Scharfsinn86/iStock via Getty Images

Introduction to Gevo (NASDAQ:GEVO)

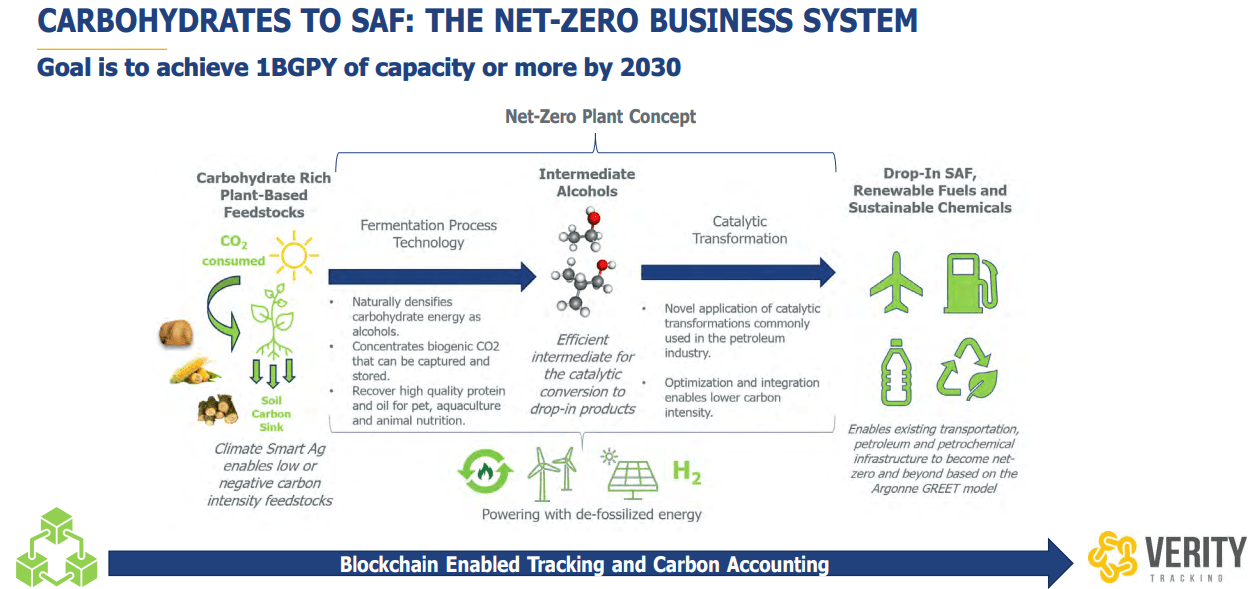

Gevo is a company that is attempting to help in phasing out the need for non-renewable oil and gas products by using various chemical processes to create the same key molecules using only renewable resources. The company uses agricultural products, typically corn, as the feedstock for its biofuels and offers fully integrated solutions for reducing emission in manufacturing. With its work, the company has been able to earn awards and milestone payments to support development, and the company has claimed 2022 to be the year where the fulfillment of contracts shall begin.

It is increasing clear that biofuels can be a viable source of renewable energy in contrast to the finite nature, geopolitical instability, and deleterious global effects of fossil fuel energy.

