Spencer Platt/Getty Images News

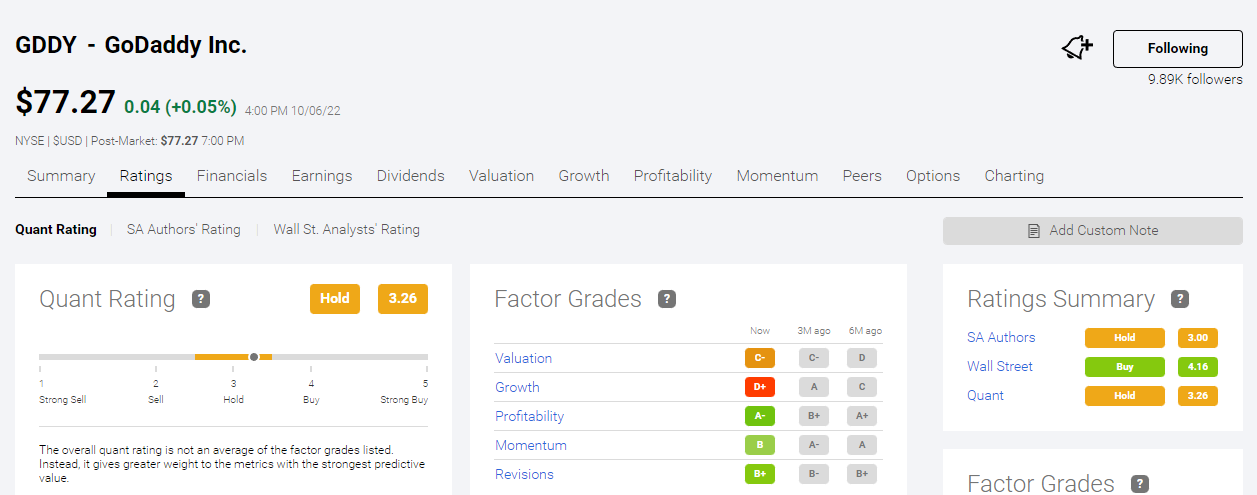

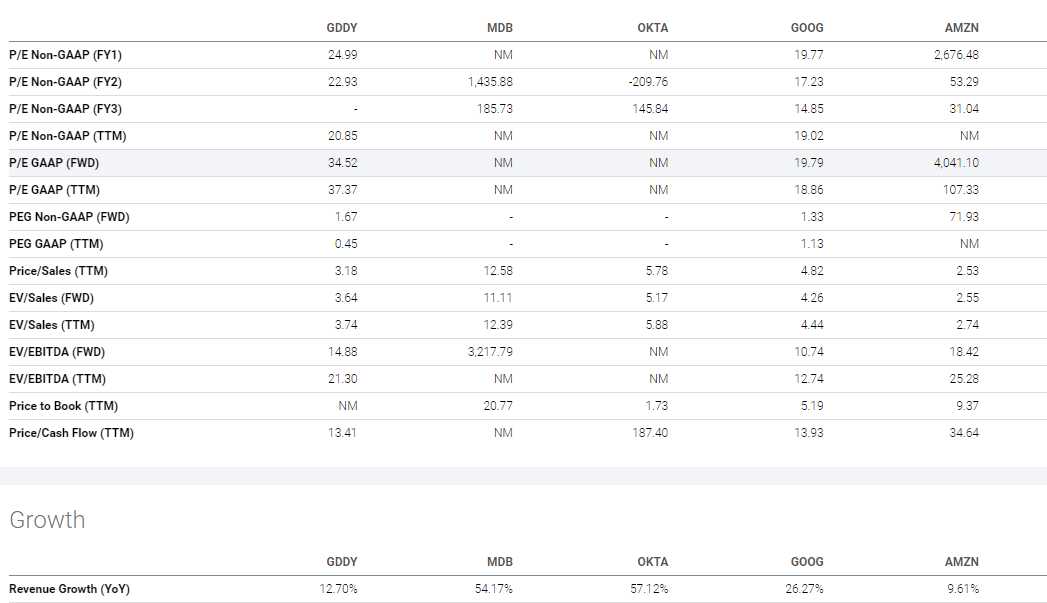

I disagree with the Hold rating that Seeking Alpha’s quantitative assessment algorithm gave GoDaddy, Inc. (NYSE:GDDY). The decades-long survival of GoDaddy in the web hosting business is prima facie evidence of its tenacity and brilliancy. The TTM revenue CAGR of GDDY is 12.70%. Seeking Alpha’s Hold rating for GDDY is largely because of its growth grade of D+.

