Olemedia/E+ via Getty Images

Investment Thesis

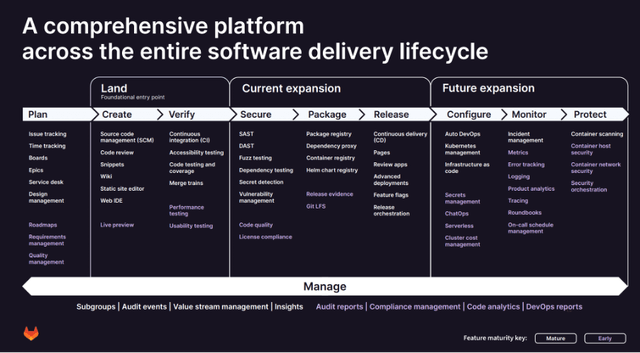

GitLab (NASDAQ:GTLB) is a leading DevOps platform with one of the broadest offerings around, taking a fundamentally new approach due to its unified data model. Typically, these types of companies operate within a specific DevOps niche, meaning that their customers are having to use multiple tools from multiple DevOps solution providers across their business, which isn’t ideal. Perhaps it’s not a surprise then that, according to GitLab’s Q2’23 Investor Presentation, 60% of organisations will have switched from multiple point solutions to value stream delivery platforms to streamline application delivery by 2024 – and this is where GitLab excels.

GitLab Q2’23 Investor Presentation

This company ticks many of the boxes I look for in my investments: high switching costs (dollar-based net retention rate >130%), rapid growth, a great culture, founder-CEO with skin-in-the-game (15% ownership), an attractive margin profile, and a large opportunity ($40B TAM).

Despite the positives for this high-flying business, its October 2021 IPO hasn’t exactly been a slam dunk. Whilst the company itself may have continued to perform well, shares certainly haven’t, and are currently down 60% from their 52-week highs.

Given the difficult macroeconomic landscape, investors were looking for these Q2’23 results to provide some good news, with the hope that GitLab’s resilience & importance would show up in the numbers.

GitLab Q2 Earnings Overview

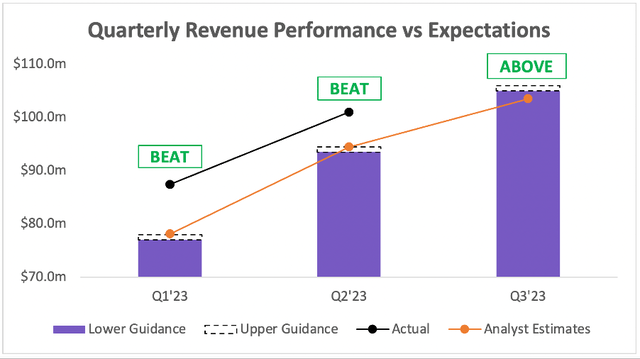

Starting from the top, and revenue grew a staggering 74% YoY to reach $101.0m in the quarter. This soared past management’s guidance of $93.5-$94.5m whilst comfortably beating analysts’ expectations of $94.4m.

Investing.com / GitLab / Excel

The outlook was equally strong, with management’s Q3’23 guidance of $105-$106m coming in above analysts’ expectations of $103.5m – and, if history is anything to go by, I would expect GitLab to comfortably beat this guidance.

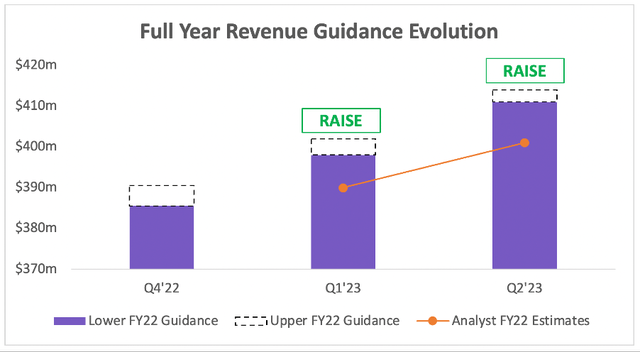

The story for revenue gets even better when it comes to the full year outlook, as GitLab raised this to $411-$414m, which once again exceeded analysts’ estimates of $401m.

Consensus Gurus / GitLab / Excel

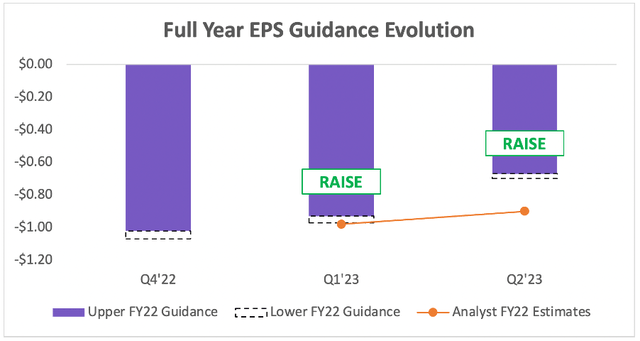

Perhaps most impressive is the fact that, from Q4’22 to Q2’23, GitLab has raised its full year outlook from ~$388m to ~$413m, representing an increase of 6% in just half a year. Given the extremely tough macroeconomic environment, it really has been only the best and most essential businesses that have been able to continually raise guidance like this, which speaks volumes about GitLab’s strength.

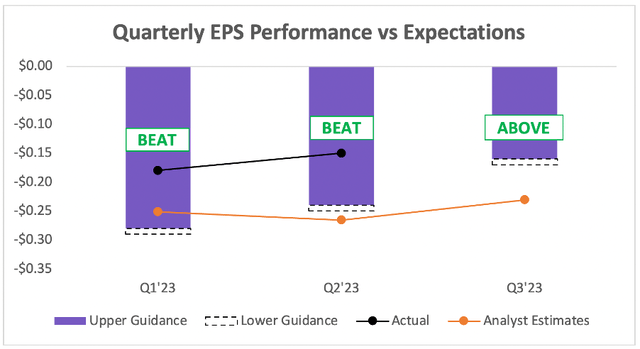

Another pleasant surprise for investors came on GitLab’s bottom line. The company is not yet profitable, but management does monitor & give guidance on adjusted EPS – and I’m glad they do, considering what they achieved in Q2. The company delivered adjusted EPS of $(0.15), which was well ahead of management’s $(0.24)-$(0.23) guidance & also beat analysts’ estimates of $(0.23).

Investing.com / GitLab / Excel

Management went on to guide for adjusted EPS of $(0.16)-$(0.15) in Q3, demonstrating continued improvement in terms of profitability whilst coming in ahead of analysts’ expectations of $(0.25).

Given all this, investors won’t be surprised to learn that management raised its full year EPS guidance to $(0.67)-$(0.64), coming in well ahead of analysts’ estimates of $(0.90). It’s worth highlighting in particular that the FY23 EPS outlook given in Q4’22 was for $(1.00), so this estimate has improved substantially over the year so far.

Consensus Gurus / GitLab / Excel

There haven’t been too many companies with beats across the board this earnings season, so GitLab joins a fairly exclusive club – and it is certainly well deserved. The ability to grow revenues in excess of 70% in the current environment should be applauded, and the market rewarded shareholders with a 14% pop following the announcement of these stellar results.

GitLab Q2 Earnings Call Highlights

The GitLab earnings call was all smiles, which is no surprise; there were plenty of positives to talk about, but I’ll start with this humble brag from Co-Founder & CEO Sid Sijbrandij:

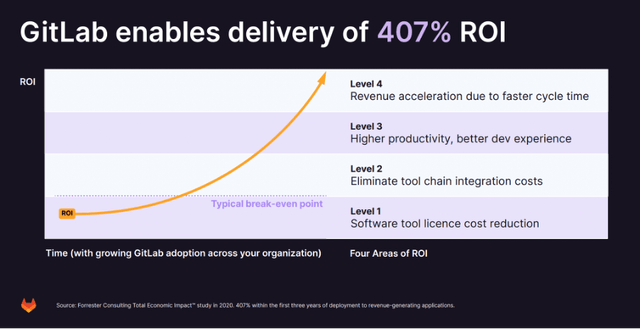

What GitLab delivers is a faster cycle time, faster execution on cost saving initiatives, the opportunity for revenue acceleration. To quantify these benefits based on a study conducted by Forrester Consulting and commissioned by GitLab, our customers saw a 407% return on investment within three years of deployment of our DevOps platform.

If you were wondering how GitLab is able to achieve such impressive results, this statement alone should provide many of the answers. If a company is able to use GitLab and see an ROI in excess of 400%, then it feels like a true no-brainer. This should also give investors who do not have specific technical knowledge or experience of DevOps (myself included) further confidence that GitLab is delivering a high-quality product to go with its high-quality numbers.

GitLab Q2’23 Investor Presentation

Another impressive nugget on the call came from CFO Brian Robins:

We price our platform in U.S. dollars. So, we have no currency impact. These attributes contribute to the results we are seeing. To illustrate this, customer cohorts from seven years ago are still expanding today.

Despite the volatility in the macroeconomic environment in the second quarter, we have not seen any impact to our business. Customers increasingly recognize the need to address multiyear digital transformation challenges. The current environment is not slowing down customer decisions, nor elongating our sales cycles. Buying cycles have actually sped up across the business and we continue to see strong win rates.

Whilst there are plenty of companies out there blaming the macroeconomic environment for their woes, the truly great companies have been able to roll with the punches & continue to succeed regardless. This is exactly what GitLab has done, despite the US dollar strengthening & the macro uncertainty, and this should give investors even more faith in the business for when times do get better.

GTLB Stock Valuation

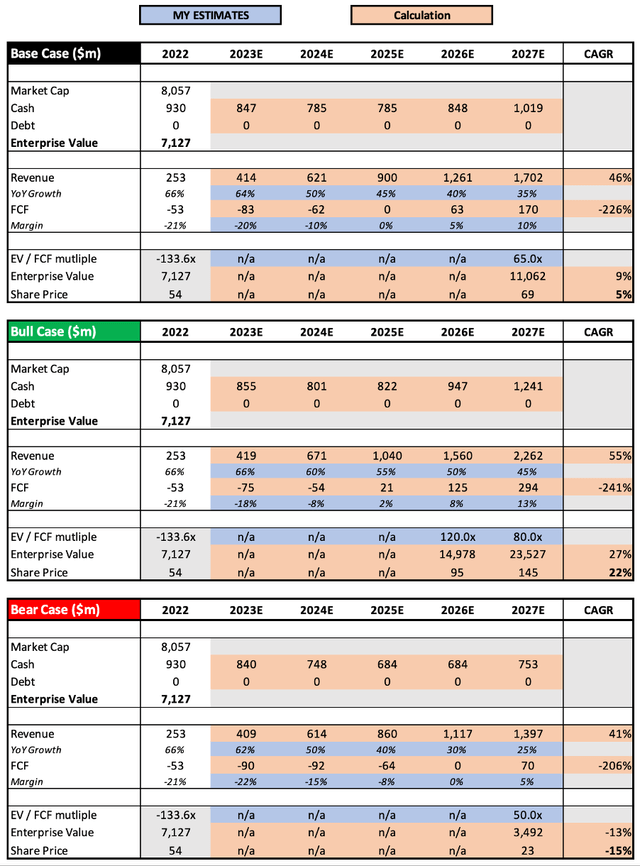

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether GitLab is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

This is a particularly difficult company to value using my model: it has incredible growth potential that is hard to predict over the next 5 years, it is unprofitable, and it has a very negative free cash flow margin. Whilst I would not be surprised to see the FCF margin improve substantially over the next couple of years, I cannot assume that in my base case scenario.

In my base scenario, my assumption is that growth slows for GitLab but remains strong, and the company achieves a 46% revenue CAGR through to FY27. I’ve also assumed that the FCF margin does improve as the company scales up, eventually hitting 10% in FY27 – but, I believe that GitLab is capable of achieving FCF margins in the range of 20-40% when fully optimised (based on software peers), so there is plenty of opportunity for revenue growth and margin expansion from 2027 onwards. Given this, I have used a relatively high final EV / FCF multiple that I believe represents this future opportunity; in truth, the assumed multiple could be even higher.

My bull case scenario assumes that revenue can grow even quicker, at a 55% CAGR, and that FCF margins eventually expand to 13% by 2027 – which, again, may even be too conservative, but it is very unknown at this point. The bear case scenario assumes essentially that growth is unsustainable, and as such everything is much less impressive.

Put all that together, and I can see GitLab shares achieving a CAGR through to 2027 of (15%), 5%, and 22% in my respective bear, base, and bull case scenarios.

Bottom Line

GitLab is one of those companies that is priced for perfection, but appears to be capable of consistently delivering this perfection. Other companies in this vein include The Trade Desk (TTD), CrowdStrike (CRWD), and even Tesla (TSLA). All are businesses who have delivered incredible results, and all are businesses with share prices that have appeared overvalued pretty much constantly over the last 5 years.

If GitLab does continue to execute with the same level of success, I could see its results being a lot closer to my bull case scenario. There is plenty to be impressed by when it comes to GitLab, and although it isn’t a company I personally own yet, this quarter has certainly piqued my interest even more.

Given all this, I would rate GitLab as a semi-cautious ‘Buy’, and certainly a stronger buy if the share price dips substantially from here. It is a high-quality business that is executing flawlessly, and it’s one that I can see myself building a position in over the coming months.

Be the first to comment