Oat_Phawat

Introduction

Sometimes you get it really wrong. In February, I wrote a bullish article on GoldMining Inc. (NYSE:GLDG) in which I said that the company’s properties could be worth over $500 million at today’s gold price. Well, gold prices are down by 6.4% since then, but the market valuation of GoldMining has almost halved as of the time of writing. So, what went wrong? Well, I think there are several factors for the slump – weakness in the gold mining sector, poor financial results, and a lack of progress on spin-outs and asset sales.

Overall, I remain bullish on GoldMining as I continue to think the company remains significantly undervalued based on the quality of the projects it owns. Let’s review.

Overview of the recent developments

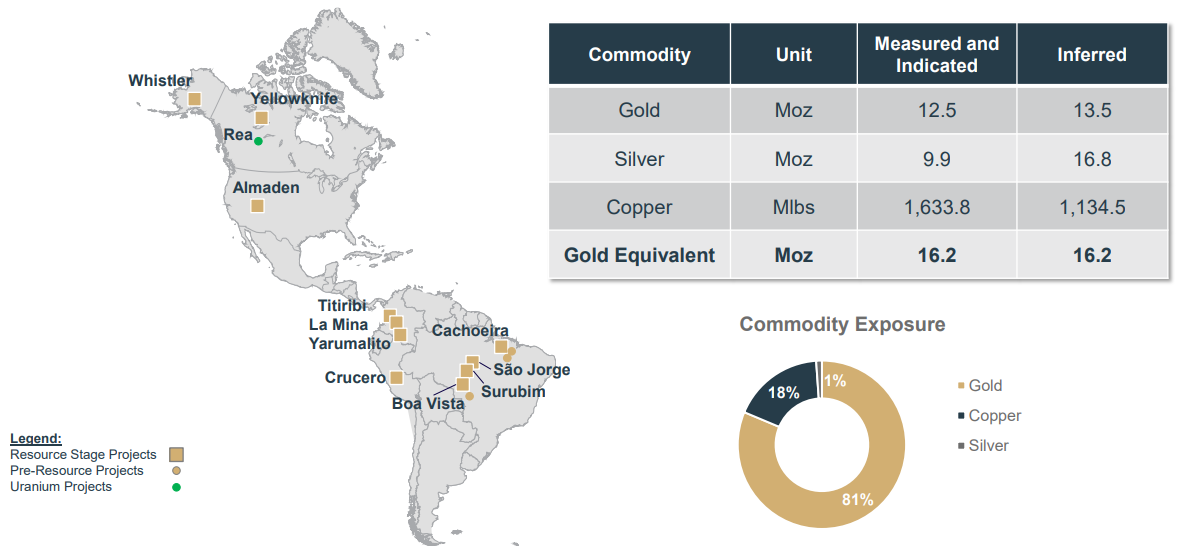

In case you haven’t read my previous article on GoldMining, here’s a quick description of the business. The company currently owns majority stakes in a total of 13 gold projects across the Americas, with 7 of them located in Brazil. It also has a small uranium property in Canada. The largest project in Goldmining’s crown is Titiribi in Colombia, which has measured and indicated resources of 5.54 million ounces of gold and 1.06 billion pounds of copper as well as inferred resources of 3.16 million ounces of gold and 212.6 million pounds of copper. Overall, this property holds an impressive 11.5 million ounces of gold equivalent, which makes it one of the largest undeveloped gold projects in the world today. Yet, it accounts for less than half of GoldMining’s combined gold resources.

GoldMining

GoldMining plans to unlock the value of its portfolio through spin-outs and disposals. Its first step in this strategy was a $90 million initial public offering of its royalty arm Gold Royalty Corp. (GROY) in March 2021. GoldMining still holds 20.7 million shares of this company, and they have a market valuation of $62.1 million as of the time of writing.

On June 14, GoldMining optioned its Almaden project in the USA for up to C$16.5 million ($12.8 million) to NevGold (OTCQX:NAUFF). I think this is a very good deal for GoldMining considering it includes an initial consideration of C$3 million ($2.3 million) for a project that was bought for just C$1.15 million ($0.89 million) in March 2020. Almaden currently has measured and indicated resources of 0.91 million ounces of gold and inferred resources of 0.16 million ounces of gold, which means that the maximum amount of the deal values it at about $12 per ounce. Applying this amount to GoldMining’s remaining portfolio yields a market valuation of about $375 million.

So, which property is on the chopping block next? Well, I think it’s either Whistler or La Mina. In February, GoldMining created a US subsidiary focused on advancing Whistler, and it seems that it’s likely this company will get listed in the future. Whistler is a much larger project than Almaden as it has indicated resources of 2.99 million gold equivalent ounces and inferred resources of 6.45 million gold equivalent ounces. Considering Whistler is located close to several other large gold-copper projects, I wouldn’t be surprised if it fetches above $20 per ounce of gold equivalent.