Seeking Alpha Premium

Seeking Alpha authors have a consensus hold rating for GoDaddy Inc. My dissenting opinion is that GDDY deserves a buy recommendation. This article will show that GoDaddy has other redeeming qualities. Other authors and the AI of Seeking Alpha’s quantitative platform are unhappy with GoDaddy because of that 12.70% TTM revenue CAGR.

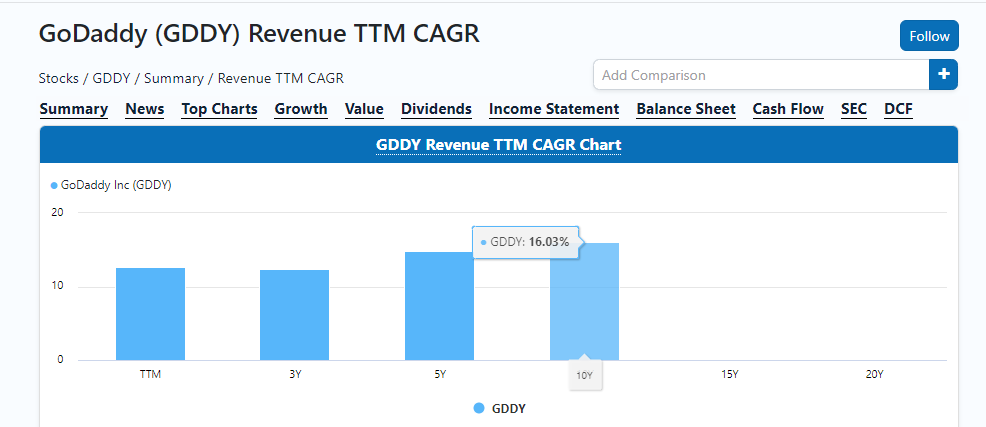

The 10-year average CAGR of GoDaddy is 16.03%. The chart below clearly illustrates that GoDaddy is trending toward an 11% or lower revenue CAGR.

FinanceCharts.com

GoDaddy has no chance of meeting that ‘at least 20% revenue CAGR’ requirement to gain a growth-stock status. Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) (GOOGL) provide web hosting services. These cloud computing giants are the headwinds for GoDaddy’s core business. The $1 to $3 monthly web hosting plans of Amazon Web Services is partly why GoDaddy’s revenue CAGR is dipping.

On the other hand, the growth prospect of GoDaddy is fortified by its reseller and affiliate programs. A developer like me can create dozens of WordPress-made web hosting sites under my custom Asia-centric branding, but powered by GoDaddy’s network of servers.

Still Number One And Profitable

My buy rating for GDDY is because of its resilience. It still hosts 15.6% of all websites, making it number one. Its closest rivals are Amazon Web Services with 11.1% share, and Google Cloud with 7.9%. GoDaddy touts more than 21 million paying customers.

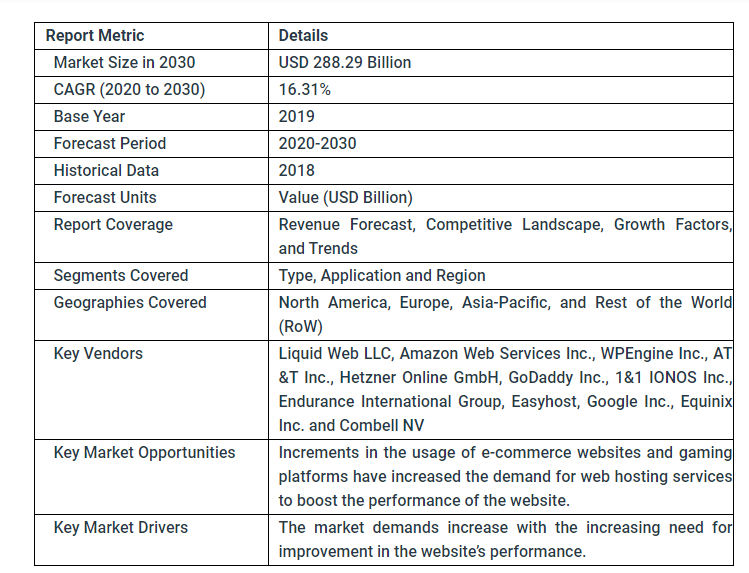

AWS or Google Cloud can only become number one web hosting company if one of them buys GoDaddy. That 21 million loyalists of GoDaddy includes us, UpWork contractors and sub-contractors. Consolidation is a must because the web hosting industry is growing at 16.89% CAGR. This particular business is expected to become a $288.29 billion industry by 2030.

