alexsl/iStock via Getty Images

The Pain Has Spread

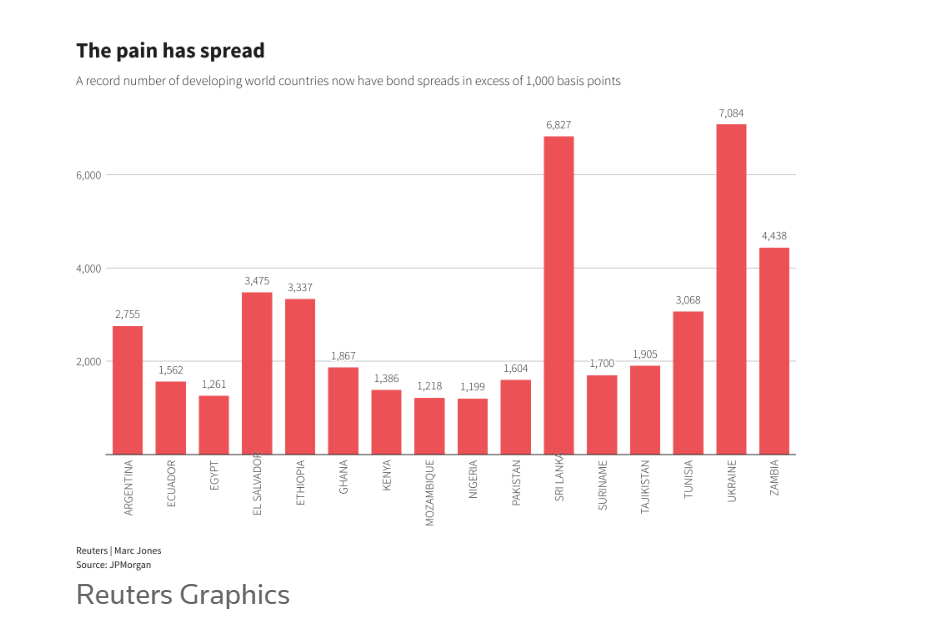

Reuters reported on July 15, 2022, that a dozen countries are at risk of defaulting on their loans. Lebanon, Sri Lanka, Russia, Suriname, and Zambia are already in default. Many more are at risk as borrowing costs and inflation rise on top of record debt levels around the world. Argentina owes more than $150 billion, while Ecuador and Egypt owe between $40 and $45 billion. Hopefully, the International Monetary Fund can help avoid a wave of defaults, especially if the global economic system can settle down somewhat.

Reuters Graphics (The pain has spread)

For Argentina, the peso trades at a 50 percent discount on the black market, bonds trade at 20 cents on the dollar, and reserves are extremely low. No substantial debt payments are due until 2024, but a crisis is looming unless Argentina’s economic situation markedly improves.

With the Russian invasion, Ukraine will have to restructure its more than $20 billion in debt. Some $1.2 billion in bond payments are due in September, which Ukraine could pay with aid money and reserves. State-run Naftogaz asked for a two-year debt freeze this week, which suggests the government might do the same.

Africa has many countries at risk of default, led by Tunisia. The country has nearly a 10 percent budget deficit, one of the world’s highest public sector wage bills, and there are questions about whether Tunisia can continue to meet the IMF program’s requirements for debt payments. Compared to U.S. bonds, investors are demanding 2,800 basis points to buy Tunisian bonds.

Ghana’s debt-to-GDP ratio hit 85 percent and its currency has lost nearly 25 percent of its value this year. Ghana already spends more than half its tax revenue on debt payments and inflation is close to 30 percent.

Egypt has a 95 percent debt-to-GDP ratio. Egypt owes $100 billion in hard currency debt over the next five years. Egypt devalued their currency 15 percent and asked the IMF for help in March. Bond spreads are now at more than 1,200 basis points compared to U.S. bonds.

Kenya spends about 30 percent of its revenues on interest payments already. Their bonds have lost almost half their value and they have a $2 billion bond due in 2024.

Ethiopia, El Salvador, Pakistan, Belarus, Ecuador, and Nigeria are facing similar crises, with debt payments coming due and economies under severe pressure due to rising interest rates and inflation, often leading to social unrest.

