InfinitumProdux

Thesis

We highlighted in our previous article that Golden Ocean Group Limited (NASDAQ:GOGL) stock has likely bottomed even as a global recession drew closer. Accordingly, GOGL has outperformed the market since our update, as long-term buyers returned to stanch further selling downside.

Therefore, the market has gotten the battering in GOGL from its June highs absolutely spot on, as it anticipated Golden Ocean wasn’t immune from worsening macroeconomic headwinds.

But, as we have often highlighted: the market is forward-looking. Global freight rates have continued to come under pressure impacting both dry bulk and container shipping companies. Port congestion has also eased significantly, while global export momentum has also fallen.

China also emerged from its recent 20th CPC National Congress with no signs of easing its zero COVID restrictions, putting a dampener on investors expecting a policy pivot. Moreover, recent weaker-than-expected export data from China corroborates the thesis of a coming global recession, adding to the weak data from South Korea earlier in October.

The consensus estimates on GOGL have also been slashed well into FY24, as Street analysts revised their modeling, given significant macro weakness. Therefore, the previous optimism on Golden Ocean regaining its June highs has likely dissipated.

Leading container shipping company Maersk also issued a gloomy outlook as it revised its demand forecasts, anticipating “dark clouds” for container freight services.

We discuss why GOGL is at a critical juncture, with buyers needing to defend its September lows to sustain its long-term uptrend bias. Notably, the buying momentum has been robust at its critical defense line.

However, we need the market to demonstrate its conviction to spur a further re-rating of GOGL moving ahead. Nevertheless, we don’t expect GOGL to retake its June highs anytime soon, given a broad de-rating of the shipping industry.

Maintain Buy with a price target (PT) of $11.

Street Analysts Slashed GOGL Estimates Further

We gleaned that Wall Street has finally awakened to its overly optimistic forecasts as analysts slashed Golden Ocean’s estimates through FY24. Therefore, we urge investors to pay attention to price action as it had pointed to a significant topping action in June.

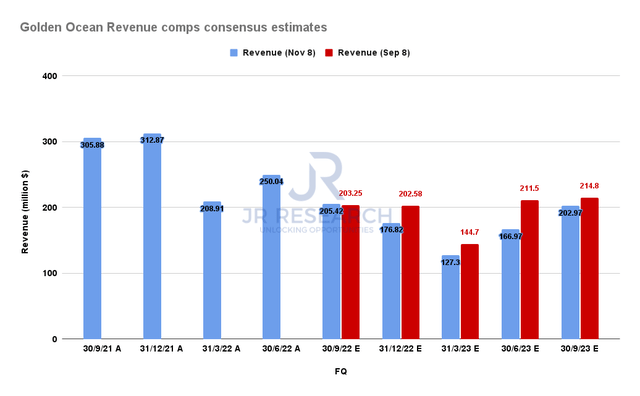

Golden Ocean Revenue comps consensus estimates (S&P Cap IQ)

As such, the consensus estimates from Q4 have been slashed markedly to reflect the worse-than-expected global macro outlook through FY24. Golden Ocean’s Q3 estimates have not been cut as the company had already secured substantial charter coverage which we highlighted in our previous article.

Therefore, we believe the market’s de-rating of GOGL from its June highs is justified to reflect significantly higher execution risks through the cycle.

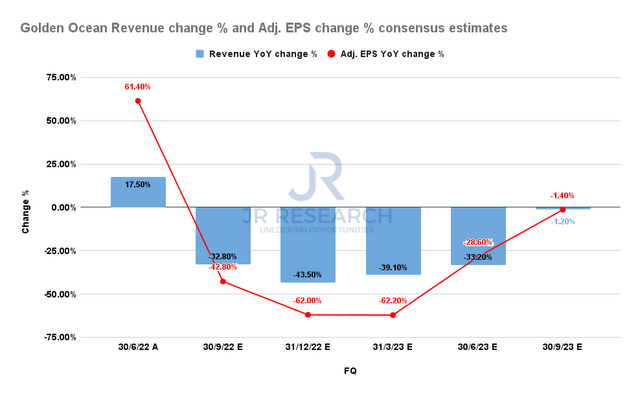

Golden Ocean Revenue change % and Adjusted EPS change % consensus estimates (S&P Cap IQ)

Accordingly, investors should expect Golden Ocean’s profitability growth to decline through H2’23 before recovering. The Street’s modeling likely suggests a relatively short-term, mild-to-moderate recession, in line with our base case.

