alvarez

On Thursday, August 11, 2022, liquefied natural gas tanker and platform operator Golar LNG Limited (NASDAQ:GLNG) announced its second quarter 2022 earnings results. The initial headline numbers were admittedly not particularly impressive as the company missed the revenue estimates of its analysts despite posting a year-over-year revenue increase. However, as I have pointed out in previous articles, particularly this one, Golar LNG is going through a fairly tremendous change in its business model as it slowly migrates away from being a tanker operator and instead focuses on its floating liquefaction platforms. This is perhaps a more stable and ultimately profitable business model over the long term as the market for liquefied natural gas will likely grow substantially going forward. We can consider that these results were overall quite positive, although Golar LNG does still have one or two issues that it needs to resolve as it progresses with its transformation.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Golar LNG’s second quarter 2022 earnings report:

- Golar LNG reported total operating revenues of $67.227 million in the second quarter of 2022. This represents a slight 2.95% increase over the $65.303 million that the company reported in the prior-year quarter.

- The company reported an adjusted EBITDA of $100.952 million during the reporting period. This compares very favorably to the $89.695 million that the firm reported in the year-ago quarter.

- Golar LNG sold the FSRU Golar Tundra for $350.0 million and the Golar Arctic tanker as a converted FSRU for €269.0 million.

- The company managed to reduce its contractual debt to $1.0 billion at the end of the quarter.

- Golar LNG reported a net income of $230.032 million in the second quarter of 2022. This represents a 51.21% decline over the $471.434 million that the company reported in the second quarter of 2021.

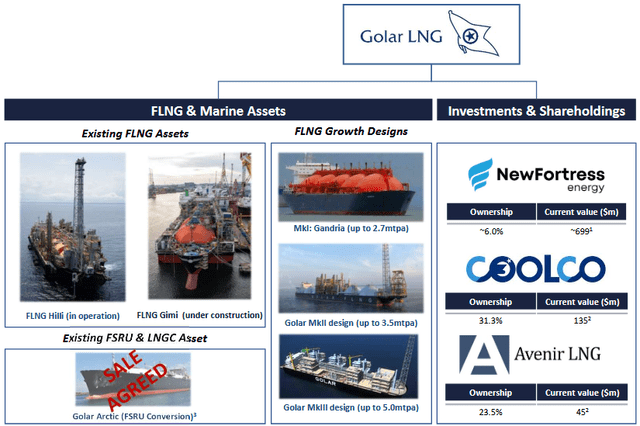

As stated in the introduction, Golar LNG has been steadily working to transform its business away from the operation of liquefied natural gas tankers. To this end, Golar LNG formed an entity called CoolCo to acquire all eight of the tankers that the company had on its books. During the second quarter, CoolCo completed this process by purchasing the two remaining liquefied natural gas carriers that Golar LNG owned at the start of the quarter, Golar Ice and Golar Kelvin. This brings CoolCo up to eight owned carriers. Although this transaction does officially take Golar LNG out of the liquefied natural gas tanker business, it is still active in it to a degree. This is because Golar LNG owns 41.3% of the outstanding common stock of CoolCo. In fact, Golar LNG owns stock in a few other companies:

As we can see though, the only company in which its investment is valued at more than $500 million is New Fortress Energy (NFE), which owns liquefied natural gas terminals, natural gas power plants, and other natural gas infrastructure. However, once the agreed-upon sale of the Golar Arctic is completed, Golar LNG’s primary business will be owning and operating floating liquefaction plants. It is, in fact, not inconceivable that the company will sell off its investments at some point and focus solely on this business. This is certainly not a bad business to be in.

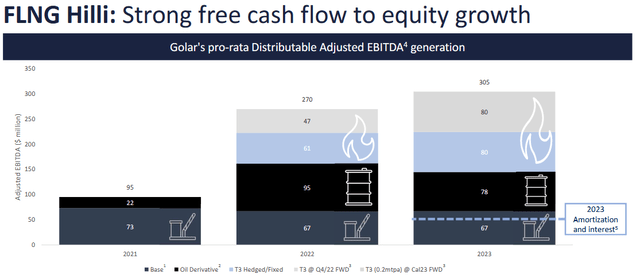

As stated in the introduction, the operation of these floating liquefaction plants is overall a very stable business model for the company. This is because these platforms are contracted to major energy companies, such as BP (BP), under very long-term contracts. In fact, Gimi’s contract is twenty years in length. The way that these contracts work is that the customer pays a base fee every quarter and an additional fee that is based on energy prices. As is the case with many companies whose cash flows depend on energy prices, Golar LNG uses hedges in order to better project and protect its cash flows from the inevitable fluctuation that would otherwise result from fluctuating energy prices. Naturally, the hedges that the company can get are going to result in more attractive cash flows when energy prices are high. This allowed Golar LNG to secure hedges for 50% of its exposure to the energy price-linked payment under this contract back on August 9 that guarantee that Hilli, which is the company’s only operating unit, will generate an additional $80 million on top of the base payment. If we assume that the futures price of natural gas remains static then the unit will see substantially higher cash flow in 2023 than today. As might be expected, the level that we are seeing today is a significant improvement over 2021:

At first glance, one might wonder why I stated that the operation of the floating liquefaction platforms is a stable business when the cash flows vary somewhat based on resource prices. It is due to the fact that the long-term contracts include a base rate that Golar LNG will always receive regardless of energy prices. This is pretty much the only thing that Golar LNG was receiving from the unit back in 2020.

