whitebalance.oatt/iStock via Getty Images

One of the most prominent payment processors is Global Payments (NYSE:GPN), a Fortune 500 firm that is well-positioned to meet the expanding demand for digital payment services.

As a result of reaching an agreement to acquire EVO Payments (NASDAQ:EVOP), one of the leading players in the market, for an all-cash deal, GPN was able to maintain its rising top line and revenue despite the news of departing operations in Russia and its consumer business, Netspend. It will also allow GPN to serve a larger client base of 4.5 billion consumers, up from 4 billion in FY ’21.

This will also enable the company to keep its concentration on its merchant solution segment, which will continue to account for 75% of its future total revenue. This sets GPN well for the expanding opportunity for the worldwide adoption of digital payments.

According to management, they already have a substantial presence in e-commerce, which accounts for 25% of its total revenue in FY ’21. I believe the actual positive growth of EVOP in its tech-enabled business should assist GPN to strengthen its position in the market. GPN is appealing, particularly given its expanding TAM and improving business servicing shift from cash to card payments.

GPN 2.0

EVOP is a more efficient company, as seen by its trailing gross margin of 84% over GPN’s 57% and net margin of 2.49% versus GPN’s 0.87%.

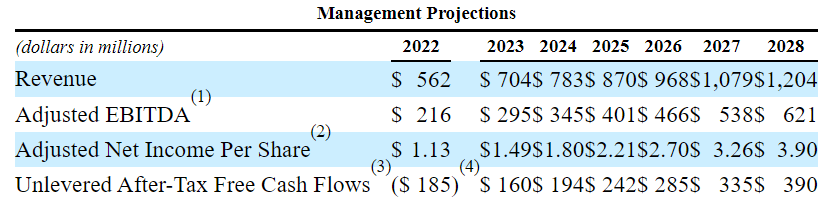

EVOP: Improving Financials (Source: EVOP)

Looking at EVOP’s management projection in the image above, we can see that it is poised to grow efficiently with an estimated 51.6% adjusted EBITDA margin by 2028. This speaks positively for a smooth merger and the realization of operational synergies, which supports management outlook for FY ’22.

On a constant currency basis, we expect full year adjusted net revenue before dispositions to be in a range of $8.48 billion to $8.55 billion reflecting growth of 10% to 11% over 2021.

Also, we are raising our expectations for adjusted operating margin expansion to up to 150 basis points, an increase from the prior outlook of up to 125 basis points. Source: Q2 2022 Earnings Call Transcript

As mentioned earlier, GPN exited its Russian merchant solution business and incurred a loss of $127.2 million and it also agreed to sell its Netspend’s consumer assets for $1 billion as part of its growth expansion strategy, however, it plans to retain its Netspend’s B2B assets. Considering these transactions, the management provided an adjusted top line of $7.9 billion to $8 billion for the fiscal year ’22 and an improving adjusted operating margin improvement of up to 150 basis points.

Furthermore, Silver Lake, a global leader in technology investing, strategically invested $1.5 billion in GPN in the form of unsecured convertible notes. Looking at its GAAP numbers, GPN’s diluted EPS is predicted to fall from $3.29 in FY ’21 to roughly $1.02 in FY ’22. This decrease is only transitory since it comprises acquisition and integration costs as well as charges for disposal operations.

Its aggressive expansion approach is reflected in its sliding bottom line; in fact, GPN ended the quarter with a trailing net income of $76.9 million, a significant decrease from the $965.5 million recorded last calendar year and snowballed to a declining net margin of 0.87% from its 11.33% recorded in FY ’21. The said transactions bloated the company’s P/E ratio to 420.98x, unattractive compared to its 5-year average of 82.36x

On The Brighter Side

GPN produced total sales of $2,280.90 million in Q2 ’22, increasing 6.71% year on year from $2,137.40 million in the same period the previous year. This is driven by a stronger transaction volume growth of 15% year over year and is most likely to improve with its EVOP acquisition. Despite this, GPN posted a concerning growth performance compared to its Q2 ’21, when it grew by 28% year on year.

However, with its improved global footprint as a result of the EVO payment purchase, I think we will see a better growth figure in the next quarterly report. This is particularly relevant given the upcoming Holiday season, when consumers are more likely to overspend.

