syolacan/iStock via Getty Images

“Man cannot discover new oceans unless he has the courage to lose sight of the shore.”

–André Gide

Americans aren’t that big on traveling abroad – only about one-third of US citizens have a valid and unexpired passport at any given time. Similarly, American investors only have around 20% of their assets abroad, while markets outside the US represent about half of the value of global markets. This phenomenon (known as home bias) also is present in nearly every country studied.

But for those who are a bit adventurous in either their travels or investments, the present strength of the US dollar opens up a world of opportunities. This isn’t just theoretical. I’m writing this beachfront in Spain, having denied my landlord’s “generous” offer for a 20% rent increase to sign another 13-month lease back in Texas. The place is still vacant.

But even if you’re not wanting to travel the world, your money can do so on your behalf. Later on in this article, I’ll share the three best ETFs for international investing.

How Strong Is The US Dollar?

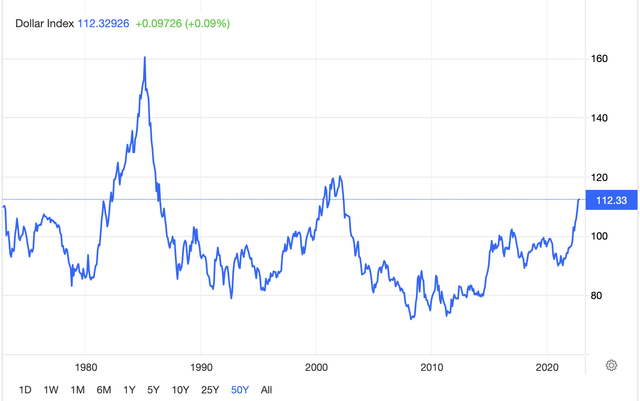

The US dollar is quite strong, although it’s been stronger for brief periods of time in the past.

US Dollar Index (Trading Economics)

The US dollar is approaching levels last seen in the early 2000s, which was an excellent time to load up on international stocks of all kinds. You can feel it when you travel that the dollar seems like it goes a long way, but there’s also a mathematical relationship called purchasing power parity – PPP – that quantifies it. One dollar currently gets you $1.61 in purchasing power in Spain, $1.44 in the UK, and $1.37 in France. The euro is presently at ~$0.98 and the pound is at $1.12, so these are huge differences. Against the Canadian dollar, things are a bit more even with a purchasing power of $0.80 vs. $0.73 on the market, and against the Australian dollar, it’s about even as well, with a PPP of $0.69 vs. a market rate of $0.65. But with pretty much any currency you look at, the dollar is stronger than its purchasing power in terms of goods and services would suggest. Even Switzerland didn’t feel overly expensive when I visited last week! Just how strong the dollar has taken quite a few people by surprise – when the year started I had thought the dollar would be weaker this year, but the war in Ukraine put that idea on ice.

Why is the dollar so strong? Simply put, the demand for dollars is greater than the supply, pushing up the exchange rate. Money is flowing from abroad into the US dollar and Treasuries, and there’s as much traffic going the other way. It’s obviously an attractive proposition to hang out on the beach in Spain for a bit. There’s virtually no crime, and the cost of living for the few months of my planned stay is half of what it was in North Texas, where we had about 50 days over 100 degrees Fahrenheit and about 50 days of air quality alert this year. But in the grand scheme of things, not that many people actually can take these kinds of opportunities, keeping the exchange rate differential wide. You can buy a nice house by the ocean for less than the median home price in the US, but you don’t see a lot of Americans doing it.

But why not? The US is the best place in the world to make a few million bucks and cash out, but math for FIRE or early retirement is pretty brutal. If you’re a couple in your 40s or 50s and quit your jobs, you’re going to be paying $20,000 or more in annual health insurance premiums, and often hefty property taxes. Interestingly, the government here in Andalucía (southern Spain) is recognizing this for the opportunity it is. They’ve repealed all inheritance taxes and wealth taxes, including property taxes. The socialist central government here is now trying to impose its own wealth tax now, but it’s not likely to hold up in court, and my guess is their paper-thin majority will fold next year anyway. If Spain isn’t your thing, you can look at France (good tax treaty with the US), Portugal (tax exemption scheme), Italy (tax exemption scheme), Ireland (no tax on foreign assets), Switzerland (if you’ve got big bucks), or other English speaking countries like Australia, Canada or the UK if you can fit into one of their visa programs. Note that this international gambit only works if you have location-independent income or a solid amount of invested assets, but if you have either of those you’re golden.

