naphtalina/iStock via Getty Images

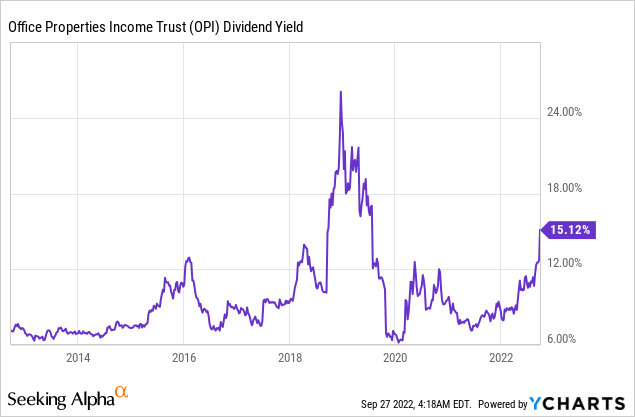

Almost three months ago, I stated that the 11% dividend of Office Properties Income Trust (NASDAQ:OPI) was attractive but not entirely safe. Since then, business prospects have deteriorated and the stock has declined 21%. Consequently, it is now offering a dividend yield of 13.9%, which may entice income-oriented investors. However, investors should be aware that the risk of a dividend cut has increased due to the high debt load of this real estate investment trust (“REIT”) and the increased risk of a recession.

Business overview

Office Properties is a REIT that owns more than 170 properties, with 22.5 million square feet in 32 states. Its buildings are leased mostly to single tenants with high credit quality. The trust generates about 20% of its rental income from U.S. government agencies and 63% of its rental income from tenants with an investment grade credit rating. As a result, Office Properties has a defensive business model in place.

Some REITs have recovered from the coronavirus crisis thanks to the strong economic recovery that has succeeded the fierce recession in 2020. Unfortunately, this is not the case for Office Properties, which has been significantly hurt by the adoption of a “work-from-home” model by many companies. While some employees have returned to their offices, the office occupancy rates in most metropolitan cities remain depressed.

Moreover, the pandemic caught Office Properties with a high debt load, and thus the REIT has been forced to divest many of its properties. The divestment of assets has taken its toll on the performance of the REIT, which has incurred a 20% decrease in its funds from operations [FFO] per unit in the last three years, from $6.01 in 2019 to an expected $4.80 in 2022.

On the bright side, Office Properties exhibited positive business performance in the second quarter. Thanks to increased leasing activity and the sale of some vacant properties, the occupancy rate of the REIT grew from 91.2% to 94.3% and its FFO per unit grew 6% over last year’s quarter, from $1.15 to $1.22, thus exceeding the analysts’ estimates by $0.10. It is also worth noting that Government agencies comprised approximately 30% of new leasing volume. As these agencies are the most reliable tenants a REIT can have, this fact is undoubtedly positive for Office Properties.

On the other hand, as if the pandemic and the resultant “work-from-home” model were not enough, Office Properties is currently facing a strong headwind, namely the risk of an imminent recession. Inflation has proved much more persistent than initially expected, and hence the Fed is raising interest rates aggressively, in an effort to restore inflation to its long-term target of 2%. The aggressive interest rate raises significantly reduce the total amount of investments in the economy and thus the risk of an upcoming recession has greatly increased.

It is also important to note that the management of Office Properties was especially cautious in the latest conference call. It stated that tenants still hesitate to return to their offices while they evaluate the merits of a hybrid work environment. While some investors expect a swift return of employees to their offices, Office Properties expects the headwind from the “work-from-home” model to persist for the next several quarters.

Moreover, Office Properties has meaningful lease expirations in the upcoming quarters. More precisely, leases that generate 4% of its annual revenue are set to expire in the second half of this year and leases that generate 13.5% of its annual revenue are scheduled to expire in 2023. On the one hand, the REIT is likely to take advantage of high inflation and raise its rent rates in some of its properties. On the other hand, if a recession shows up in the upcoming quarters, it will reduce the negotiating power of the REIT with tenants.

Dividend

Due to the 44% plunge of its stock price this year, Office Properties is currently offering a nearly 10-year high dividend yield of 13.9%.

While the current yield is abnormally high, the stock has an adjusted FFO (“AFFO”) payout ratio of 65%, which provides a meaningful margin of safety for the dividend. On the other hand, investors should note that the stock has frozen its dividend for 15 consecutive quarters. This is a clear signal that the REIT is struggling to maintain its dividend.

The primary reason behind the absence of a dividend hike for three consecutive years is the leveraged balance sheet of Office Properties. Its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $2.5 billion, which is more than triple the market capitalization of the stock and 11 times the annual funds from operations and hence it is excessive. In addition, interest expense consumes 91% of operating income and the leverage ratio (Net Debt to EBITDA) stands at 7.1, far above the healthy range of 3.0-5.0.

Due to its high debt load, Office Properties is in the process of selling properties, in an effort to strengthen its balance sheet. The REIT expects aggregate sales proceeds of $100-$200 million this year and additional asset sales in 2023. The assets sales are likely to improve the balance sheet of the REIT, but they are also likely to take their toll on its FFO per unit in the upcoming years.

Despite its leveraged balance sheet, Office Properties is likely to maintain its generous dividend in the absence of a material recession, primarily thanks to its defensive business model, which involves reliable tenants and thus reliable cash flows. On the other hand, if a material recession shows up, it may force the REIT to slash its dividend in order to strengthen its financial position. Unfortunately for the shareholders, the risk of a recession has increased lately due to persistently high inflation, which has led the Fed to adopt an exceptionally aggressive stance.

Final thoughts

Office Properties is doing its best in the factors it can control but it is currently facing strong headwinds from a “work-from-home” model and the risk of an upcoming recession. The REIT has a solid business model, which involves reliable tenants, and a decent payout ratio. As a result, it can defend its 13.9% dividend even in the event of a mild recession. However, in the adverse scenario of a material recession, management is likely to decide to cut the dividend in order to enhance financial flexibility.

Be the first to comment