Looking at GPN’s sustainable net income, amounting to $985 million, up from its $948.8 million, we can see that excluding those non-recurring figures, it actually continues to post a positive bottom line to consider. Furthermore, its trailing adjusted EPS of $8.74, up from $8.16 in FY ’21 and $6.40 in FY ’20, suggests that it is competitively profitable. As a matter of fact, management projected a favorable adjusted EPS outlook for FY ’22 of roughly $9.53 to $9.75, up from FY ’21 and FY ’20.

Relatively Cheap Vs Peers

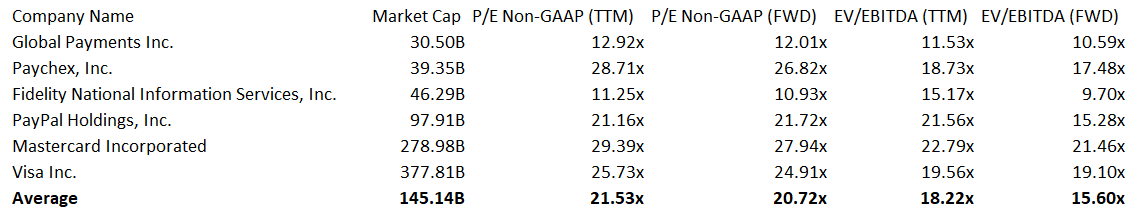

GPN: Relative Valuation (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

Paychex (NASADQ:PAYX), Fidelity National Information Services (NYSE:FIS), PayPal (NASADQ:PYPL), Visa (NYSE:V), Mastercard (NYSE:MA)

Examining Global Payment’s normalized figures will enable us to conduct a more comprehensive review of the company. Its trailing Non-GAAP P/E of 12.92x is cheaper than the 21.53x of its peer group and its 25.50x 5-year average, while its trailing EV/EBITDA multiple of 11.53x indicates that it is more attractive than its peers’ average of 18.22x and 5-year average of 20.93x. With analysts’ growing EPS forecasts, I believe Wall Street’s average price target of $159.52 is within reach, representing nearly a 40% upside potential as of this writing.

Additional Caveat

On the other hand, it is worth noting that during a possible recession, consumers may not spend as much during the holiday season, which may have an impact on GPN’s overall total of services. Furthermore, the company’s increased interest expenditure as a result of its rising total debt of $12,633.9 million, up from $12,660.6 million in FY ’21 and $10,271 million in FY ’20, may further negatively impact its GAAP bottom line.

