Aksana Kavaleuskaya

In “It’s Hard to Beat Blue-Chip REITs” – a title that pretty much sums up the article’s thesis – JBierw left the following comment:

“@Brad Thomas – Always appreciate the commentary about the strategic approach for the REITs. This is key to understanding if there is good management at the helm. No strategic vision, it’s a roll of the dice.”

I really appreciate that way of putting it. I’ve written about management so many times before, but I can’t say I’ve ever quite put it like that.

So a big shout out to JBierw, not just for inspiring this article but for inspiring an entire series. “The Good Management Behind Your Money,” which you’re reading now, is the first installment of four.

Here are the next three:

- “The Great Management Behind Your REIT Money”

- “The Bad Management Behind Your REIT Money”

- “The Awful Management Behind Your REIT Money”

But for now, let’s set up the larger series’ premise by exploring why management matters in assessing a company.

Is a stock worth buying into?

Should you set it aside?

That depends on so many factors – the majority of them determined by management.

When the Going Gets Tough, Management Matters More Than Ever

Looking over a 2009 Forbes article on the subject, I particularly appreciated a quote from Hilary Kramer. She was chief investment officer of A&G Capital Research, a company that helps corporations and estate beneficiaries navigate the murky laws surrounding unclaimed property.

The way she summed up the management situation was to call it “everything.” When the going gets tough, that is:

“You can be in the sweetest spot in the market in a growth area, and it doesn’t matter if your company is inefficient. You can also face a recession and other challenges and still succeed with a strong CEO.”

That might sound like an obvious statement – so obvious that it’s stupid to state at all. And it probably should be.

But how many times do people give their money to companies just because of a trend?

Or just because someone told them to?

Or based on star-power recognition alone?

They recognize a product or a name (or the name of someone who knows the name), and out their wallet goes. “Sign me up! How much should I put down?”

That’s not to say a product or name (or the name of someone who knows the name) is a bad reason to invest in a stock. It just shouldn’t be the only one.

You should know something bigger about the business first and who’s behind that business. What is that leader doing? How is he or she doing it? And why?

The more you know about members of management… their career backgrounds, professional track records, and capabilities… and the way they see themselves, their companies, and the larger world…

The more confidence you can have in your final decision.

Assessing CEO Success

That quest for secure investment solutions is part of why I keep interviewing CEOs on iREIT on Alpha.

I know I talk up the insider information angle all the time. And I can’t stress enough how important that is. You can’t get the same feel for a company’s health while reading information in mere black and white.

Just like you can’t get the same feel for a man or woman’s character.

For instance, is the management member in question an egomaniac?

That kind of insight usually shows up in the news somehow, someway. (Former WeWork (WE) CEO Adam Neumann comes to mind, though that’s a story for another article in this series…)

But is he simply too confident in his capabilities or his company’s prospects? Or is she too fixated on a particular way of accomplishing her goals?

Those are more subtle possibilities that can come up in personalized interactions.

In the same way – just on the positive side – a man or woman’s tone, gestures, and expressions can convey intricate layers of:

- Wisdom

- Street smarts

- Connectivity

- Awareness

- Conviction

- Integrity

Here’s another thing to consider: Members of management, especially CEOs, determine more than “mere” company direction. They foster employee enthusiasm too, which affects productivity and customer service relations.

Those two factors are arguably everything in the end.

After all, no products or services, no sales potential. And no capable people to push those products and services, no actual sales.

Incidentally, that sales goal is much easier to accomplish when those capable people are enthusiastic about their jobs. Which happens when employers (i.e., management) make sure to make them feel motivated and appreciated at work.

Knowing that, I’ve listed several real estate investment trust CEOs who are good at what they do… and see stock market success as a result.

Iron Mountain (IRM)

William Meaney assumed the CEO role at IRM in 2013 (and also became a member of the Board). Prior to that he served as CEO of The Zuelling Group (2004-2012) and prior to that he was Managing Director and CCO for Swiss International Airlines.