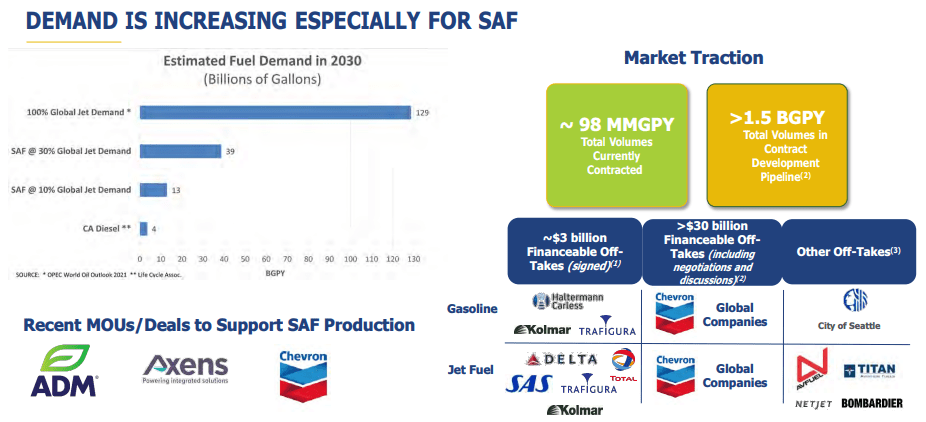

Due to its long operating history, Gevo is one of the first large-scale biofuel producers. In fact, its first process demonstration was back in 2009, and the first facility opened in 2010. While there are multiple potential end uses for Gevo products, the company has focused on Jet Fuel and has established multiple partnerships with airlines. In fact, recently it was announced that Oneworld Alliance members and Delta have established contracts for up to 200 million and 75 million gallons of fuel per year, respectively. While this pales in comparison to the 2019 US jet fuel consumption of 18.3 billion, it is an important and significant increase for the company.

Importantly, after years of development, but no revenue growth, investors remain skeptical of the potential. Therefore, the current valuation is a gamble into whether the company can begin fulfilling contracts during the year. Due to the wide range of potential, and significant negative public image, I would recommend waiting for revenues to increase even at the cost of short-term price jumps.

The science is there and any renewable source should be allowed to be the main contender. (Gevo)

Positives to Biofuels

Biofuel is increasingly under the microscope as development enters full production. There are multiple positive points for Gevo to leverage into the future:

-

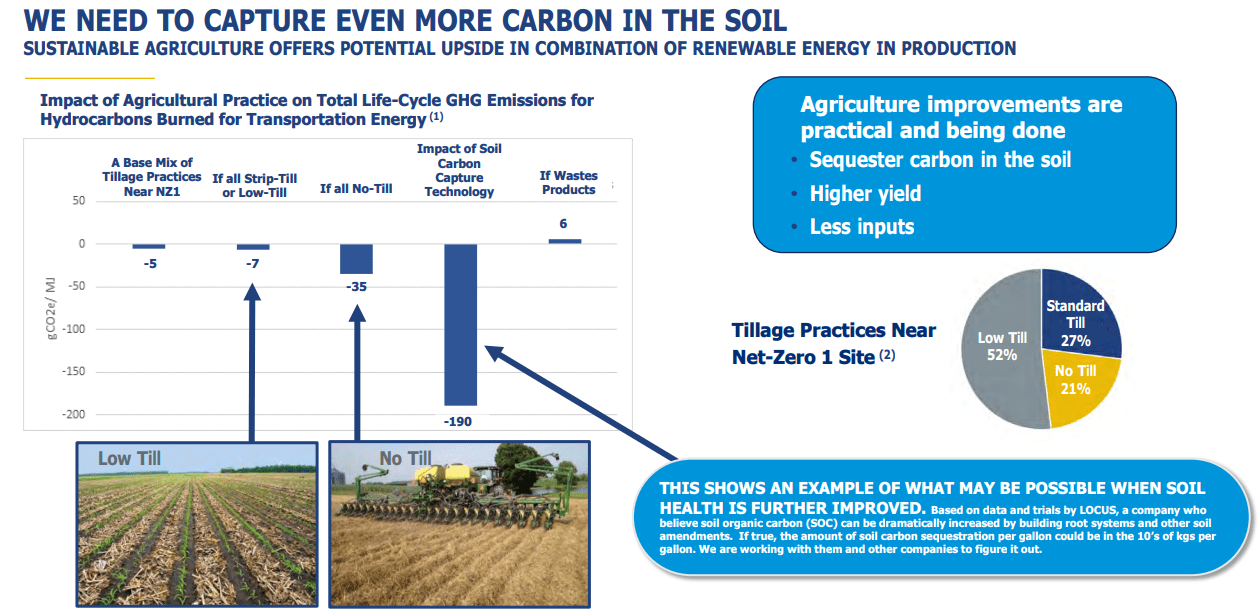

While the products produced by Gevo still release CO2 upon combustion, R&D in increasing agricultural productivity and the green manufacturing process allows for carbon neutrality.

-

The system allows for circularity and positive feedback. As an example, increased agricultural productivity of high-protein cattle feedstock reduces emissions, allows for manure biofuel production, and reduces demand for competitive corn consumption long-term.