Golar LNG is positioned to deliver very tremendous growth in the near future. This is because the company currently only has one operating liquefaction plant that is operating and making money. However, Golar LNG does have another plant that is currently under construction. This unit, the Gimi, is scheduled to be complete and operational around the end of 2023 so we should begin to see its impact on the company’s results. That impact is expected to be tremendous as the unit is expected to generate an adjusted EBITDA of approximately $151 million annually. This is admittedly less than the $305 million that Hilli is expected to generate this year but there are a few factors to consider here. The first is that Golar LNG only owns 70% of the Gimi but it owns 100% of the Hilli so its proportional share of its cash flow will be lower. This lack of full ownership was part of the agreement with Keppel (OTCPK:KPELF) to delay the launch of the unit at the request of BP. In addition, it is uncertain whether or not the contract that Himi will be operating under has a similar energy price cash flow component to the one for Hilli.

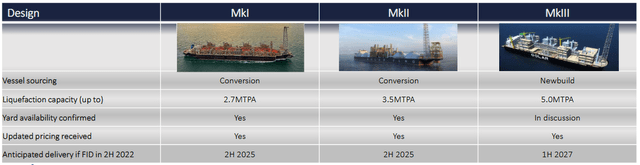

As we can see here, Golar LNG is planning to potentially construct three more floating liquefaction plants:

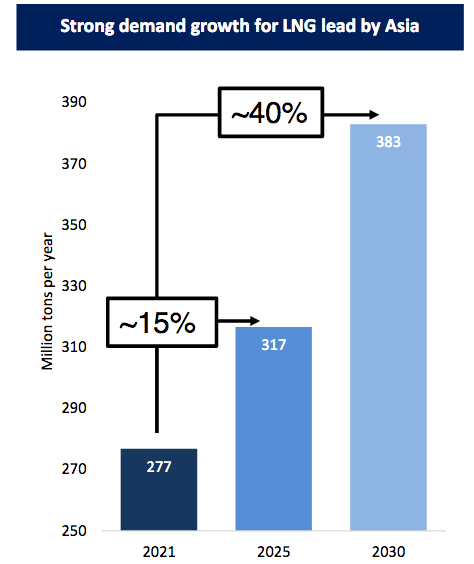

It is important to note that Golar LNG has not made a decision about whether or not to proceed with the construction of any of these units. This decision will ultimately depend on whether or not it can secure a contract for them. This makes a great deal of sense since it would be a poor decision for the company to spend a tremendous amount of money to construct a floating liquefaction plant that nobody wants to use. However, Golar LNG does suggest that it is not expecting to have trouble securing such a contract and there are some reasons to believe that the company is correct about this. This is because the demand for liquefied natural gas is expected to surge substantially. There are a few reasons for this, one of which is environmental as various Asian nations work frantically to improve their air quality and solve their smog problems. The solution to this is natural gas but these countries do not have the ability to produce the gas that they need to meet their energy needs on their own. The natural solution is to import it and the only way to transport natural gas over water is to convert it into a liquid. As a direct result of this, Asian liquefied natural gas demand is expected to increase by approximately 40% by the end of the decade:

Golar LNG

In addition to this, Europe has been increasing its demand for liquefied natural gas. This is partly because of the sanctions against Russia, which has resulted in Russia reducing the supply of gas to the continent. As I pointed out in a recent article, Europe has increased its liquefied natural gas imports by 51% so far this year compared to the same period of last year. All of this will require much greater liquefaction capacity than what exists today and that is exactly what Golar LNG is marketing with these platforms.

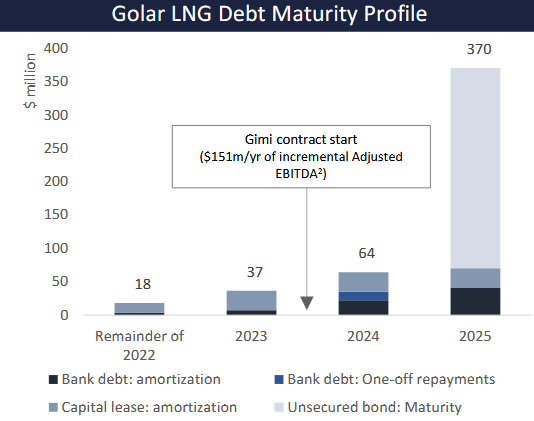

Fortunately for investors, Golar LNG has substantially improved its balance sheet in order to actually be able to finance these projects. As stated in the highlights, Golar LNG has managed to reduce its contractual debt to $1.0 billion at the end of the quarter compared to the $1.7 billion that it had at the start of the second quarter of 2021. This was accomplished through a few actions that the company took during the second quarter of 2022 including the sale of its tankers to CoolCo and a sale of some of its shares of New Fortress Energy. However, perhaps even nicer is that Golar LNG has essentially no near-term debt:

Golar LNG

As we can clearly see, the overwhelming majority of Golar LNG’s debt matures in 2024 and especially in 2025. The reason why this is appealing is because of Gimi starting operation in late 2023. We have already discussed the powerful impact that this unit coming online will have on Golar LNG’s cash flow. Thus, Golar LNG should be in a much stronger position to handle its debt as it matures than it would be with only the Hilli operating. Thus, things look fairly bright in this respect.

In conclusion, the company’s most recent results certainly show its transformation away from its former status as an operator of tankers and into an operator of floating liquefaction plants. This is a much more stable business model than the company’s previous dependence on shipping day rates, although it does have some exposure to energy prices. The company has largely addressed some of the biggest concerns that many have expressed about its debt load and appears to be very well positioned for growth. There appears to be a lot to like here.

Be the first to comment