JamesBrey

On Tuesday, November 8, 2022, farmland-focused real estate investment trust Gladstone Land Corporation (NASDAQ:LAND) announced its third-quarter 2022 earnings results. At first glance, there was a lot to like here, as the company posted quarter-over-quarter revenue growth that beat the expectations of analysts. The company also posted improvements in both net income and funds from operations. This sort of annual growth is largely par for the course for the company, as Gladstone Land almost always sees at least some growth in its earnings results.

However, there are some signs that things might be beginning to change for the company, as rising interest rates are putting some pressure on the real estate industry and valuations. This naturally affects the company, because it becomes more difficult for it to borrow money in order to acquire new farms. The higher interest rates are unlikely to abate any time soon, although the economy has begun to slow up. With that said, the company remains reasonably financially strong and should be able to opportunistically acquire properties over the next few quarters. The company’s stock price has been devastated this year, which is certainly not unusual for real estate companies but unfortunately, it continues to remain overvalued. As such, it may be best for investors to continue to wait a bit and see if the company’s price falls a bit more so that a purchase may begin to make sense.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Gladstone Land Corporation’s third-quarter 2022 earnings results:

- Gladstone Land reported total revenues of $24.209 million in the third quarter of 2022. This represents a 19.30% increase over the $20.293 million that the company reported in the previous quarter.

- The company reported funds from operations totaling $6.387 million in the reporting period. This compares quite favorably to the $4.819 million that the company reported last quarter.

- Gladstone Land acquired four new farms consisting of 1,317 acres and executed six new lease agreements during the most recent quarter.

- The company increased its distribution by 0.44% to $0.1368 per share per quarter.

- Gladstone Land reported a net income of $1.806 million in the third quarter of 2022. This represents a 194.62% increase over the $613,000 that the company reported in the third quarter of 2022.

It seems essentially certain that the first thing anyone reviewing these highlights would notice is that essentially every measure of financial performance showed improvement compared to the second quarter. This is not unusual for Gladstone Land, as the company usually shows growth such as this. One of the reasons for this is that the company acquired four new farms during the third quarter. As stated in the highlights, Gladstone Land purchased four new farms totaling 1,317 gross acres during the quarter.

Interestingly, Gladstone Land did not issue press releases when it performed these acquisitions, as the company usually does. This is certainly disappointing, as we do not know exactly what crops these farms are growing, but we do know that they are located in Washington and Oregon. It should be obvious why this would cause the company’s financial performance to improve, however. After all, following the acquisitions, the company would begin collecting rents from these properties, which would increase its revenues. All else being equal, higher revenue tends to result in higher cash flow and earnings because more money is available to cover the company’s expenses and make its way down to profits.

The company appears to have gotten a pretty good price on these farms, too, as they have a minimum net capitalization rate of 6.2%. That is certainly much better than the 5.5% capitalization rate that we have been seeing from previous acquisitions along the West Coast. This may be a sign that real estate values have begun to decline in many areas of the country, which would be supported by information published in other media sources.

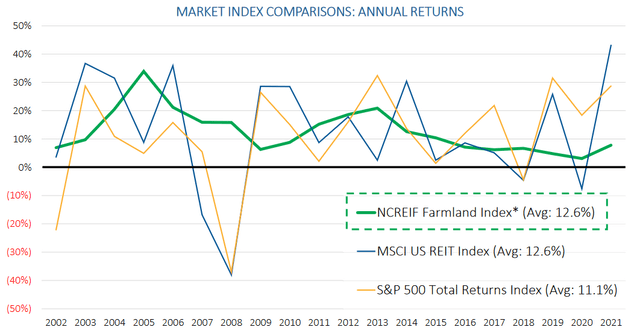

With that said, farmland values have been holding up surprisingly well this year. The NCREIF farmland index is up 9.7% over the trailing twelve-month period ended June 30, 2022 (the latest date for which data is currently available). This certainly does not show any weakness in the market for farmland, despite the impact that rising interest rates have had on mortgage costs. In fact, farmland in general tends to be a good asset class to own in any market environment. Over the twenty-year period ended December 31, 2021, the NCREIF farmland index returned an average of 12.6%, which beat the S&P 500 index (SPY) over the same period:

Gladstone Land/Data from NCREIF

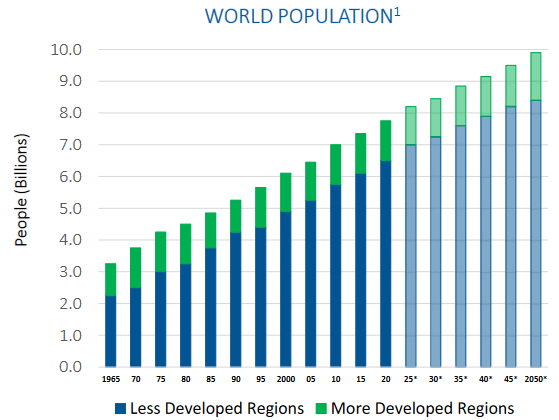

Now may be an especially good time to buy farmland because of the inflationary environment that we are in. As has been made clear in many reports over the past year, the bulk of the inflation has been centered around energy and food. Obviously, food is grown on farmland. There are other factors working in favor of farmland going forward as well. One of the most important of these is that the amount of farmland available to feed each person is declining fairly rapidly. Every year, thousands of acres of farmland are converted into housing developments, parks, industrial and commercial buildings, and government uses. In addition to this, the population is growing, which should be fairly obvious as otherwise there would be no need for all these new suburban buildings. The global population is expected to pass eight billion on November 15 of this year and continue growing to exceed ten billion by mid-century:

Gladstone Land/Data from United Nations

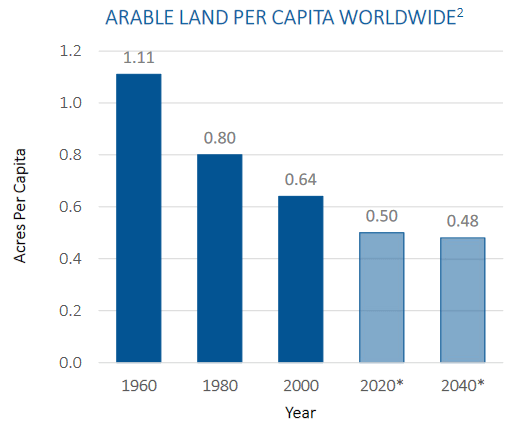

Meanwhile, the amount of arable farmland is decreasing due to the need of supporting all these people as already mentioned. Currently, there is about a half-acre of farmland available to feed each person. That is a marked decline from the 1.11 acres per person that was available back in 1960:

Gladstone Land/Data from United Nations

Unlike any other type of real estate, farmland is a necessity because everyone needs to eat in order to survive. Thus, as farmland becomes more precious, we can expect it to appreciate in value. We have already seen that it has been holding its value much better than many other types of real estate. Gladstone Land is one of only two farmland real estate investment trusts on the market so it offers one of the only ways for most investors to get direct access to this asset class.

Gladstone Land has, fortunately, other ways to grow its revenue besides simply buying new farms. We saw this benefit the company in the third quarter as well. The most significant of these other methods is to raise the rent at lease renewal. Gladstone Land managed to accomplish this on six of its farms during the third quarter, which should result in an extra $281,000 in net operating income on an annual basis. This was a 9.8% increase over the previous leases. We do not know exactly when in the quarter Gladstone Land executed these leases so the company likely saw some benefit in the third quarter but it will see an even bigger boost in the fourth quarter as the higher rents will be in effect for the entire quarter as opposed to only part of it.

Unfortunately, Gladstone Land’s growth trajectory may slow down over the next few quarters. The trust’s chief executive officer David Gladstone suggested this in the press release:

“While we have completed over $62 million of new farm acquisitions this year, acquisition activity has been slower for us this year, and we expect it to remain slow for the rest of 2022 and likely into 2023. We are still in the market should attractive opportunities arise, but we continue to act conservatively with our capital and be more selective with acquisitions in light of increased interest rates and overall uncertainty within the economy.”

