SpVVK

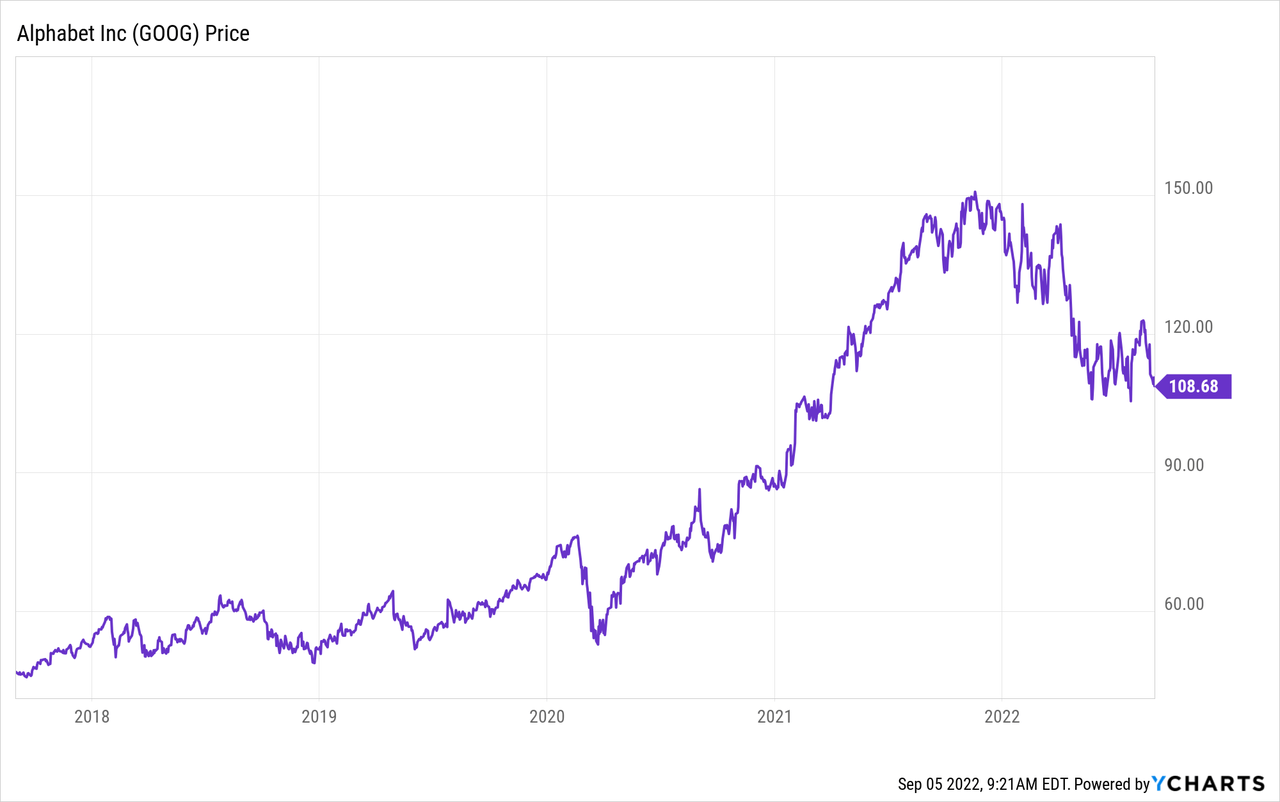

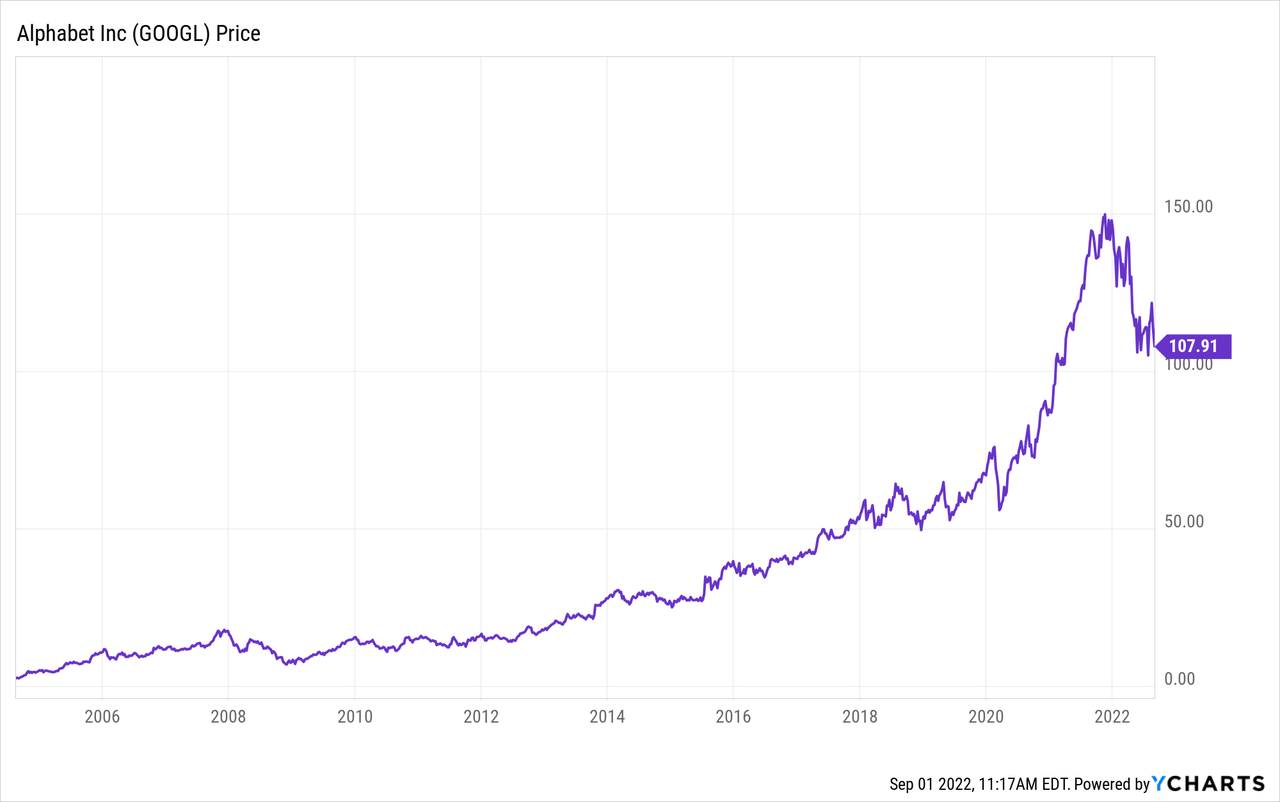

Alphabet, the parent company of Google (NASDAQ:GOOG) is the most low-key of the mega-cap tech companies. The valuation is lower than peers like Apple (AAPL) and Amazon (AMZN), and while the company invests heavily in research & development, its efforts aren’t indiscriminate. Google hasn’t plowed billions into creating a new universe, and it has been fortunate enough to mostly stay out of politics, unlike the company formerly known as Facebook (META) and Twitter (TWTR). While not matching the most explosive gainers in the NASDAQ (QQQ), Google stock is no slouch, returning 19.3% annually since its highly anticipated IPO in 2004. The stock peaked a little above a split-adjusted $150 per share in late 2021 and is now near $109 per share as of my writing this. So is Google a buy at this price, and if not, where should you snap it up?

Unlike many NASDAQ stocks whose stocks have vastly outrun their underlying businesses, Google’s PE ratio is about the same as it was 10 years ago.

Google is a great long-term business.

- The company spends almost as much on R&D as it does on payroll and general & administrative costs. While not all research & development spending is productive, academic research on US and global markets shows companies that spend big on R&D outperform companies that don’t by a large margin. Automation is going to be one of the key trends in the economy going forward. Google’s artificial intelligence efforts and other related R&D give the company some great optionality in this arena.