Will I stay here? And should you think about doing the same? I don’t know, but it’s worth thinking about. If you have a 3% mortgage on a house you bought in 2016, you might be happy with the situation in the US. But if you’re looking at having to pay 7x your annual income for an overvalued house at 7% interest, going and hanging out on the beach abroad seems much more sensible than levering up and risking bankruptcy at home to speculate on real estate. Other English-speaking countries are having similar real estate bubbles, but the 40%+ aggregate home price gains since COVID in my home state of Texas are fairly egregious. Only by traveling the world do you gain the ability to challenge the dominant narrative and choose the life you want, rather than pay 7% interest on a $700,000 McMansion that the seller bought five years ago for $350,000 and 3% interest.

Your Money Can Travel For You

Although I have several friends who are doing it as well, I clearly recognize that it’s not possible for everyone to drop their lives back home and travel to take advantage of the strong dollar. However, if you have a brokerage account, you can send your money abroad for you and get benefits along the same lines. Something interesting if you like reading finance theory is Siegel’s Paradox, named after Jeremy Siegel. To grossly oversimplify, Americans can often make more money investing in Europe, while Europeans can often make more money investing in America. This is due to the nature of currency fluctuations.

Because of the strong dollar, investing abroad can get you:

- Higher dividend yields – investing abroad can get you dividends of 4%, 5%, or more. There are companies domestically that pay high dividends, but a lot of them are value traps. The estimated yield on the S&P 500 is about 1.8%, whereas, for international stocks (NYSEARCA:VEA) the estimated yield is about 4.1%.

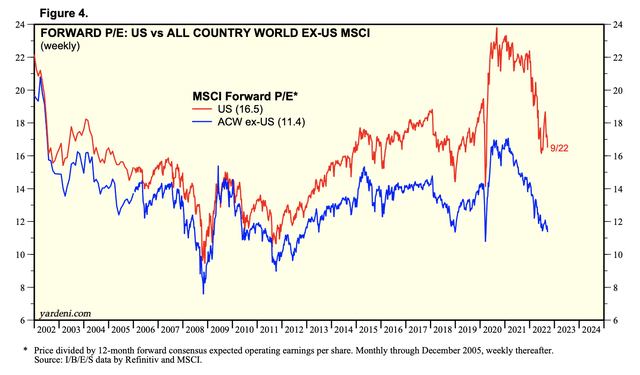

- Lower valuations. US equities trade for around 16x expected earnings, whereas the world trades for about 11x. This is historically much wider than you would expect the spread to be.

Forward PE Ratios (Yardeni Research)

