Khanchit Khirisutchalual

Last Thursday morning was like most others, I was trying to trade where I could find advantage, reviewing fresh earnings reports, CNBC on low volume on the TV. Then, about 11:30, a well-respected, widely followed investment advisor came on and spewed the same misinformation for at least the second time in the last twelve months.

When asked about investing in REITs, the advisor warned taxable investors off investing in REITs because their dividends are so egregiously taxed. Because this guy is so universally loved, I’m going to respond from the perspective that he must be reasoning with an incomplete data set.

He is wrong; REITs, and often their dividends, enjoy huge tax advantages. Examples abound, but we will draw from personal experience in profiling Gladstone Commercial (NASDAQ:GOOD).

Dividends and Taxation

I think the confusion arises from the fact that dividends generated from entities with different corporate structures are taxed at different rates.

In 2022, Qualified dividends are taxed at a maximum rate of 20%. As an example, you can consider that Microsoft’s (MSFT) $0.95/share dividend translates to a 3.70% nominal yield at today’s $257 share price. After paying the 20% federal income tax, you have $0.76 remaining for an after-tax yield of 2.96%.

In contrast, non-Qualified dividends (REIT dividends) are taxed as ordinary income at a maximum rate of 37%. GOOD’s $1.50/share dividend translates to a 7.85% nominal yield at today’s $19.10 share price. After paying the maximum 37% federal income tax, you have $0.945 remaining for an after-tax yield of 4.95%.

But wait, it’s not quite that simple. Since 2017 tax reform, ordinary REIT dividends are eligible for the 20% Section 199A deduction. Under this rule, the taxable portion of GOOD’s $1.50 ordinary REIT dividend would be reduced to $1.20; at the 37% federal rate you’d owe $0.444 in taxes, leaving you with $1.056 for an after-tax yield of 5.52%.

But wait, it’s still not quite that simple. In the bullet points above I noted that nominal dividend yields might not be apples to apples comparisons. More to the point, nominal dividend yield comparisons of one REIT against another might well be apples to oranges. This needs further explaining.

REITs are Tax Efficient by Design

If you visit NAREIT’s excellent website, you’ll quickly learn that modern REITs were born in the 1960 Eisenhower administration to give all investors access to income producing real estate. Through unique tax structure, REIT income is not taxed on a corporate level which enables a higher level of cash flow to be passed through to shareholders in the form of dividends. Importantly, the depreciation and amortization tax benefits are in some cases sufficient to accommodate tax deferral/shelter on the shareholder dividend level.

Examples abound, but we will draw from history in profiling Gladstone Commercial.

GOOD: Triple Net Dividends a cut above the rest

Gladstone Commercial is a small cap, triple net lease REIT with 133 properties split almost evenly between the office and industrial sectors. Since its 2003 IPO, GOOD has paid an unbroken stream of monthly dividends, annualizing at ~$1.50/share over the last 15 years.

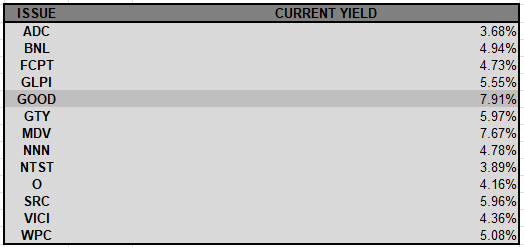

Contrast against the handful of other triple-net lease REITs, Gladstone’s $1.50 divided and $19 share price make it a sector yield leader.

QuoteStream Media

If treated as a bond equivalent, the extra dividend yield can really add up over time in your 401(k) or IRA account. But this article isn’t about retirement account investing. It’s about the taxation of REIT dividends and that is where GOOD really stands out.

Portfolio Income Solutions REIT Dividend Tax Historic Characterizations

A standard mantra of tax-exempt municipal bond investing is, “it’s not what you get, it’s what you keep.” Basically, muni-bond proponents contend that, after paying taxes due on corporate bonds, treasuries, or stock dividends, municipal bonds can sometimes offer a higher after-tax return. By certain considerations, many REITs have historically offered a similarly compelling after-tax dividend yield.

Form 8937

Early every year, REITs file Form 8937 with the IRS to characterize the dividends they paid in the prior tax year and reflects Returns of Capital and related reduction in cost basis. Basically, Form 8937 allocates dividends into 3 different categories:

*Ordinary Dividend (could qualify for the Section 199A deduction)

*Capital Gain (taxed at capital gains rate)

*Return of Capital (not currently taxable, reduces cost basis)

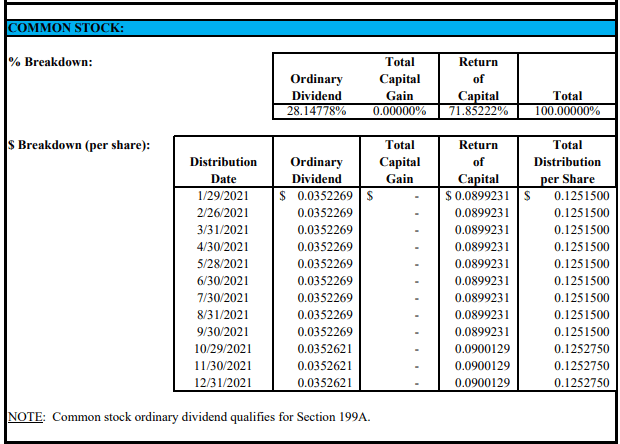

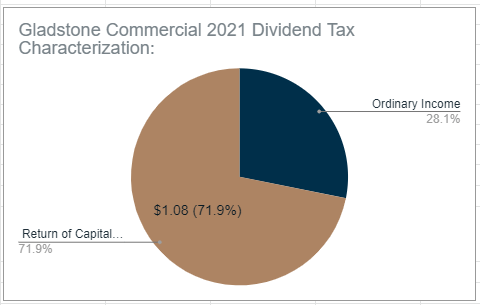

The three categories should sum to the total distribution paid. GOOD’s 2021 Tax Characterization looks like this:

GOOD

Applying this information to our calculations from earlier in this article, we now have a clear picture of 2021’s after-tax yield.

According to the 2021 Tax Characterization, 28.148% of the $1.50/share dividend ($0.422) was characterized as Ordinary Dividend. This amount qualifies for the 199A deduction, so $0.3376 is taxable at the 37% rate. After paying the $0.125 tax your left with $1.375 income (current year) for a 7.2% after-tax (carrying) yield. The effective, current year tax rate on the entire $1.50 dividend was only 8.33%, not the onerous, nominal 37% ordinary income tax rate.

The dividend characterized as Return of Capital reduces your cost basis and increases your potential capital gains tax liability when your shares are sold.

Contra to common wisdom, REIT dividends can be extremely tax efficient.

Comparing the Household Names to GOOD

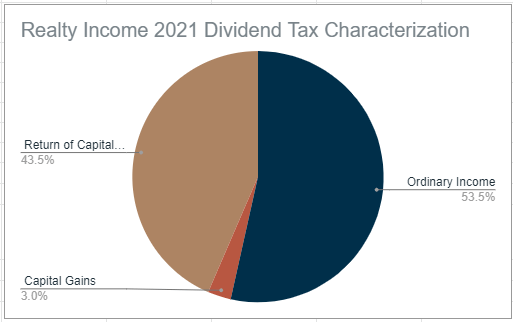

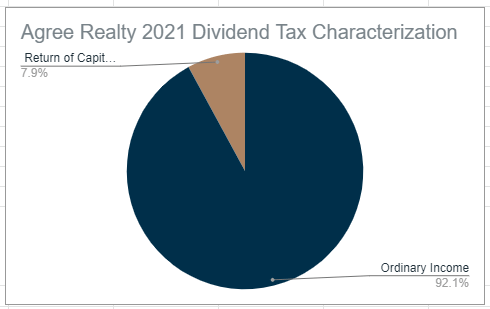

When considering Triple Net Lease investment opportunities, Gladstone Commercial is typically not even a part of the conversation. Instead blue chip stalwarts like Realty Income (O), Agree Realty (ADC), and National Retail Properties (NNN) capture most of the attention.

However, if optimizing your portfolio income (and especially your after-tax portfolio income) is a priority, you might do well to run the same tax characterization exercise on each of the companies.

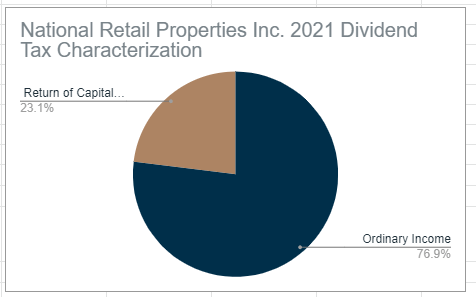

The big three look like this:

Portfolio Income Solutions

Portfolio Income Solutions

Portfolio Income Solutions

Vs. GOOD

Portfolio Income Solutions

GOOD’s significantly higher nominal yield is complemented by having a much larger portion of the dividend be characterized as Return of Capital and this leaves the taxable investor with a dramatically higher after-tax yield.

Tax Efficiencies are an Important Second Level Consideration

Portfolio Income Solutions has built a directory of Historic REIT Dividend Tax Characteristics for more than 100 equity REITs. The directory details each REIT’s prior five years dividend history and tax characterizations. While the characterizations vary from year to year, they tend to rhyme. This might be valuable information in determining whether to buy, hold or sell a given position for a taxable account.

The Takeaway

The tax characterizations described above don’t describe tax-exemption, but rather tax-deferral. As a financial planning tool, this information can be used to optimize your investment income.

Be the first to comment