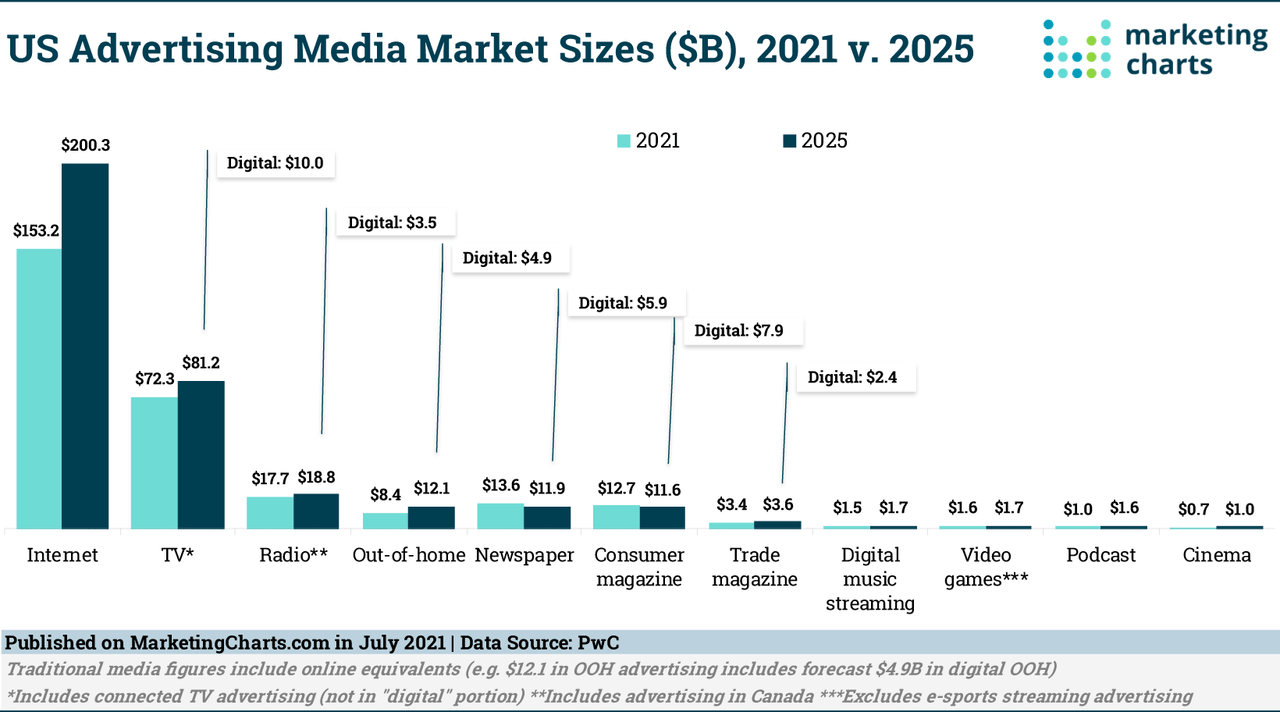

- Google advertising is simply more effective than traditional advertising due to the ability to better match consumers looking to fill needs with businesses looking to provide goods and services. I get annoyed when I see TV ads for stuff like structured settlements, erectile dysfunction, products to quit smoking, or drugs to treat rare autoimmune diseases. None of these apply to me. Advertisers are spending money to saturate the airwaves when the vast majority of people watching don’t need or want their product! However, if someone is Googling these same things, the chance is much higher that they might need a product to help them, and companies only have to pay per click.

- The network effect of being the dominant search engine offers the company a natural monopoly.