Fortunately, with the exception of possible reduced acquisition activity, further increases in interest rates are unlikely to have any near-term impact on Gladstone Land. This is because the company’s current debt is all at fixed rates for at least the next five years and the company does not need any new financing unless it purchases new farms. So, for the time being, it should remain financially stable and should not be impacted by rising rates. Investors should not be expecting the company to deliver the same growth rate that it has over the past several years, though.

Gladstone Land could also be a way to hedge consumer exposure to rising food prices. This is because many of its lease agreements include participation rents. These act much like profit-sharing agreements with the farmers operating the trust’s properties. Basically, the farmer gives some of the harvests to Gladstone Land, much like a royalty trust would take some of the crude oil or natural gas produced on its property. As food prices increase, Gladstone Land should thus receive larger participation rents. The company benefited from this somewhat in the third quarter and this was another cause of the improved financial performance that the company enjoyed in the third quarter relative to the second. However, the majority of its income from this source comes in the fourth quarter. We can expect a fairly significant revenue increase in the fourth quarter from these participation rents but most importantly, the higher food prices go the more the trust benefits from this so overall it could be a way for investors to offset some of the pain that is felt in the grocery store.

One of the major reasons to invest in real estate trusts is because they pay out a substantial portion of their profits as dividends to investors. As stated in the highlights, Gladstone Land continued with its long-running tradition of boosting its dividend slightly, gifting us a 0.44% increase to $0.1368 per quarter. However, the company actually pays its dividend monthly:

The monthly dividend is pretty attractive for those that are depending on their portfolio incomes to pay their bills or finance their lifestyles. This is because bills tend to be due monthly and of course, most of us are used to receiving our paychecks at least once a month during our working careers so we are used to it. This payment schedule is also quite nice for those that are still amassing their assets as monthly distributions help a lot when it comes to compounding as it speeds up the process a bit and results in more money in the long run. As is always the case though, we need to make sure that Gladstone Land can actually afford its dividend. After all, we do not want it to be forced to reverse course and cut the dividend since that would reduce the company’s share price and our income.

The usual way that we judge the ability of a real estate investment trust to cover its dividend is by looking at its funds from operations. Funds from operations are akin to operating cash flow as it basically tells us how much cash is generated by the properties themselves after all the bills are paid. As stated in the highlights, Gladstone Stone reported total funds from operations of $6.387 million in the third quarter of 2022, which works out to $0.185 per diluted common share. This is quite a bit more than the $0.1368 that the trust declared in dividends so it appears that it can easily afford the dividend with money left over for other purposes. We should not really need to worry about a dividend cut here.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a real estate investment trust like Gladstone Land, we can value it much as we would a closed-end fund. After all, that is essentially what the trust is, it is just a portfolio of real estate instead of stocks or bonds. That means that we look at the trust’s net asset value, which is the current market value of all its farmland minus any outstanding debt. This is the amount that we as shareholders would get if the trust were immediately shut down and liquidated. As of September 30, 2022, Gladstone Land has a net asset value of $16.56 per share but it actually trades for $20.36 as of the time of writing. Thus, the trust appears to be trading for 22.95% more than fair value. This has long been a problem with this company as it perpetually trades for more than it really should. It may be a good idea therefore to wait for the price to come down before buying in, although the price right now is more attractive than it has been in about two years.

In conclusion, Gladstone Land reported reasonably good results in the latest quarter, which is what we have come to expect from the company. The overall fundamentals for the real estate in its portfolio are very good, although the rising interest rates are likely to have a negative impact on the company’s growth over the next year or two. There is no reason to shy away from buying the trust today though, except that the price still looks a bit high. It might make some sense to wait a bit and see if we are presented with an even better buying opportunity for Gladstone Land Corporation.

Be the first to comment