Editor’s note: Seeking Alpha is proud to welcome Herman Schroeder as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Vesnaandjic

Thesis

Eagle Materials (NYSE:EXP) have been trading at a price earnings multiple of 20x over the last few years, making it too expensive for value investors to look at. However, in my view, given the company’s recent good results and the pullback in share price it is now trading at a forward multiple of 9x, or half its recent average, and trading at a discount to peers. Clearly, the market is pricing in some bumpier times ahead, which made me perform a detailed analysis.

Based on my assessment, I believe even if a deep recession was to unfold, Eagle would be able to make it through financially. Over the longer term, the company should benefit from limited added cement capacity in the US, the Infrastructure Investment Jobs Act announced last November, and the pent-up demand for housing.

Company Overview

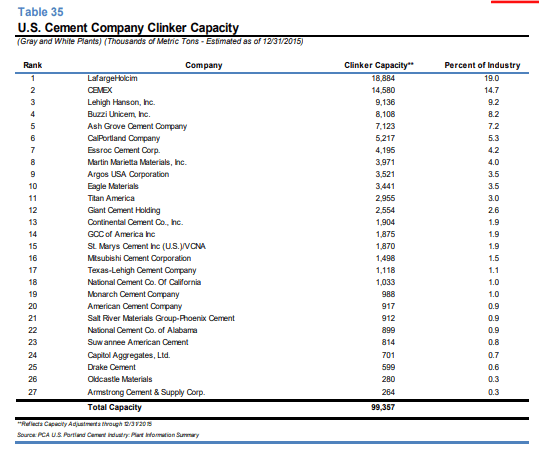

Eagle Materials is a manufacturer of heavy construction and light building materials in the United States. Products are split up between Heavy Materials (50% of EBIT) such as cement, concrete and aggregates, and Light Materials (50% of EBIT) that consist of gypsum, wallboard and paperboard. The company has a 3.5% market share in the cement industry, according to a 2016 report, and roughly 10% market share in the gypsum industry.

Approximately 65% of the FY 2021 revenues were generated in 10 states. Eagle operated eight cement plants, 26 concrete batching plants, three aggregate facilities and five gypsum wallboard plants. The biggest shareholders are Vanguard with 9.1% and BlackRock with 8.4%. The CEO is Michael Haack and the Chairman is Mike Nicolai. The company is headquartered in Dallas, Texas. It has $983 million of debt, $19 million of cash, and a market cap of $4.3 billion, having earned net income of $374 million in FY 2021.

Eagle manufactures commodity products in cyclical industries. The US cement industry has to compete with imports, and also faces lower profits from higher fuel costs and a tough regulatory environment.

Cement Industry (Heavy Materials)

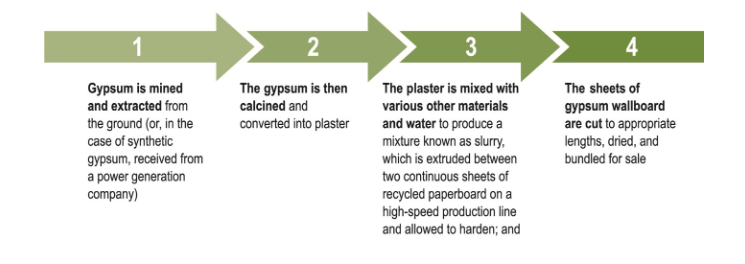

The US cement market is dominated by large international competitors such as Holcim (OTCPK:HCMLF), Heidelberg Cement (OTCPK:HLBZF) and Cemex (CX). Eagle has a roughly 3% market share. US listed companies that also produce cement are mainly focused on the aggregate market, these include Vulcan Materials (VMC), Martin Marietta Materials (MLM) and Summit Materials (SUM).

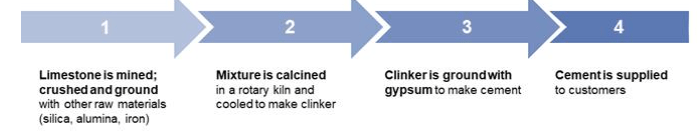

Below is a basic process flow involved in the manufacture of cement.

Manufacturing process for cement (Company 10-K)

Eagle has stated in the latest 10-K that it has enough limestone reserves for at least 25 years of production. I believe this number is conservative but also adequate.