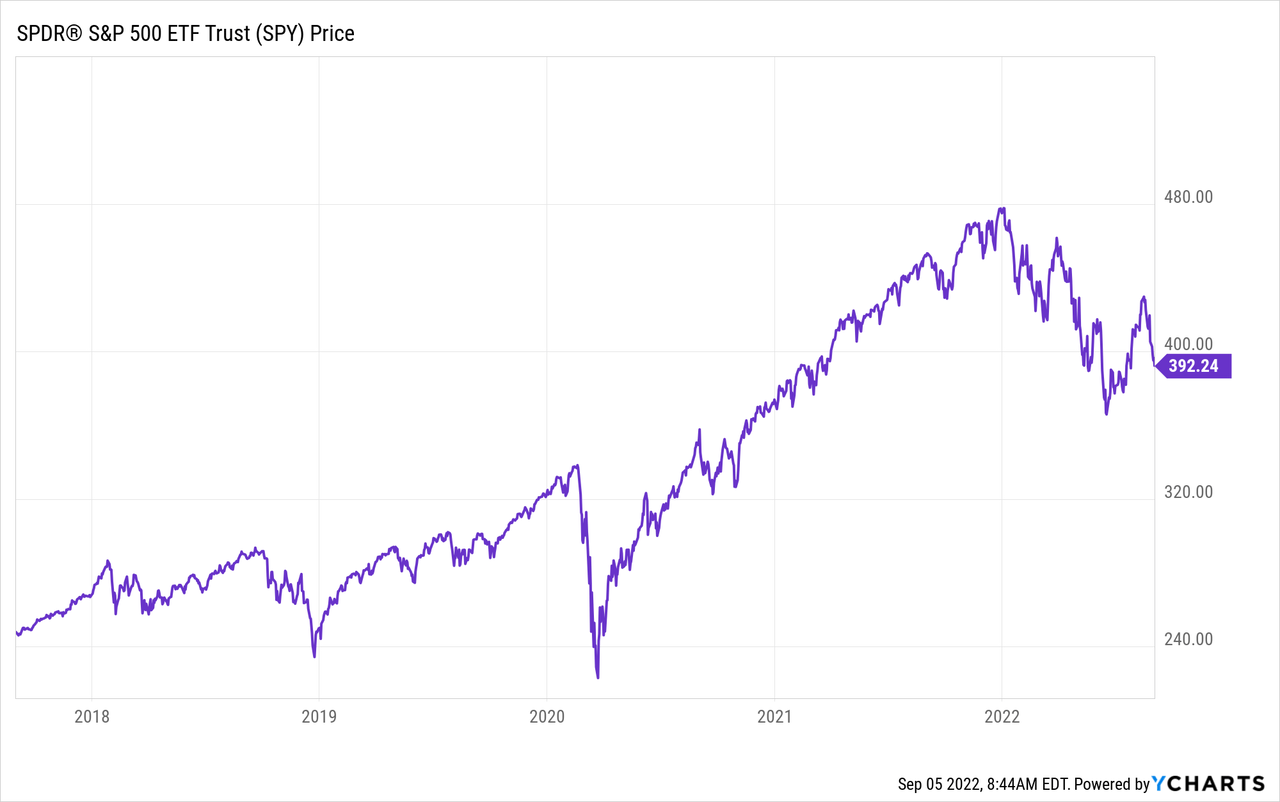

However, as I pointed out in my Microsoft (MSFT) article last week, Google is one of the largest holdings in ETFs, inextricably tying the stock to the macro picture and the Fed’s efforts to battle inflation. As risk sentiment changes, Google is likely to be sold off along with all of the other tech stocks, even though the business remains solid. This is a potential opportunity.

Why Are Stocks Selling Off?

I’ve covered the macro picture a few times on here. In general, the market is correcting but remains somewhat mispriced. Corporate America has done well over the past few years, but what has increasingly happened is that share prices have risen faster than the underlying earnings of companies. During this time, valuations went from being a little high to being completely out of control in late 2021 against shaky earnings growth estimates. The reasons I gave at the time were that stimulus had artificially juiced corporate profits, while the Fed’s free money COVID policies artificially caused valuations to swell. The result– stocks rallied epically in 2021 while nothing changed under the hood to make the economy structurally better.

