bymuratdeniz

The Global X MLP & Energy Infrastructure ETF (NYSEARCA:MLPX) is a simple midstream energy index ETF. MLPX offers investors an above-average 4.9% dividend yield, exposure to comparatively safe, resilient companies, and industry-beating performance. It also trades with a historically above-average share price and valuation, and historically low dividend yield. Although MLPX is one of the strongest funds in its peer group, it is not a buy at these levels, in my opinion at least.

MLPX – Basics

- Sponsor: Global X

- Underlying Index: Solactive US Energy Infrastructure MLP Index

- Dividend Yield: 4.85%

- Expense Ratio: 0.45%

- Total Returns CAGR 5Y: 8.75%

MLPX – Quick Overview

I’ll start with a quick overview of the fund before analyzing its valuation and share price, the focus of this article.

MLPX is a simple midstream energy index ETF.

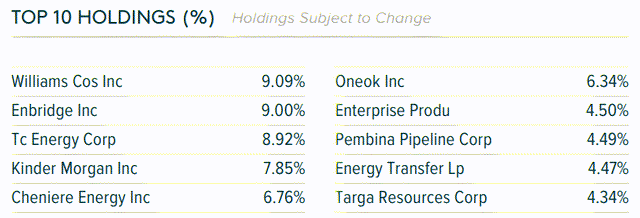

MLPX’s underlying holdings generate most of their revenue from the transportation, distribution, and storage of energy products, including oil, natural gas, and assorted refined products. MLPX invests in 25 different midstream companies, including traditional corporations and MLPs (no K-1 though). The fund’s largest holdings are as follows.

