Kruck20/iStock via Getty Images

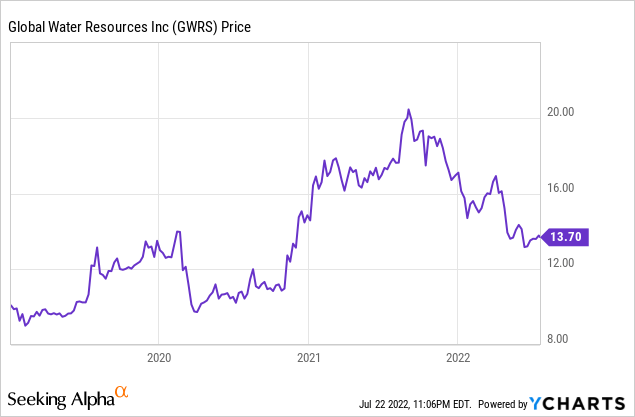

Global Water Resources (NASDAQ:GWRS) is an Arizona-based water utility that I’ve been covering here at Seeking Alpha since early 2019. Shares initially surged from $9 to a high of $20 last year but have since fallen back to around $14 during the current market sell-off:

A 30% pull-back off the highs isn’t necessarily a deal-breaker for a small-cap growth company, however it’s certainly a meaningful drawdown for a company in a recession-proof industry like water utilities. So, has something gone wrong with Global Water, or is it simply caught up in the broader market downpour?

A Fast-Growing Utility

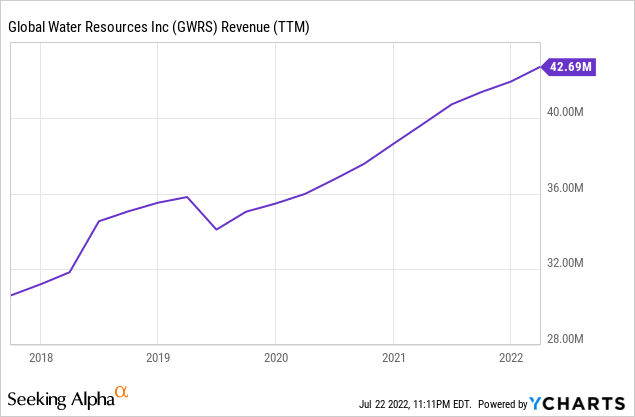

Over the past five years, Global Water has grown revenues at an incredibly consistent rate, excluding one small bump from non-recurring revenues in 2018:

To put it in percentage terms, Global Water Resources has grown revenues 39% since this time in 2017. Let’s compare that against the other biggest publicly-traded U.S. water utilities:

- Global Water: 39% five-year revenue growth

- American Water Works (AWK): 16% five-year revenue growth

- California Water Service Group (CWT): 24% five-year revenue growth

- American States Water (AWR): 11% five-year revenue growth

*Essential Utilities (WTRG) is excluded from this comparison since it made a transformational acquisition during this period.

My core thesis has been and continues to be that Global Water will rapidly outgrow its rival water peers. Current earnings and free cash flow are not especially relevant metrics. Water earns steady regulated returns and so if you grow top-line revenues, profits and cash flow naturally follow. Global Water is splashing out capital now to build its infrastructure footprint and as Arizona grows, the financial metrics will catch up.

I realize this is not a particularly-common approach to investing in the utility industry. If you want a cheap stock, Global Water isn’t it. But if you see the further lightning-fast growth of the Arizona population as likely over the next 10-20 years and Global Water as a shrewd manager riding that trend, then the investment makes a great deal of sense. That statement of the thesis being made, has anything damaged the thesis that would justify the 30% drop in the stock price lately?

Arizona Housing Is Heading For A Slowdown

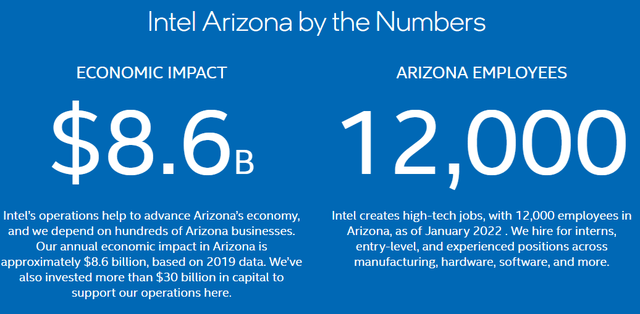

I am long-term bullish on Phoenix and Arizona. Arizona is a burgeoning hub for both semiconductors and electric vehicles, along with its appeal as a retirement destination due to favorable climate and tax policies.

Intel Arizona economic impact (Corporate Website)

However, that doesn’t mean demand for Arizona housing will rise in a linear fashion. The Arizona housing market was one of the hardest-hit during the 2008 financial crisis and it appears to be in-line for a significant downturn this time around as well.

Phoenix housing sales are now down 17.6% for June 2022 compared to the same month last year. Inventory on the market has soared 27.5% versus the same period last year. And while median sales prices are still higher on a year-over-year basis, prices were essentially flat versus May 2022, indicating that prices may be reaching their peak.

This is a negative for Global Water, since its growth strategy is reliant on homebuilders constructing new subdivisions in Global Water’s service areas. Given how far housing sales have slowed and inventory has increased already, it seems likely that the median home price will have to dip significantly to reach a new supply and demand equilibrium.