US Cement company clinker capacity (2016 U.S. Cement Industry Annual Yearbook) Revenue mix for peers (Vulcan 10-K)

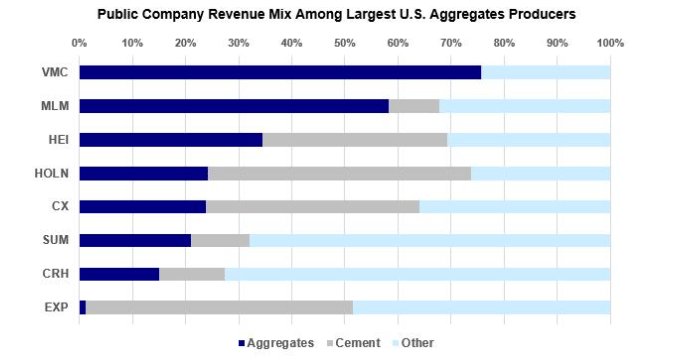

Gypsum Wallboard (Light Materials)

Eagle sells gypsum under the brand name American Gypsum. The major companies in the US gypsum market are Knauf, formerly USG (Private, Germany), National Gypsum Company (Private, USA), Certaineed (Saint-Gobain (OTCPK:CODGF) subsidiary, France), and Koch (Private, USA). These companies account for 85% of the market, per the latest 10-K. In a 2019 call, Eagle’s CEO said that the company has a roughly 10% market share.

Manufacturing process for gypsum (Company 10-K)

Before USG invented drywall in 1916, building interiors in the USA were constructed by placing layers of wet plaster over thousands of wooden strips called laths. Drywall is a much more cost efficient alternative and is the predominant method for making interior walls today. Residential construction accounts for 80% of the industry sales, per the latest 10-K.

Other

Eagle has two additional segments Concrete and Aggregates (classed under Heavy Materials) and Paperboard (Light Materials). These segments are not material to the business, and won’t be discussed in detail here.

Cyclical Industry

In my view, the biggest reason for Eagle’s low valuation, especially compared to the aggregate players such as MLM, VMC and SUM, is due to the cyclicality of the business. Unlike the aggregate players, Eagle is more tied to the housing cycle due to the fact that 80% of gypsum and 30% of cement consumption is driven by residential construction as stated by the CEO Michael Haack in 2021:

Residential construction represents the most important single demand driver for us, driving around 80% of the demand for Gypsum Wallboard and about 30% of the demand for Cement.

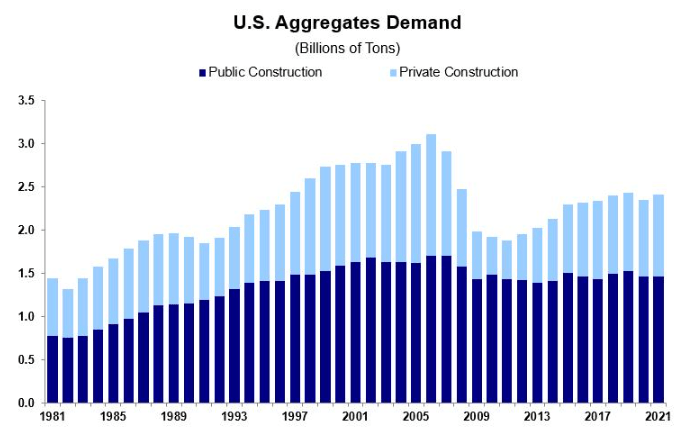

U.S. Aggregates demand (Vulcan 10-K)

