With questions beginning to be raised about the strength of the economy and the Fed’s aggressive rate hikes, now might be a good time to add exposure to GBIL to help balance out money market allocations within one’s portfolio. Douglas Rissing

As our readers are aware, we have spent 2022 focused on shoring up portfolios by upgrading the quality of the companies within and utilizing cash or cash-like vehicles that can help preserve capital while also delivering monthly income to replace fixed income allocations and avoid losses in that space. We have chosen to focus on products structured in a way to benefit from rising rates, or at a minimum to avoid large losses while generating larger monthly distributions while the U.S. Federal Reserve remains aggressive. So far this strategy has paid off, with the money market funds generating greater yields monthly, floating rate portfolios continuing to reset at higher yields while maintaining NAVs and even our shortest duration ETF bond funds are generating higher yields while also maintaining NAVs right around where we have recommended being buyers.

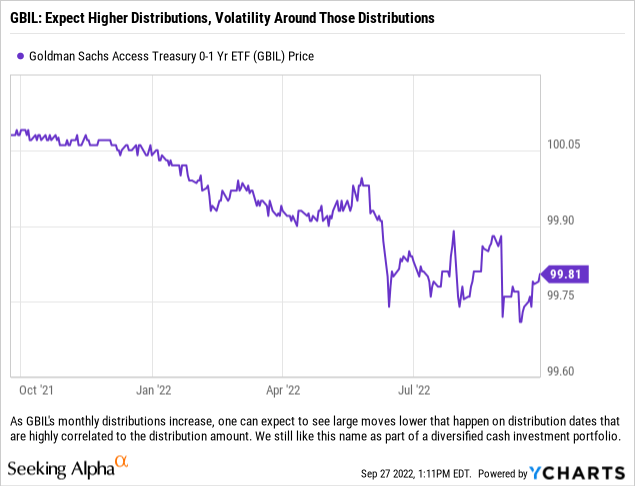

We previously discussed the Goldman Sachs Treasury Access 0-1 Year ETF (NYSEARCA:GBIL) on July 21, 2022 and highlighted it as a product that was structured to deliver larger payouts in a period of rising rates while also minimizing price volatility that investors have been bitten by via some other fixed income ETFs that marketed themselves as short-duration bond funds but whose durations had crept further out than investors may have anticipated. While 1-3 year funds are invested in securities that “live” for short periods of time (especially when considering there are plenty bonds with maturities of 20, 30, 50 and even 100 years), almost no bond fund is short enough to avoid steep losses when the Federal Reserve decides to get as aggressive as it has in the last 3-4 months. That at least is our takeaway after conversations with investors who were a bit puzzled by the sharp declines in funds they thought were invested in shorter maturities than they actually were.

Our recommendation remains that for investors wanting to utilize the Goldman Sachs Treasury Access 0-1 Year ETF within their portfolio for cash purposes, that it be utilized along with a money market fund in order to normalize rates and have a blended duration. It might serve as a drag as rates increase, but will be quite beneficial once they plateau or when they fall.

Update On Fund Structure

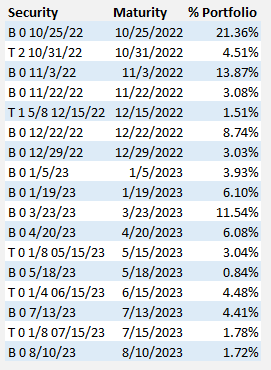

The ETF only holds government/treasury issuances. Sorted below by maturity date are the fund’s current holdings:

The fund holdings are positioned perfectly around Fed rate decisions and should allow the fund managers to significantly increase the monthly distributions through year-end. (Securities Filings, Author)

The fund remains positioned to take advantage of the aggressive Fed, with roughly 53.1% of the portfolio in the 0-3 month maturity range and 39.74% of the portfolio set to mature in the next 45 days. We would point out that these maturities will greatly enhance the yield on the portfolio as some of the larger positions have been on the books for a while (For instance, the 10/25/2022 cash management t-bill has been a large position dating back to when we last wrote about this ETF, and that was prior to two rate hikes worth 150 basis points in total). We also view the maturities around the Federal Reserve meetings to be key, as over 25% of the portfolio will mature basically a week ahead of the Fed’s next rate hike (which the market is telling us is nearly assured to happen and be a 75 basis point increase), followed by nearly 14% of the portfolio the day after the Fed move. That should really help increase the income moving forward and pave the way for sharply higher monthly distributions thereafter.

The monthly payout on this fund has already doubled since our first article, and we suspect that with an indicated yield of 1.75% currently that there is plenty of further upside potential for monthly distributions in the months ahead. We just discussed how maturities will play a role in this, and we suspect that investors might see the monthly distribution double by the end of the year from current levels. While that sounds crazy, even if the Fed takes no action through the end of the year, it would be possible depending on which future maturities the cash from current maturities is rolled into (it must also be noted that the target rate is already nearly double from the fund’s indicated yield).

Final Thoughts

While one could generate higher monthly distributions via money market funds today, we do think that this is an ETF which should be added to the cash mix as it will help stabilize your total monthly distributions received; yes, it will hold your yield back in the current environment, but when the Fed hits the pause button or has to lower rates, the Goldman Sachs Treasury Access 0-1 Year ETF will help keep your rate higher as its longer duration will then be a benefit. We like diversification, especially the further into this rate hike cycle we get into.

We also think that a fund with maturities such as this one enables investors to continue to avoid the yield curve chaos present in the 2-5 year space where the rates begin to invert. We think picking a fund now, which focuses in the 1-3 year or 1-5 year space is a bit foolish, especially as large portions of those portfolios remain underwater and yields are not anywhere close to market rates. Let the market come to you by staying relatively short and avoiding pitfalls that could ensnare you and wait to figure out where the market will eventually be. Going long now, especially if utilizing individual treasuries/bonds, would not be beneficial. Trying to decide whether to lock in a higher rate in the 3-year space, or a lower rate further out on the curve expecting the Fed to eventually have to cut rates aggressively has been somewhat of a fool’s errand lately and we know of a few guys running fixed income portfolios (professionally) who have expressed frustration over trying to invest in a space where the curve inverts and that inversion moves around. It has made some professionals look and feel silly, so wait to make those decisions until the Fed is forced to hit pause and then reevaluate the field. That, we feel, is the best insight one can give right now.

Be the first to comment