As such, stocks have fallen rapidly in 2022 with stimulus in the rearview mirror and rates normalizing. But with the markets falling, the valuations of some stocks are starting to look attractive again. Therefore, our strategy here is pretty simple– use the falling market to get stocks for a discount.

“Buy the dip” is a popular strategy with investors, but the catch is that you have to buy good businesses when their valuations fall, and not just buy crappy stocks because they’re down. Seeking Alpha is a good place to get a read on whether stock price declines are justified, and there are software tools like F.A.S.T. Graphs that can help you make these determinations as well. Google isn’t a hard call for me–it’s a good business. If you look at the company’s financial statements over the last 10 years, it’s clear that the company is a growth machine (in this case, the best line to look at is “normalized diluted earnings per share” to avoid holding tax charges from the 2017 tax bill against them).

If investing is like cooking, buying blue chip companies on market declines is like chicken parmesan. It’s solid, tasty, and hard to mess up. No one is going to give us a Michelin star for this kind of strategy, but it offers a path to double your money in about 5 years with relatively little fanfare or drama.

Google is a great company. The question is the right price to pay for it.

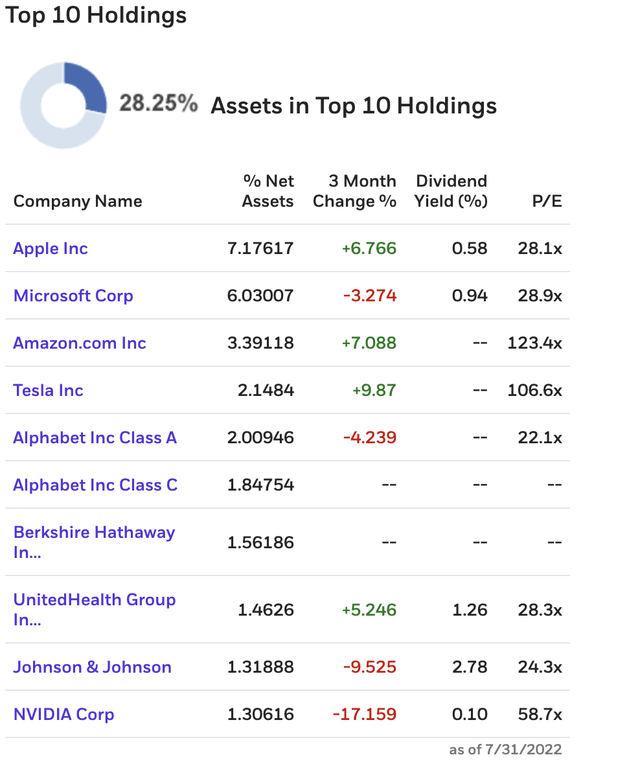

In my Microsoft article from last week, we looked at the price-to-earnings ratios of the biggest companies in the S&P 500 index (SPY) as of July 31st.

If you take these and plug in a 20x PE for Berkshire, the average price-to-earnings ratio is about 46! Crazy high. But Google is the cheapest of all of these stocks. Weird, right?

I’ll admit that Google is not a recession-proof company. Advertising is not going to grow at the same pace it has in a recession, and ad sales may decline. But regardless, Google should not be the cheapest stock out of the top 10 S&P 500 holdings. Unlike many large-cap peers that make use of aggressive accounting to boost reported income, Google’s accounting may actually understate how profitable the company is due to the company’s fondness for moonshot R&D spending.