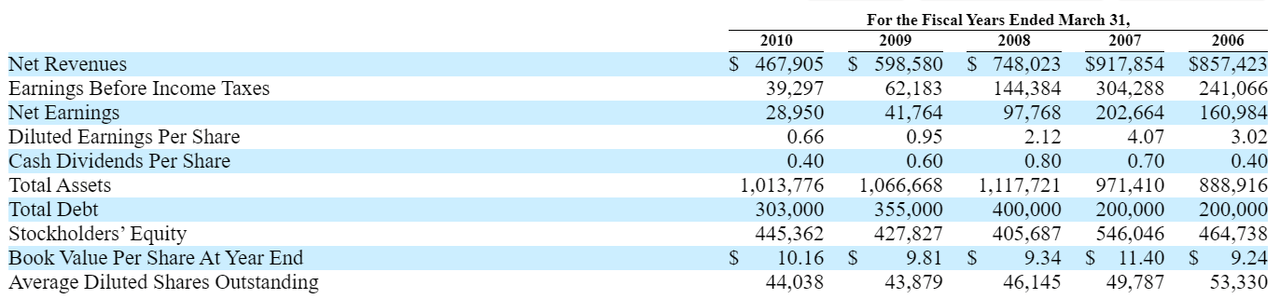

Although Eagle was profitable during the recession in 2008, the company’s revenue halved from 2007 and would only start rising again in 2012. On an EPS basis, the company would only match the EPS of $4.07 reached in 2007, in 2017, 10 years’ later.

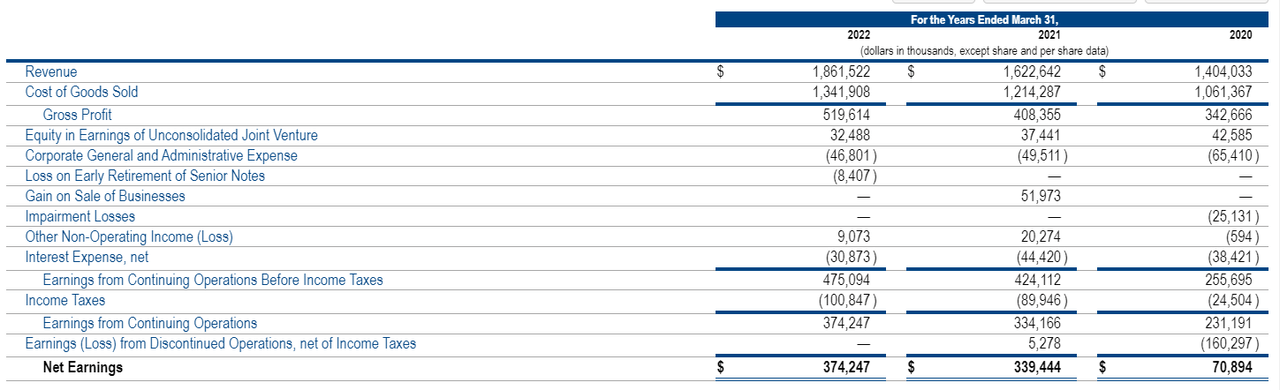

Company Financials (Company 10-K)

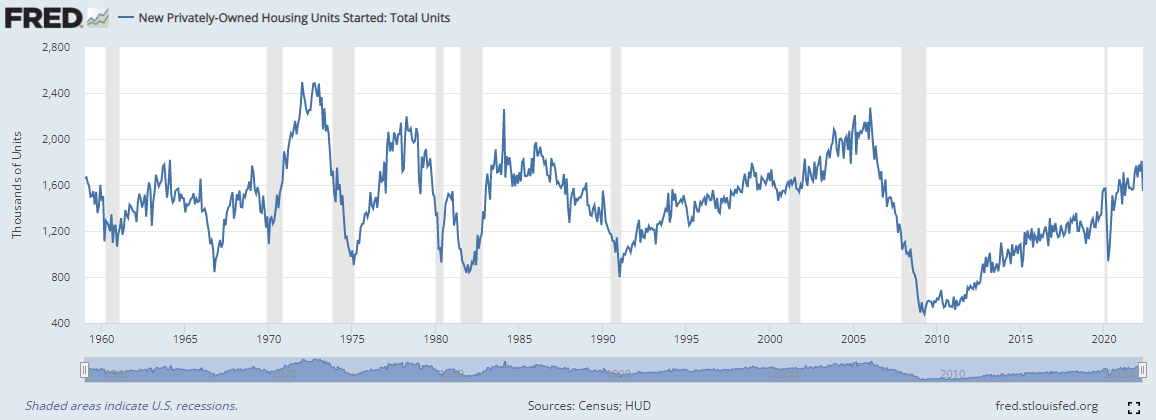

The company’s profits are largely driven by housing starts that peaked in 2006 at 2 million which then dropped to 0.5 million in 2009. Housing starts are currently at 1.5 million.