MarketResearchFuture.com

Fortune Business Insights thinks the global web hosting industry is growing at 18% CAGR, and it will be worth $267.10 billion by 2028. Data Bridge Research’s own forecast says this industry is growing at 15.87%, and it will be worth $254.86 billion by 2029.

We can safely assume that GoDaddy is leading in an industry that’s growing at 16% CAGR.

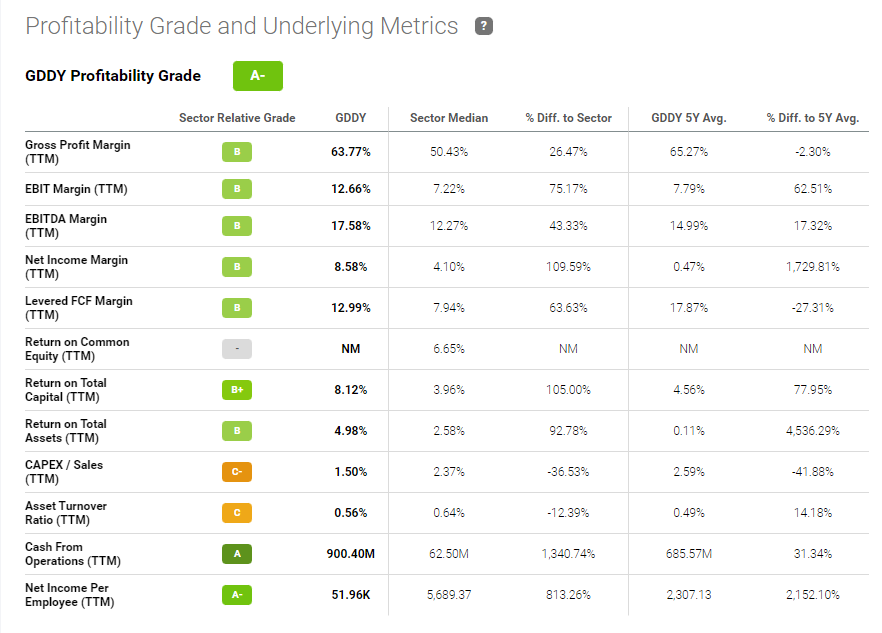

Web hosting is not a high-margins venture. GDDY still gets a profitability grade of A+ from Seeking Alpha’s quantitative stock evaluation algorithm.

Seeking Alpha Premium

The TTM net income margin of GoDaddy is only 8.58%. This is more than 109% higher than the Information Technology sector’s average of 4.10%. GoDaddy is doing better than the majority of its sector peers. This 8.58% TTM net income margin is much higher than GoDaddy’s 5-year average margin of 0.47%.

GDDY boasts improving profitability in spite of the growing competition.

Is GoDaddy Overvalued?

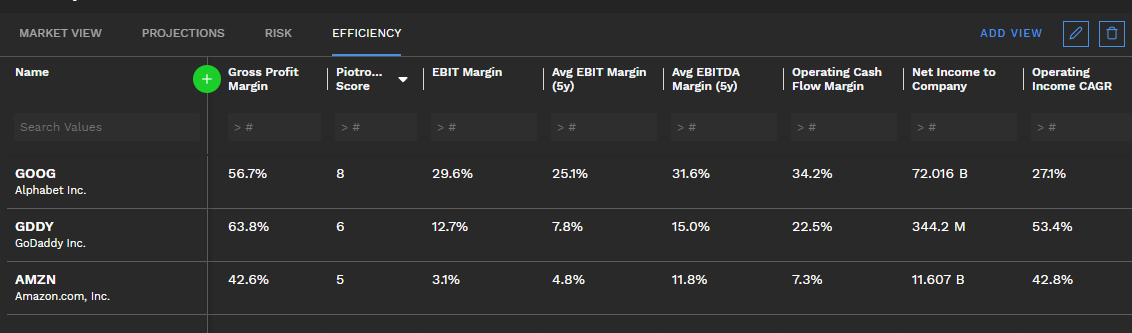

The Hold rating that other Seeking Alpha authors and Seeking Alpha Quant gave to GDDY can also be blamed to its high valuation ratios. Based on the comparative chart below, GDDY’s TTM GAAP P/E of 37.37x is notably higher than GOOG’s 19.79. On the other hand, GDDY’s P/E valuation is extremely much lower than AMZN’s 107.33x.

