Editor’s note: Seeking Alpha is proud to welcome Ted Littlefield as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Pgiam/iStock via Getty Images

Gogo Inc. (NASDAQ:GOGO), the inflight internet company, has evolved since its 2020 sale of its commercial aviation business to Intelsat. The commercial aviation business was a money-loser, and unburdening itself of that line left the company more cash rich, and profitable. The company is undervalued, and continues to generate large amounts of free cash flow (FCF) and has an attractive runway of growth ahead of it.

The Economics of Inflight Internet

In a groundbreaking study by the London School of Economics and Political Science (LSE), Sky High Economics, and British satellite telecommunications company Inmarsat, the LSE estimated that inflight internet will be a $130 billion global market by 2035, providing airlines with an additional $30 billion in incremental revenue. The vast majority of planes do not have inflight internet, whether they are commercial or business flights, and even when they do have inflight internet, the quality of the connection is often greatly inferior to what passengers would experience on the ground. The LSE and Inmarsat believe that inflight internet will be ubiquitous by 2035.

Not only are passengers increasingly needful of inflight internet, but airlines are realizing that inflight internet is an additional source of revenue. Thus, external and internal forces will drive adoption of inflight internet. Although the study was conducted in 2017, the basic outlines are probably more true today, in the aftermath of the pandemic: airlines have lost a lot of revenue thanks to the pandemic, and have to find more ways to attract passengers and get them to spend more money per flight.

The ability to earn these incremental revenues will depend on operators and owners making use of the opportunity provided by long haul flights to offer passengers premium content on their e-commerce platforms. Consequently, the biggest beneficiaries of this trend toward inflight internet will be full service carriers, rather than low cost carriers, with full service carriers estimated to earn $19 billion of the $30 billion generated.

Owners and operators of aircraft will be able to use more advertising, content and packages to drive revenue growth, once inflight internet is established. Inflight internet has the possibility to create a new market for airlines to make them much more profitable. The opportunities for partnerships are numerous. For instance, T-Mobile (TMUS) provides service for their subscribers on Gogo-enabled aircraft. This is an example of how inflight internet can drive take rates. Indeed, the Seamless Air Alliance believes that inflight internet could be such a powerful force for owners and operators as to make the business of aviation regularly profitable.

Gogo’s Role in the Inflight Internet Market

Gogo provides inflight internet services to the business aviation market. Business aviation refers to the use of general aircraft for business purposes. The company’s end users are largely aircraft owners and operators. Gogo sells directly to all the Original Equipment Manufacturers (OEM). The company also has a global distribution network servicing its aftermarket. The company also serves fractional jet operators, charter operators, corporate flight departments and individuals owning aircraft. Gogo serves, then, the market segment which is most likely to experience a rise in demand for inflight internet. With the shift to digital, there will come a time when it will become unthinkable for a business flight not to have inflight internet. Gogo is placed as the best winner in domestic business aviation, given that it holds about 90% of the domestic business aviation market.

It has to be emphasized that although commercial aviation does not have as great an incentive to shift to the highest quality inflight internet, with many airlines using old technologies, business aviation is very different. There has not yet been an upper bound found for what you can charge passengers. An employee traveling on business is not going to be told by his employer that he can’t spend too much on inflight internet, because that is a vital part of his work. Gogo, then, can drive up prices for its clients. Prices, indeed, have been rising.

