Carsten Koall/Getty Images News

Investment Thesis

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) sold off following a historic tech boom. But the stock is perhaps our favourite buy among trillion-dollar companies. The king of advertising has many hidden assets, as well as risks, and we’ll take a deep dive. In the decade ahead, we project returns of 11% per annum.

The 2021 Boom

2021 was a terrific year for large cap tech. COVID-19 forced many to stay at home, shop online, and get glued to their screens. The economy roared through 2021 as real GDP in the United States grew by 5.7%, its fastest one-year jump since 1984. All of this benefited Google as people were watching videos on YouTube, searching Google, and clicking on ads. Consumers were awash with cash, and advertisers were awash with e-commerce sales.

If we move forward to 2022, the market is telling us that Google’s year-over-year growth is about to come to a screeching halt. In fact, Google’s earnings are expected to decline for the first time since 2017, dropping from $5.61 per share to $5.44 per share as the hangover effect takes hold. But, not even a brutal recession can kill the king.

The King Of Advertising

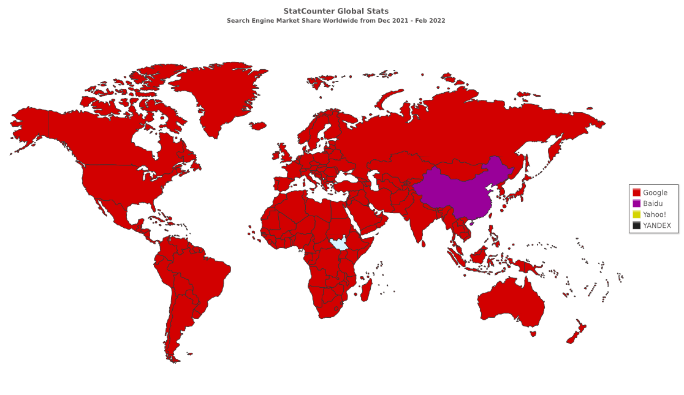

Google is the king of advertising, dominating search throughout much of the world:

Search Engine Market Share (Serpstat)

Google’s monopoly on search means it’s often the gateway to consumers finding e-commerce products. Whether you want to buy an engagement ring, a t-shirt, or a car, you’re likely to Google your options. Sure, you may buy later on from a brick-and-mortar retailer, but brands have an opportunity to draw you in with ads on Google search and YouTube.

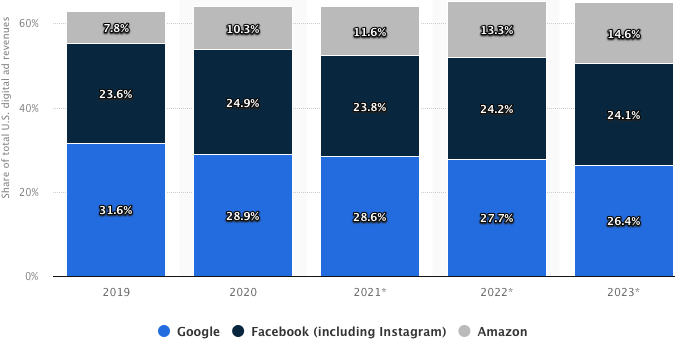

Keep An Eye On Amazon

Of course, competition remains a risk for Google. For example, Amazon (AMZN) is gaining share as consumers go to it to check prices on essentially, everything. Once consumers get onto Amazon’s website or app, Google’s search engine is no longer a factor.

Share of U.S. Digital Ad Revenue (Statista)