He holds a bachelor’s degree in mechanical engineering from Rensselaer Polytechnic Institute and master’s degree in industrial administration from Carnegie Mellon University.

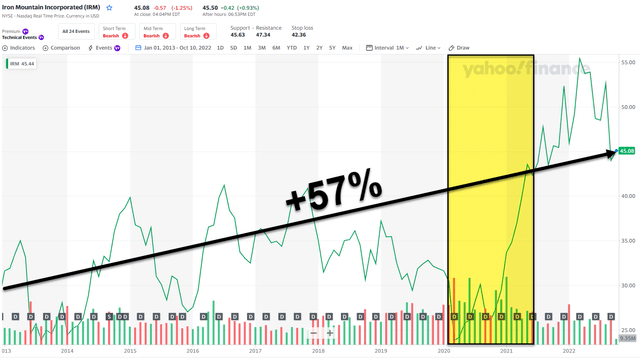

Yahoo Finance

As you can see (above), IRM shares are +57% since Meaney took the wheel at IRM and that includes mush of the period that the company has been traded as a REIT. As you may recall, IRM began trading as a REIT in 2015 after many decades as a C-Corporation.

In addition to taking credit as the REIT facilitator, Meaney also is responsible for transforming IRM from a secure record storage firm to a global leader in innovative storage that includes digital transformation and data storage. Today the firm is trusted by more than 225,000 customers worldwide.

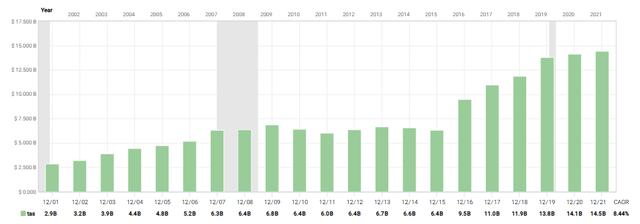

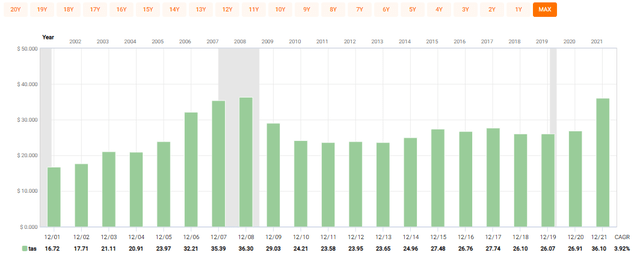

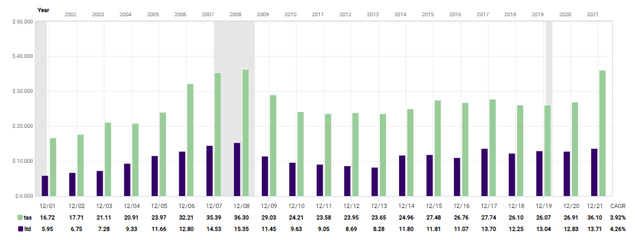

Total Assets

FAST Graphs

As you can see (above) IRM has grown its asset base substantially during Meaney’s tenure, expanding the business to 1,400 facilities worldwide and over 725 million square feet of global storage volume. IRM has more than 25,000 employees and generates more than $4.8 billion in revenue (over a 12-month period).

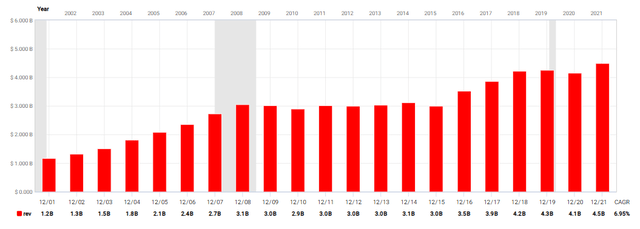

Total Revenue

FAST Graphs

Capital management is one of the most important things that we look for when we examine management, and Meaney has delivered an excellent record of prudent risk management. We cite the company’s successful sale-leaseback practices in which the company sold and leased back facilities in order to generate higher ROIC.

