Falcor

Investment Thesis

Gold Fields Limited (NYSE:GFI) is a gold mining company headquartered in South Africa with 2.25Moz in gold equivalent production per year and $1,381/oz in AISC (all-in sustaining costs).

In addition to organic development by GFI, there are significant secular tailwinds for gold, which we discuss in our article on the modern gold market. Gold reached a historic all-time high of $2,122/oz on December 3. Gold has been a historically stable value asset, one of the few options now that Treasuries have fallen out of favor internationally, hinting at its potential to sustain high prices.

GFI has experienced significant headwinds with above-inflation labor cost increases and decreases in production. However, GFI has a significant low-AISC expansion opportunity with the Salares Norte Project and has recently entered JVs in Ghana and Canada. GFI’s strategic expansions, future portfolio actions, and strong financial health, combined with the favorable dynamics of the gold market, position it as a strong dividend payer with modest growth.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/EPS (Price/EPS)

EFV = E25 EPS X P/E = $1.40 X 13.2 = $18.48

Analyst consensus puts the E25 EPS at $1.33, however, we feel that gold prices being sustained for longer a higher estimate for the future. Similarly, the consensus P/E is around 10.0, which we feel is a low multiple given the peer group and broader mining market conditions.

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

2.7 |

2.6 |

2.5 |

|

Price-to-Earnings |

12.4 |

13.2 |

12.3 |

Portfolio Overview

|

Quarter ending September |

AISC (all-in sustaining costs) ($/Oz) |

Production (Gold Equivalent kOz) |

As a % of total Adjusted Free Cash |

|

Americas |

$1,762 |

51.7 |

15% |

|

West Africa |

$1,485 |

185.4 |

24% |

|

Australia |

$1,272 |

244.1 |

41% |

|

South Africa |

$1,309 |

80.7 |

20% |

|

Total |

$1,381 |

546 |

Adjusted FCF is equal to operating cashflow less capex, capital leases, and environmental payments.

Production is concentrated in Australia and Ghana, making up most of the production in the portfolio. While generally more expensive on average, these areas are geopolitically far more stable, with high safety standards and limited labor disputes. South Africa had some difficulties with weather-caused ground conditions, reducing full-year guidance by 5%. The strongest area was Peru, with a 4% increase in production due to higher grades recovered.

The Americas’ AISC has spiked following a significant uptick in operating expenditures associated with the early stages of production for the Salares Norte project. Salares Norte is the largest fully owned development asset and is expected to see its first gold in April 2024. Mining operations have already begun, with an estimated 520kOz of gold stockpiled in 2.3 million tons of ore. However, the mill is the final uncompleted step.

|

AISC (all-in sustaining costs) ($/Oz) |

Yearly Production (Gold Equivalent kOz) |

|

|

2024E |

$700 |

220-250 |

|

2025E |

$700 |

600 |

|

2024E-2029E (Prime Years) |

$700 |

500 |

|

2024E-2033E (Full Life) |

$780 |

355 |

The $700/oz AISC estimate would make Salares Norte one of the cheapest gold mining operations in the world.

Expansion

With the conclusion of the full $1.2 Billion expenditure associated with the Salares Norte mine, we expect a reduction of capital expenditure over the short term. However, there are two further major development projects that, once approved, will likely increase capex spending.

In March of 2023, GFI announced the Tarkwa expansion JV with AngloGold Ashanti in Ghana, with ongoing negotiations with the Ghanaian government. The current Tarkwa mine is reaching the end of its life, with gold output decreasing 13% yearly due to lower yield. The expansion JV could become the largest gold mine in Africa, significantly expanding output and lowering AISC. Preliminary reports from GFI expect an AISC of $1,000/oz for the first 5 years, with over 18 years of mine life.

The Windfall project is a new Canadian development and a 50-50 JV with Osisko Mining. GFI has paid the initial payment of $222 million, with an additional $34 million in pre-construction costs. In May of 2023, GFI submitted its first environmental impact assessment for approval by the Canadian government. This will likely receive preliminary approval by the quarter ending June 2024, with full approval for construction by the end of 2024. Once approved, GFI will pay another $220 million and split the future construction costs with Osisko, which is estimated to be $415 million for GFI. Initial production is expected in 2026, with AISC around $800/oz, with 10 years of mine life.

Further limited expansion has been considered in non-gold areas, such as copper. GFI has acquired a 20% stake in Chakana Copper, a new miner in Peru with two development projects. However, whether GFI intends to open a copper operation is unknown.

Portfolio Optimization

GFI is considering portfolio optimization actions. According to GFI, Cerro Corona in Peru is beginning to see lower production associated with lower-grade material extraction. At the current production levels, Cerro Corona will close in 2031, with a ramp-down of output beginning in 2025. With the Salares Norte mine reaching full production around the time of ramp-down, trimming the Cerro Corona position is on the table.

Additionally, with the significant investment in the Tarkwa mine, the sister Damang mine may be sold off to consolidate Ghanaian operations. We believe that this is the most likely divestiture to happen in 2024. On December 21, GFI announced its intention to sell its 45% stake in the Asanko mine for $65 million in initial cash compensation and an additional $85 million through 2026. This transaction also includes an additional $20 million in Galiano stock.

Risk

In the Australian and South African operating areas, GFI has struggled to find and retain skilled labor, causing above-inflation expense increases. However, we do not expect the pressure associated with this to be maintained over the long term as gold prices have increased.

Salares Norte was over capex budget and failed to open on time. Initially, there was an estimated cost of $860 million, and production in March of 2023. This grew to $1.2 billion in costs with a delayed opening of April 2024.

The mining world has recently been full of labor disputes, with massive strike actions affecting competitors’ operations in South Africa and Mexico. Additionally, adverse weather and safety concerns caused mine closures for GFI during 2023. Mining is unpredictable, with many surprises across a breadth of risks: labor, regulatory, costs, mine quality, pricing, and weather.

A top priority for GFI is a significant reduction in the environmental impact of its mining operations. Environmental impacts of mining extend beyond energy consumption through tailings, the toxic after-product of stripping gold from rock. This includes linking credit revolvers and loans to ESG targets.

Outlook

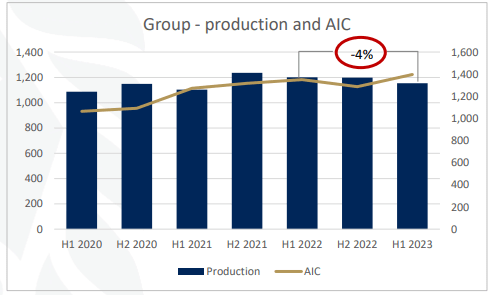

GFI

Full 2023 production is expected to be between 2.2-2.3 Moz, with a full-firm AISC in the $1,300 area. This represents a small yearly production shrinkage and a significant cost increase. However, we expect a recovery in 2024 production as Salares Norte comes online, with divestitures in the year potentially helping the company-wide AISC move back in line with the historical trend.

|

Quarter ending September |

Year-over-Year Change |

|

Production (excluding royalties) |

-9.2% |

|

Revenue (excluding royalties) |

13.2% |

|

AISC (all-in sustaining costs) |

30.2% |

Despite significant expansion efforts and inflationary pressures, GFI has a debt-to-EBITDA of 0.48x and a covered ratio of 27.8x, making it one of the strongest balance sheets in the sector. While replacing assets and new acquisitions has slowed down in recent years, GFI still has a solid free cash base and a low debt level that would allow it to expand with debt. However, GFI states it is unlikely to engage in any major M&A activity like the ill-fated Yamana deal. Increases in gold prices and global production have made the economics of major M&A in the area less appealing.

The current dividend yield is 3.08%, but we expect the dividend to grow to $0.48 by 2025, which would be a 3.7% yield on the current price. As Salares Norte comes online and other JV projects begin to produce, earnings are expected to increase meaningfully, likely resulting in a dividend increase.

GFI’s outlook is bolstered by its potential for margin expansion, particularly with the Salares Norte mine set to become one of the cheapest gold mining operations in the world and two JVs in geopolitically stable areas. In conclusion, with its strategic expansions, robust financial health, and alignment with favorable market trends, GFI is well-positioned for both dividend yield and capital appreciation.

Be the first to comment