MLPX

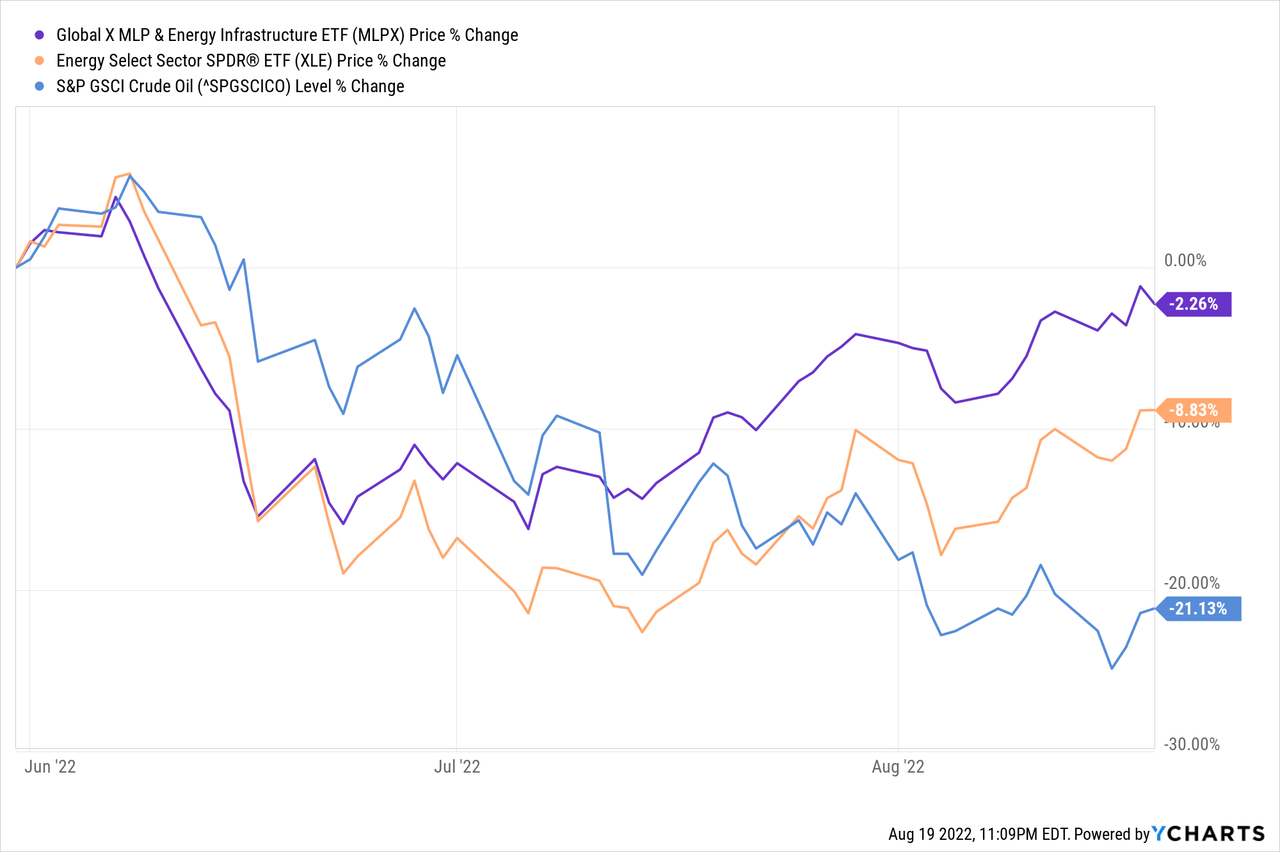

Midstream energy companies have significantly less energy price exposure than average, and suffer fewer financial losses when commodity prices decline. Midstream energy companies are the safest companies in the energy industry, making MLPX a comparatively safe investment, at least compared to its peers. Expect below-average losses when oil prices decline, as has been the case since late May.