Seeking Alpha Premium

The significant difference between 37.37x and AMZN’s 107.37x is a market aberration. This bias is unjustified. GoDaddy’s YoY revenue CAGR of 12.70% is higher than AMZN’s 9.61%. The TTM net income margin of AMZN is a measly 2.39%, far lower than GDDY’s 8.58%. Efficiency-wise, GDDY has a higher Piotroski Score than AMZN, 6 versus 5.

Finbox.io Premium

GoDaddy is therefore not overvalued when compared to no. 2 web hosting company Amazon. Be happy that the much smaller GoDaddy can outplay a $1.23 trillion firm like Amazon.

The low-margin business of domain name sales and web hosting could worsen. Amazon is the granddaddy of selling low-margin products/services. Fortunately, GoDaddy is not sitting idle.

Expanded Services

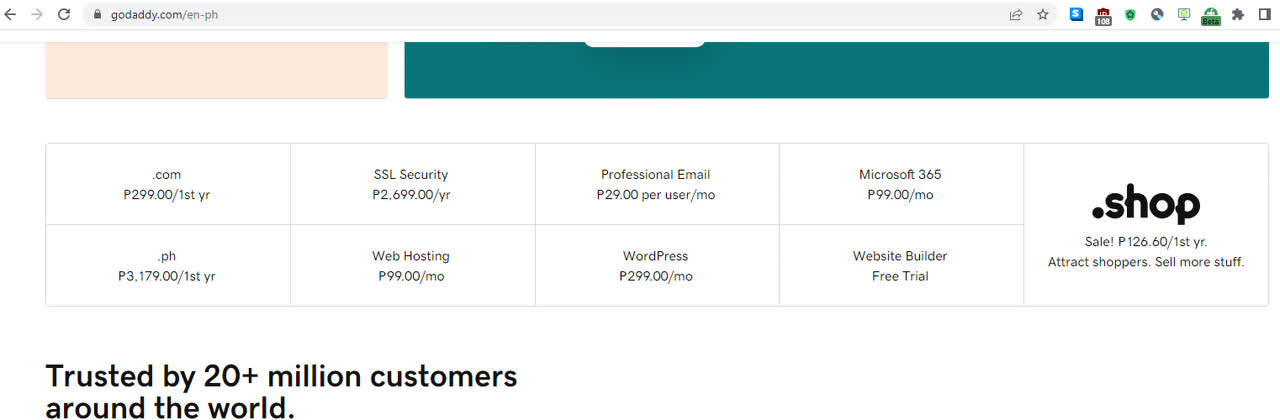

GoDaddy is not just a vendor of domain names and web hosting services. It is a reseller of premium email and Microsoft 365. Serving as an affiliate of Microsoft could help GoDaddy improve its sales and profitability.

Let us be happy that GoDaddy is selling affordable pro email and Microsoft 365 subscriptions to Filipinos like me. The exchange rate is $1 = 58 Philippine Pesos. The dirt-cheap Microsoft 365 is not for everyone. It’s only for the top customers of GoDaddy.