Sri Lanka

Gravitas Plus reported on the crisis in Sri Lanka. The West saw the 1980s as a boom time. Latin America saw the 1980s as a lost decade. They faced financial turmoil and a debt typhoon. Two oil shocks sent oil prices sky high and took their foreign debt to new highs. Mexico in 1982 defaulted on its debts, and then one country after another in Latin America faced debt defaults, high unemployment, and crashing economies.

Today, Sri Lanka is facing a similar crisis. The country has high debt. They spent more than the national income while cutting taxes. Externally, the cost of borrowing rose while the cost of food increased after Russia invaded Ukraine. All of it led to a collapse of the Sri Lankan government and economy.

The Sri Lankan crisis could spread. More countries are set to fall. The entire developing world is at risk.

Just days before Russia invaded Ukraine, the World Bank issued a warning that the developing world was facing a debt crisis. Seventy countries, low and middle income countries facing debt repayments of $11 billion, which could easily overwhelm them. Then Russia invaded Ukraine and threw supply chains into turmoil. Oil prices skyrocketed. In March, the UN reported that 107 countries faced at least one of three crises: rising food prices, rising energy prices, or a tougher financial situation. Sixty-nine countries faced all three risks in Africa, Asia and Latin America. Egypt is down to only three months of grain reserves. Lebanon has seen food prices increase 11 times and the currency fell 90 percent of its value. There is a bread shortage due to the war in Ukraine. Argentina is facing increasing inflation and has defaulted on its debt payments nine times. El Salvador and Peru also face increasing commodity prices and high debt. Ghana, Ethiopia, Kenya, and South Africa face similar problems. Turkey has increasing debt and soaring inflation.

The World Bank says that in the next year as many as a dozen countries will not be able to service their debt. It will be the largest debt crisis in history. Many states in India have debt-to-GDP ratios similar to Sri Lanka. The entire world is in debt distress. Governments have to cut spending or borrow even more.

Creditors must offer contingency plans to borrowers. We need better ways to manage shocks, with less-developed nations prone to disaster when shocks hit. The G20 should help use the framework their developed to restructure debt to cover all poor countries. We should also promote more alternatives to borrowing, such as improving tax collection. We should increase accountability and transparency, such as further clarity in Chinese lending, which often include clauses that allow China to dictate other country’s domestic policies in exchange for funding. This is, in part, what happened in Sri Lanka.

Economic crises are a security issue and we must act to better manage economic crises, so they do not turn into international security crises.

The Lost Decade

For Latin America, the 1980s were a “Lost Decade.” Many Latin American countries failed to make the payments on their foreign debt.

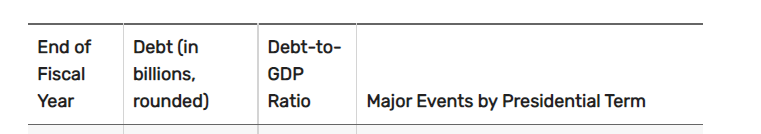

In the 1970s, oil spiked to record highs twice, which led to many Latin American countries experiencing current account deficits. Countries that exported oil had current account surpluses. The U.S. government encouraged banks to take deposits from the oil exporters and lend that money to the oil importers. Under this system, Latin American borrowing skyrocketed in the 1970s. In 1970, debt stood at $371 billion, but by 1982, debt hit $1,1 Trillion.

U.S. National Debt by Year

US debt (Reuters) Debt Crisis (Federal Reserve)

Some analysts began to warn about U.S. banks’ risk in lending so much to Latin American countries. Such warnings went unheeded, and by 1982, the nine largest U.S.-money center banks held Latin American debt equal to 176 percent of their capital.

In the early 1970s, the situation was stable, since short-term interest rates were almost zero and the world economy was growing. However, industrialized countries began to focus on lowering inflation rates, which led to the U.S. and Europe tightening their monetary policies. Nominal interest rates rose, and in 1981 the global economy went into recession. At the same time, commercial banks began to charge higher interest rates and impose shorter terms on their loans. Latin American countries quickly found it impossible to make their debt payments.

In August 1982, the crisis began when Mexico informed the U.S. that Mexico could no longer service its debt, which then totaled $80 billion. Sixteen Latin American countries soon declared that they could not make their debt payments either. The 16 countries and 11 Less Developed Countries in other parts of the world had to reschedule their debt payments.

Banks began to stop foreign lending as they tried to collect on their existing loans. The sudden cut-off of lending sent many Latin American economies into deep recessions. The previous system of heavy borrowing, high currency levels, high government intervention in the economy, and high domestic consumption, which was common in Latin American, could not continue.