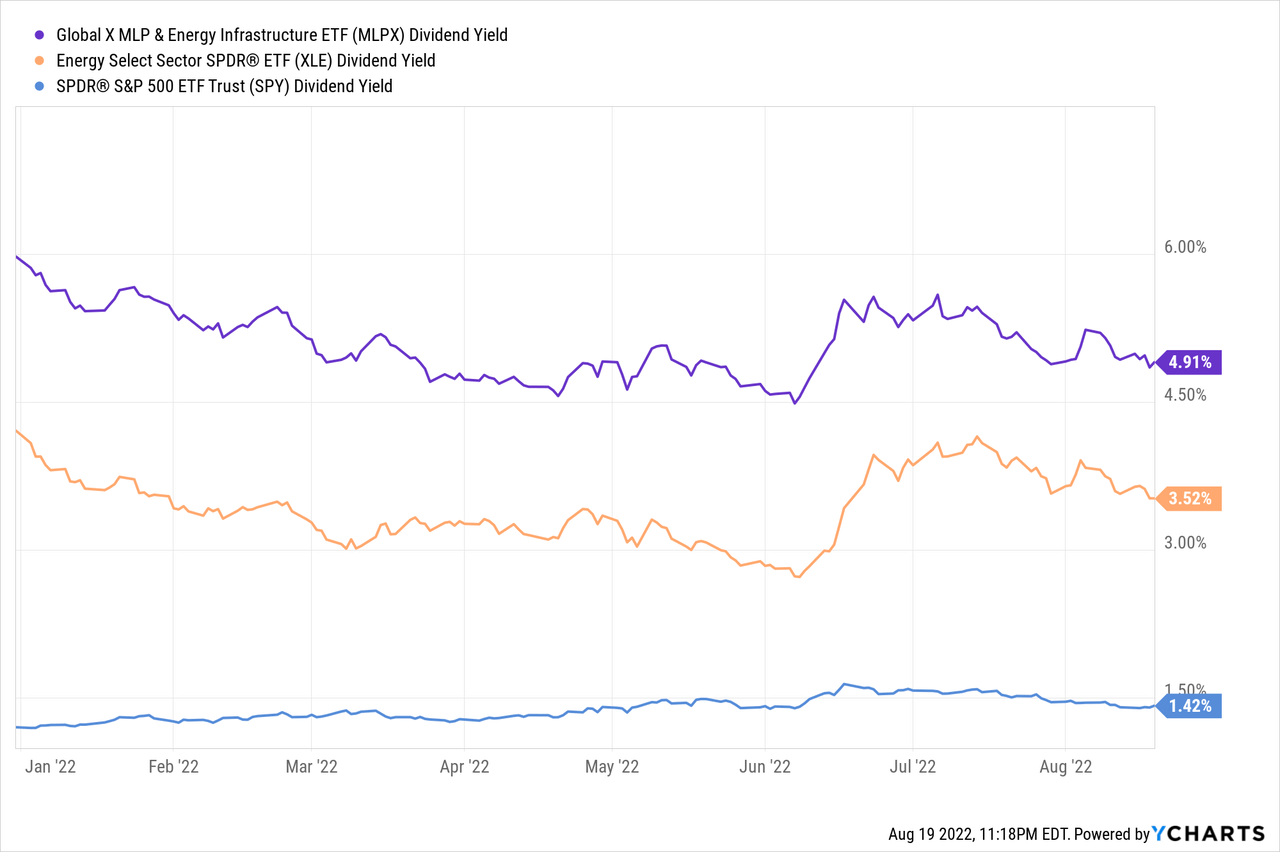

Midstream energy companies also tend to distribute significant cash-flow to investors, in the form of dividends and distributions. Midstream tends to have high yields, and MLPX is no exception, with the fund sporting an above-average 4.9% yield.

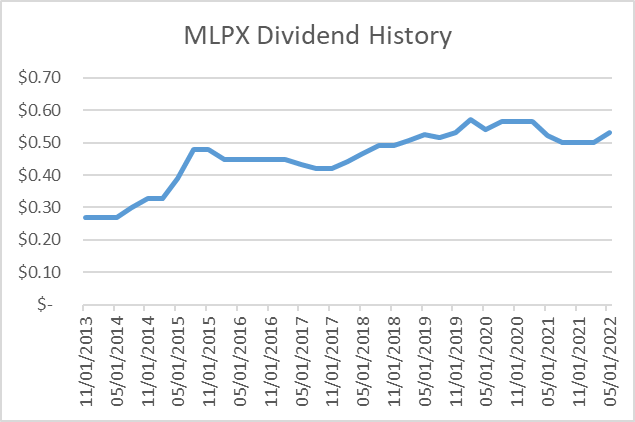

MLPX’s dividends are also comparatively safe, and tend to see healthy annual growth. Dividends do tend to get cut when energy prices decline, and there is some volatility in the fund’s quarterly dividends, but the long-term trend is positive.

