allanswart

Written by Nick Ackerman. This article was originally published to Cash Builder Opportunities members on August 22nd, 2022.

Business development companies (“BDCs”) typically offer loans to smaller and mid-sized businesses. These loans then provide regular income streams to investors holdings the shares of these investments. Since they are leveraged and invest in relatively riskier businesses, their dividend yields can be quite attractive. In my opinion, we are getting compensated well for the higher risks we take.

With interest rates rising, BDCs can be in an even better position to benefit from the current environment. Generally, BDCs are leveraged primarily via fixed rates and then invested in floating rate debt. Thus, when rates are rising, their income should also be rising while their costs can remain fixed.

Of course, as I mentioned, they are invested in generally riskier businesses. This would be due to lending to smaller-sized businesses. These businesses can often be the first to feel the pain of a slowing economy. They don’t have the balance sheets to be able to handle a slowdown in business. Some of these businesses can’t even afford to operate even in good times. That’s why we usually see underperforming positions in BDCs, no matter where we are in the economic cycle.

Today, I wanted to provide a quick update on two of the BDCs I hold. That would be Gladstone Investment (NASDAQ:GAIN) and Horizon Technology Finance (NASDAQ:HRZN). An opportunity to increase one’s positions in these names might be on the horizon if volatility picks back up. While they are both BDCs, they take quite different approaches to the investments they pursue.

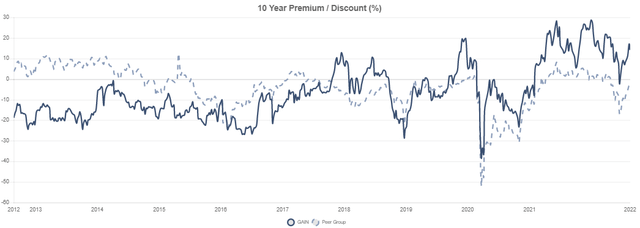

The overall market has been a challenge in 2022. We’ve rallied off of the lows from June so far, but volatility is picking back up. Both of these funds have had their valuations in terms of discount/premium relative to their net asset value per share come down from where they were months ago. However, they’ve been again bouncing a bit higher along with the market in the last several weeks.