The U.S. Fed led an emergency meeting to address the crisis in tandem with other central banks. They gave Mexico a bridge loan and encouraged US banks to reschedule Mexico’s debt. As the crisis spread, the US became a lender of last resort. Banks restructured loans, while the International Monetary Fund and other governmental agencies lent countries enough to pay the interest, but not the principal, on loans. In return, the indebted countries restructured their economies and cut budget deficits. The plan was for the reforms to increase exports, which would generate trade surpluses and dollars to pay the external debt.

The crisis was averted, but the basic problem continued. Instead of reducing state-owned companies, many Latin American countries cut spending on infrastructure, health, and education, while freezing the wages of government employees. This led to high unemployment, a drop in income, and slow or negative growth.

U.S. banks could also delay having to recognize the full losses on their loans. It soon became clear that the loans would never be repaid. Banks began to set up loan loss provisions.

The U.S. government also realized that Latin American countries could not repay their loans while also growing economically. Under Secretary of the Treasury Nicholas Brady’s plan, loan principals were reduced. Between 1989 and 1994, banks forgave $61 billion in loans, about one third of the total. The 18 countries that participated in the Brady plan agreed to further reforms so they could service their reduced debt.

Despite evidence of the problem, most involved did not recognize the problem until it had become a crisis. The U.S. reacted by weakening banking regulations so banks with large loans would not go insolvent. The actions staved off a panic, but it allowed the big banks to avoid the effects of their earlier risky lending practices. The experience may have led to increased risk taking, as we have seen in recent years.

The World Bank says that in the next year as many as a dozen countries will not be able to service their debt. It will be the largest debt crisis in history. Many states in India have debt-to-GDP ratios similar to Sri Lanka. The entire world is in debt distress. Governments have to cut spending or borrow even more.

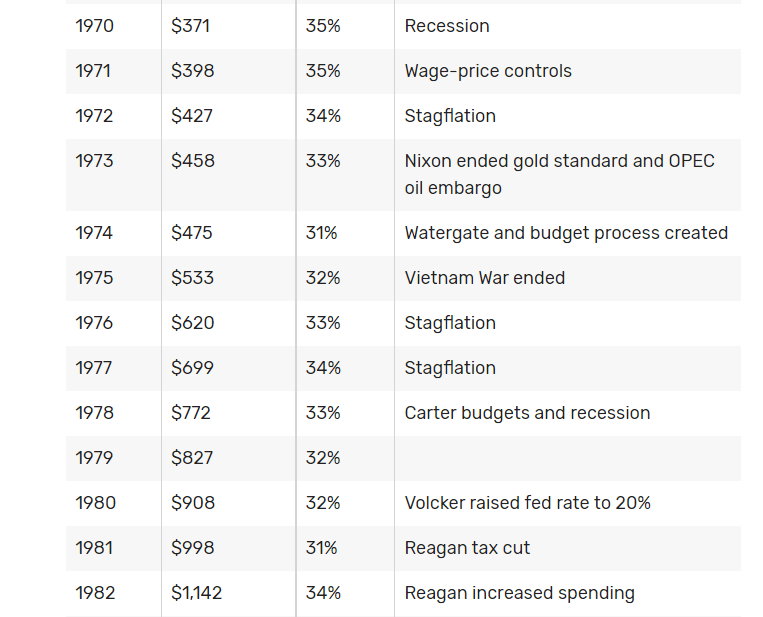

Gold Price History – The 1970s 1980 Gold Bull Market

1980s gold (goldchartsrus.com)