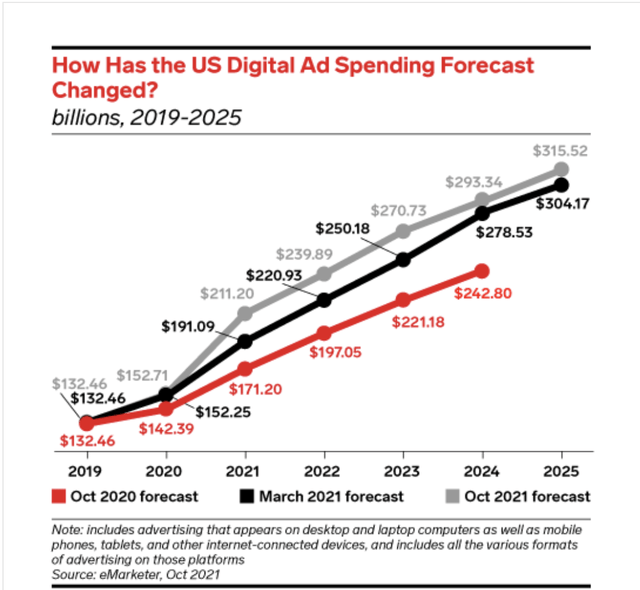

To this point, GOOG has a pretty decent chance of becoming the world’s most valuable company in a few years’ time. Google is expected to grow earnings faster than Apple going forward, and if valuations come down across the board, Google is likely to get more support as investors realize it’s cheap and scoop up the stock. The adoption rate for digital advertising over traditional ads continues its unstoppable advance, and I believe Google has good prospects for gaining future market share against competitors like Snap (SNAP) and Twitter. Despite the hype over dopamine hijacking media platforms like TikTok, YouTube is a much better platform for monetizing ads due to the wider variety of niches that can match customers and businesses.

Estimates from 2020 for the size of the digital ad market.

Ad Market Sizes (“PWC”)

And then these are more recent estimates. Note the growth!

I’d be remiss if I didn’t note that the crazy ad boom in 2021 may have been somewhat cyclical. Funded by nearly free VC money, the startup ecosystem heavily used digital ad spending to drive revenue. I have to give them some credit here–hedge fund Bridgewater saw this long before the market did, and put out pieces calling the 2022 NASDAQ price declines in late 2021. While I don’t agree with 100% of their research, they’re a great source for research and analysis that doesn’t get much media attention at all. As such, Google is down about a third from the high in late 2021.

Again, Google is not a recession-proof stock, but advertising on Google provides the best bang-for-the-buck for businesses, so while 2021 may have pulled forward some demand, Google is going to be making plenty of money over the next 10 years. Although Google could continue to fall in the short run, you’re now getting solid compensation for these risks at under 20x earnings. Additionally, the lower Google’s valuation goes, the more shares the company will be able to eat up with the buyback.

Google’s Valuation

Google trades for about 18x 2023 earnings estimates. Yes, these estimates are in the process of being revised downward by analysts, so Google is not quite as dirt cheap as it appears. This said, the company is still pretty cheap. Why should Google trade for about the same valuation as the S&P 500 at large? It shouldn’t. Google very clearly has better long-term growth prospects than the average S&P 500 company, so it should trade at a premium. By contrast, Coca-Cola (KO) trades for 24x earnings, and analysts expect 5-6% annual growth (which history shows they’ll likely miss).

Giving Google’s 2023 earnings estimates a 10% haircut and applying a roughly 10% earnings-per-share CAGR gets you an estimated 14.9% long-run annual return from buying Google stock at today’s price. At $100, you’re getting about 15.4%, and at $90, you’re getting about a 16% annual return. This obviously isn’t an exact science, but Google’s valuation is low enough and the future growth estimates are high enough that it’s very likely you’ll make money on the stock even if you’re imprecise with forecasting.

Given the macro headwinds but Google’s excellent long-term prospects, anything under $100 looks really good for Google, and anything under $90 is even better, taking a lot of the Fed/macro risk out of the stock. Google’s growth path means it should be a $200 stock in 5-6 years–any further declines in the stock price are likely to be good buying opportunities.

