Bani Khatun/iStock via Getty Images

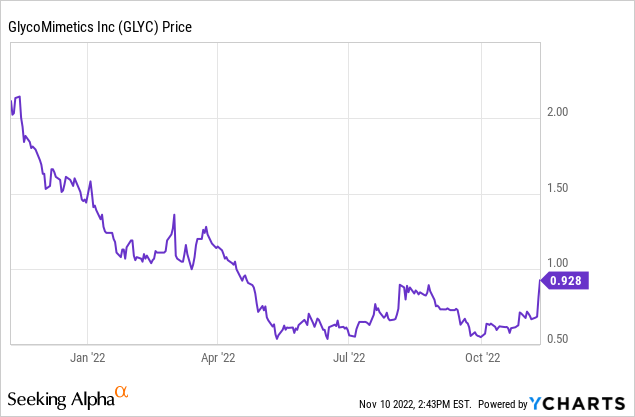

GlycoMimetics (NASDAQ:GLYC) is a clinical-stage biotechnology company that specializes in therapies based on glycobiology. At its analyst conference on Wednesday, November 9, 2022, the company announced a new development that sent its stock significantly higher, up 15% to $0.82. Because this is a penny stock, I believe the significance of the announcement has escaped the notice of most investors, even of those who, like myself, specialize in biotechnology stocks. This article will explain the importance of the announcement about the clinical trial of uproleselan and why the stock could surge even higher in the weeks and months ahead.

Uproleselan trial background

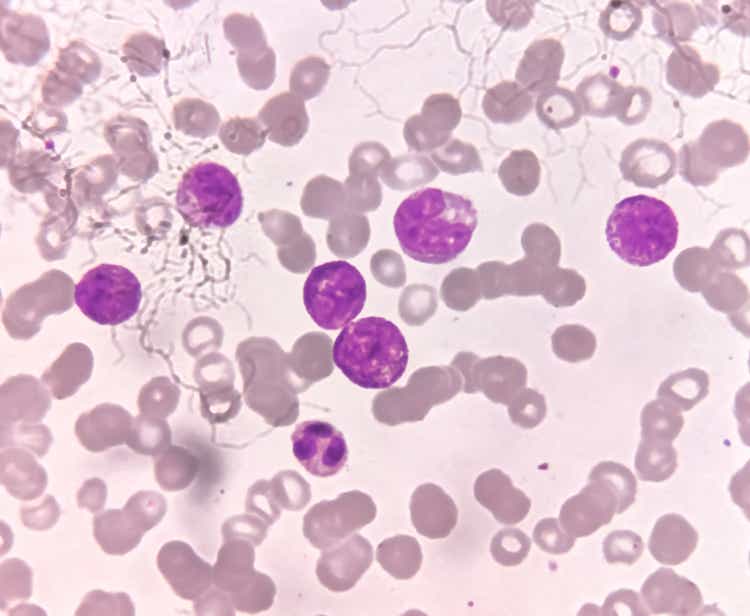

Uproleselan is an E-selectin antagonist. In Acute Myeloid Leukemia, E-selectin mediates the interaction between leukemic (cancer) cells and the bone marrow where they originate. The return of AML after treatment with standard of care therapies is believed to result from cancer cells hiding in the bone marrow, out of reach of the therapies. By disrupting E-selectin, uproleselan releases leukemia cells into the bloodstream, where they can be killed by chemotherapy. This means uproleselan is not administered as a monotherapy, but rather in combination with chemotherapy. In the Phase 2 trial, uproleselan combined with chemotherapy resulted in better outcomes than expected from chemotherapy alone.

Based on those Phase 2 results, GlycoMimetics began a Phase 3, randomized, controlled trial which completed enrolling patients in November 2021. The primary endpoint of the trial is OS (overall survival), the average time until death. Given historical rates of OS, the trial was originally expected to generate data by the end of 2022 or early in 2023. Investors, doctors, and patients began waiting for these results. A certain number of deaths had to occur, and only then would the trial be unblinded to see how the uproleselan arm did compare to the placebo (chemotherapy only, in this case) arm.