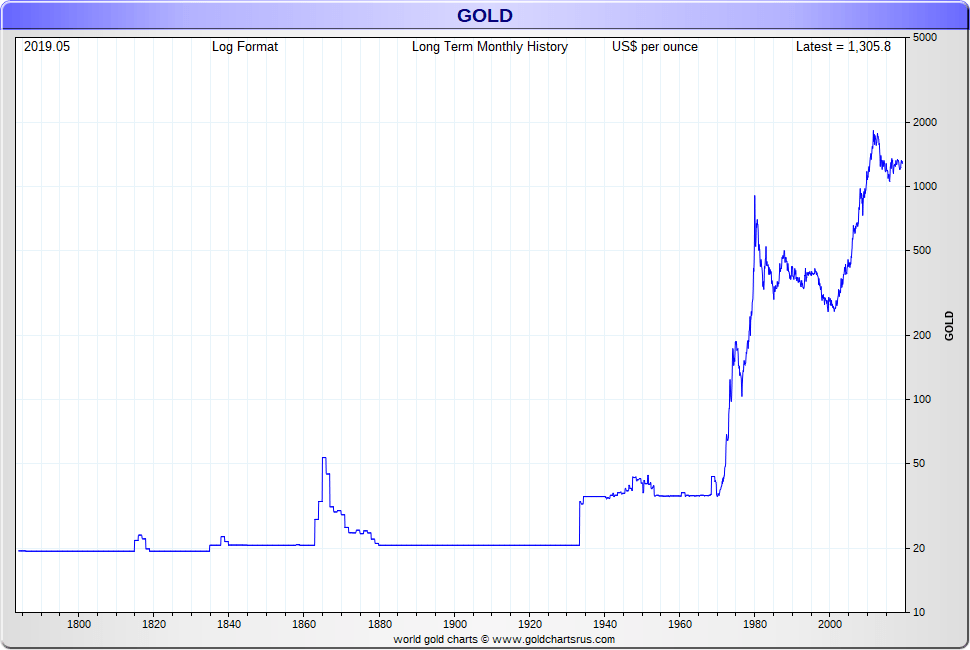

All-Time Recorded Gold Price History (USA)

Gold price history (goldchartsrus.com)

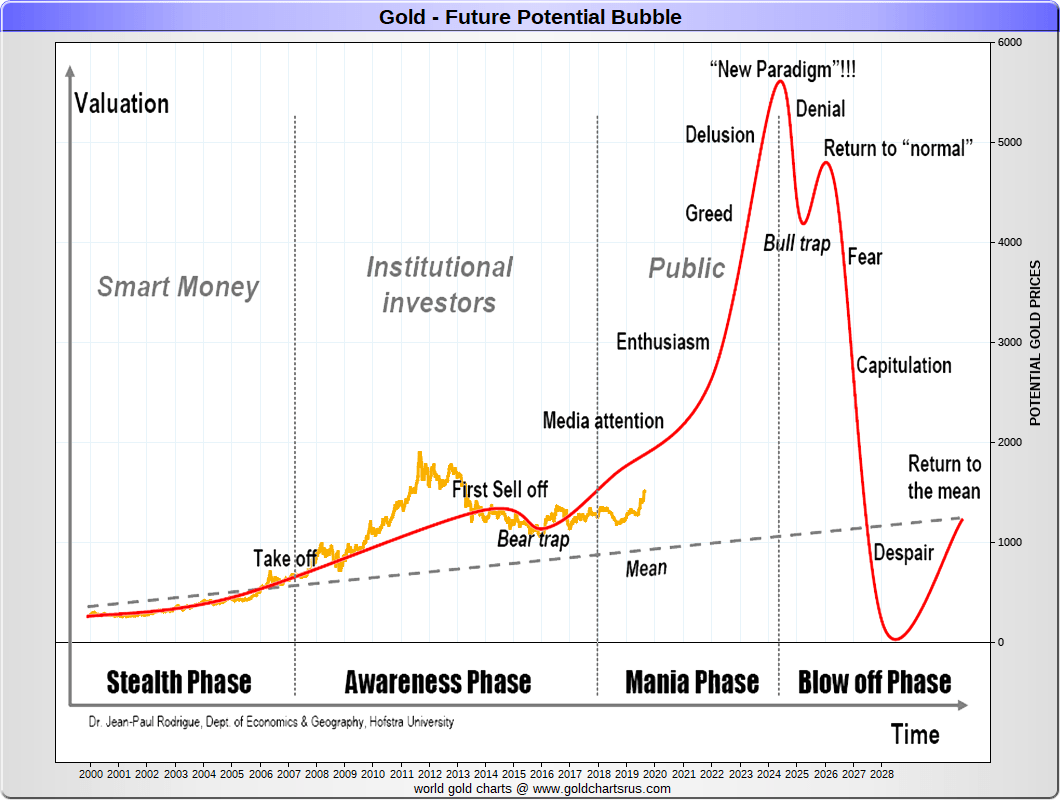

Gold Price History – 21st Century Global Gold Bull Market Ongoing

Gold Bull market ongoing (goldchartsrus.com)

