liorpt/iStock via Getty Images

Golden Ocean Group (NASDAQ:GOGL) is now the largest listed owner of large-size dry bulk vessels, with an average age of approximately 6.4 years. Considering GOGL’s new and young vessels, we can expect to see the company will catch up with other dry bulk carriers soon and report better financial results in the future. However, recent geopolitical issues and macroeconomic policies affected the iron ore demand during the last few months. Notwithstanding a well-performed performance, my evaluation indicates that Golden Ocean is worth around $12 per share and thus, is a hold.

1Q 2021 highlights

In its 1Q 2022 financial results, GOGL reported total operating revenues of $265 million, compared with 1Q 2021 total operating revenues of $158 million, up 68%. GOGL’s net income increased by 421% to $125 million, or 62 cents per diluted share in 1Q 2022. The company reported an adjusted EBITDA of $149.4 million for the first quarter of 2022, compared with $54.6 million for the first quarter of 2022, up 174%. In 1Q 2022, the asset turnover of GOGL increased by 72% to 0.079, and its gross margin increased by 3700 bps to 39%.

“Throughout 2021, Golden Ocean actively grew and renewed its fleet, disposing of several older vessels and acquiring or placing orders for 25 modern vessels. The company is the largest listed owner of large-size dry bulk vessels, with an average age of approximately 6.4 years, including newbuildings,”

GOGL’s board of directors explained. Moreover, Golden Ocean has seven 85000 dwt Kamsarmax vessels on order, which are expected to be delivered in 2023. Thus, new and young vessels will improve Golden Ocean’s asset turnover and gross margin. The CEO commented that the main driver of SBLK’s growth will remain limited fleet growth and environmental regulations, which create a competitive advantage for the company.

The market outlook

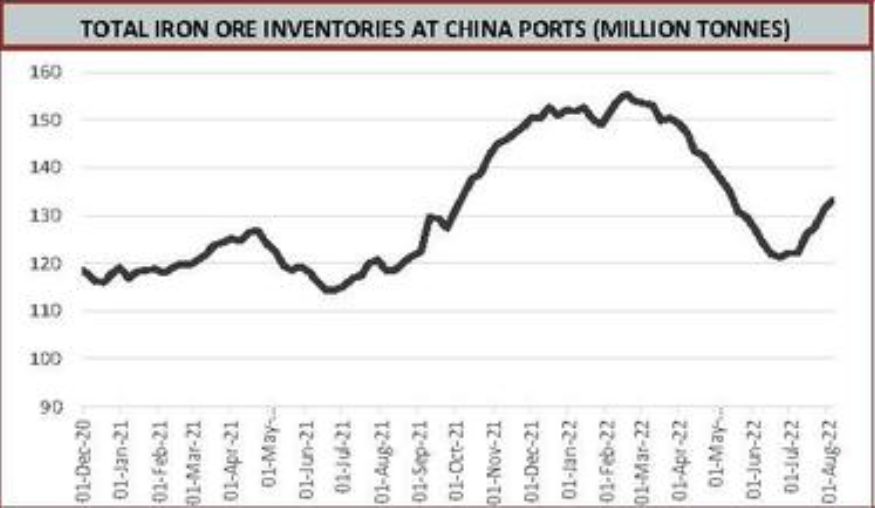

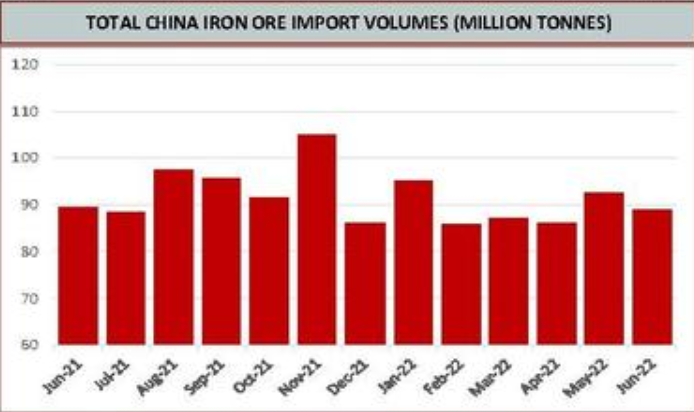

Due to COVID-19 lockdowns, China’s economy contracted by 2.6% QoQ in the second quarter of 2022. Because of geo-political tensions driven by the war in Ukraine, disruptions in China due to COVID-19, and increased interest rates in the United States & Europe to combat inflation, iron ore demand has been decreasing in the past few months. According to the MMI daily iron ore index report, published on 8 August 2022, total iron ore inventories at China ports increased from about 120 million tonnes on 1 June 2022 to around 132 million tonnes on 1 August 2022 (see Figure 1). On the other hand, total China iron ore import volumes increased from more than 90 million tonnes in May 2022 to less than 90 million in June 2022 (see Figure 2).

Figure 1 – Total iron ore inventories at china ports

MMI

Figure 2 – Total china iron ore import volumes

MMI

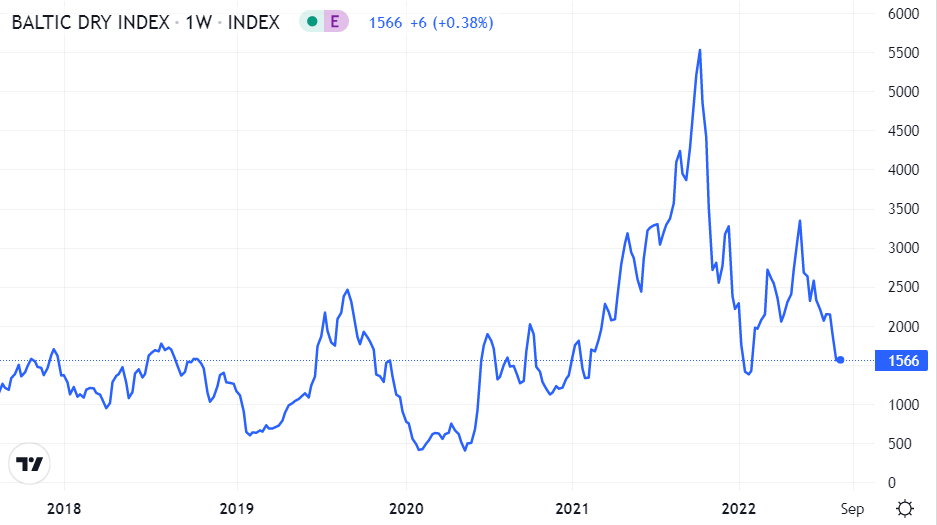

Moreover, Chinese rebar and hot-rolled coil production decreased in the last few weeks (see Figure 3). We can see that Chinese rebar and hot-rolled coil consumption in July 2022 are below their levels in July 2019, 2020, and 2021. Looking at the Baltic Dry Index, we can see that after a significant rise from the beginning of the year to mid-May, the index dropped by more than 50% to below 1600 (see Figure 4). Thus, the short-term outlook for the iron ore market is not as strong as six months ago.

Figure 3 – Chinese steel consumption and production

MMI

Figure 4 – The Baltic Dry Index

tradingeconomics.com

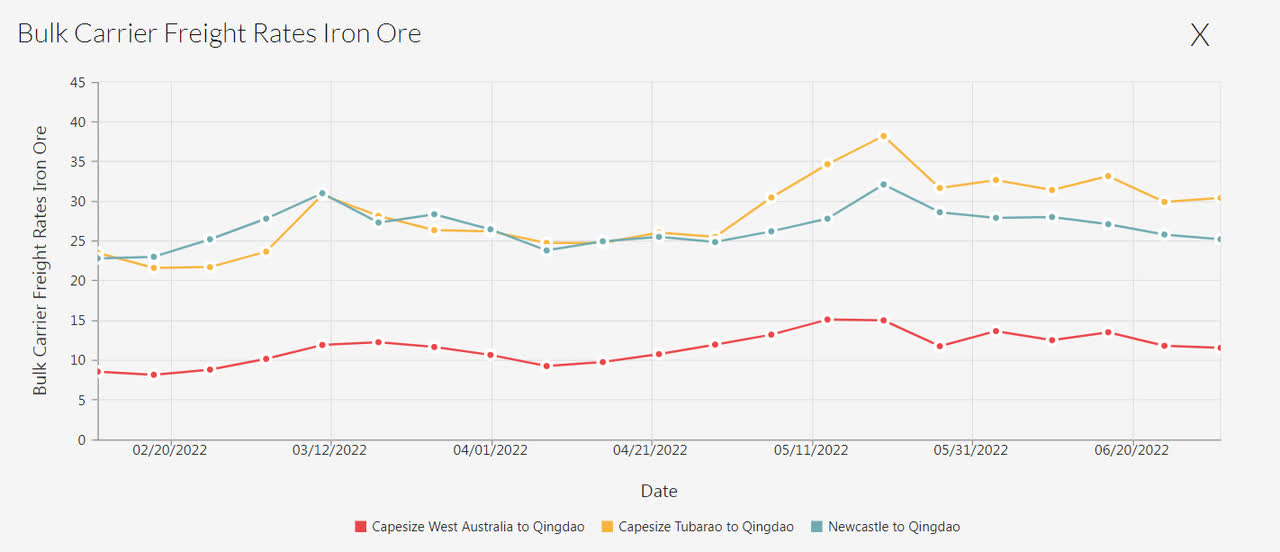

However, the long-term is different. According to a report by MMI, the investment in iron ore mining has increased rapidly. For example, from January to June 2022, the growth rate of investment in the ferrous metal mining and dressing industry increased by 76.1% year on year. Also, Despite the weak outlook for iron ore demand in the following months, on average, bulk carrier freight rates in July 2022 were higher than in the first quarter of 2022 (see Figure 5). Furthermore, as a result of environmental regulations, increased shipbuilding costs, and limited shipyard capacity, global fleet growth will be slow in the upcoming years. Based on the information on the dry bulk market and the company’s quarterly financial reports, I estimate a 2Q 2022 TCE per day of $27800 for the company. Also, I estimate a 2Q 2022 adjusted EBITDA of $170 million for Golden Ocean. Finally, I estimate a TTM adjusted EBITDA of $793 million for the company in the third quarter of 2022. However, I estimate the company’s full-year 2022 adjusted EBITDA to be below $650 million.

Figure 5 – Bulk carrier freight rates for iron ore

ssyonline.com

GOGL performance outlook

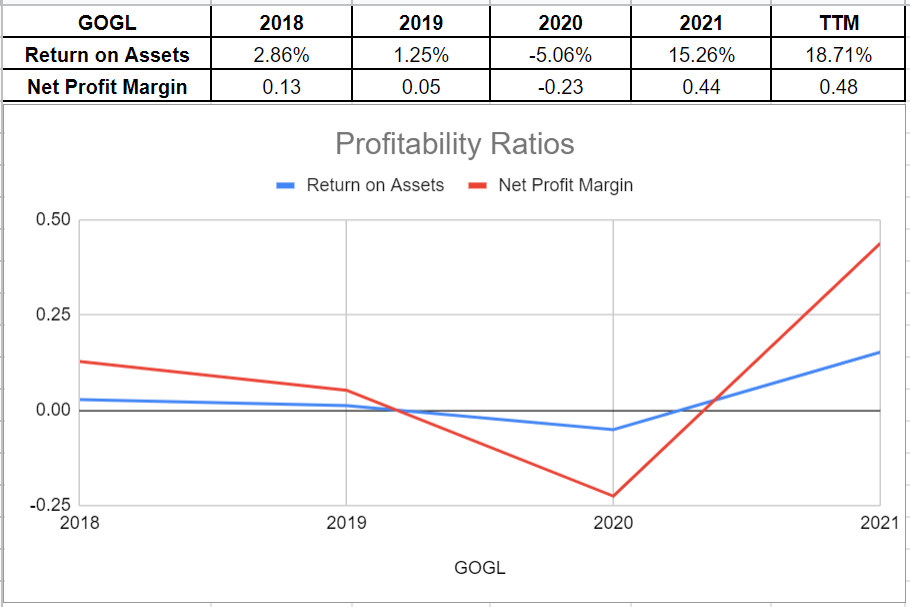

To show a picture of the company’s profitability, GOGL’s net profit margin showed impressive growth and sat on 0.44 at the end of 2021 compared with its amount of (0.23) in 2020 when the pandemic started. Also, its TTM amount increased by 9% to 0.48. Moreover, across the board of return on assets, the ROA ratio in TTM shows that 18.7% of the company’s net earnings is related to its assets. Golden Ocean’s return on assets boosted impressively during 2021 and sat on 15.2% versus its previous level of (5.06) % at the end of 2020. Both net profit margin and ROA amounts in TTM are well above the amounts before the pandemic started. Thus, Golden Ocean’s profitability ratios provide a good perspective of its ability to generate income relative to the revenue and assets (see Figure 6).

Figure 6 – GOGL profitability ratios

Author (based on SA data)

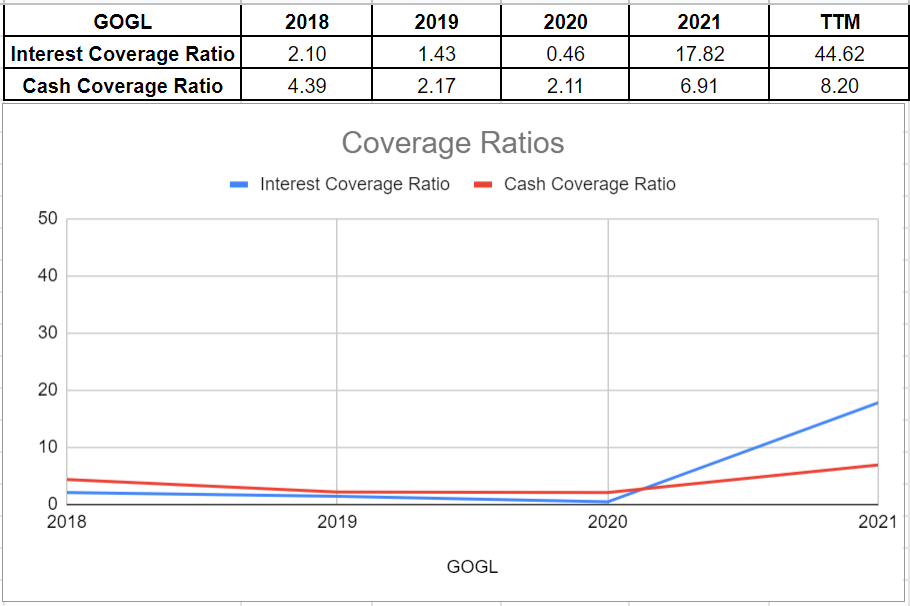

Moreover, we can analyze GOGL’s coverage ability across the board of its interest-coverage ratio and cash-coverage ratio. Its ICR in TTM indicates that 44 times the company is able to pay its interest expenses on its debt with its operating income. GOGL’s interest coverage ratio in TTM has improved impressively compared to its amount of 17.82x at the end of 2021. Also, as a conservative metric to compare the company’s cash balance to its annual interest expense, GOGL’s cash-coverage ratio in TTM has increased to 8.20x versus its previous level of only 6.91x at the end of 2021, rising 18%. In a word, Golden Ocean’s coverage ratios represent that the company is able to pay its obligations easily (see Figure 7).

Figure 7 – GOGL coverage ratios

Author (based on SA data)

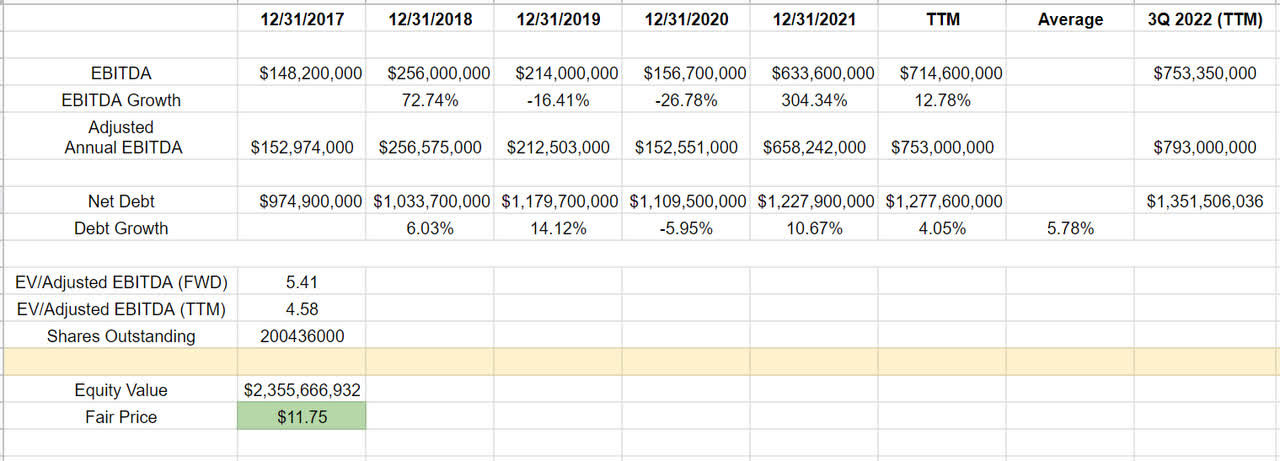

GOGL stock valuation

To estimate Golden Ocean’s fair value, I investigated its EBITDA growth during the last five years. The company’s EBITDA grew impressively in recent years, but in 2020 when the pandemic started. Also, its net debt increased by over 5.75%, on average, in the previous years. Based on my estimation, GOGL is expected to generate an adjusted EBITDA of circa $793 million in 3Q 2022 (TTM). According to the net debt in TTM and EV/EBITDA ratio in TTM, Golden Ocean’s fair value is around $12 per share. The stock thereby is a hold (see Table 1).

Table 1 – GOGL stock valuation

Author

Summary

In sum, analyzing the TCE rate and Golden Ocean’s overall performance during the previous quarters, I estimate a 3Q 2022 (TTM) adjusted EBITDA of $793 million for GOGL. Moreover, notwithstanding a relatively high net debt amount, Golden Ocean’s very healthy profitability and coverage ratios indicate that the company can generate income relative to its revenue and assets and thus can pay its obligations easily. Furthermore, I do not expect the iron ore market to be as strong as in the first half of 2022. All was said and done; I estimate that the stock is worth around $12 per share. Hence, I believe that it is a hold.

Be the first to comment