ymgerman

Thesis update

This is an update to my original Getty Images Holdings, Inc. (NYSE:GETY) thesis.

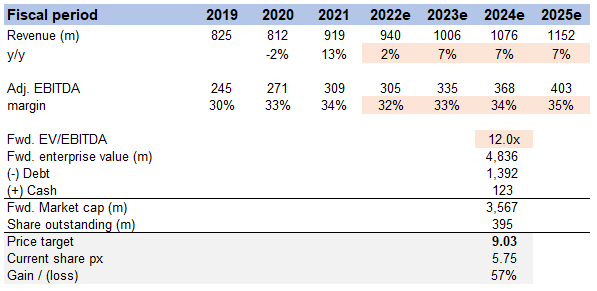

I still recommend buying GETY. It serves a sizable and expanding market driven by a number of growth drivers and offers a differentiated offering in the form of a product that should help it expand its share of the market. If GETY is able to successfully implement its growth strategy, it will increase its equity value to $9 per share by FY25, based on my projected figures ($1.1 billion in revenue and $403 million in EBITDA).

Earnings update

Both the Creative and Editorial divisions underperformed in Q3 2022, with $145 million and $82 million in revenue, respectively, contributing to GETY’s disappointing quarterly total of $230 million. Nonetheless, management stated in the announcement that total revenues would have increased by 2.8% if not for foreign exchange effects. The press release also states that if revenues had been calculated on a currency-neutral basis, they would have totaled $706 million for the year so far, implying that revenues for Q3 of 22 would have been $242 million, an increase of $12 million over reported figures.

Revenue margins were impacted negatively by FX pressures, leading to a 4.8% decline in Adjusted EBITDA to $78 million (up 2.2% on a constant currency basis). Year-to-date Adjusted EBITDA would have been $232 million without the impact of currency fluctuations, implying that Adjusted EBITDA for the third quarter of 2018 would have been around $80 million.

In reality, 3Q22 earnings were not terrible, though I agree that the reported and headline figures were unappealing and the market clearly did not approve. To me, these are all temporary setbacks, and the current valuation is ridiculously low when considering the mid-single-digit growth implied by the market.

Strategic updates

In its quarterly report, GETY updated its partnership status as follows:

- A worldwide exclusive agreement with BBC Studios lasting several years

- Joint venture between House Photography and the British Academy Film Awards

- New commercial agreements between Amazon and Canva

- Unsplash+, which was previously only offered as a free, ad-supported product, was made available as a paid, unlimited tier by GETY in early October.

In addition, in the third quarter, GETY and the creators of the AI tool BRIA announced a partnership to offer their customers Generative AI-powered features for their creative endeavors.

Regardless of the company’s financial standing, I see these developments as strong evidence that they are proceeding in the right direction and are still very applicable in the modern business world.

Tracking data

FY22 guidance reiterated

GETY maintained its FY2022 currency neutral guidance, but has lowered its projected FY2022 FX adjusted revenue and Adj. EBITDA to account for the lower exchange rates as of November 1. GETY forecasts that its total revenues will be between $955 and $980 million in 2022e, on a currency-neutral basis, growing by between 4.0 and 6.7% year over year, and that its adjusted EBITDA will be between $310 and 320 million, on a currency-neutral basis, growing by between 0.2 and 3.5% year over year. GETY has revised its revenue forecast for 2022E to a range of $929-953 million, with adjusted EBITDA in the range of $297-307 million.

Despite the sluggish macro-environment, this guidance was not welcome but also did not significantly alter the intrinsic value of GETY.

Valuation

Price target update

My price target for FY25 has been lowered from $9.3 to $9. This is in line with the predicted decline in FY22 revenues and EBITDA. I still think GETY is undervalued on the market and that the recent selloff is excessive. As a result of a number of different factors stated in my original post, I still expect GETY’s long-term revenue growth to be in the low to mid-single digit range (between 5 and 7 percent). Once we get past this short-term hurdle, I think GETY could grow at a faster rate than its historical low-teens CAGR since 2017. Also, as the company moves toward a subscription-based business model, management has stated that it anticipates achieving an EBITDA margin in the mid-30% range.

Own’s estimates

Conclusion

I think the current market price of Getty Images is too low. I think GETY will be able to meet its guidance because there are a number of factors pushing the company forward, and the switch to a subscription model would increase margins thanks to the reduced outlay for customer acquisition. A very large TAM is also under consideration. That makes me optimistic that Getty Images Holdings, Inc. will keep expanding as planned.

Be the first to comment