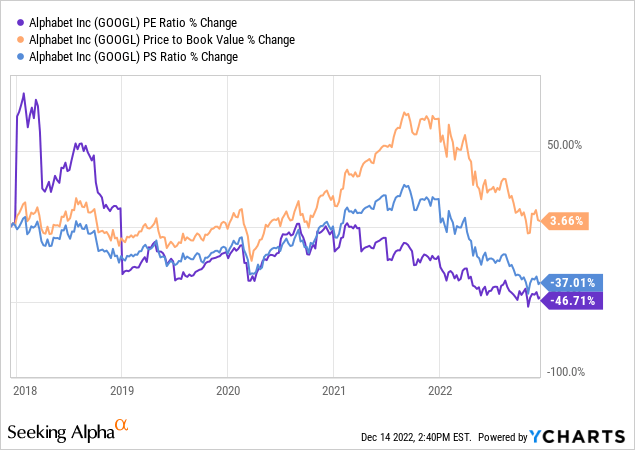

Chart One: Price Relationships

For growth companies, you’re not always going to get a good view of valuation based on absolute numbers. The problem, if you want to call it that, is that strong growth is often nonlinear. Therefore, stock prices can skyrocket for no reason. Profits can look absurd. Revenue can radically increase in the blink of an eye.

I like to look at multiple ratios simultaneously. Perhaps more importantly, I like to look at proportional changes over time. In other words, instead of looking at P/E compression from 80 down to 40, I like to look at the % change, because it seems to visually clear the misconceptions.

Per the chart above, it’s rather clear that GOOGL’s price relative to some rather bland and standard measures has fallen. If this was just one year then it wouldn’t be as impactful. However, this is five years of data. It says to me that GOOGL is far better priced now versus 2018, which is eye opening. And, in short, it tells me that GOOGL could be a buy.

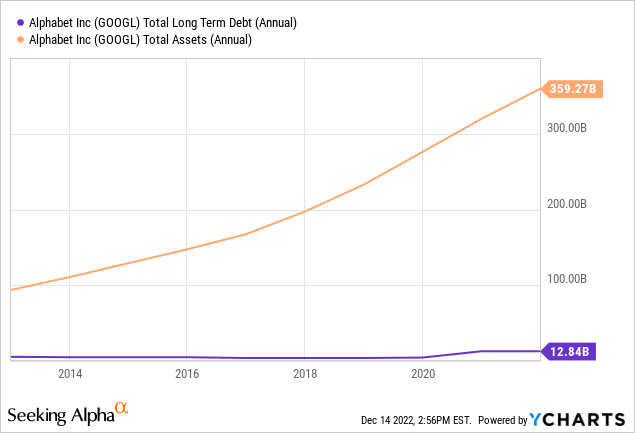

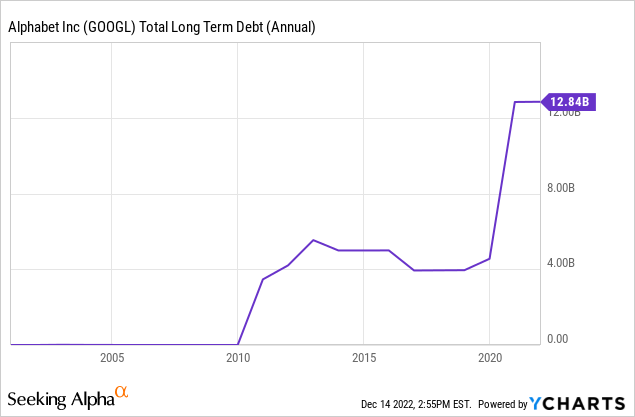

Chart Two: Debt

I’m generally not too worried about GOOGL’s debt. Frankly, comparing debt to assets is almost a joke because of the value creation. There are no red flags here whatsoever, at least not in this chart.