-

Renewable fuel sources will eventually be necessary as oil and gas take a long time to form naturally.

-

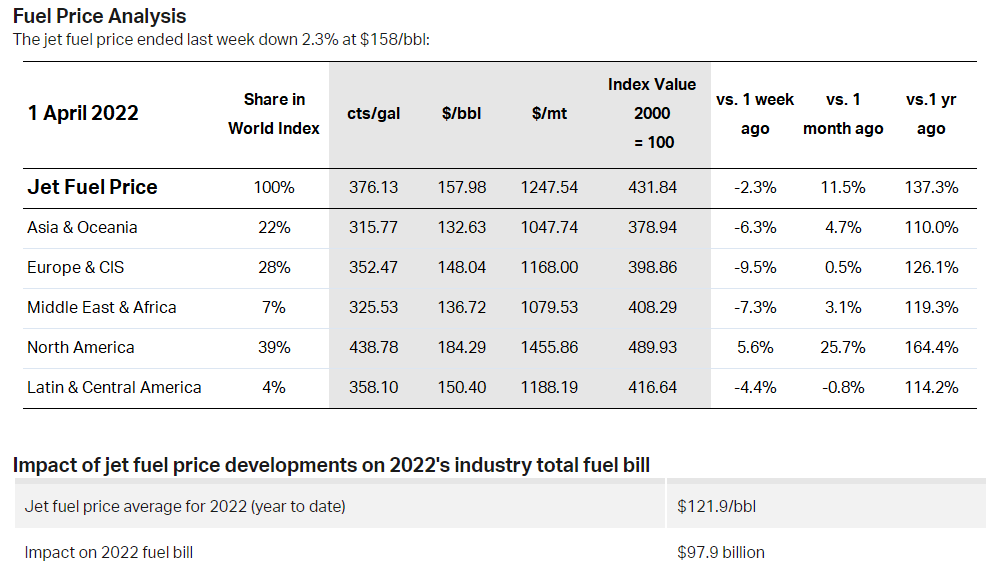

The current oil and gas market suffers from incredible volatility due to geopolitical, supply, and demand effects, and increasing fuel sources will reduce this volatility.

-

Gevo can create multiple end products (they currently focus on jet fuel), and this diversification will sustain growth if hydrocarbon use remains falling.

-

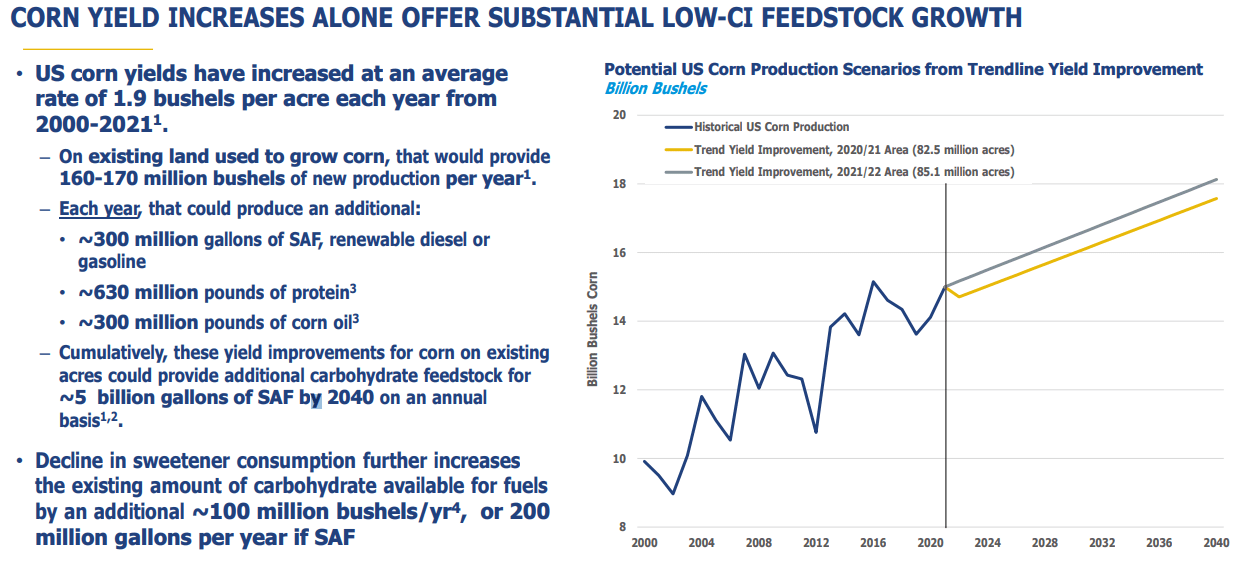

Gevo is also working on diversifying feedstocks to reduce demand on corn markets, as row farming has downsides.