MLPX – Chart by author

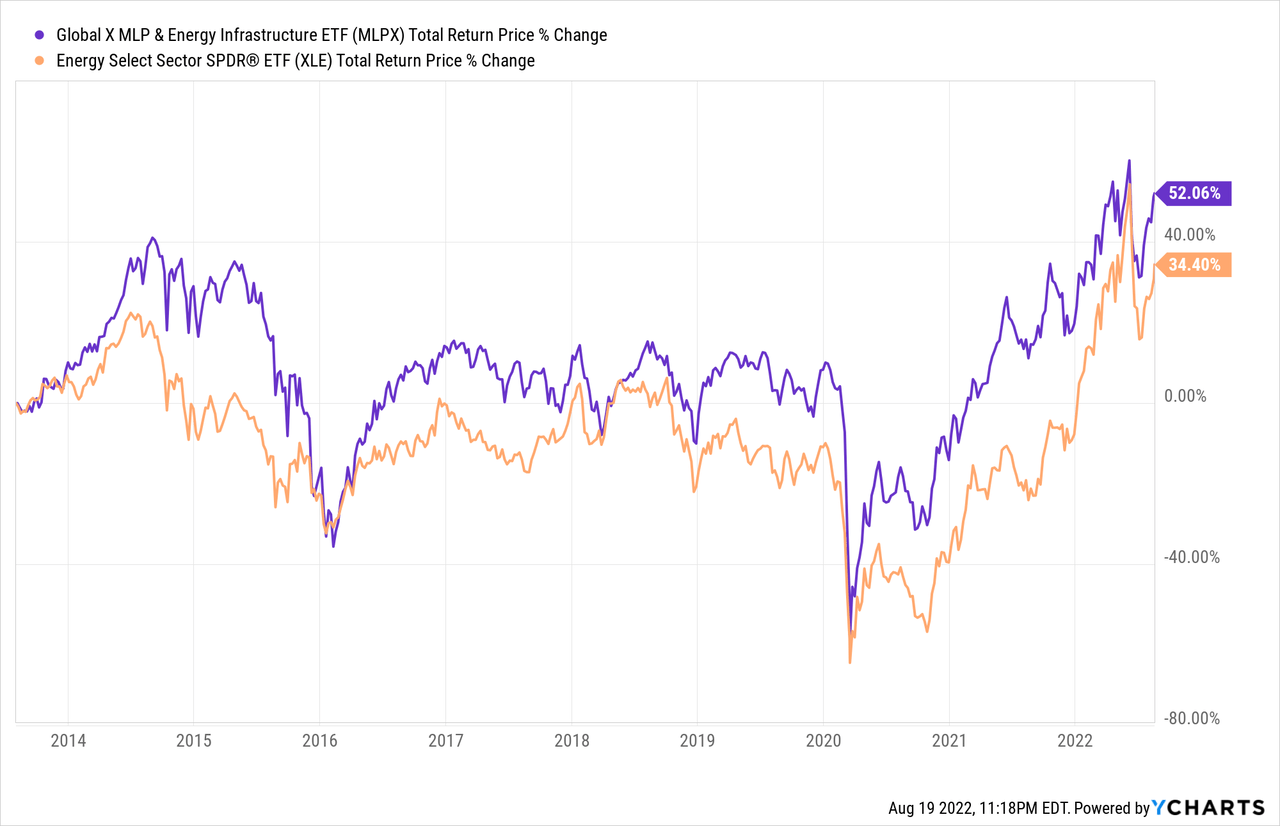

MLPX’s above-average yield, and comparatively strong performance during commodity price crunches, combine to deliver relatively strong long-term total shareholder returns. MLPX’s total returns have been more than twice those of broader energy indexes since the fund’s inception, outstanding results, all things considered.

Finally, MLPX’s underlying holdings will benefit from current high energy prices, due to increased revenues, margins, earnings, and new capital projects. As an example, midstream energy companies will almost certainly have to expand LNG terminals to handle increased exports to Europe. Larger, newer facilities means more gas can be shipped to Europe, which means higher revenues and earnings for midstream companies. This tends to be a slow, drawn-out process, but one that ultimately benefits the midstream industry and its investors.

MLPX offers investors an above-average 4.9% dividend yield, exposure to comparatively safe, resilient companies, and industry-beating performance. This is a fantastic combination, but current share prices and valuations give me pause. Let’s have a look at these issues.