Trading Near Support

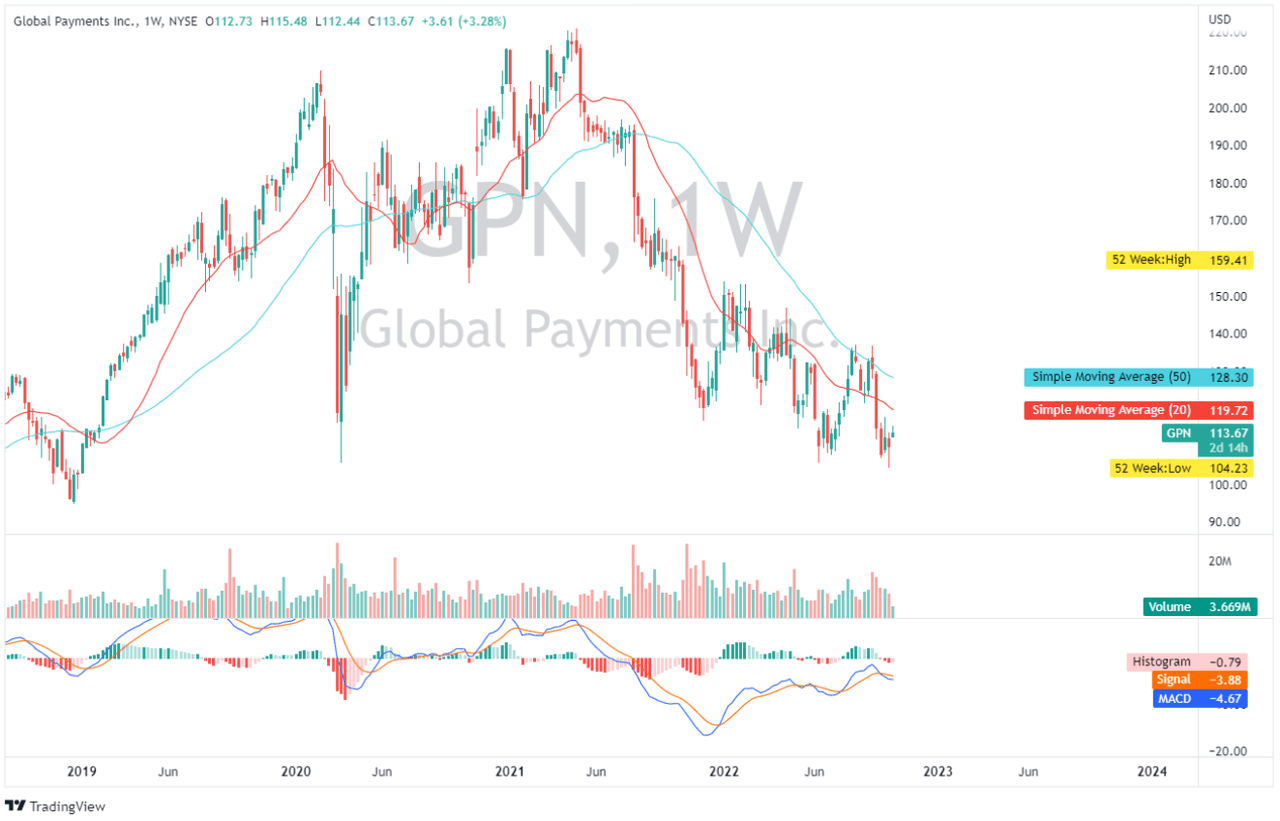

GPN: Weekly Chart (Source: TradingView)

GPN is trading near its 52-week low of $104 and with improving valuation as previously noted, I believe this will act as a strong support to monitor. However, a breach of these levels may push GPN to retest its $95 level.

Final Key Takeaways

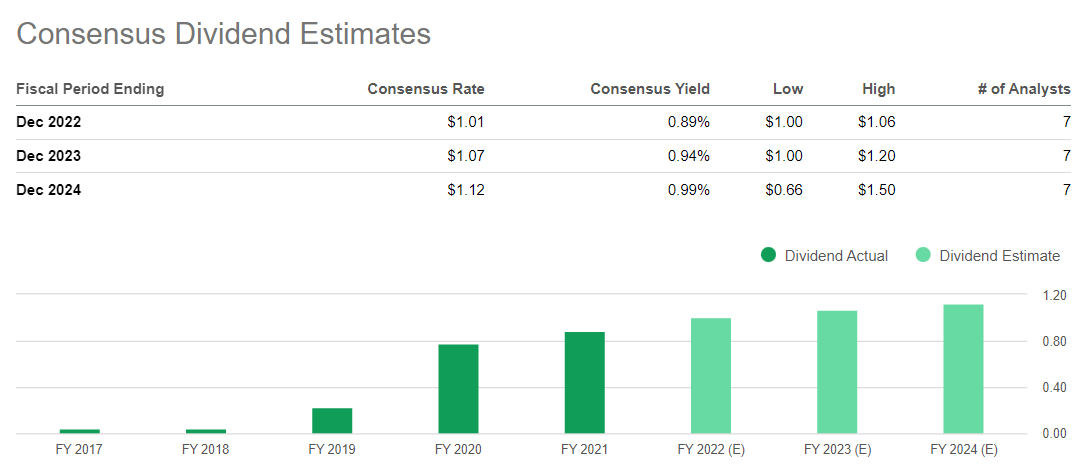

The potential drop will further improve GPN’s current dividend yield of 0.88%, making this stock even more attractive. In fact, it has a payout ratio of just 11.44% and is expected to grow further, as shown in the image below.

GPN: Growing Dividend (Source: SeekingAlpha)

With an increasing cash flow from operations of $2,869.30 million, up from $2,780.80 million in FY ’21 and $2,314.20 million in FY ’20, and a positive expectation from its operating margin in FY ’22, I believe Global Payments will stay liquid and have funds to continue utilizing its $1.5 billion share buyback authorization. The company also has a better debt to equity ratio of 0.53x compared to its 0.82x 5-year average.

Finally, GPN is well positioned to continue growing, thanks to its successful growth strategy making it well positioned to the growing global B2B payments. With GPN’s sustainable income statement and a stable outlook, this stock is a buy at today’s weakness.

Thank you for reading and good luck!

Be the first to comment