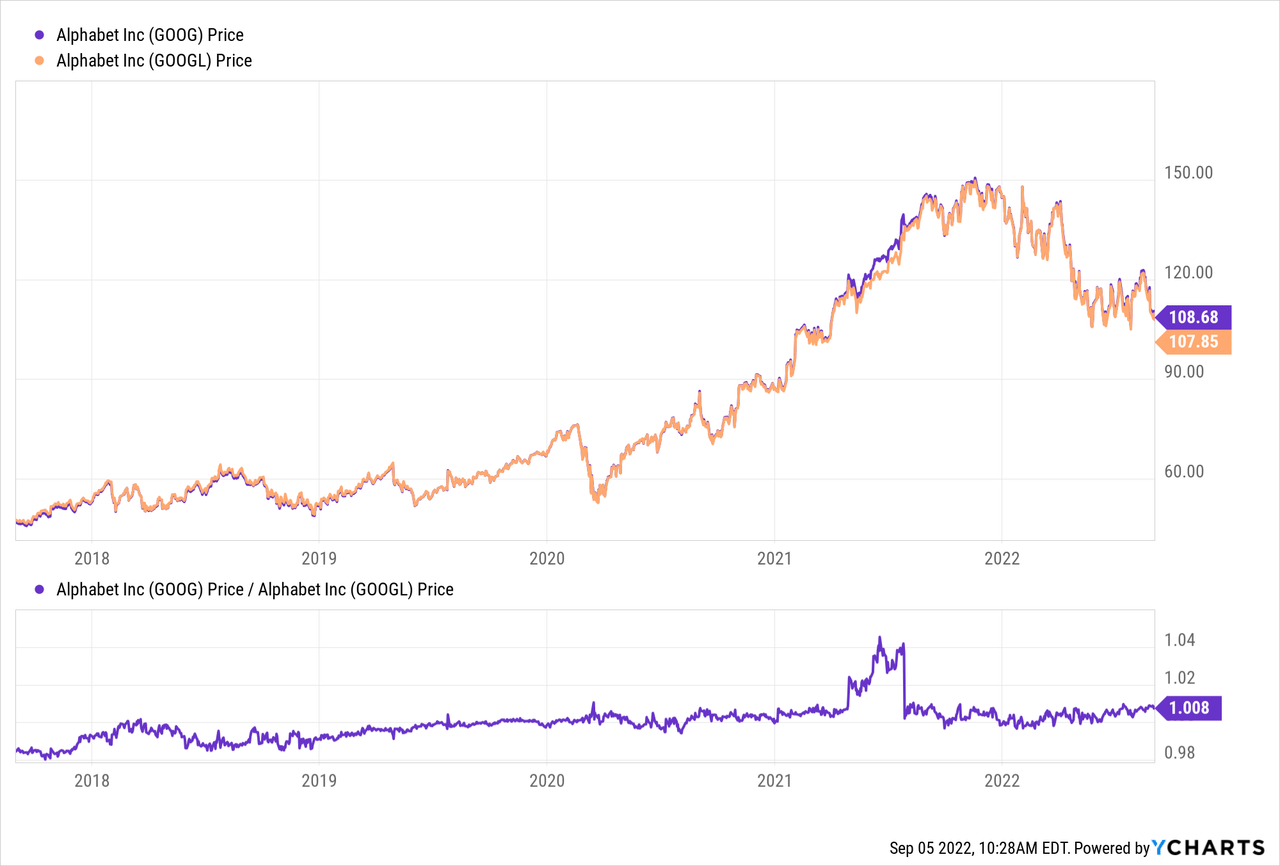

A little easter egg about Google– the company has multiple share classes. Class A stock (NASDAQ:GOOGL) trades for slightly less than Class C stock (GOOG). There is no practical difference between them, but the Class A stock is about 1% cheaper than the more popular Class C stock. This will normalize over time. For one, Google has recently started to buy class A shares with the buyback if they’re cheaper. Buy the Class A shares for a roughly 1% discount and a little additional edge.

Bottom Line

Google is the cheapest stock in the top 10 holdings of the S&P 500. During bear markets, stocks like Google go on sale despite their strong long-term business prospects being good. You can buy now and get decent long-term compensation, but I’d especially look to buy GOOGL stock anywhere under $100. If you’re able to do that, chances are that you can double your money in a few years’ time.

Be the first to comment