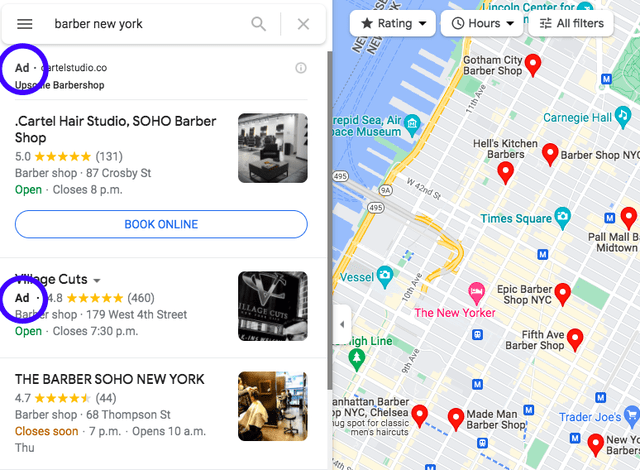

Google Maps Is Under-appreciated

If you’re looking for a service, look no further than Google Maps, which has become nearly essential for all businesses to list on. Android, and even some Apple (AAPL) phone users, have the Google Maps app in their pocket at all times. Looking for a gas station, mechanic, lawn care agency, or coffee shop? Google Maps not only gives you directions, but tells you what customers think with millions of reviews. Businesses on Google Maps now have the option to attract more customers with Google’s paid advertising:

How Profitable Are Android And Google Play?

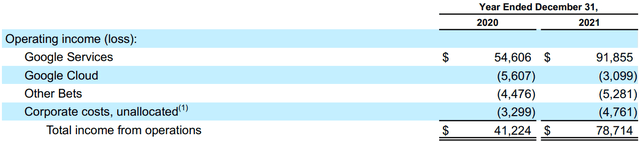

We don’t see how profitable Android and Google Play are individually because their profits are buried within the Google Services segment:

Google’s Operating Income By Segment (Annual Report)

We know Google Cloud is still making losses despite its rapid growth, but how much do these other important assets make? Well, Android makes very little selling the operating system to companies like Samsung, instead, it makes its money from being the default maps application, payment app, search engine, and app store on every android phone. Of these, Google Play Store is thought to be the most profitable.

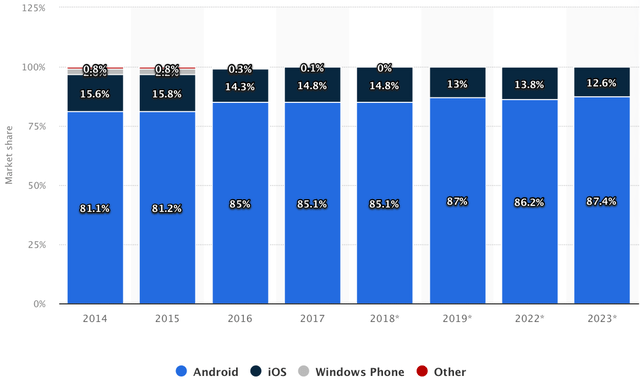

Android has a massive market share:

Market Share By Operating System Shipments (Statista)

In 2016, a lawyer disclosed in court that Android contributed around $22 billion to Google’s net income. In 2019, it was estimated that Android’s cost savings and synergies contributed $19 billion to Google’s net income. Today, Android could be contributing more than $30 billion to the bottom line.

Android’s Synergies (Kamil Franek)

Other Bets

In Alphabet’s annual report, under the heading “Moonshots,” management advised:

“As we said in the original founders’ letter, we will not shy away from high-risk, high-reward projects that we believe in, as they are the key to our long-term success.”

At times, we question Google’s technological prowess, but we don’t question its algorithms. For example, Google Drive is clunky to use, YouTube’s comment section has been littered with spam, and Apple’s iOS seems to have far less issues than Android. Alphabet’s bread and butter is not its technology, but its algorithms, which have powered Google search to sheer dominance. We believe Google would do best to focus on algorithms in its “Other Bets” segment as well.

Harvard Business School Professor Clay Christensen, who famously developed the theory of “disruptive innovation,” once said at a Talks at Google event that it is not the job that changes but the method of accomplishing the job. For example, we used to drive chariots, now we drive cars. We believe that if Google Search should be displaced, it will be by increasingly clever artificial intelligence. It’s much easier to asked your car, watch, phone, or computer a question and get a quick answer than it is too search it manually, especially if you’re on the go.

On other bets, Google says:

“We are investing significantly in the areas of health, life sciences, and transportation.”

But, the more promising businesses are Google’s moonshots, “like artificial intelligence (AI) research and quantum computing.”

We believe Google agrees with us, and sees the threat artificial intelligence poses to search, which is why the company is investing in its Multitask Unified Model (MUM) software. On this, Google says:

“We are currently experimenting with MUM’s capabilities to make searching more natural and intuitive and even enable entirely new ways to search.”

Long-term Returns

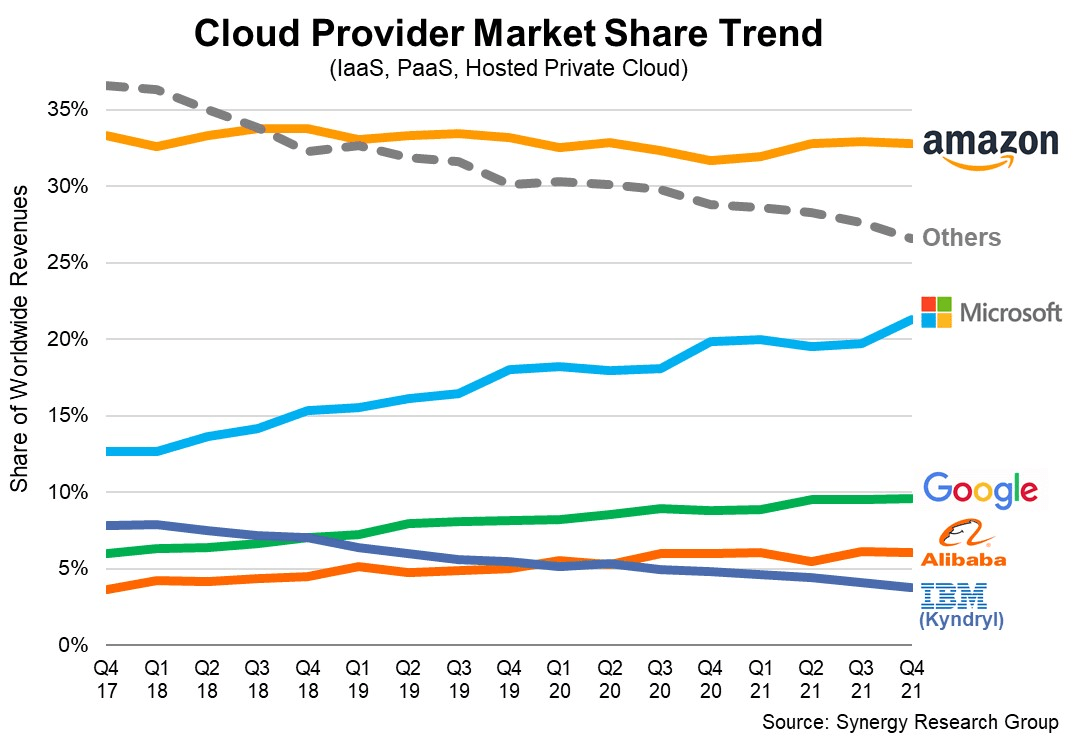

First, let’s take look at expectations for Google’s core industries. The online ads market is expected to grow at 14% per annum through to 2027. And, the global cloud market is forecasted to grow at 16% per annum through to 2030. We think cloud and digital ad growth will be faster in emerging markets and slower in developed markets. As these industries develop into 2030 and beyond, growth will slow. Google’s online ad share has decreased slightly, and its global cloud share has increased slightly:

Global Cloud Market Share (Synergy Research Group)

Our 2032 price target for Google is $328 per share, implying a return of nearly 11% per annum.

- We believe Google can grow its net income at 9% per annum, reaching $175 billion of net income by 2032. While this is an enormous number, Google’s moat and industry tailwinds make it possible. Given Google’s profitability and $116 billion of working capital, the company should be able to repurchase shares at a rate of 3.5% per annum, with ample cash left over to defend its turf. This would give Google 2032 earnings per share of $18.75. We’ve assigned a terminal multiple of 17.5x. Keep in mind, there are geopolitical, regulatory, and anti-trust risks that could interfere with this conclusion.

Buy The Split

Despite the risks of competition, cyclicality, regulation, and technological change, we have a “buy” rating on GOOG. The company’s competitive moat is unquestioned, and its industry tailwinds are strong. While the need to search will always exist, we don’t know for sure how the “job” will be carried out, but Google is addressing this with A.I. Google Maps shows enormous promise as it scales its ads. Android, and the Google apps that come with it, are enormously important and profitable assets. Google could nearly 3x in a decade’s time, returning 11% per annum. Our opinion: Buy the split.

Be the first to comment