New Privately-Owned Housing Units Started (FRED Economic Data)

Over the cycle the company has grown however. EPS in 2022 was $9.23, and was more than double the EPS of $4.07 reached in 2007. This has been due to more houses being built recently as the industry recovered from 2008 and the de-urbanization as a result of the pandemic.

To understand the future of the company, the important questions for me are:

1. Will Eagle make it through another recession?

2. What will the business look like in 10 years’ time?

Commodity products

In my view, one of the reasons that Eagle and the demand for its products are so closely tied to the economy is due to the fact that cement and gypsum are used for discretionary purposes, to build a new home, unlike utilities and groceries that we need no matter what. To combat this demand cycle, it is important to operate in states with high growth rates, where the population is increasing and there is a business-friendly environment.

Eagle calculates in the latest 10-K that approximately 65% of its revenue is generated in Colorado, Illinois, Kansas, Kentucky, Missouri, Nebraska, Nevada, Ohio, Oklahoma, and Texas. The company has said that the population is expected to increase approximately 11% between 2020 and 2050 for these 10 states, compared with an 8% population growth for the United States as a whole. This is okay, but not great. There are some states with much higher expected growth – Texas’ population, for example, is estimated to increase 37% from 2020 to 2040.

Imports

I believe that the commodity-like nature of cement also opens the industry to threats of cheaper imports. Cement is typically imported into deep water terminals, along the coast, Great Lakes or on the Mississippi River system near major population centers.

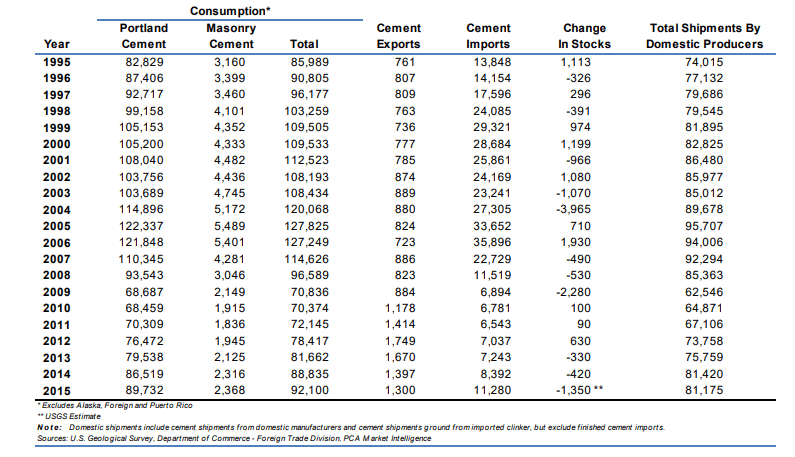

Imports have however been less of a threat in recent times. Imported cement consumption was 15% of total US sales in 2021, down from 28% at the top of the housing bubble in 2008. Imports seem to be utilized more when the local industry is at full capacity, indicating that domestic production is cost competitive.

US Cement Exports and Imports (2016 U.S. Cement Industry Annual Yearbook)

Because of its low value-to-weight ratio, the relative cost of transporting cement on land is high and limits the geographic area in which each producer can market its products profitably.

Eagle estimates that shipments of cement are only economical by truck for a 150-mile radius, rail up to 300 miles, and further by barge. The company likes to highlight that its locations are inland and do provide protection from imports. In addition, it notes that imports carry a larger carbon footprint than almost any domestic US cement producer.