My understanding is that direct buyers such as Opendoor (OPEN) are heavily involved in the Phoenix market, as compared to many other American cities.

This, combined with Phoenix’s boom/bust performance in the 2008 housing crash leads to a cautious short-term outlook for it in particular. For whatever reason, Phoenix, along with other sunbelt cities, is known to be prone to greater levels of speculation than other markets. It’s no surprise that investors are putting things with Arizona exposure, like Global Water into the penalty box as a sort of preventative measure while we wait to see how bad the housing downturn will be.

Global Water Can Ride Out The Downturn

If you’re an investor in a sunbelt homebuilder or something like Opendoor, I understand why there is panic now. These businesses can’t necessarily endure much of a downturn at all. When you have tons of capital and leverage at play and thin profit margins, even a moderate downturn in the industry can lead to financial ruin if you don’t play your cards right.

As a water utility, however, the game is totally different. A water utility doesn’t live or die by one year’s results. Indeed, Global Water isn’t usually judged on current results. It consistently trades at a steeply-elevated P/E and EV/EBITDA multiple compared to its peers. This reflects the fact that Global Water is a decades-long growth play that hinges on Arizona’s future prosperity. By contrast, if you buy something like American States Water, you are buying for today’s cash flows, not any significant future growth beyond the inflation rate.

That gets to another point. The current market is rewarding companies with strong cash flows and dividends today, and penalizing the ones where more of their value comes from future years rather than today’s results. Within the water utility universe, Global Water is as much a growth investment (as opposed to value) as you can get. It makes sense why investors would rather sell Global Water at 65 times earnings and buy American Water Works at 33.

Over the next twenty years though, let’s say, you’d probably rather own Global Water at a 7% annual organic growth rate instead of a generic national water utility with a 1% organic growth rate.

Even 7% growth, which may not sound like that much, will lead to Global Water’s business quadrupling in size by 2042. Given how stable and steady water utilities are, these are essentially bond proxy assets once they mature. I see Global Water as a way to get what will eventually be a huge cash flow stream (water services to Phoenix and Tucson suburbs) that is still small and thus underappreciated today.

Arizona: More Than Just Sunny Retirement Communities

It’s not just more houses, either. Though there will be plenty of those given the unending stream of both retirees and Hispanic immigrants that have been moving to Arizona in recent years.

But, the real upside kicker is Arizona as a manufacturing hub. See my past articles on Global Water for much more information on this. The quick story, however, is that a large industrial park/inland port has emerged within Global Water’s service area and big future employers such as Lucid Motors (LCID) are setting up in Casa Grande, Arizona, which is right in the middle of Global Water’s service area.

Factories use a ton of water. Lots of houses will be built in proximity to these factories on Global Water’s land area. Additionally, when you have both jobs and houses in one place, you need schools, shops, firefighters, parks, and so on to service those base demand drivers. That’s a lot more water demand. It’d be one thing if Global Water were just serving new subdivisions (this would still be profitable, no doubt). But it’s quite another when you see a whole electric car manufacturing hub setting up in Global Water’s backyard and creating an entire new economic supply chain in the area.

This is hardly the only thing going on in the greater Phoenix area, either. Intel (INTC), for example, is spending billions on its new made-in-America semiconductor facilities in Phoenix.

As industries return home from Asia in the post-Pandemic global economic landscape, look for lots of supply chains to start in Mexico, with higher value-add assembling and precision manufacturing occurring in border states such as Arizona and Texas. Global Water is assembling a massive land package in both Phoenix and Tucson that is primed to collect on decades of future growth in southern Arizona as the full effects of North American manufacturing supply chains kick into high gear.

Global Water’s Bottom Line

At this point, someone could complain that I’m only focusing on the big picture, and I’m ignoring Global Water’s quarterly results. That’d be totally valid. Frankly, I don’t much care about the company’s near-term results.

Success is measured, in my view, in two ways. One, is Arizona as a whole and Global Water’s primary service areas in particular continuing to grow? And two, is Global Water doing a good job at M&A? That is to say, acquiring more water systems that put it in the path of additional future suburban growth. In the year 2022, the answer is yes to both questions.

Given Arizona’s unique regulatory environment, there are dozens if not hundreds of sub-scale water utilities. Think of ones set up to service just one subdivision or rural interstate exit area, for example. Global Water can, for not much more than pocket change, buy one of these, add a few hundred new taps to the system immediately, and pick up more square miles of service rights in currently undeveloped Phoenix and Tucson suburbs.

Someday, be it 2025, 2030, or even 2040, developers will come and slap houses, logistics centers, shops, or whatnot on some of those additional Global Water parcels that it picked up for a song today.

The nice thing about being publicly-traded, and generally at a high valuation, is that Global Water has great currency. It can issue stock at a big multiple and immediately pick up assets selling at a fraction of that price. This is a classic set-up for a business that can compound through both acquisitions and organic growth for decades to come.

To put it in a nutshell, Global Water has already built a lot of infrastructure in the Phoenix and Tucson suburbs. It will now reap the rewards as one of America’s fastest-growing economic hubs continues to blossom. Given the 2.1% dividend yield (with monthly payments on said dividends) there is also a nice income component here while the broader growth trajectory plays out.

Be the first to comment