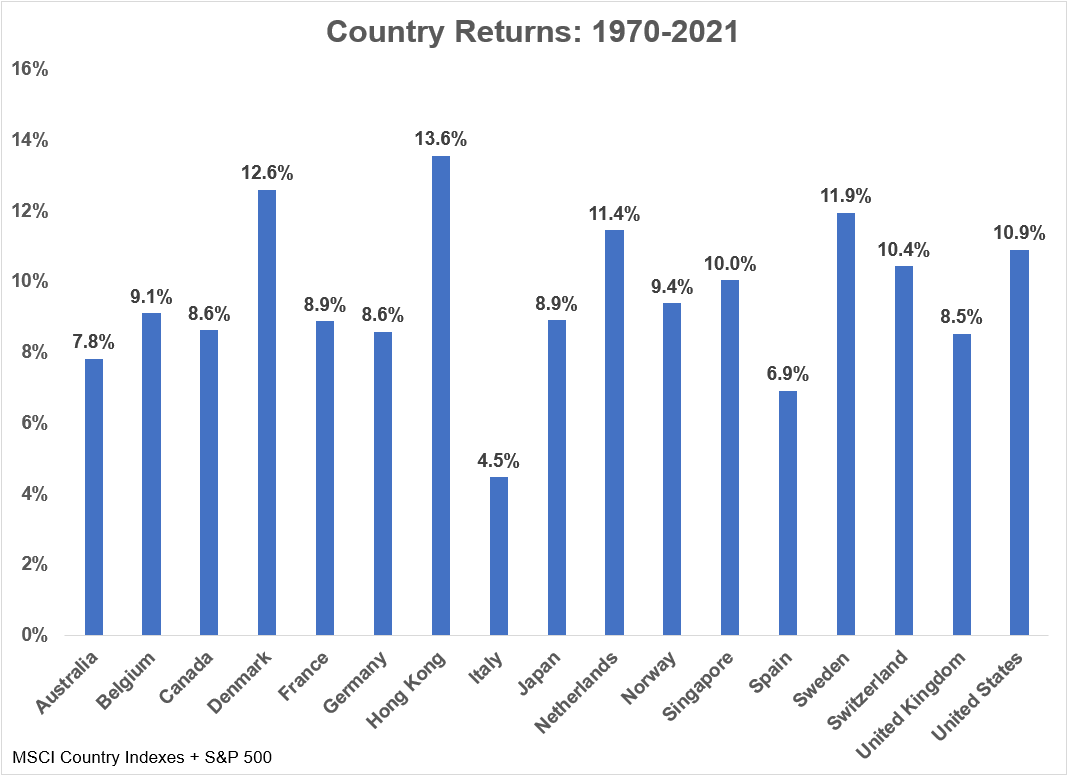

3. Diversification. The US has been among the better performers among global markets, but the perception that it is the No. 1 performer is wrong. Due to higher valuations than global markets, we are likely to regress further to the mean. And research shows that US investors who include international stocks see reduced volatility, less risk of portfolio-busting multi-year drawdowns, and protection against future declines in the value of the US dollar.

US Vs. International Stocks (A Wealth of Common Sense)

How To Invest Abroad

For the uninitiated, investing abroad sounds complicated and risky. Fortunately, all you have to have is a normal brokerage account and know which ticker symbols to buy. Point and click!

International stock funds are by and large not hedged against the US dollar, so you can take advantage of the strong dollar by default and profit if it subsequently weakens. Of course, there are other ways to park money abroad – such as buying your dream home abroad for cash, but index funds are the simplest way to invest.

1. Vanguard Developed Markets ETF (VEA)

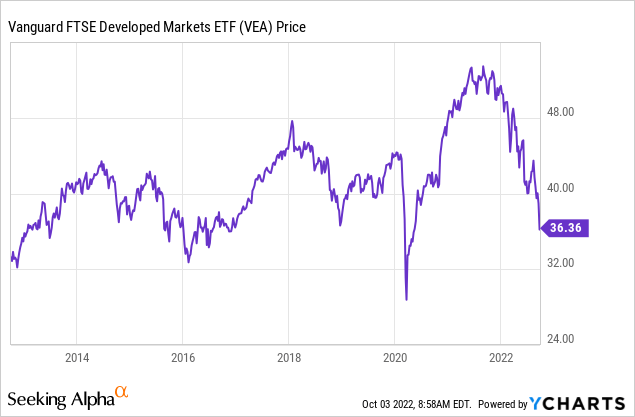

The first fund is VEA, a Vanguard fund that I like:

- VEA has a rock-bottom expense ratio of only 0.05% per year.

- A 4.1% dividend yield.

- And it tracks the index I prefer, which is developed international markets.

The idea here is simple – my research shows that rule of law and paying a reasonable valuation have the highest correlations with equity returns – and not GDP growth of markets. The upshot to this is that investing in places like China and India is not a great way to make money, because so much of the overall capital base is either stolen or invested unproductively. The poster child for this theory is Japan. Japan was historically a huge destroyer of capital but has come miles in terms of corporate governance. Now their stock market has become a much more reliable compounder of capital.

VEA has more or less gone nowhere over the last 10 years, but investors have been able to pocket nice dividends along the way. Don’t be fooled into thinking the US is the only place where you can invest going forward because of the recent strength of US stocks, the vast majority of the outperformance has come from changes in PE ratios, tax rates, and the US dollar. Seeing the entire world stock market falling to near 10-year lows means it’s time to buy, not sell. And for around 11x earnings, you have a ton of room for things to come in below expectations and still earn double-digit returns over time.