Cost of Fuel

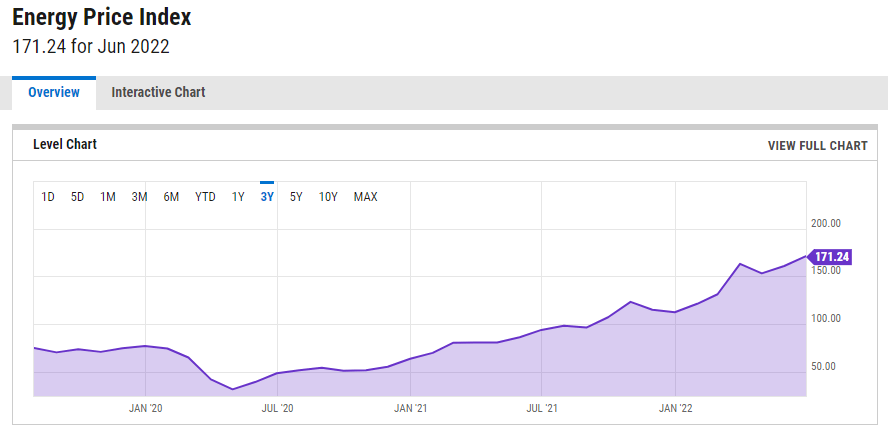

The recent spike in electricity prices is expected to hurt Eagle’s margins in the coming quarters. Martin Marietta has said that, ‘energy accounted for approximately 23% of the cement production cost profile in 2021′. I would assume the same is true for Eagle as the CFO Craig Kesler had this to say in 2018: “The Cement business is predominantly an energy-related business”.

The Energy Price Index, which is the weighted average of coal, crude oil and natural gas prices, indexed to 100 in 2010, has been moving up consistently since 2020.

Energy Price Index (YCHARTS)

Despite the Energy Price Index increasing by 3x over this period, Eagle has been able to increase revenue and operating profit, and it would appear the company is able to pass on costs to the customer successfully.

Latest Financial Results (Company 10-K)

Debt Levels

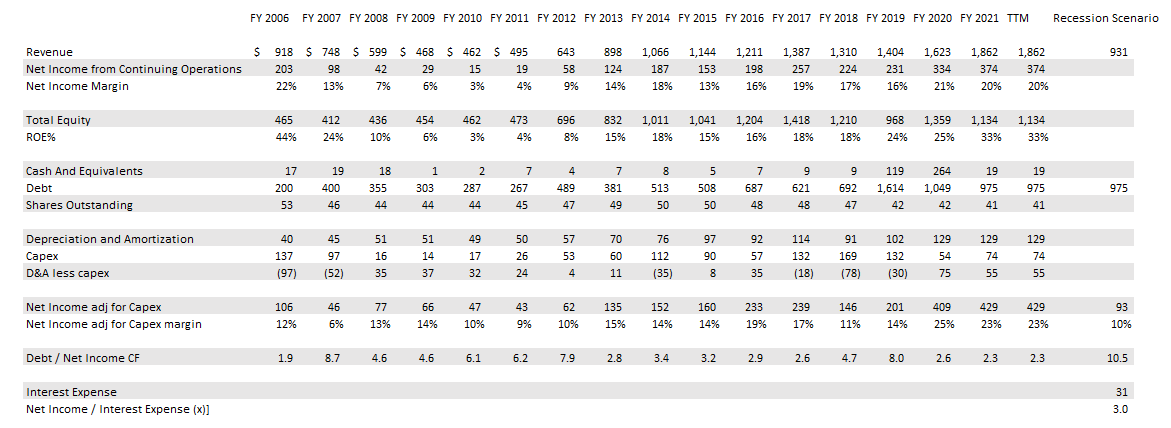

I believe that being in a cyclical industry, it is important to think about Eagle’s ability to make it through the next recession. The company’s debt has increased from $200 million in 2006 to $975 million in 2021. A big reason why the company was able to make it through the last recession was its healthy balance sheet at the time, but also the fact that it was able to pull back capex spending. Capex fell from $137 million in 2006 to $14 million in 2009.

To try and determine the net income over the cycle for the business, adjusted for capex, I have calculated the net income, plus depreciation and minus capex for Eagle since 2006. It becomes clear how the ability to pull back on capex helps the business in a downturn.

Assuming a 2008 recession scenario, that is revenue falling by 50% and adjusted net income margin falling to 10%, I calculate that the company would have $93 million of adjusted net income in this scenario, covering the current interest expense 3 times. It would appear that although another recession would be very painful, I believe the company would make it through it.

Author’s calculations based on data from Company financials

Regulation

Once it is safely through the possible coming recession, Eagle has to deal with some other long-term trends. Environmental and zoning regulations have made it increasingly difficult for the US cement industry to expand existing facilities or to build new facilities and is likely to continue into the future.

In my view, this headwind is actually becoming a tailwind for the company. Michael Haack, the CEO, has said that clinker capacity and the number of cement kilns in the US has not only not expanded since 2010 and the industry is nearing full capacity, helping margins. The limited increases in the supply of cement should mean that the industry can charge higher prices, helping margins into the future, whilst also curtailing capex spending.