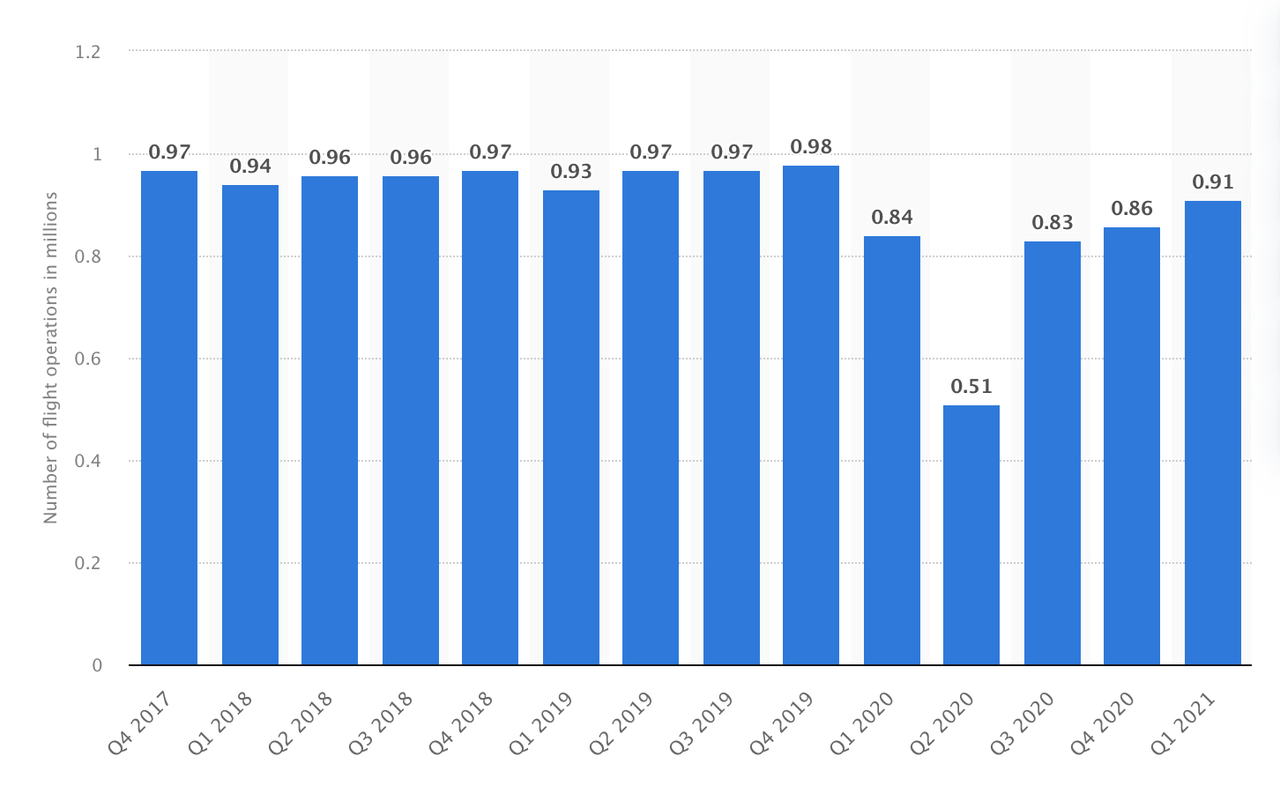

Over the last three years, business aviation has remained relatively stable. However, there was an obvious drop off during the first and second quarters of 2020, as data from Statista, which shows the number of flight operations in the United States, reveals.

Source: Statista

Gogo enjoys immense advantages in the industry, thanks to its dedicated air-to-ground (ATG) network, and inflight systems of proprietary software and hardware. In addition, Gogo has the exclusive license to 4MHz for ATG use in the United States and Canada. The company has recently deployed its 5G network to serve its market.

According to the company’s Gogo’s 2021 annual report, Gogo’s service provision on business aircraft generated around 75%, 78% and 72% of the company’s revenue, for the years 2021, 2020, and 2019. A meaningful portion of service revenue is recurring, emanating from subscription agreements in which customers pay Gogo between $100,000 and $250,000, for Gogo’s system and then a monthly fee for use of the service. The rest of the service revenue is from fractional or charter operators. Subscription agreements are typically for a period of a year.

This ensures that Gogo gets a highly predictable recurring income on top of the initial investment. Although there is a risk that customers will terminate the agreement, and, on paper, they are free to do so, “at will,” the reality is that there is a lot of customer capture. It is very difficult to move from service provider to service provider, and, as long as Gogo provides a threshold service, it’s highly unlikely that customers would leave Gogo.

This is especially true when you consider the economics of the aviation industry: profits, when they exist, are often razor thin, and so, there is not so much space in the budget to shift service providers and assume the associated capital costs of doing so. Gogo does not give any customer retention figures in its annual report, but warns in its risk factors discussion that investors must be aware customer retention may materially decline. I interpret that to mean that this has not, in fact, yet happened. We can therefore assume that switching costs are very high.

In total, the company serves 6,400 business aircraft, with 3,900 under Gogo Biz, its legacy ATG systems; and 2,500 through its AVANCE platform, through which multiple spectrum frequencies and networks can be used. The AVANCE provides 4G and 5G services. New installations are mostly on AVANCE. The majority of planes on its legacy ATG systems are expected to upgrade to AVANCE (either through its L5 or L3 systems), which will allow customers to enjoy a superior inflight experience and generate greater revenues for Gogo.