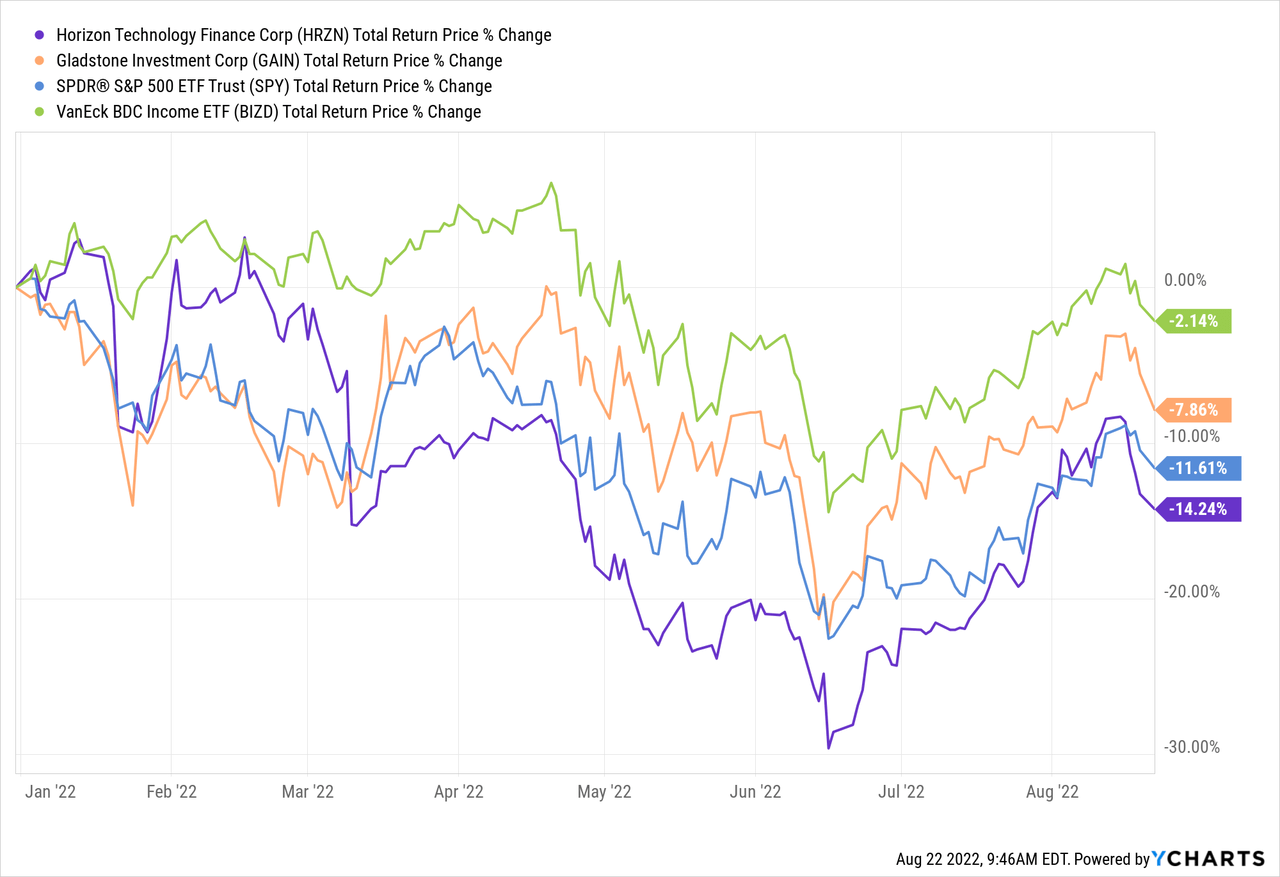

Here’s a look at the total return performance on a YTD basis of these two compared to the SPDR S&P 500 (SPY) for context. I’ve also included the VanEck BDC Income ETF (BIZD) for reference to the rest of the BDC group.

Ycharts

Horizon Technology Finance

Here is how HRZN defines itself:

Horizon is a leading venture lending platform that thoughtfully and creatively provides structured debt products to life science and technology companies. Horizon’s experienced team of investment and operations professionals has been providing debt capital to some of the most exciting companies for decades. The members of the Horizon team have, collectively, originated and invested more than $5 billion in venture loans to thousands of companies. Since 2004, Horizon has directly originated and invested more than $2.3 billion in venture loans to more than 285 growing companies.

This is an externally managed BDC. That isn’t necessarily a negative immediately, but it does turn some investors off. The reason is that the management might not be as directly aligned with shareholder values. There could be conflicts of interest that pop up.

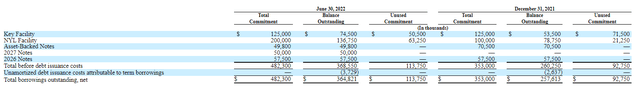

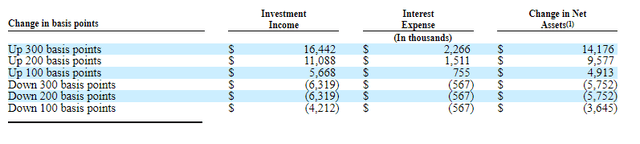

Some of the borrowings for HRZN are done through a credit facility. Those borrowings are linked to a floating rate.

HRZN Borrowings (HRZN Quarterly Report)

So they aren’t completely immune to the rise of higher interest rates, but the underlying portfolio would offset this impact. Here’s a look at how rates could impact the portfolio.

HRZN Expected Interest Rate Impact (HRZN Quarterly Report)

We can see in the performance comparison at the opening that this BDC has been particularly weak. Weaker than the overall market and much weaker than BIZD, which we are using as our sort of pseudo benchmark. This helps highlight two different things about HRZN.

First, the market views it as a riskier investment is my first assumption. Given that their underlying investments are tied more to tech/growth companies, that’s exactly what investors have been shunning this year.

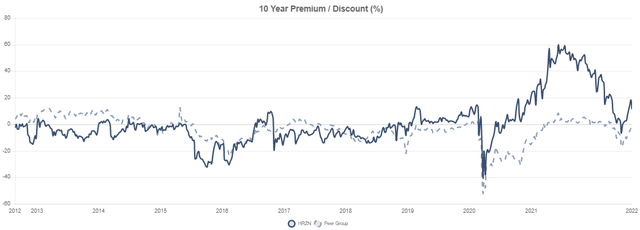

The second point is how valuations matter and they matter quite a lot. This was a BDC that was defying gravity. Externally managed BDCs tend to trade at discounts relative to their internally managed counterparts. Therefore, seeing the large premium of touching around 60% was unusual.