Therefore, if the market anticipates a severe recession, it could overturn these estimates and render our base case invalid. Consequently, it could lead to further value compression even before the analysts could slash their estimates further (since the market is forward-looking).

We caution investors not to rule out such a scenario, even though it’s not a significant cause for concern for now. As such, investors are urged to exercise prudent capital allocation discipline to capitalize on potentially significant pullbacks if the market anticipates a severe recession occurring.

Is GOGL Stock A Buy, Sell, Or Hold?

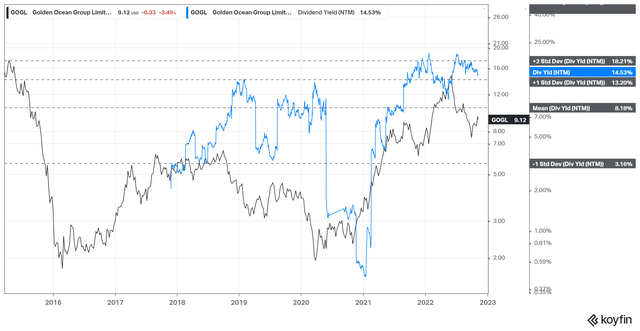

GOGL NTM Dividend yields % valuation trend (koyfin)

GOGL last traded at a NTM dividend yield of 14.5%, just under the two standard deviation zone over its all-time mean of 8.2%. We postulate that the market could force further value compression above that zone if it anticipates a severe recession.

For now, the current positioning is appropriate if management doesn’t cut its forward dividend guidance much more than what the Street has penciled in.

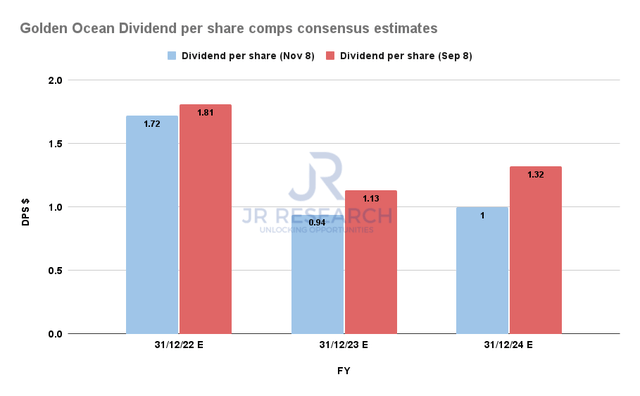

Golden Ocean Dividend per share consensus estimates (S&P Cap IQ)

As a result of the slashed earnings estimates, Golden Ocean’s forward dividend per share (DPS) projections have also been cut. FY22’s DPS has been reduced by 5%, while FY23’s DPS forecast has been cut by nearly 17%.

Given the battering from its June highs, we believe the market has reflected these uncertainties in its valuation. Also, lowering the bar for management to outperform in its guidance for Q3 earnings is constructive.

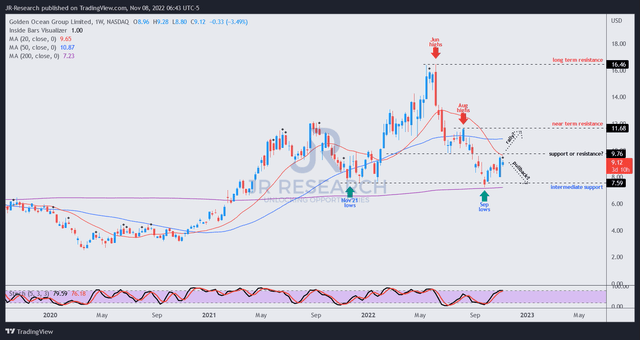

GOGL price chart (weekly) (TradingView)

As seen above, GOGL buyers defended its near-term support level at its September lows. However, with its momentum reaching overbought levels, investors can consider waiting for a pullback before adding further.

We postulate that GOGL needs to regain decisive control of its 20-week moving average (red line) to sustain its recovery from its September lows. With that, GOGL could see a rally toward its August highs before consolidating. However, investors need to be wary about adding above those levels, as we expect selling resistance to be robust.

Maintain Buy with a PT of $11.

Be the first to comment