Justin Sullivan

A few days ago, I published an article about Amgen Inc. (AMGN) and in that article I pointed out how important it is right now to identify recession-proof companies. Over the next few quarters and years, it will not be important to identify companies and stocks that can deliver high growth rates over the short term, but rather to identify stocks that may help us to protect our investment. And not only Amgen might be a good pick during a bear market and recession, but Gilead Sciences (NASDAQ:GILD) might be as well.

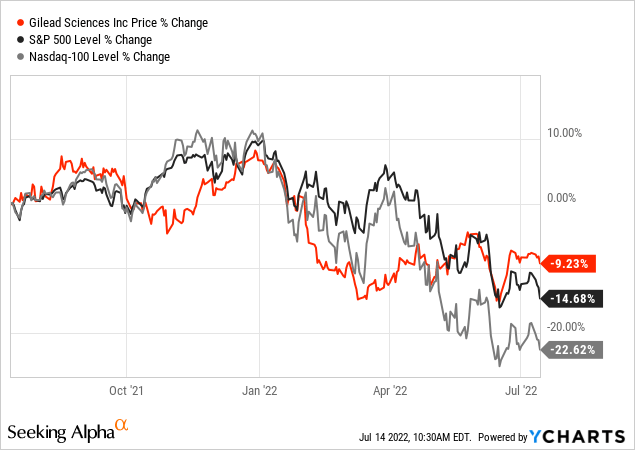

Similar to Amgen, Gilead Sciences also outperformed the S&P 500 (SPY) as well as the Nasdaq-100 (QQQ) in the last twelve months. Gilead Sciences did not perform as well as Amgen in the last twelve months, but it did outperform the general stock market. And as we are expecting a steep recession and brutal bear market in the coming quarters, Gilead Sciences can be a solid investment. The company will perform quite well during a recession and as the stock is trading for rather low valuation multiples, the downside risks also seem limited.

Quarterly Results

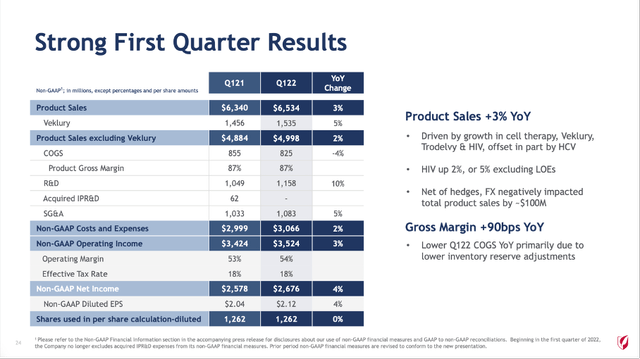

When looking at the last quarterly results (for the first quarter of fiscal 2022), Gilead Sciences could report mediocre results. The company could increase total revenue from $6,423 million in Q1/21 to $6,590 million in Q1/22 – resulting in 2.6% year-over-year growth. The biggest part of revenue is stemming from product sales with only $56 million stemming from royalty, contract and other revenues. And total product sales excluding Veklury were $4,998 million – 2.3% higher than a year before.

Gilead Sciences Q1/22 Presentation

And while revenue could increase a little bit, income from operations declined pretty steep from $2,890 million in the same quarter last year to only $197 million this quarter. The reason is a $2.7 billion “in-process research and development impairment” related to assets acquired by Gilead Sciences from Immunomedics in 2020. And not surprisingly, net income also declined from $1,729 million in Q1/21 to only $19 million in Q1/22 resulting in diluted earnings per share declining from $1.37 to $0.02. Non-GAAP diluted earnings per share however increased 3.9% year-over-year from $2.04 in the same quarter last year to $2.12 this quarter.

Growth

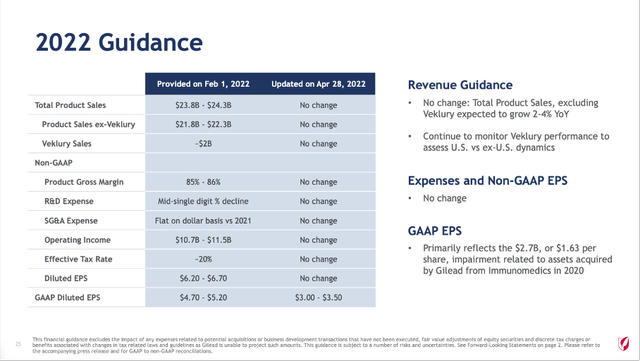

Guidance for fiscal 2022 was almost unchanged compared to the previous quarter. Only diluted earnings per share (on GAAP basis) are now expected to be only in a range between $3.00 and $3.50, which reflects the impairment related to assets acquired by Gilead Sciences from Immunomedics.