Housing and Infrastructure

Residential construction is closely tied to interest rates, which have been higher this year, but have recently started to come down. Over the longer term however, I do believe the fundamentals are healthy. The limited number of new houses built over the last decade would indicate that there is a pent-up demand for new houses, increasing the demand for cement and gypsum. Since 1960 there has been on average 1.4 million houses built per year in the US; however, since 2007 an average of 1 million houses were built per year. This has resulted in a deficit of over 5 million homes. Even if the actual deficit is much smaller, there would appear to be some pent-up demand for residential housing, which will be a big tailwind for Eagle’s gypsum and cement business.

The Infrastructure Investment Jobs Act announced last November is the largest increase in federal highway, road and bridge funding in more than six decades, per Vulcan’s latest 10-K. It is expected to double the funding available for roads and other infrastructure until 2026. Given that public infrastructure accounts for nearly 50% of cement demand, this should be a large tailwind for Eagle.

Capital Allocation

As Eagle has grown over the years, it has proven to be an excellent capital allocator and also has the highest ROE in the sector. The company has reduced its share count by 45% since 1994 and spent close to $1 billion on share repurchases and dividends over the last 3 years. As it continues to grow and benefit from the pent-up housing demand and the infrastructure bill, I expect it to return capital to shareholders too.

Eagle Materials Valuation

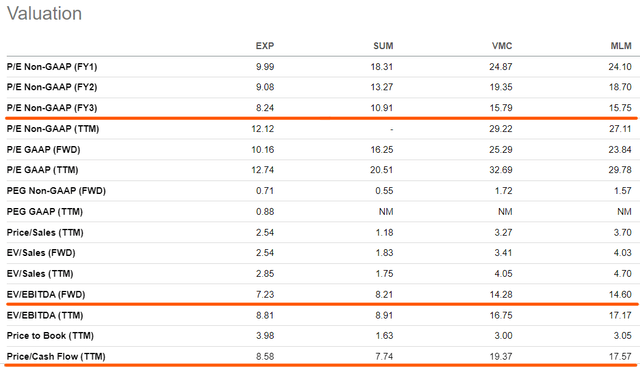

I think the correct way to value Eagle is to look at price multiples. This is in part due to the cyclical nature of the industry making DCFs hard to model out. As Eagle returns a large amount of capital through buybacks, resulting in falling shares outstanding, the best metric to look at is P/E.

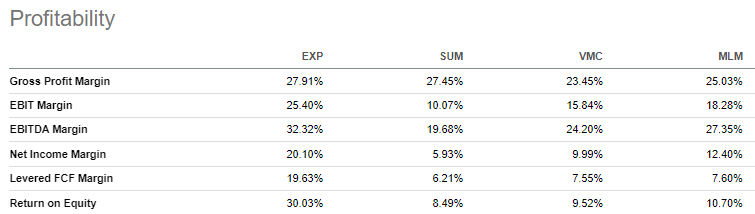

Profitability (Seeking Alpha)

As can be seen from above, Eagle, compared to other US heavy building materials peers, trades at a discount. As discussed before, the US peers are more heavily invested in aggregates, which is a less cyclical business than cement, which might warrant a higher multiple. On the other side, the cement and gypsum businesses are earning much higher margins and returns on capital.

Given this, I believe Eagle should at a very least trade at the lower end of the range of the US peers. If we look at the 3 years out P/E multiples, Summit is trading at 10.91x and I believe Eagle should trade at around the same level. This would represent a more than 35% increase from where it trades at the moment.

I must however note that, based on the Price/Cash Flow metric, Eagle does trade at a premium to Summit. However, cash flow multiples can vary widely from year to year due to working capital movements. On EV/EBITDA terms, which is less likely to change dramatically from year to year, Eagle trades at a 13% discount to Summit.

Conclusion

The share price of Eagle Materials has fallen over the last few months and I believe investors should take note. The company is in a cyclical market, has more debt than during the last recession and operates in a capital-intensive industry.

Yet, long-term tailwinds such as constrained domestic cement supply, infrastructure spending, and pent-up housing demand should benefit the company going forward. With a good growth outlook, a history of good capital allocation, an attractive valuation, and the best-in-class return on equity, I believe Eagle is an appealing opportunity.

Be the first to comment