Negatives to Biofuels

-

There is limited data to indicate that biofuels actually are more sustainable than traditional fossil fuels, in regards to carbon output, water waste, and environmental degradation.

-

Current policies and regulations in place do not allow for the support of sustainable crop production practices, so I see a need for increased transparency similarly to FSI, FSC, or PEFC in sustainable forestry.

-

Due to the current net-zero movement, contradictory demand exists, especially as fossil and gas developers phase out use (think: the end of plastic packaging, EVs reducing fuel consumption, nuclear electricity generation, etc.) As such, the cost-benefits may remain skewed towards traditional drilling.

Gevo

Corn Yields have increased favorably, and this allows the industry to be less impacted by shifting demand. (Gevo)

Financial Summary

Due to the completion of their major manufacturing sites and the completion of trial runs, the company has been able to establish working relationships and contracts with multiple airlines around the world. This is reflected in the revenue profile of the company as a sharp decline in revenues, but these have mostly been the result of awards and milestone payments. Now is the turning point for the company as they begin to grow physical sales at a rapid clip. However, most investors who have been following the company are reluctant to believe in growth, as promises have failed to materialize over the past few years. As contracts pile up, but revenues remain nonexistent, the risk of failure increases significantly.

However, as of the end of 2021, the company had about $450 million in cash and liquidity, with a ~$60 million loss for the full year, allowing for a bit of a leeway for investors at the current ~$940 million market cap. Like most pre-production companies, there is limited insight into when the biofuel sales will increase. The saving grace for Gevo is that if they are able to meet 50 million gallons in sales, less than 10% of their supposed contracts, the company is able to earn about $2 billion in revenues at current prices. Whether this happens in 2022 or not is up in the air. I expect the next earnings, due early May, will offer a critical insight into the company’s capabilities. I suspect most investors are tired of waiting, and any bad news will end up causing the price to fall.

IATA

Gevo

In the future, I expect the company to remain at a low valuation due to the risks involved, and I also expect margins to be quite low as cost-efficiencies continue to develop. As such, even if revenues reach $500 million in a year or two, this would only allow for a doubling of the share price, and not more. As such, I find that it is hard to expect significant share price increases even if the company begins commercialization. Albeit, short-term bumps thanks to actual revenues may be favorable for traders. I discuss some more expectations below.

Conclusion

While I believe Gevo has found their niche, is a leader in their sector, and offers first mover advantage, the risks are still likely to be hindrance long term. Further research into supply and demand, such as how other sustainability companies develop their own net-zero technologies, will be important for understanding how Gevo will perform in the coming decades. Much like with the performance over the past decade, much of the risk remains in the development of their manufacturing sites to meet demand. If contracts are pulled, significant losses will occur and the company may fail. Especially with the rise of competitors in time.

The demand seems to be there, let us hope Gevo are able to capitalize. (Gevo)

However, at the moment, the company seems to be succeeding in its growth, and 2022 will be a key year in delivering contracts. Further, watch for the company to begin meeting its 2030 goal of 1 billion gallons per year, but I am sure it will increase this if contracts prove successful. Along with that, I find the company may be a standout M&A candidate, especially now that major oil and gas companies are increasing their renewable investments. With the current valuation, the company offers a tantalizing value proposition as client contracts increase, oil & gas prices climb, and production scales up and I believe it is worth a second look. As such, I will recommend a hold/neutral rating in the meantime as we gain more information on capabilities with the coming earnings, but would be supportive of those with ample risk tolerance to take a bet on both the high and low side.

Thanks for reading, let me know what you think below.

Be the first to comment