A premium isn’t all bad as it allows BDCs to utilize an at-the-market offering. An ATM is where shares are created; since it is done at a premium, it is accretive to the NAV.

HRZN Premium/Discount History (CEFData)

Now, valuations have come down quite considerably. The latest NAV reported was $11.69. At the time of writing, that translated into a premium of around 11.4%, currently above the share price. That’s still on the more expensive side. That could be considered an area where we could begin to nibble. That’s much different than where we were with our previous coverage.

Overall, if the market picks up with volatility again, we could be pushed to a discount again. That’s where I believe one could get a bit more aggressive with picking up this name.

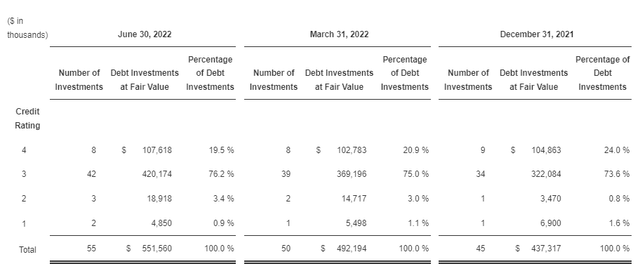

Their own internal credit rating has those at the highest degree of risk of loss of principal as remaining low. Those are the credit rating of 1 – it was two investments with an aggregate cost of $14.8 million. That was a tick-up from the single investment in this category previously. In terms of the number of assets at the highest risk, it was a small decrease.

HRZN Portfolio Credit Quality (HRZN Quarterly Report)

At this point, their portfolio is still operating smoothly as we are going through 2022.

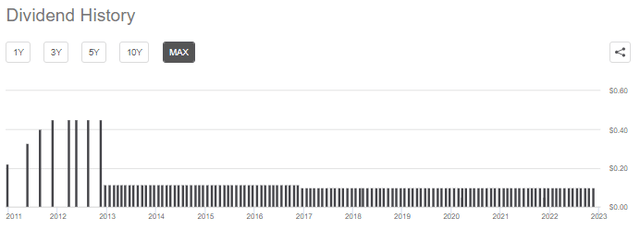

As a BDC, they’ve been able to pay out a steady dividend to investors for several years. Years ago, they had previously cut their pay. The latest coverage looks healthy. They reported NII of $0.35 in the latest quarter while paying out $0.10 per month.

HRZN Dividend History (Seeking Alpha)

Gladstone Investment

GAIN is also externally managed. Here’s how GAIN describes itself:

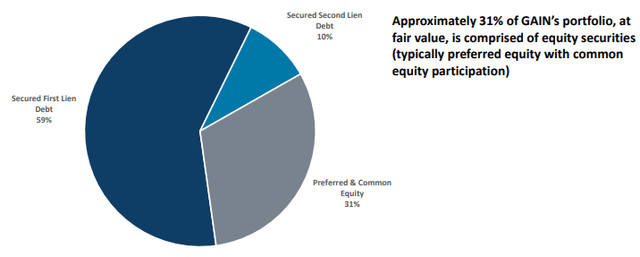

Gladstone Investment makes debt and equity investments in established private businesses in the U.S. Debt investments primarily come in the form of three types of loans: senior term loans, senior subordinated loans and junior subordinated debt. Equity investments primarily take the form of preferred or common equity (or warrants or options to acquire the foregoing), often in connection with buyouts and other recapitalizations. Gladstone Investment’s individual investments typically total up to $70 million, although investment size may vary. Gladstone Investment intends that the investment portfolio over time will consist of approximately 75% in debt securities and 25% in equity securities, at cost.

I believe that GAIN is a bit more diversified in terms of its approach to investing in underlying business industries relative to HRZN. That could see them hold up a bit better during a downturn as they can provide more diversification. It should be noted, though, that some of this is balanced out by GAIN’s greater exposure to equity investments.

At the end of March 2022, they held around 69% in debt investments and 31% in equity.