MLPX – Valuation and Share Price Analysis

High Share Price – Trading Near Multi-Year Highs

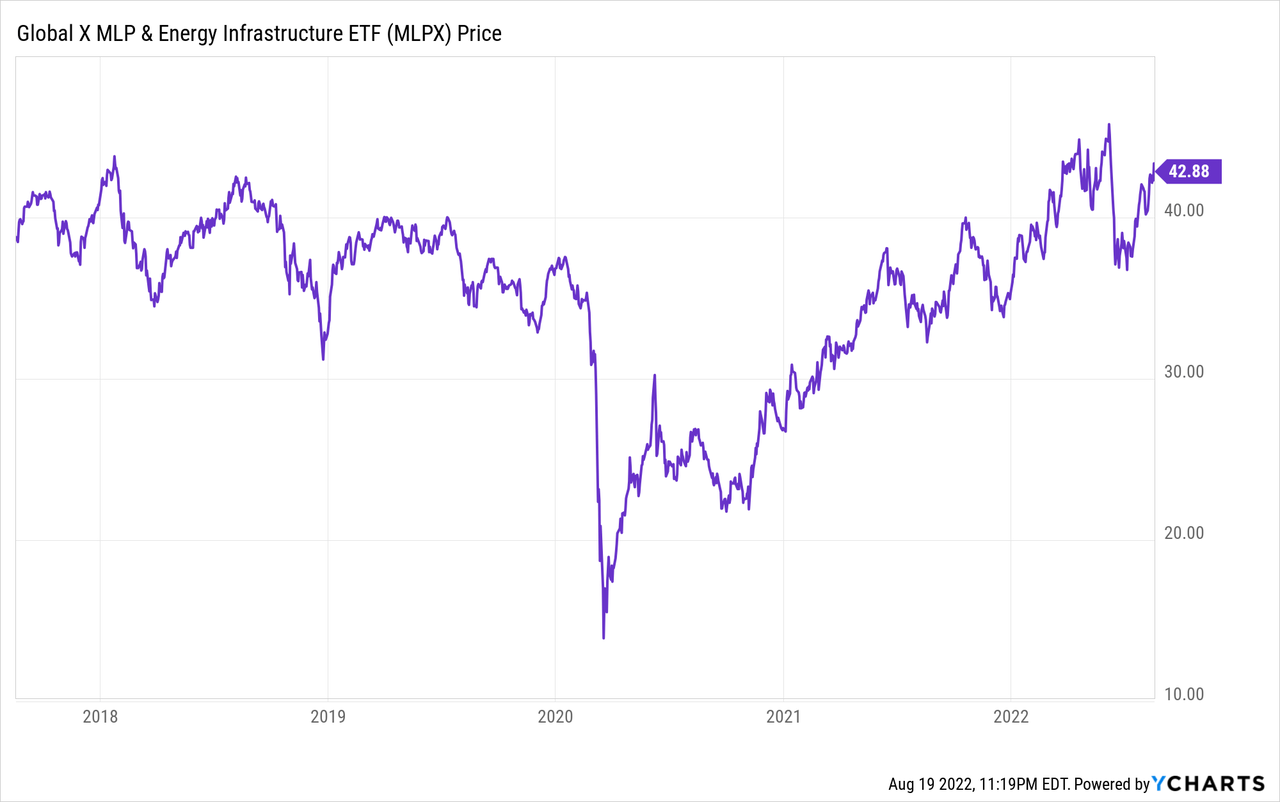

MLPX currently trades at $43 per share, a relatively high amount. Although the fund’s share price moves around by quite a bit, it is quite clear that $43 per share is on the high-end for the fund. MLPX did trade with slightly higher share prices earlier in the year, when oil prices skyrocketed after the Ukraine war started in earnest.