GoDaddy.com

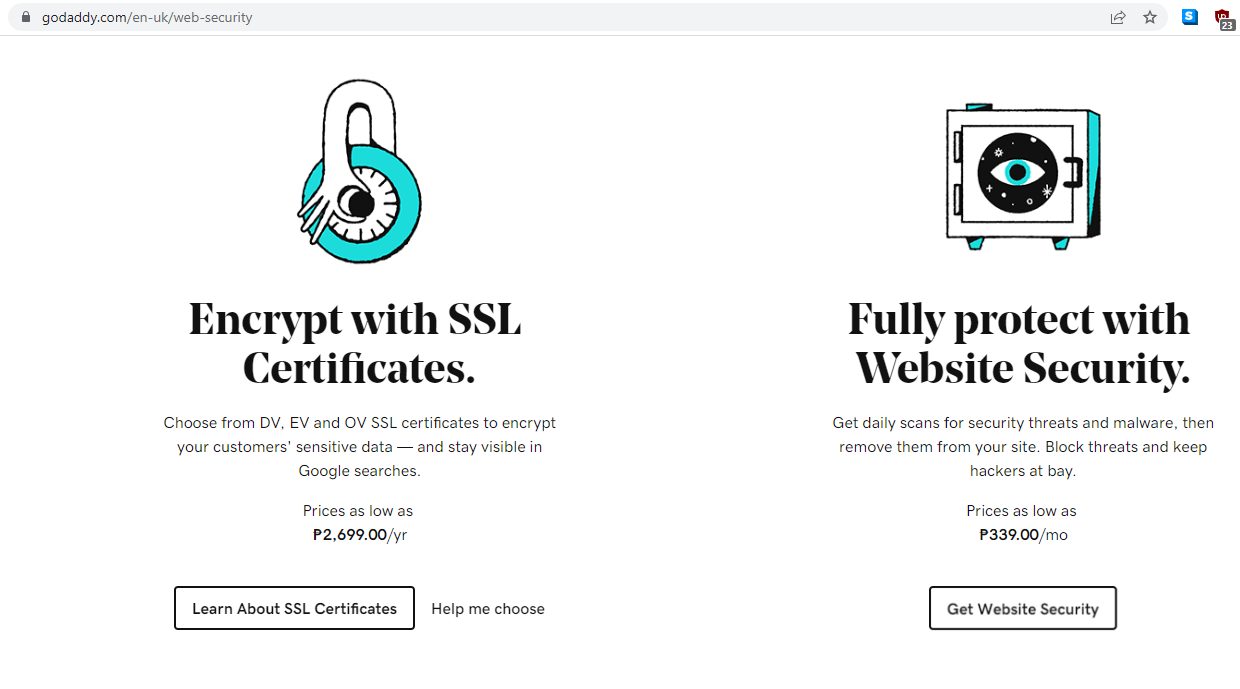

GoDaddy is also letting its customers avail of its subscriptions-based web security and encryption services. The 299 pesos ($5.16) per month WordPress hosting probably needs GoDaddy’s 339 pesos or $5.84/month web security service. More affluent website owners may avail of the SSL and encryption service of GoDaddy.

GoDaddy.com

GoDaddy markets the $9.99/month GoDaddy Studio alternative to the $12.99/month Canva Pro. Like Canva, GoDaddy Studio is a templates-driven design Android/iOS app that helps ordinary people make impressive logos, brochures, newsletters, and other marketing graphic materials.

Lastly, GoDaddy offers its own Digital Marketing Suite. It is an email campaign/social media/SEO marketing service that goes for $9.99 to $29.99 per month. We should evaluate the investment quality of GDDY by calculating its future role in the fast-growing (19.1% CAGR) global digital marketing service. GoDaddy’s venture into the $56.52 billion digital marketing industry is worth monitoring. In my view, GoDaddy should just concentrate on one or two segments of digital marketing. Competing against the all-in-one digital marketing platforms of Google and Facebook (META) is not optimal.

The email marketing industry is a growing opportunity. GoDaddy can laser focus on the 17% CAGR of email marketing. It is estimated to be worth $12.4 billion this year and will grow to $59.8 billion by 2032.

Conclusion

GoDaddy persists as the no. 1 web hosting company. This is in spite of the stiff challenge from AWS and Google Cloud. The declining sales growth CAGR is not a dealbreaker because GDDY has increasing profitability.

GoDaddy has diversified into web security, templates-driven design services, and digital marketing. These non-core subscription services could help GoDaddy improve its revenue and net income numbers.

Go long on GoDaddy and be happy. I believe it could eventually get acquired by Amazon, Microsoft, or Google. That estimated 16% CAGR of the web hosting market might actually go higher. Blame this on the rising popularity of PWAs (Progressive Web Apps) and WebAssembly. It is highly desirable that GoDaddy starts marketing itself as an affordable host of PWA and WebAssembly applications.

Becoming a reseller of Microsoft Azure’s application hosting services is an option for GoDaddy. Hosting applications will require big spending on server infrastructure.

GoDaddy could be transformative and become a tolerant host of cloud gaming, online betting/gambling, and AR/VR dating sites.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment