Hispanolistic

The past few days have been incredibly volatile for investors in Getty Images Holdings (NYSE:GETY). On October 31st, shares of the enterprise closed up 34.7% after stock market pundit Jim Cramer considered the company on his ‘Mad Money’ show to be ‘worth looking at’. After the initial enthusiasm died down, shares of the company plunged 11.8% on November 1st. For true investors, those who focus on fundamentals, this volatility should be viewed as an opportunity to buy or sell the stock as would be most beneficial to each market participant. No real weight should be given to the fact that Cramer brought up the firm. Instead, the company should be viewed through the lens of its potential from a business perspective. Although investors should always be skeptical when pundits bring up investment prospects, I do believe it’s also true that his initial claim about the firm is correct. Given how shares are priced today and the continued growth the company is experiencing, I feel comfortable rating it a ‘buy’.

Getting the picture

For those not familiar with Getty Images Holdings, it’s worth noting that the company is almost certainly more involved in the display of content than almost any other company on the planet. Its offerings are everywhere, but yet nobody recognizes them. If this seems odd, is because of the business model that the company operates under. For the past couple of decades, the firm has built for itself an unprecedented library that consists of over 495 million assets in total. These assets take multiple forms. Examples include stock images, editorial photography, videos, music, and more. Using its platform, the company distributes this content globally, using a variety of methods such as a la carte, subscription offerings, and even custom assignments.

Under the Getty Images brand name, the company largely focuses on catering to enterprise customers, with an emphasis on premium creative and editorial content. This can include a lot of customized work, such as guaranteeing extensive protections and rights customized to customer needs. But there are other aspects of the company as well. For instance, under the iStock name, the company focuses on budget-conscious creative stills and videos largely marketed to small and medium businesses. And under the Unsplash brand name, the company sells access to unreleased creative stills to a variety of customers across the creative spectrum. In this case, they don’t offer any indemnification and, instead of charging outright, they monetize the platform using advertisements and by charging for access to its API.

Although this may not seem like a big business to some, the firm has a truly massive market reach. In the trailing 12 months ending June 30th of this year, the company said that it had 843,000 total purchasing customers and 89,000 total active annual subscribers. these members compared favorably to the 749,000 customers and 66,000 active annual subscribers that the company had only one year earlier.

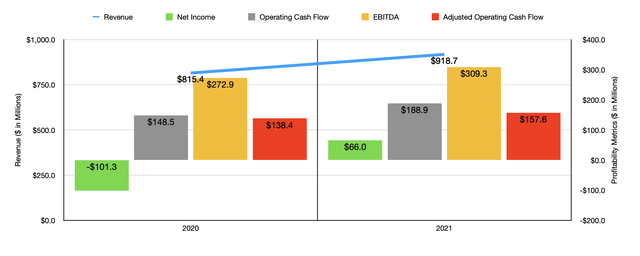

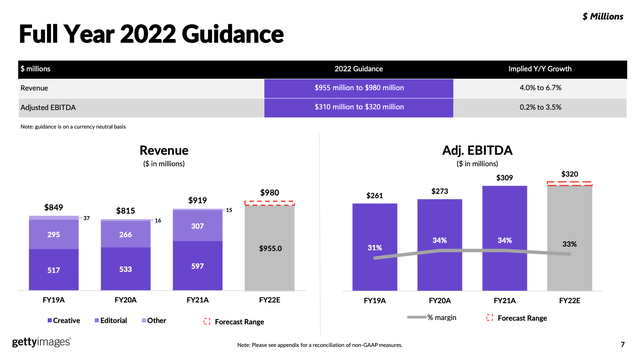

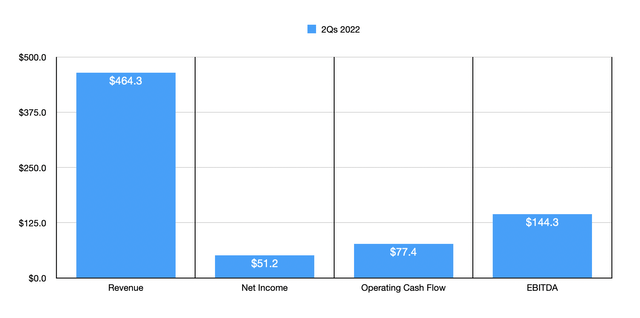

As you might expect, a company with such a large and growing customer base is bound to generate significant revenue. Sales in the 2021 fiscal year came in at $918.7 million. That was up from the $815.4 million generated in the 2020 fiscal year. Due to when the company came to market, we do have some data that is either missing or that could be considered not comparable. However, we do know that revenue in the first half of this year came in at $464.3 million. In the latest quarter alone, the $233.3 million in sales was 4.1% higher than it was last year. And according to management, revenue this year should come in at between $955 million and $980 million. That implies a year-over-year growth rate of between 4% and 6.7%.

On the bottom line, the picture has been favorable for the company as well. For starters, I should mention that the net income figure provided by the company for 2020 is not exactly comparable to the 2021 data. So I will leave that out. But what I do know is that operating cash flow over this time rose from $148.5 million to $188.9 million. If we adjust for changes in working capital, it still would have risen, climbing from $138.4 million to $157.6 million. Another metric that rose nicely year over year was EBITDA. Based on the data provided, it increased from $272.9 million in 2020 to $309.3 million in 2021. As for the current fiscal year, things are looking up for the company. Operating cash flow totaled $77.4 million during the first half of the year, while EBITDA came out to $144.3 million. According to management, EBITDA for this year should come in at between $310 million and $320 million. That translates to an improvement over what the company generated last year of between 0.2% and 3.5%. No guidance was given when it came to other profitability metrics. But if we assume that operating cash flow will rise at the same rate that EBITDA is expected to, then we should get a reading this year of $192.4 million on an adjusted basis.

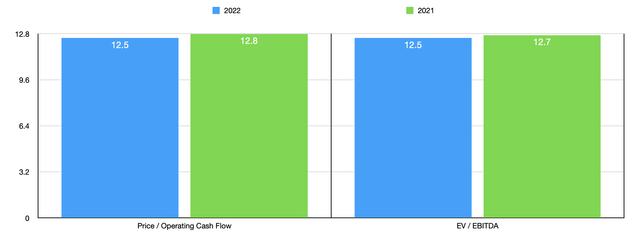

Given these figures, I calculated that the company is trading at a forward price to adjusted operating cash flow multiple of 12.5. That same reading applies to the EV to EBITDA multiple. To put this in perspective, using the data from the 2021 fiscal year would give us a price to adjusted operating cash flow multiple of 12.8 and an EV to EBITDA multiple of 12.7. Truth be told, I don’t believe that there are very many good firms to compare Getty Images Holdings to. Perhaps the two best would be Shutterstock (SSTK) and Adobe (ADBE). At present, these two companies are trading at price to operating cash flow multiples of 12.2 and 19.8, respectively. And they are trading at EV to EBITDA multiples of 10.7 and 21.2, respectively. In both cases, Getty Images Holdings is in the middle of the two, but drifting to the low end of the range.

Takeaway

I understand that economic times are uncertain at this moment. But when it comes to a company like Getty Images Holdings, I find myself optimistic. In the near term, the company may experience some pain. But its massive library of content reminds me of other major content providers that operate outside of this particular arena. I wouldn’t necessarily call the company a deep-value prospect. By considering that it should continue to fare well in the long run and considering how attractive shares are, I have no problem rating it a ‘buy’.

Be the first to comment