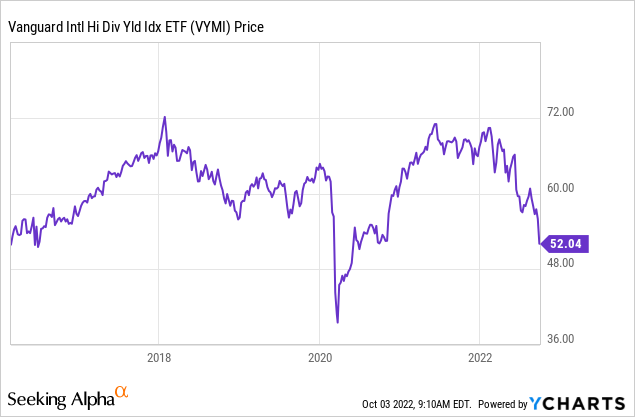

2. Vanguard International High Dividend (NASDAQ:VYMI)

Dividend yields are generally higher abroad, and this fund puts the pedal to the metal on the dividend theme. VYMI yields an estimated 6% after the big fall in global markets, and its components trade for a mere 8.3x earnings. The 6% yield is even better than it looks because many of the dividends come with foreign taxes already withheld (this is true for most international funds as well). The expense ratio is a bit higher at 0.22% per year, but in the grand scheme of things, it’s not much.

VYMI is a newer fund, and it was performing quite well even before taking into account dividends until the 2022 bear market hit. There are 1,300-plus holdings in the fund, but the top 10 are a mix of pharma, oil, autos, banks, and energy.

Unlike VEA, VYMI has some exposure to emerging markets, which makes the two funds complement each other nicely. But VYMI successfully avoids some of the issues that plague emerging markets by focusing on dividends. There are a lot of nonsense companies in the EM space, but since dividends need to be paid in cash, this effectively filters a lot of that out.

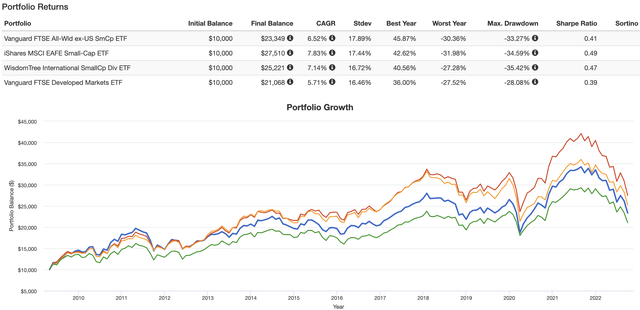

3. iShares MSCI EAFE Small Cap ETF (SCZ)

SCZ is the biggest and best fund in the international small-cap space, despite having an expense ratio that is a bit high by index fund standards at 0.39%. There’s a cheaper Vanguard competitor (VSS), but I’ve found from doing long-term backtests that SCZ beats the Vanguard fund in returns while having less risk. I haven’t done a full study on the funds. However, usually, when this happens it means the holdings are higher quality in the fund that beats the other with less risk. There’s also a WisdomTree international small-cap dividend fund that does about as well as SCZ, but that one costs 0.58% annually.

Here’s the test–with SCZ in red.

International Small Caps Backtest (Portfolio Visualizer)

I looked, and indeed, that particular Vanguard fund is exposed more to emerging market small caps that I believe are unlikely to have good corporate governance. As such, my guess is that you pay less in fees to the fund company, but more of your capital ends up in emerging-market-public-company managements’ pockets without any rules or enforcement to stop them! If Vanguard ups their game with international small caps, I’ll invest, but SCZ is the best for now.

Bottom Line

The strong dollar opens up a world of opportunities for those who are willing and able to take advantage. Open your eyes and look around! One small way you can take advantage of the strong dollar is by increasing your holdings in international equities and decreasing your holdings in US equities. I favor investing 40%-50% of your equity exposure abroad – and making sure your money is placed where it will be safe and work hard for you.

Be the first to comment