GAIN Portfolio (GAIN Investor Presentation)

More recently, at the end of June 30th, 2022, they mentioned that around 73% of their portfolio were debt investments with 27% equity positions.

Equity investments will tend to be more volatile in general. Additionally, they can be more unpredictable in their returns as they don’t provide regular income.

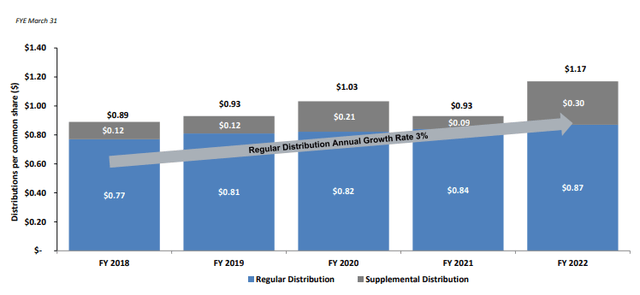

Instead, equity investments in smaller companies will rely heavily on capital gains. That has been the end result for GAIN, as evidenced by the regular supplemental distributions it has paid out for several years now. This also hasn’t disrupted the regular dividend to investors as that has been growing over the years too.

GAIN Dividend History (GAIN Investor Presentation)

The latest earnings reported NII per weighted-average common share of $0.22. That’s against their monthly dividend of $0.075. That means NII coverage is quite tight and even slightly negative.

Ideally, we’d want that to be greater than 100%. That’s where the equity investments come in to fill in the gap. With that latest quarter, they realized $4.452 million in capital gains. Based on the shares outstanding at that time, it would have worked out to another $0.134 per share.

100% of their loans were variable rates with a floor. However, we can see more unusual results with the equity sleeve as they wouldn’t benefit the same. Yet, the BDC is positioned at this time with no floating rate debt, so the outcome here should still see a net benefit.

GAIN’s premium has been coming down from where it was several months ago too. Although, it never got quite as elevated as HRZN’s valuation had. The current valuation could come down a bit before I’d feel more confident in nibbling for shares.

That being said, for a longer-term income investor wanting to initiate a position, now could be a great time. With some volatility, we would be in a similar situation as HRZN, where we could get that premium to come down even further.

GAIN Discount/Premium History (CEFData)

GAIN had held up better than the broader market but underperformed BIZD YTD in our chart at the opening of this article. The decline in the fund’s premium is a primary culprit for this, in my opinion.

They have the ability to withdraw leverage from a credit facility. However, they had zero outstanding at the end of March and June 2022. Unfortunately, they are still being hit with an unused commitment fee of around 1%. Instead, they’ve been relying mostly on their publicly traded notes to make up the bulk of their leverage position.

That’s the 5% Notes due 2026 (GAINN) and 4.875% Notes due 2028 (GAINZ). Both of these are fairly interesting income investments, too; if an investor is seeking capital preservation as a higher priority, these could be more appropriate.

Conclusion

Both of these BDCs present attractive yields to investors that pay monthly. There are unique risks to consider before investing in BDCs. During the current environment, they should benefit from higher interest rates. However, an economic slowdown could impact the underlying companies more acutely. They just don’t have the financial strength to withstand the slowdowns that larger companies do.

It should also be noted that higher interest rates can benefit to a point. While yes, they are holding a lot of variable rate loans, that also means the costs of those companies’ borrowings are going up. They might have been able to afford an 8 to 10% interest rate on a loan before, but if it climbs to 12%+, that could be a risk in itself. There is a cut-off point where the higher rates become detrimental to the loans due to pushing them into default. Where that cut-off is, I’m not sure exactly. I don’t particularly want to find out either.

HRZN has held its monthly dividend steady for years now and yields around 9.4% at this time. The dividend has had strong coverage with the latest report. GAIN’s dividend hasn’t been well covered through NII alone. Instead, they have been relying on capital gains due to a heavier weighting of equity investments. That has been more than enough to offset the shortfalls and even provide regular supplemental distributions. Based on the regular monthly dividend, we are seeing a yield of 6.05%. This would, of course, be higher if incorporating the supplementals.

Valuations have come down on both of these names regarding their premiums. That makes them more interesting at this time. For more patient investors, waiting to see if volatility picks back up could create an even better opportunity.

Be the first to comment