In addition, Meaney was instrumental in launching Project Summit a transformation program that generated compelling EBITDA benefits of around $375 million (from 2020-2022).

In Q2-22 IRM generated the highest ever quarterly revenue of $1.29 billion, representing 13% total organic revenue growth and an all-time record for EBITDA of $455 million, in spite of significant FX headwinds. These results are further proof of IRM’s solid demand for services across key markets.

In terms of the balance sheet, IRM ended Q2-22 with net lease adjusted leverage of 5.3x, which reflects a sequential improvement from Q1-22. Also, in Q2-22 IRM declared a quarterly dividend of $0.62 per share that represents a payout ratio of 68%, approaching the REIT’s long-term target range of low to mid-60s.

In other words, the dividend today is safer than it has ever been thanks in large part to Meaney’s leadership. I’ve never been the CEO of a REIT, but I can say that it isn’t easy delivering shareholder value unless you’re committed to a safe and growing dividend.

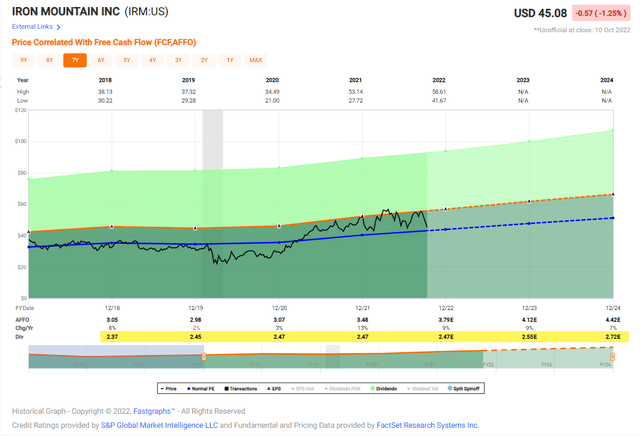

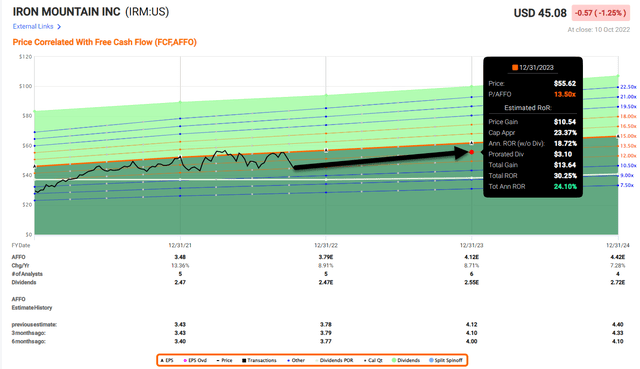

FAST Graphs

IRM has not grown the dividend in a few years because the company has been focused on reducing its payout ratio so it’s in line with other data center REIT peers like Digital Realty (DLR).

According to FactSet Meaney is paid $1.1 million per year with total compensation of $17 million. He has been at IRM for nine years and the COO has been at IRM for 26 years. Since Meaney has been at IRM shares have returned ~10% annually, and iREIT forecasts shares to return ~20% over 12 months.

FAST Graphs

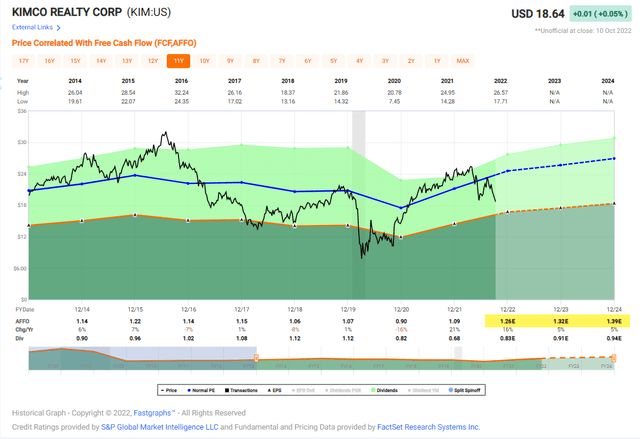

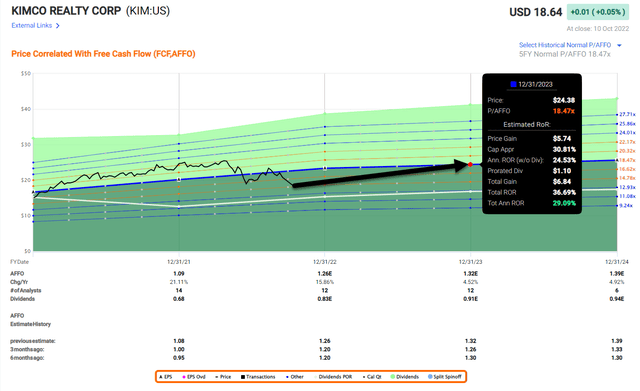

Kimco Realty (KIM)

Conor Flynn was named CEO at KIM in 2016 (and joined the Board of Directors). Prior to that he was as Asset Manager (when he began working at KIM in 2003) and also served roles including president, COO, and CIO. He holds a Bachelor of Arts degree in economics from Yale University and Master’s degree in real Estate Development from Columbia University.

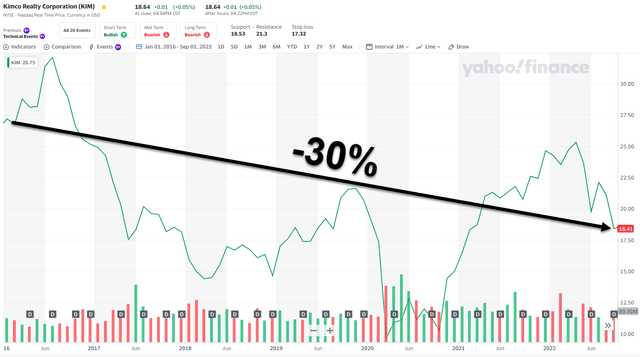

Yahoo Finance

As you can see, KIM shares are down nearly 30% since Flynn was CEO, however, we believe the market has not reflected the value creation with this CEO at the helm.

Prior to the pandemic Flynn was responsible for orchestrating a large-scale recycling program that consisted of unloading quite a few non-core properties in the middle part of the US. This was part of a strategic plan for the company to begin focusing on higher traffic sites in larger gateway markets.

As part of that blueprint, Flynn was responsible for creating a war chest of capital, and of course he had no clue that KIM was able to enter into a global pandemic.

Total Assets

FAST Graphs

During COVID, KIM decided to put its balance sheet to work by acquiring Weingarten Realty in a transaction that $3.9 billion deal (cash and stock) that created a national operating portfolio of 559 open-air grocery-anchored shopping centers and mixed-use assets encompassing roughly 100 million square feet of GLA.

Having witnessed KIM cut its dividend during the Great Recession, Flynn was cognizant of the dangers of excessive leverage, and it has been his goal to stay disciplined as he leads the pure play shopping center REIT into the new cycle.

Total Debt and Total Assets

FAST Graphs

It’s true that KIM did have to cut the dividend in 2020, yet the latest pricing on $650 million of 4.6% notes that are not due until 2033. Over 99% of all outstanding consolidated debt is at a fixed rate having a weighted average maturity of nearly nine years.

KIM’s net debt to EBITDA (includes pro rata share of JV debt, perpetual preferred issuances) stands at 6.4x, which remains the best level achieved since KIM began disclosing this metric over a decade ago.

Also, and I’ll give Flynn the credit, this does not include any potential benefit from monetizing KIM’s Albertsons investment, which has a current market value of more than $1 billion.

Further, upon completion of the significant portfolio repositioning efforts in 2018, Kimco is seeing the fruits of its labor as the company has been one of the top performing shopping center stocks over the last three years.

KIM’s current liquidity position remains strong with $2.3 billion of immediate availability comprised of $300 million in cash and a $2 billion revolving credit facility as well as the Albertsons investment.

KIM should generate AFFO per share of around $1.26 in 2022 which is higher than its pre-COVID $1.22 in 2015. The company has plenty of cushion for dividend, which suggests the company will likely continue to boost the dividend by a meaningful level.

FAST Graphs

According to FactSet, Flynn is paid $1,000,000 per year with total compensation of around $10,00,000. He has been at KIM for 19 years (CFO has been at KIM for 27 years).

In terms of relative performance, KIM has been a top performer over a three-year period, and while the sector has been out of favor, there’s not much Flynn could do except to outperform the peers. In addition, the tone seems to be slightly improving (fore retail) and iREIT targets KIN to return 25% over the next 12 months.

FAST Graphs

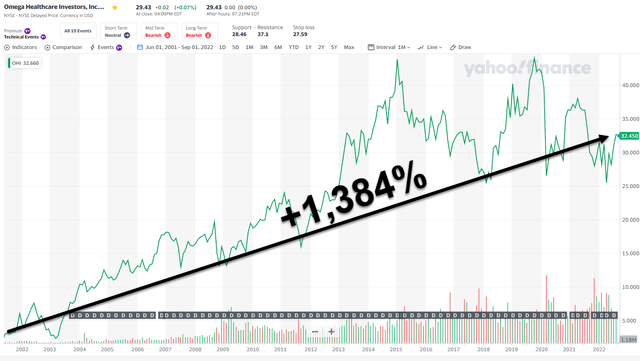

Omega Healthcare Investors (OHI)

Taylor Pickett has been the CEO at OHI since June 2001 and has served as Director of the since May 30, 2002. From January 1993 to June 2001, he served as a member of the senior management team of Integrated Health Services, Inc., most recently as Executive Vice President and Chief Financial Officer.

Prior to joining Integrated Health Services, he held various positions at PHH Corporation and KPMG Peat Marwick. He has a BS in Accounting from University of Delaware and JD from University of Maryland.

Yahoo Finance

As you can see (above), Pickett has navigated OHI through multiple recessions and now a global pandemic and has delivered excellent results. A lot has changed over the two decades, and Pickett and his team have maintained strict discipline in order to manage the turbulent times.

With many operators continuing to struggle with the impact of COVID-19 on both occupancy and staffing, there remains an elevated risk that additional operators may be unable to pay in accordance with their contractual terms.

OHI has been able to navigate this environment because of its experience (long-standing operator relationships) and sound financial discipline. Today OHI’s portfolio consists of 921 properties in 43 states and the UK.

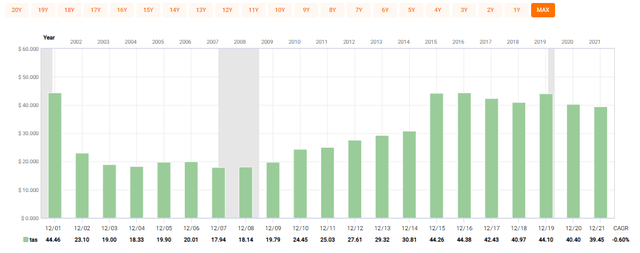

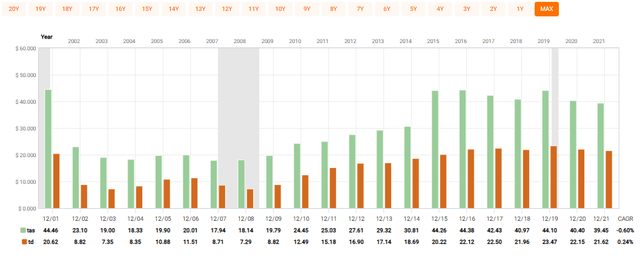

Total Assets

FAST Graphs

As of the end of Q2-22, operators representing approximately 15% of OHI’s annualized contractual rent and mortgage obligations did not pay all of their contractual obligations. In July 202 the company collected rent from operators representing approximately 92% of Q2-22 annualized contractual rent and mortgage obligations.

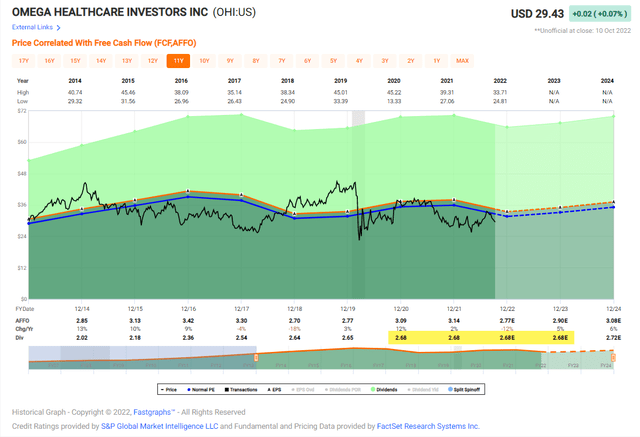

As viewed below, analysts are forecasting OHI to generate AFFO per share of $2.77 in 2022, which translates into a payout ratio of 97%. However, it appears there’s improvement has the company improved the FAD payout ratio by 7% in Q2022 by restructuring portfolios.

FAST Graphs

Throughout 2021 and the first half of 2022 OHI took initiatives to improve liquidity, capital stack maturity ladder and overall cost of debt. In Q-22 the company repurchased 4.2 million shares of common stock for $115 million while maintaining low leverage. As of Q2-22 OHI had 98% of its $5.4 billion in debt fixed, and net funded debt to adjusted annualized EBITDA was 5.3x.

Total Debt and Total Assets

FAST Graphs

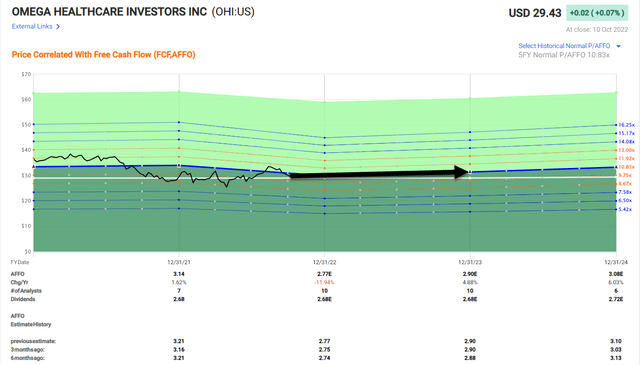

Although the skilled nursing sector is experiencing tough times, I believe OHI’s management team is capable of delivering on continued outperformance. Analysts are forecasting growth of 5% in 2023 and 6% in 2024, which positions the company to begin to increase its dividend.

According to FactSet Pickett is paid $823,000 and total compensation of $10.3 million per year. He has been with OHI for 21 years and so has the CFO and COO.

As mentioned earlier, Pickett has delivered solid returns over his two-decade long career at OHI and that includes multiple recessions and a global pandemic. iREIT maintains a BUY with a modest total return forecast of 15% over the next 12 months.

FAST Graphs

In Closing

In my new book, The Intelligent REIT Investor Guide, I wrote,

“I’m sure you’ve heard the phrase, “Bet the jockey, not the horse.” It refers to the idea that investors should focus more on the management team than the business model.

I consider the adage to be quite true, especially in REIT-dom, where management teams are responsible for all the obligations of being a landlord – from finding a tenant to collecting the rent, taking care of repairs, and maintaining the balance sheet – and, of course, sending distributions (i.e. dividends) to investors.

Stated bluntly, bad management can destroy value in a portfolio of real estate properties. Good management can add value.”

I plan to continue to the “management” series in which I will provide examples of great, bad, and awful management. To cite my book again,

“…you’re not only placing your “bet” on the underlying real estate. You’re also putting your hard-earned money toward paying the “jockey” that’s running it for you.”

Be the first to comment