Gilead Sciences Q1/22 Presentation

Total product sales for fiscal 2022 are expected to be in a range of $23.8 billion to $24.3 billion. Veklury sales are expected to be about $2 billion for the full year, but as Veklury already generated $1,535 million in sales in the first quarter, the guidance might be a bit too pessimistic.

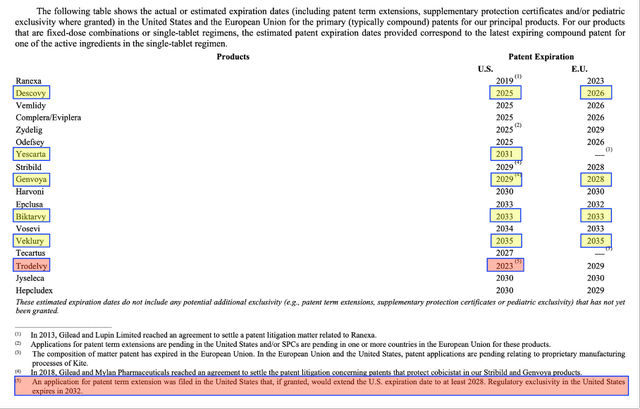

When looking at longer timeframes and trying to estimate what growth rates might be realistic, we must look out for potential new blockbusters as well as products with a high risk of declining revenue. One of the reasons why Gilead Sciences was struggling in the past was the fact that growth from new products was offset by declining revenue of existing products. And of course, we can’t rule out declining revenue from current products (Veklury sales might decline in the coming years), but the products generating the most revenue for Gilead Sciences right now are at least patent protected for several years to come. Only Descovy is just patent protected until 2025 in the United States and 2026 in Europe, and the patent for Trodelvy is expiring 2023 in the United States, but Gilead Sciences is confident that patent extension will be granted until 2028.

But it won’t be such a huge problem for Gilead Sciences when it loses patent protection for Descovy as sales already seem to shift to Biktarvy, which generated $2,151 million in sales in Q1/22 and was growing 18% year-over-year primarily due to higher demand. Descovy could also increase sales by 4% YoY driven by higher demand and pricing, but Biktarvy has a market share of 43% in the United States – eight times the market share of the closest competitor. And Biktarvy could also gain 500 bps in market share over the last 12 months. It is also worth pointing out, that the HIV treatment market is still below pre-pandemic levels.

And not only Biktarvy might contribute to growth in the years to come, the two cell therapy products Yescarta as well as Tecartus are also growing with a solid pace. Yescarta sales in Q1/22 increased 32% YoY to $211 million and Tecartus sales increased 103% YoY.

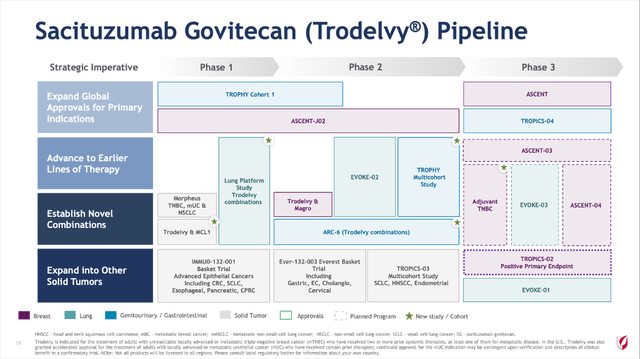

Gilead Sciences Q1/22 Presentation

And one of the most promising candidates is Trodelvy, which generated already $146 million in sales in the first quarter of fiscal 2022 (growing 103% year-over-year). But Gilead Sciences see broad potential for Trodelvy across multiple tumor types and lines of therapy and therefore peak sales for Trodelvy are estimated to be somewhere between $1.5 billion and maybe even $5 billion.

Share Buybacks

But aside from growing the top line, Gilead Sciences could also grow its bottom line by using share buybacks and, in the last 10 years, share buybacks have also been an important capital allocation tool management was using and the number of outstanding shares was decreased by 20%. However, in the last few quarters the number of outstanding shares rather stagnated, and in fiscal 2021 the company spent only $546 million on share buybacks and therefore much lower amounts than in previous years. Gilead Sciences is generating huge amounts of free cash flow and management can use the free cash flow to repurchase shares again in the years to come.

In the last few years, the company was using a huge part of its free cash flow for acquisitions – like the $21 billion deal for Immunomedics or purchasing Kite Pharma for $12 billion – that did not really pay off so far. Of course, Trodelvy and Yescarta are already generating revenue and both are stemming from acquisitions. However, revenue from these products is not enough to justify the deals yet.

And although Gilead Sciences was struggling in the last few years and growth potential in the years to come is dubious (in theory, there is growth potential, but there was also theoretical growth potential in the last few years), there are at least two reasons to buy the stock right now: the dividend and the upcoming recession (and the valuation might be a third reason).

Reason to Buy: Dividend

It is also worth mentioning that Gilead Sciences is getting more and more interesting for its dividend. Due to a constantly increasing dividend over the last few years and a stock price that is declining (or staying at a rather low levels), the dividend yield is increasing over time. Right now, Gilead Sciences has a very attractive dividend yield of 4.7%.

Right now, the company is paying a quarterly dividend of $0.73 and since Gilead Sciences started paying a dividend in 2015, management increased the dividend every single year and the 5-year dividend growth rate is 7.78%. When comparing the current annual dividend of $2.92 to earnings per share of $3.58 in the last four quarters, we get a payout ratio of 82% which does not seem to be very sustainable. However, earnings per share might be a bit misleading due to the “in-process research and development impairment” mentioned above. Instead, we can compare $3,633 million paid in dividends in the last four quarters to a free cash flow of $9,953 million and get a much more sustainable payout ratio of 37%.

Reason to Buy: Recession

When looking for companies one can invest in during a recession, we often turn to healthcare companies as they seem to be an obvious pick during recessions. And it is not surprising that healthcare companies (including pharmaceutical companies) are performing well during economic downturns. People also get sick and considering the mental stress during a recession and economic downturn due to job losses, assets declining in value or potential home losses, people might get sick even more.

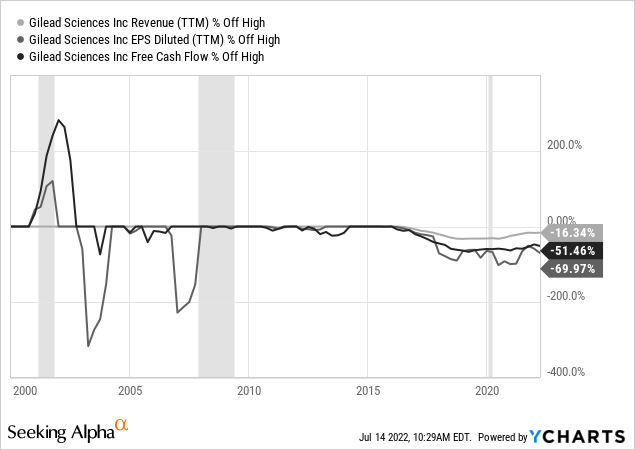

When looking at the chart, we can see revenue being rather stable. And when revenue was declining, there was no connection to a recession. Revenue was mostly declining in the past few years (due to Harvoni and Sovaldi sales declining). Free cash flow and earnings per share were also fluctuating in past decades, but I see no clear connection to a recession.

Similar to many other healthcare companies, the pharmaceutical company Gilead Sciences is also a great pick for a recession and past results indicate a solid performance during the next recession.

Reason to Buy: Valuation

One final step in every analysis is determining an intrinsic value for which a stock can be bought. It is not enough to just identify a recession-proof business, we also need a stock that is trading for a reasonable price because a stock trading for extremely high valuation multiples is also not a good investment during a bear market (and recession) as these stocks usually get punished hard.

As basis for our calculation, we can use the free cash flow of the last four quarters, which was $9,953 million. When assuming that Gilead Sciences won’t be able to grow anymore in the years to come and will just be able to generate a similar free cash flow as right now till perpetuity, we get an intrinsic value of $78.87 for Gilead Sciences and the stock is clearly undervalued at this point (assuming a 10% discount rate and 1,262 million in diluted outstanding shares).

Free cash flow of Gilead Sciences could even decline a little bit and the stock might still be fairly valued. Without much doubt, the stock is valued like a business that has trouble growing or like a business that might even decline – and when looking at the performance of the last few years, this might be justified. Again and again, we hoped that Gilead Sciences might finally move higher and return to the path of growth again. But so far, it did not happen. And it is more than understandable when investors are losing patience with Gilead Sciences (or if they already lost patience a long time ago).

And of course, an investment in Gilead Sciences is not completely worthless – we are getting quarterly dividends, and a dividend yield close to 5% is a solid return in this market. It is not great, but better than nothing.

Conclusion

In case of a recession, Gilead Sciences seems like a good pick as pharmaceutical companies are often able to keep revenue (and earnings per share) more or less stable. And in case of a recession and a bear market, it is already an achievement when a stock does not decline and $60 seems like a strong support level for Gilead Sciences. If the stock would be able to hold that level for the next two or three years (in combination with the quarterly dividends), it will be more than enough to outperform the stock market. And although we never know what might happen, a lower stock price for Gilead Sciences seems not justified from a fundamental point of view.

Be the first to comment