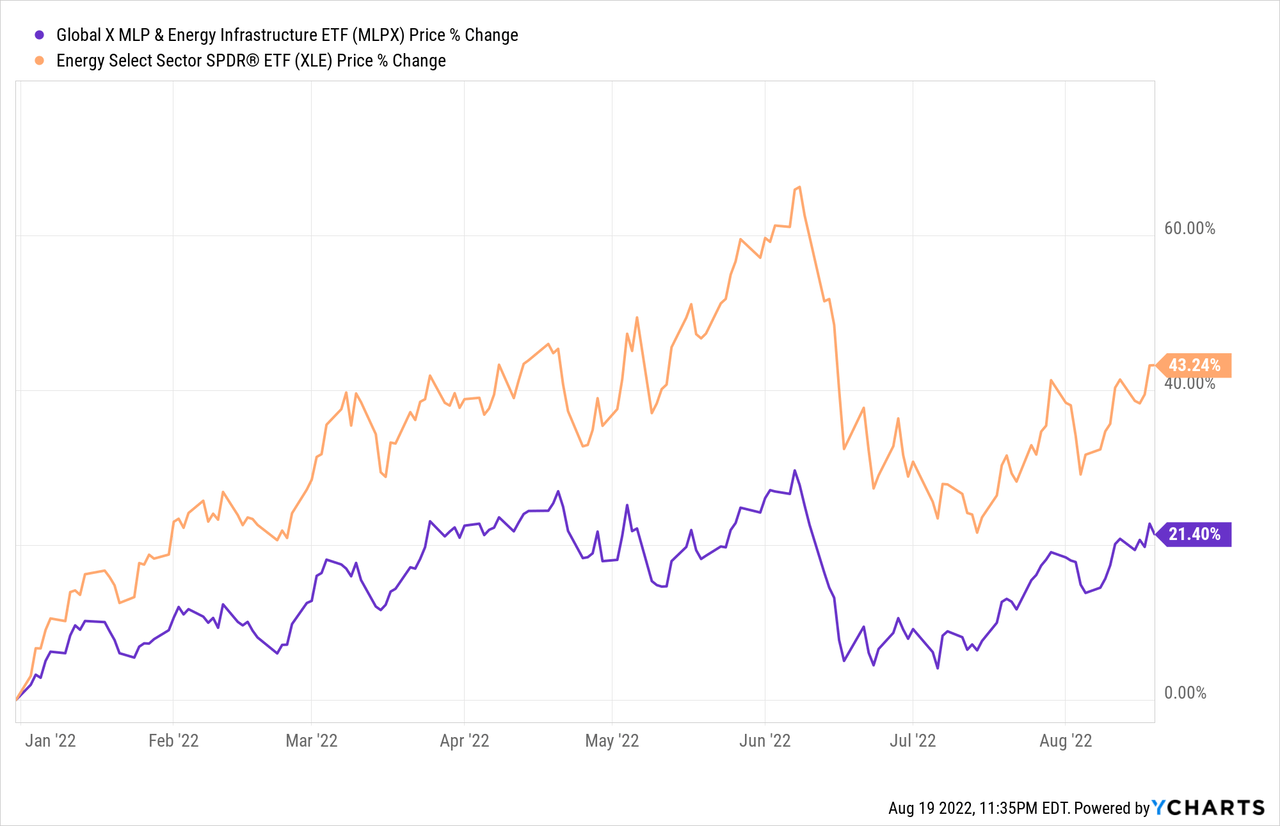

Although MLPX’s share price is not terrible, it does compare unfavorably to that of its peers. The Energy Select Sector SPDR ETF (XLE), the energy industry benchmark, has tumbled from $93 to $79 in the past few months, or almost 15%. XLE has suffered significant losses, and so presents a more compelling entry point for new investors. The same is true for other energy funds and investments. In my opinion, prospective energy investors should take advantage of current market conditions to invest in more beaten-down energy funds and investment. MLPX is mostly fine, but there are cheaper choices out there.

Comparatively Expensive Valuation

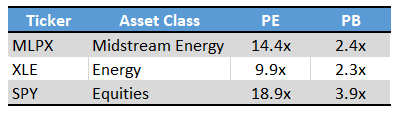

MLPX’s share price is relatively high, which results in a comparatively expensive valuation, at least when compared to other energy funds. The fund currently sports a PE ratio of 14.4x, higher than the energy industry average of 9.9x, although lower than the S&P 500 9.9x average. Energy is very cheap, midstream energy is moderately cheap, so midstream offers less potential capital gains and returns.

Fund Filings – Chart by author

Midstream energy generally trades at a discount relative to the broader stock market. It should do so too, due to the volatility inherent in energy markets, and due to bearish investor sentiment. Although MLPX’s valuation is not particularly high on an absolute basis, it does trade with a premium relative to energy. MLPX looks somewhat overvalued relative to its peers / to historical precedent, if perhaps not on an absolute basis. Under these conditions, an investment in MLPX seems unwise, or ill-timed.

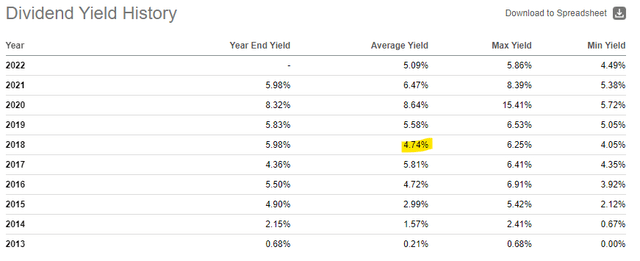

Historically Below-Average Yield

MLPX currently yields 4.9%. Although it is a reasonably strong amount, and higher than the yield offered by its peers, it is somewhat lower than the fund’s historical average. From what I’ve seen, and as per Seeking Alpha, MLPX generally yields around 6.1%, although yields oscillate wildly. In any case, yields of 4.9% or lower are uncommon, although not unheard of.

MLPX’s below-average yield is a negative for shareholders for two reasons.

First, lower yields mean lower income for shareholders, a straightforward negative for the same. Lots of investors buy MLPX for the income, and the income is simply subpar if the fund is bought at these levels. Waiting for a higher yield seems prudent, especially considering recent market weakness, and the plethora of funds offering above-average yields.