That said, I am somewhat interested in the spike in debt in 2020. More on that below. Just remember, while it looks “terrible” it simply pales in comparison to GOOGL’s assets and ability to handle that debt.

The reasons for the 2020 spike are quite simple:

Of the $10 billion offered, $4.5 billion from the seven-, 20- and 40-year tranches will be used for general corporate purposes, including acquisitions. The remaining $5.5 billion will be used for green initiatives, the company said, the largest-ever issue of corporate debt for environment, social and governance endeavors.

This is low cost and low risk debt. I see this as nothing more than a grab by GOOGL to get “almost free” money that is easy to pay off.

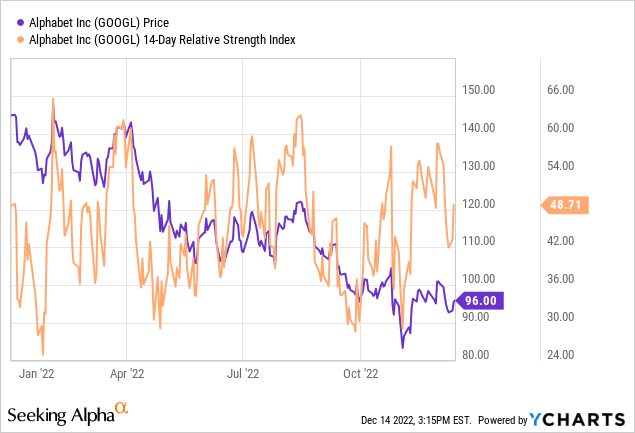

Chart Three: Relative Strength Index

This is far more technical than what I normally discuss but with GOOGL, I really like this view.

In case you’re not familiar with RSI or “Relative Strength Index” here’s a quick definition:

The relative strength index (or RSI) is a momentum indicator used in technical analysis. RSI measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security.

I like this for two main reasons. First, it gives a quick look into overbought and oversold conditions. But, second, and more importantly, it can indicate trends and trend reversals. It’s especially good for technical traders.

So, the big trend here is rather obvious. GOOGL has been heading down all year. But there have been several times this year, where the 14-day RSI has dropped hard down to 40, and even 30. Those are often rather good times to pick up GOOGL for the short run. Better, those are times where you can have a pinch of confidence that you’re not overpaying.

The industry mean is about 47 right now and GOOGL is about 48 right now. So, there’s nothing to see, at least in terms of the competition. There aren’t red flags pointing to an immanent price collapse.

Adding these points together, it seems that if you’re looking at buying GOOGL, right now certainly isn’t a terrible time. It’s also not an ideal time to back up the truck. I’m quite comfortable adding in this RSI range, from a technical point of view. And, of course, I appreciate the fundamentals.

Wrap Up

Competitively speaking, GOOGL is doing just fine. We’re in a weird stretch where GOOGL’s incredible growth is being questioned. That’s fair, but the threat from ChatGPT is mild at best. There’s no sure thing here.

There’s also the possible threat of a recession. Since GOOGL generates over 50% of its cash from advertising, and recessions aren’t great for advertisers, well, there’s a pinch there. But, I have also looked closely at this in the past. Here’s something to noodle:

After the last recession in 2008, the US ad market declined by 13%. Newspaper ad spend fell 27%, radio spend 22%, magazine spend 18%, outdoor spend 11%, TV spend 5% and digital 2%. Many traditional media channels did not recover as the shift to digital advertising accelerated post financial crisis.

In other words, companies will keep killing off the weakest advertising channels but digital is still the strongest. There is still tremendous return on investment for advertisers on GOOGL. So, even with a decline if things really get bad, GOOGL will not collapse. Struggle, yes, but there won’t likely be any real catastrophe.

Finally, now isn’t a terrible time to buy GOOGL. There could very likely be better times now, and into 2023, but I’m not waiting and worrying. I continue to put money to work with GOOGL, via dollar cost averaging. Both the fundamentals and technicals indicate that we are at a rational price.

Be the first to comment