The Gold Bubble of the 1980s

The stealth phase of the gold bubble of the 1980s started in the 1970s. Gold was under $35 when President Nixon took the U.S. dollar off the gold standard and it became the Petrodollar. Gold sat around $75 and then it began to enter a takeoff phase. The cycle then began the next major long-term bull market. The price of gold rallied from its mean at around $150. Institutional investors then began to enter the market in the awareness phase, rallying gold up to about $200 an ounce. Then in about 1976, the CFTC changed the margin requirements for gold. The Hunt family, which had a huge position in silver, led to a liquidation and a bull trap around 1976-77 losing billions in the process. The market then got media attention. The mania phase then started. Gold got more media attention and the price rose from $200 to about $400 relatively fast before there was a small sell-off.

Enthusiasm grew and spread through the public due to dollar weakness. The interest led to more buying and gold topping $800. Many spoke about gold topping $2,000 an ounce at a time when the debt crisis was hitting Latin America in the early 1980s. Gold reached nearly $900. From 1981, Fed Chairman Volcker, under President Reagan, raised interest rates to about 20 percent to combat runaway inflation. The fear was that the U.S. dollar would continue to decline, so gold became more and more desirable. Then gold hit a bull trap and collapsed to below $600.–.the panic came in and gold fell into early 1983.

When Russia invaded Ukraine recently, gold topped $2,084. The longer-term chart shows that gold began to break out to the upside once Nixon took the U.S. dollar off the gold standard. Since then, the U.S. dollar has declined in value against gold. The dollar has lost about 98 percent of its value since then as the world’s reserve currency.

The fundamentals now are extremely bullish. The Third World debt crisis is spreading. Media attention is beginning to focus on debt defaults, which should lead to a run on gold, only to find shortages in gold as we did back in 2020. Gold should rise in value rapidly to more than $5,000 in about 2024. We entered the stealth phase in the early 2000s. Gold traded around $750 and we began to see smart money come into the market and take physical gold off the market. The market broke $1,000 by 2006. In 2008, we had a recession, which broke the gold market and brought it back down just below $1,000. The awareness phase began when the institutional investors realized that the U.S. dollar would continue to decline, inflation would continue to increase and stay in the market as a consequence of all the money printing and gold rallied all the way up to more than $1,900 in 2011.

In 2012, the government lifted the uptick rule, which allowed Central banks to short sell naked futures contracts in unlimited amounts. We began to see the paper market price for gold fall, even as demand for physical gold continued to grow. Gold fell to a low of about $1,050 into a bear trap in 2016-17. As the shorts were covered, gold rallied back up through 2018. The Fed began to raise interest rates, which coincided with the bottom of the gold market. By 2018-19, the Fed had to lower interest rates again and gold rose again. Since then, interest rates have risen from 0.33 on the 10-Year Note in March 2020 to 3.50 recently–a massive increase in interest rates in a short period of time, which is leading to the threat of another international debt crisis. In 1981, there was about $61 billion written off.

Today, we are looking at more than $400 billion that is threatened with default. Gold is rising quickly, even with media stories that gold is not going to go anywhere. We see gold rising to above $3,000 and then it will enter the enthusiasm stage. The public will then rush in and gold will hit $4,000. Gold will hit the delusion phase and in a new paradigm gold will hit $5,500 in 2024. After that high, gold will enter another bull trap and fear will drive gold down below $4,000. Gold will then return to its mean at about $1,500 to $2,000.

Much will depend on how the Fed tries to adjust interest rates. The 10- and 2-year notes are now inverted, with the shorter-term note trading higher than the longer note. If the inversion occurs on the 30-year bond, too, it will be a strong indication that we are entering a deep recession. This is a generational opportunity in gold to make some significant profits.

Conclusion:

As we take a look at the charts above, we can see gold is currently entering the Mania Phase. As the Third World Debt Crisis increases, gold will play a major role in the monetary system. Price discovery will overtake the price suppression and manipulation by the central banks. The Media attention phase develops as the data begins to come in regarding Latin American debt defaults that could precipitate a massive run to gold only to find a shortage of physical supplies. This could perpetuate the acceleration of the Enthusiasm phase due to the public and retail demand that could ignite greed and delusion into a blow-off phase within a peak in gold of over $5000 in 2024.

Be the first to comment