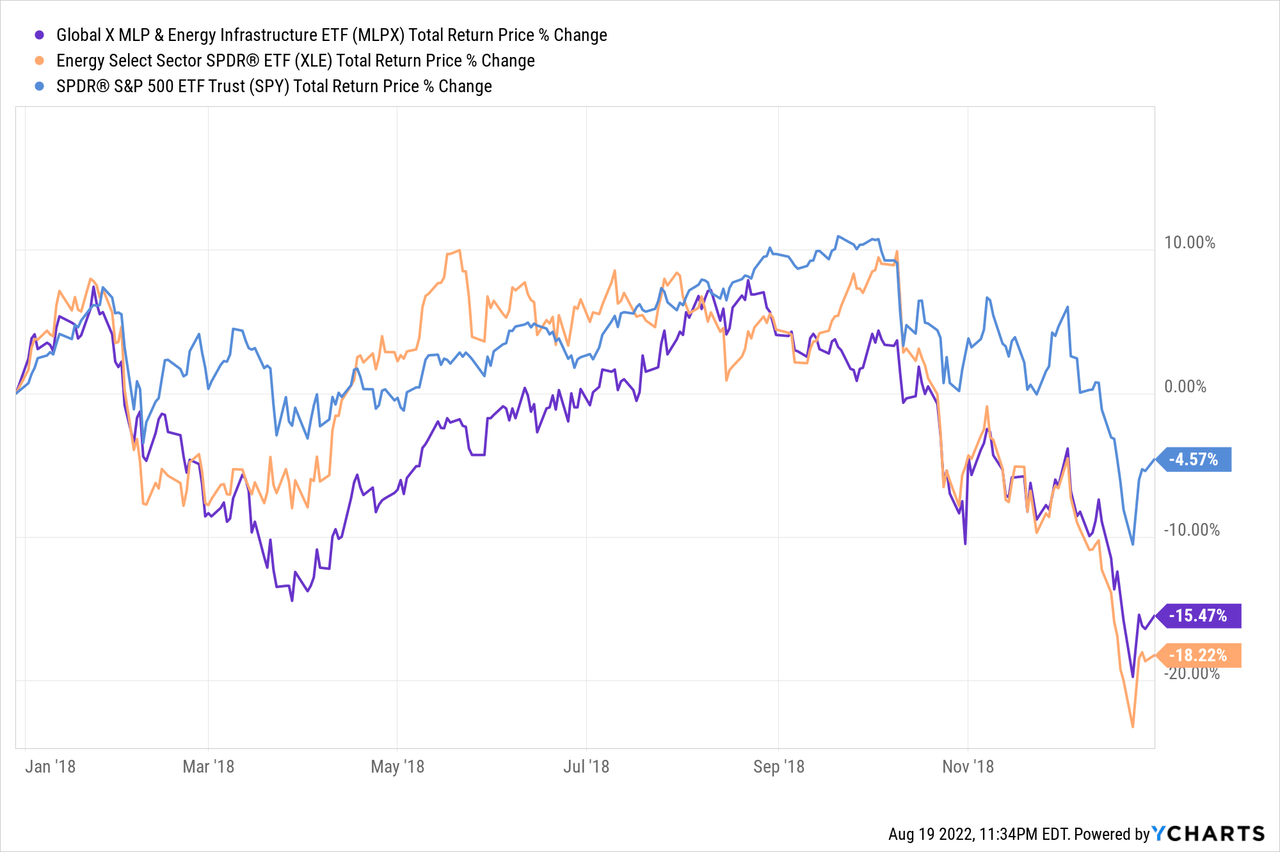

Second, lower yields expose investors to the possibility of capital losses if yields normalize. Lots of investors buy MLPX’s underlying holdings for the income, and if the income isn’t there investor demand will decrease, ultimately resulting in lower share prices for MLPX, and in capital losses for the fund’s shareholders. These issues and processes are not idle speculation from my part, but relatively common occurrences for the fund. As an example, MLPX last traded with a similarly low yield in 2018.

Seeking Alpha

MLPX’s low yield did not last very long, with the fund’s share price declining by around 20% during the year, for total returns of -15%.

It was a tough year for equity markets, so the fund’s losses were not entirely due to its low yield, but the yield definitely didn’t help. A higher yield would have almost certainly reduced capital losses during the year, due to greater investor demand, and would have increased total returns regardless.

In any case, although MLPX’s yield is reasonably good, it is below historically average levels. Investors might wish to consider waiting for a more opportune time to invest, so as to lock-in a higher yield.

Less Upside Potential

As a final point, MLPX offers less upside potential than most of its energy peers, as the fund’s midstream holdings are less exposed to energy prices. Expect comparatively low capital gains if energy prices increase, as has been the case YTD.

Expensive, low-yielding investments might make sense if potential returns are incredibly strong, but that is not the case for MLPX, at least relative to energy peers.

In my opinion, none of the issues above are deal-breakers, but the combination is quite negative, especially considering current market conditions. MLPX is not that expensive, but asset prices are down across the board, and there are many cheaper funds out there.

Conclusion – Not a Buy at These Levels

MLPX is a midstream energy index ETF. The fund trades with an above-average share price and valuation, and historically low dividend yield. As such, it is not a buy at these levels.

Be the first to comment