As each quarter passed, the number of deaths was below expectations. The timeline until the expected final results lengthened. At the third quarter 2022 GlycoMimetics analyst conference, that timeline was again extended, this time until the end of 2023. There are two factors that could cause the low death rate, and they could be in some mix with each other. The chemotherapy-only patients could be doing better than the historical record led us to believe. Or the uproleselan plus chemotherapy patients could be doing better. A data scientist would normally think the latter case is more likely, but that cannot be known without unblinding the data. The trial design did not allow the data to be unblinded before the pre-specified number of deaths occurred.

Uproleselan added interim analysis

At the analyst conference on November 9 GlycoMimetics announced it has reached an agreement with the FDA to add an interim analysis to the trial design. This interim analysis will be conducted by an independent Data Monitoring Committee, a standard industry practice. This will happen in Q1 2023. By then, about 80% of the prespecified number of deaths will have (likely) occurred. This is also called futility analysis, since it is also used to decide whether to discontinue a trial that is not going well.

Three outcomes are possible in the interim analysis. One is that, despite the low death rate, uproleselan is not effective, which would likely require that there have been more deaths in the active arm than in the chemotherapy-only arm. The trial would be futile. Investor money would go down the drain. A second possibility is that the trial will show that the uproleselan arm patients are doing better than the chemo-only patients, to a statistically significant degree. Then the trial can be halted, the positive data submitted to the FDA, and investors will have a payday. The third, and fairly probably outcome, would be that the data is trending well but has not reached statistical significance, so we will not have our answer until late 2023 or early 2024.

Q3 2023 GlycoMimetics Results

One thing we do know is GlycoMimetics Q3 2023 results. As a clinical-stage pharma company, GlycoMimetics reported no revenue in the quarter. Net loss was $8.5 million or $0.16 per share. Cash and equivalents ended at $52 million, which the company believes will fund it through the end of 2023. Clearly, more funding will be needed to launch a new product. I assume the funding will only be done if there is a positive result reported, which would raise the stock price and mean less dilution for current stockholders.

A Prior Failure and the Low Stock Price

Backing up a bit, why is GlycoMimetics a penny stock when it might have an AML therapy in its pocket? The answer is that investors had high expectations for a prior therapy, rivipansel, in 2018. When that trial failed, it reset expectations. Given the recent downtrend in interest in biotech in general, GLYC became a forgotten company. That may be about to change. Right now, it has a market capitalization of just about $50 million, less than the end-of-Q3 cash balance. The key question for investors is: what is the risk of failure, given what we know about the uproleselan trial? Note there are also other, National Cancer Institute and investigator-sponsored trials of the drug underway, plus the pretty minimal GlycoMimetics pipeline of other potential therapies.

Analysis and Conclusion

The risk of failure of the uproleselan trial has not been eliminated, nor will it be until we have unblinded, positive results. Costs will go up if an FDA approval does lead to a commercial launch. Investors should look at uproleselan in more detail to determine what they think the risk of failure is versus the possibility of success. At minimum, listen to the Q3 analyst conference or read the transcript. My personal assessment is that it is more likely than not that the interim analysis will reveal that uproleselan works. That is based on the Phase 2 trial data and the low death rate in the trial overall to date, which is most likely explained by good results in the uproleselan arm.

While there is risk, the reward could be substantial. One big unknown is how uproleselan will be priced, since it is a combining agent rather than a monotherapy. Typically, pricing is limited by payers, and their calculus depends on the specifics of the trial results. As they say in the industry, AML is a deadly cancer with high unmet medical need. If uproleselan works, it will be great for patients and great for GlycoMimetics investors. Deciding whether to buy the stock, and how much, would depend on how much downside risk is acceptable in your portfolio.

Be the first to comment