Gogo’s Growth Opportunity

Inflight internet will grow as a function of the growth in demand for business aviation travel. One key indicator of this is the growing demand for private jets since the end of the lockdown period, which has been described as “unprecedented.” With the growth in the number of business travelers in the world, and of the wealth of existing business travelers, there is a growing cohort of people who need private jets. In addition, many firms have started to shift from owning aircraft to sharing the costs with other firms. Other business travelers are opting to charter jets, purchase jet cards, use brokers, or fly on empty-leg flights. In a word, the market for business aviation is growing.

As private jet travel becomes more accessible, demand for inflight internet is growing. Business travelers demand a greater level of service than that offered on commercial flights, and this means, as we discussed above, having inflight internet. Inflight internet is increasingly an expectation even for commercial flights, and more so for business aviation, whose customers have the resources to get it. According to the Jet Card Report 2021/22, 32% of business aviation flyers need inflight internet, and 39% say they want it if possible. Inflight internet grows in demand as flights grow in length.

Gogo estimates that, of the 24,100 business aircraft in North America, just 30% have inflight internet, and of the 14,600 business aircraft in the rest of the world, just 6% have inflight internet. If we assume that the future is one of inflight internet ubiquity, then we are talking about providing about 70% of existing business aircraft in the United States with inflight internet. That is a huge market opportunity for Gogo, the predominant service provider in the industry.

Growth will come from existing qualifying aircraft adopting solutions such as those provided by Gogo, and from new aircraft fitting them on. Ultimately, it will be very hard to justify not having inflight internet on a domestic business aviation aircraft. As the world’s largest provider of inflight internet for the business aviation market, Gogo is likely to see a lot of the value created from this shift in business aviation.

As inflight internet becomes an essential feature of flying, Gogo will become part of business aviation’s digital infrastructure and it is likely to become more capital efficient. To date, Gogo has no serious rival in the ATG market. The only competition to Gogo’s ATG network are satellite-based systems in which signals are transmitted from satellites. These invariably provide inferior inflight internet, and, as time goes on, customers will demand a higher quality of inflight internet, shifting demand even more toward Gogo. Again, we must remember that operators and owners can extract more value from their airplanes by improving the quality of inflight internet, and therefore, the market is unlikely to shift toward Gogo’s rivals.

Financial Performance

Since 2019, Gogo has grown revenue from over $308 million to $335.72 million in 2021. In 2019, Gogo made a loss of $146 million. The impact of the 2020 sale of its commercial aviation business, Gogo has gone from an unprofitable business, to one which registered a profit of nearly $153 million.

Typically, there is an inverse relationship between asset growth and future returns and this is reflected in the company’s results. Assets in 2019 were $1.2 billion, but this has declined to nearly $650 million in 2021. The company’s liabilities have fallen from $1.6 billion to nearly $970 million.

The company earned a return on invested capital (ROIC) 4.5% in 2021. This is a very low ROIC, but it is the largest ROIC that the company has ever earned. Again, this is due to the company’s 2019 sale of its commercial aviation business.

Gogo earned FCF of nearly $58 million in 2021. Although the company earned a similar FCF in 2019, it has largely returned a negative FCF throughout its history. The sale of its commercial aviation business is likely to make earning a positive FCF a feature of the company’s returns.

Risks

The international market is the most challenging for Gogo given the absence of a global ATG system, or one which can cover a large market. The challenges of creating an ATG system that can cover those 14,000 business aircraft across the world makes the market much more competitive for Gogo. So the bulk of Gogo’s focus remains on the domestic market.

The biggest growth in the inflight internet market will come from the Asia-Pacific region, and Gogo and other peers have not found a way to replicate the advantages that come from operating within a single country like the United States, with lots of business flights. Even within the United States, there remain technological challenges in the way of achieving inflight internet. The biggest risk is that the company fails to overcome the technological limits that have so far challenged the industry; this will limit its growth globally. These technological challenges are more resolvable within the unique ecosystem of the United States.

Valuation

With a FCF of nearly $58 million in 2021, Gogo has a FCF yield of 2.33%, which is broadly in line with 10-year Treasuries. The company has a P/E ratio of 11.35 compared to a P/E ratio for the S&P 500 of 20.84. In addition, according to Morningstar, the industry’s P/E multiple is 17.91. The market leader, then, is trading at a cheaper valuation than the industry. These two metrics show that the company is trading cheaply.

Conclusion

Gogo’s 2019 sale of its commercial has been vital in changing the company’s fortunes. The company’s ROIC will continue to move upwards as the company benefits from an increasingly asset-light business. With growing demand for inflight internet, Gogo, as the dominant domestic inflight internet service provider, will be a huge beneficiary of these secular trends. The company is trading cheaply and will experience an improving stock performance in future years, reflecting upward ROIC movements.

Be the first to comment