DKosig

By Alex Rosen

Summary

Global X MLP & Energy Infrastructure ET (NYSEARCA:MLPX) focuses on energy infrastructure products in the U.S. and Canada. MLPX tracks the performance of midstream energy infrastructure MLPs and corporations. It seeks to hold shares in MLPs that have consistent cash flow and can be publicly traded. The focus on the energy infrastructure sector in North America makes it particularly appealing as recent technological improvements have lowered the cost of extraction, which has increased demand.

Strategy

Exchanged-traded Master Limited Partnerships trade like stocks, but their legal structure is different. They are partnerships, not corporations, like most listed stocks are. Where MLPX stands out versus traditional MLP funds is that it limits direct MLP exposure and investing in similar entities, such as the General Partners of MLPs and other energy infrastructure corporations. Over the years, several energy companies converted from MLP structure to something more tax-friendly (non-partnership entities). MLPX is weighted heavily toward the latter structure, and that allows it to avoid fund level taxes that traditional MLP ETFs are exposed to.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Industries

-

Sub-Segment: Energy MLP

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): High

Holding Analysis

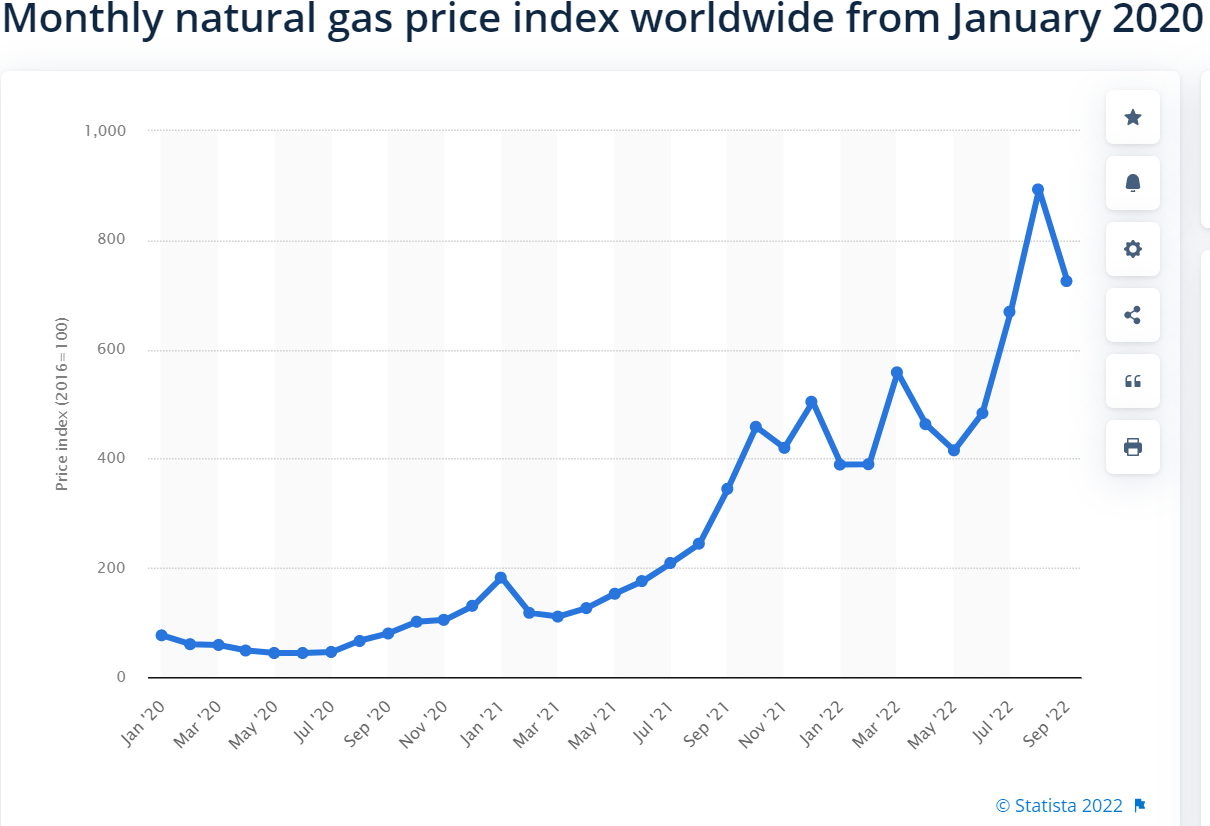

MLPX owns just 27 stocks, so it allows excellent “look through” to what you own. Two thirds of its holdings are concentrated among 10 Energy Infrastructure MLPs, with the other third spread out among the remaining 17 stocks. The shares are in midstream energy infrastructures, so think: not extraction, not end user sales, but rather processing, like LNG liquefaction plants. This is actually a very appealing model, given that it’s only in the last decade that the U.S. has granted licenses to export LNG, and the demand for liquefaction plants is increasing in lock step with the rising price of natural gas.

Statista 2022

Strengths

MLPX has less exposure to MLPs by mandate. So, it can invest in the midstream industry, but without a less-strict set of parameters. Specifically, Because MLPX is a Registered Investment Company (RIC), it is limited in how much of its portfolio it can allocate to MLPs at each quarterly rebalance (24% or less). This means the other 76% goes towards energy infrastructure.

Right now, the North American investment in midstream energy infrastructure projects is booming. In 2020, with the onset of COVID, the energy market collapsed, and many new projects were put on hold. However that market has made a quick turnaround, and the demand as demonstrated in the above chart has shot through the roof.

Weaknesses

Like any single stream ETF (that is, it only invests in one part of the energy “food chain,” the MLPX is highly susceptible to market fluctuations. Delays in construction, cost overruns, environmental concerns and even natural disasters can severely affect the bottom line for infrastructure development.

Opportunities

An energy infrastructure ETF with no exposure to emerging markets that has returned 25% YTD compared to an S&P 500 YTD return of -20% almost sounds too good to be true. Additionally, it is fairly well shielded against geo-political issues, which makes it even more appealing. Eventually the midstream energy infrastructure demand will meet supply, but not any time soon, so enjoy the ride while it lasts, which could be a while. The addition of a 5% dividend payment is also a very nice bonus on top of the total return.

Threats

As always when talking about energy infrastructure, and especially in the U.S., one of the biggest risks is that the underlying stocks suffer delays and damage due to natural disasters i.e.: hurricanes and earthquakes. Thankfully the fund also has the 24% MLP holdings to support it in the event of construction delays.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

MLPX is a sound ETF, whose structure is based on sound principles and strong underlying investments. The energy sector is the hottest global talking piece right now, and MLPX is extremely well positioned to take advantage of that. As other regions of the world suffer, the U.S. and Canada have positioned themselves very well to take advantage of this. Additionally, the relative newness and rapid expansion of the industries here make the need for infrastructure projects all the more pressing.

ETF Investment Opinion

We rate MLPX as a Buy. It’s hard to see demand slowing anytime soon, and as such the recent outperformance has a fighting chance of continuing. Business. momentum should increase as the midstream market in the U.S. and Canada is expanding rapidly in an effort to meet a global demand for energy that has seen serious supply shocks.

Be the first to comment