GoldMining

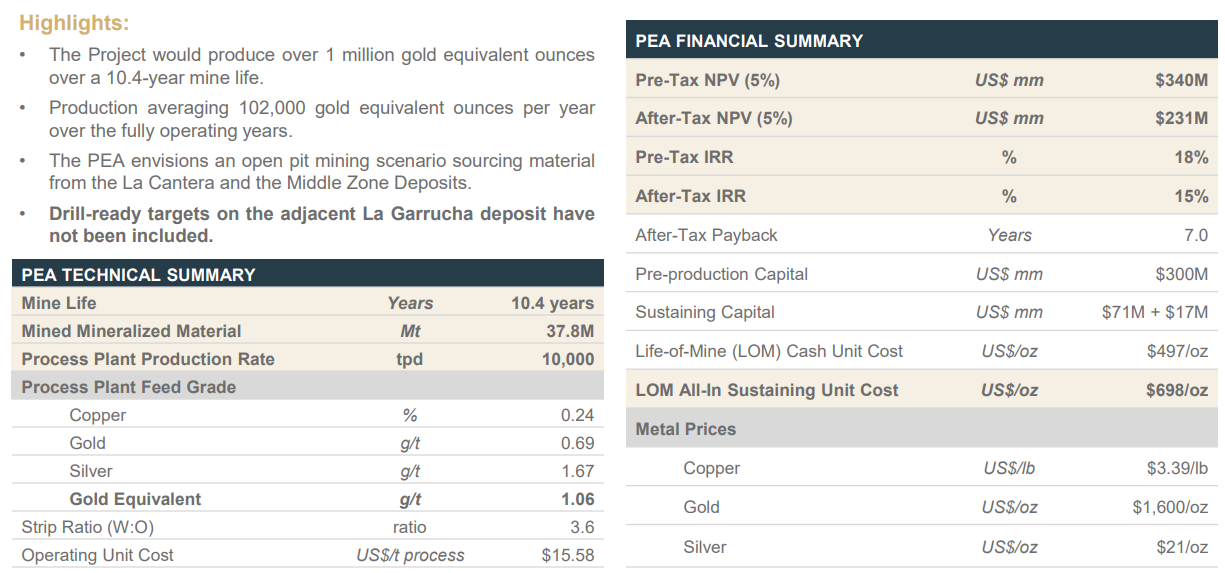

La Mina, in turn, is GoldMining’s most advanced property as it’s the only project in its portfolio with a completed preliminary economic assessment (PEA) study. The results from the PEA were released in January 2022, and I think they look robust. All-in sustaining costs are below $700 per ounce and the after-tax net present value (NPV) is over $230 million at $1,600 per ounce. The logical next step is a sale or a spin-out of a company created to hold this project and considering development stage gold junior mining companies usually trade at about 0.3-0.5x NPV, I think La Mina could be worth at least $69 million.

GoldMining

So, if there is so much value in GoldMining’s projects, why is the market valuation crashing? In my view, there are three major reasons and the most important one is weaker gold prices. Gold is down to $1,776 per ounce as of the time of writing compared to $1,898 per ounce when my previous article on GoldMIning came out. That might not seem much, but considering the AISC of many gold producers is above $1,200 per ounce, this leads to a significant contraction in margins. As a result, the VanEck Vectors Gold Miners ETF (GDX) has lost almost 23% since February 18. I think that the major reason why gold prices are falling is because global inflation fears are easing, and many analysts are predicting that central banks might start cutting interest rates in early 2023. Such moves are usually bearish for gold.

I think that the second major reason why GoldMining’s market valuation has declined is its financial performance. In the quarter ended May 2022, the company booked a net loss C$27.5 million ($21.3 million). This was driven by a C$29.7 million ($23.1 million) unrealized loss on investment due to Gold Royalty as the share price of the latter has also been declining due to low gold prices. With the share price of Gold Royalty recovering by almost 40% since early July, I don’t expect to see another loss in the quarter ending August 2022. And the third major reason is that the pace of spin-outs and asset sales has been slow. Sure, the sale of Almaden is a good deal but I think that many investors were expecting GoldMining to have monetized Whistler or La Mina by now. With gold prices moving lower, it’s likely that investors are pricing in a large delay in the spin-out or sale of these two projects.

Investor takeaway

GoldMining has a portfolio of more than a dozen projects that it bought cheaply over the past decade, and the option deal for Almaden is a sign that the company did good bargain hunting. However, recent gold price weakness has dented the prospects that many of these projects will be spun out or sold soon, and the time value of money concept is important for investors. And a lower market valuation creates issues for GoldMining as the company had just C$8.7 million ($6.8 million) in cash as of May 2022. Unless gold prices improve soon, the company will have to choose between large stock dilution or selling Gold Royalty shares at the current low prices to fund its operations.

Overall, I continue to think GoldMining’s properties could be worth over $500 million at today’s gold price. However, there are good reasons to be cautious, so I rate this one as a speculative buy.

Be the first to comment